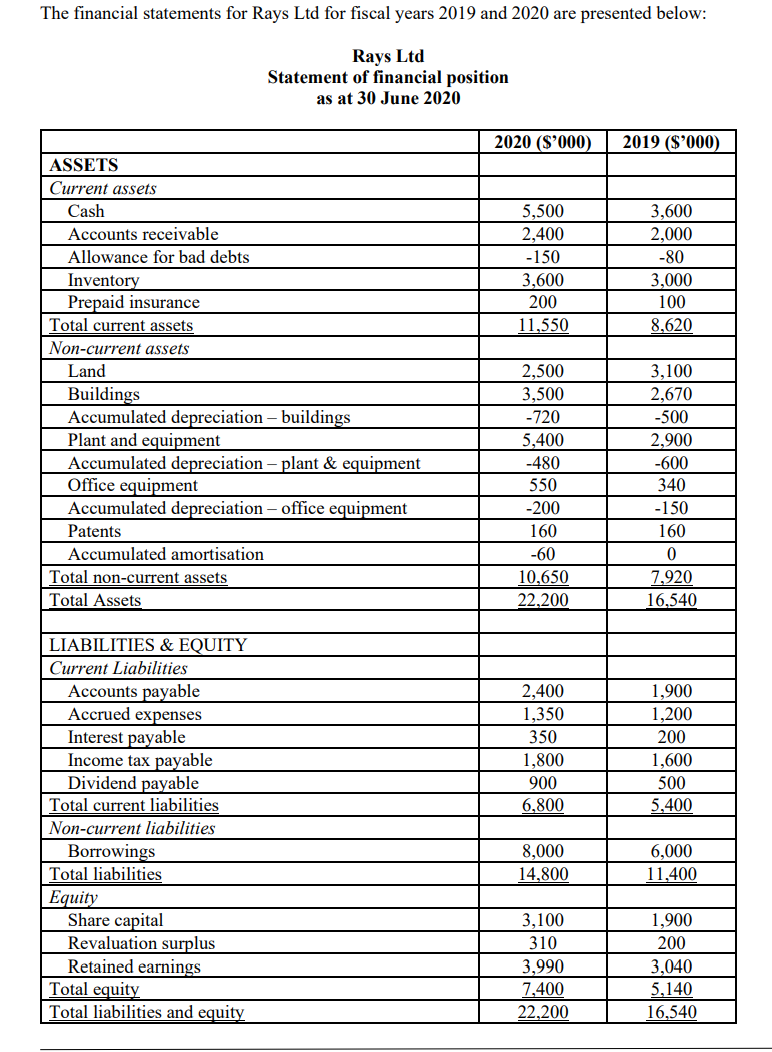

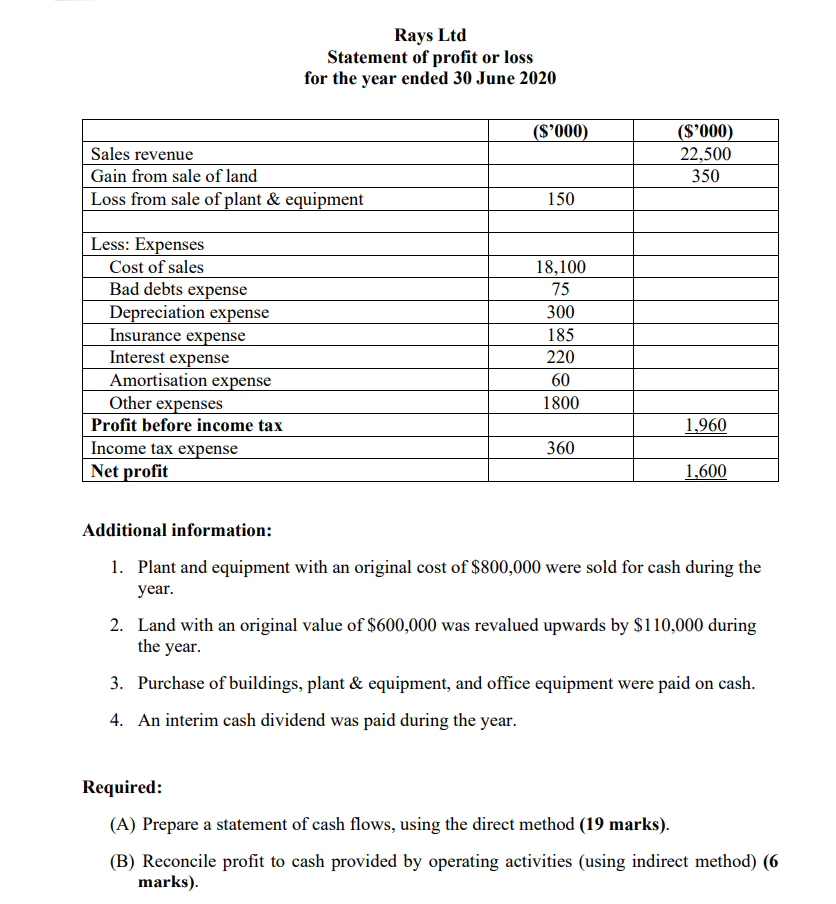

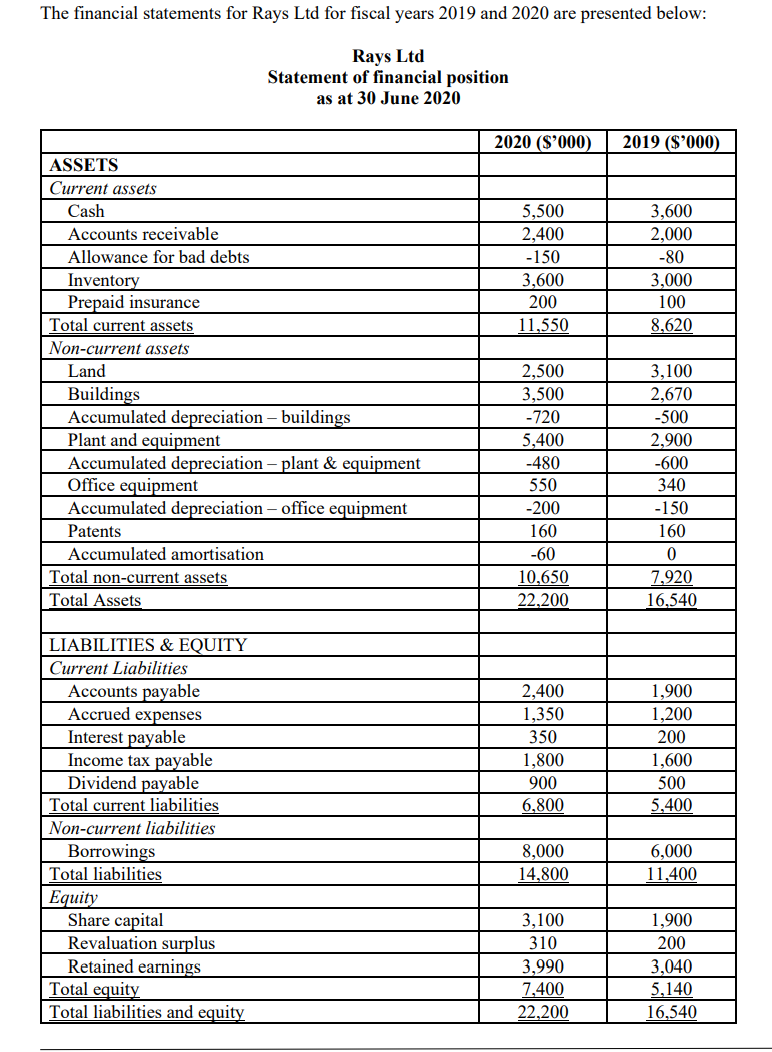

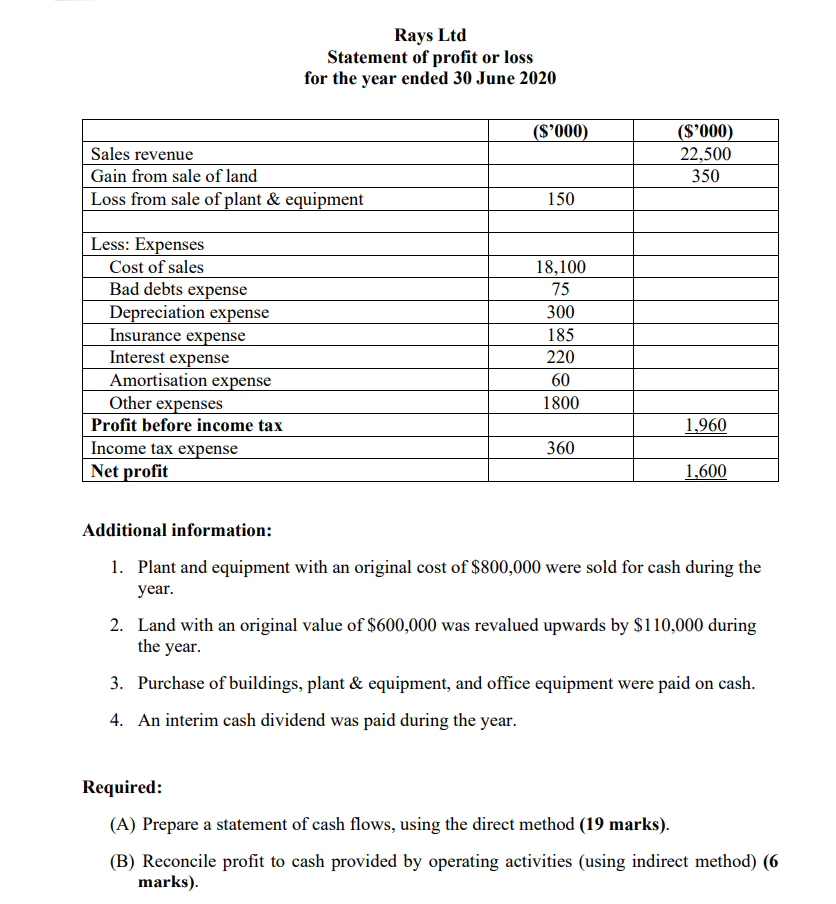

The financial statements for Rays Ltd for fiscal years 2019 and 2020 are presented below: Rays Ltd Statement of financial position as at 30 June 2020 2020 (S'000) 2019 ($'000) ASSETS Current assets Cash Accounts receivable 5,500 Allowance for bad debts 2,400 -150 3,600 200 11,550 3,600 2,000 -80 3,000 100 8,620 Inventory Prepaid insurance Total current assets Non-current assets Land Buildings Accumulated depreciation - buildings Plant and equipment Accumulated depreciation - plant & equipment Office equipment Accumulated depreciation - office equipment Patents Accumulated amortisation Total non-current assets Total Assets 2,500 3,500 -720 5,400 -480 550 -200 3,100 2,670 -500 2,900 -600 340 -150 160 160 -60 10,650 22,200 0 7,920 16,540 2,400 1,350 350 1,800 900 6,800 1,900 1,200 200 1,600 500 5,400 LIABILITIES & EQUITY Current Liabilities Accounts payable Accrued expenses Interest payable Income tax payable Dividend payable Total current liabilities Non-current liabilities Borrowings Total liabilities Equity Share capital Revaluation surplus Retained earnings Total equity Total liabilities and equity 8,000 14,800 6,000 .400 3,100 310 3,990 7,400 22,200 1,900 200 3,040 5,140 16,540 Rays Ltd Statement of profit or loss for the year ended 30 June 2020 ($'000) Sales revenue Gain from sale of land (S'000) 22,500 350 Loss from sale of plant & equipment 150 18,100 75 300 Less: Expenses Cost of sales Bad debts expense Depreciation expense Insurance expense Interest expense Amortisation expense Other expenses Profit before income tax Income tax expense Net profit 185 220 60 1800 1,960 360 1,600 Additional information: 1. Plant and equipment with an original cost of $800,000 were sold for cash during the year. 2. Land with an original value of $600,000 was revalued upwards by $110,000 during the year. 3. Purchase of buildings, plant & equipment, and office equipment were paid on cash. 4. An interim cash dividend was paid during the year. Required: (A) Prepare a statement of cash flows, using the direct method (19 marks). (B) Reconcile profit to cash provided by operating activities (using indirect method) 06 marks)