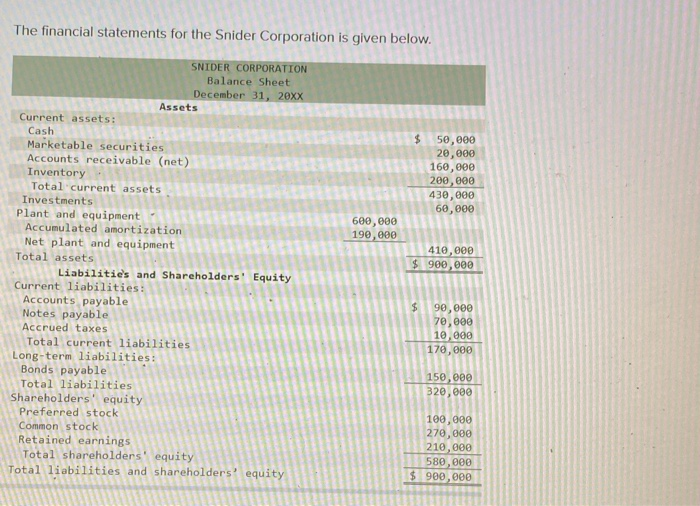

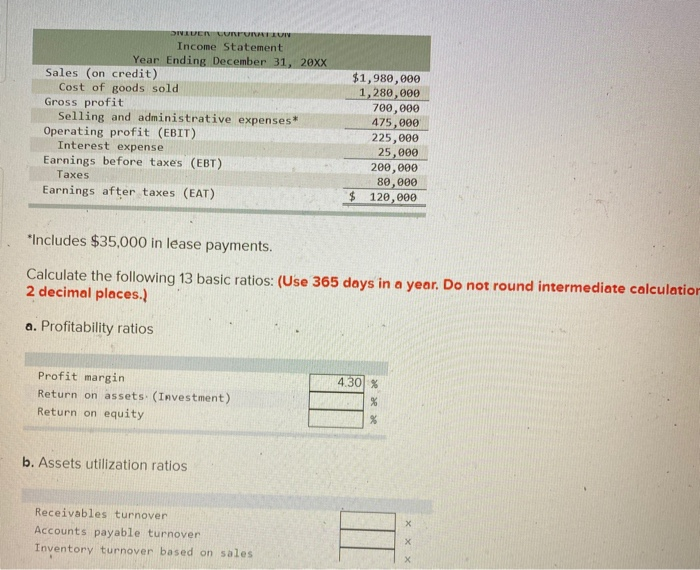

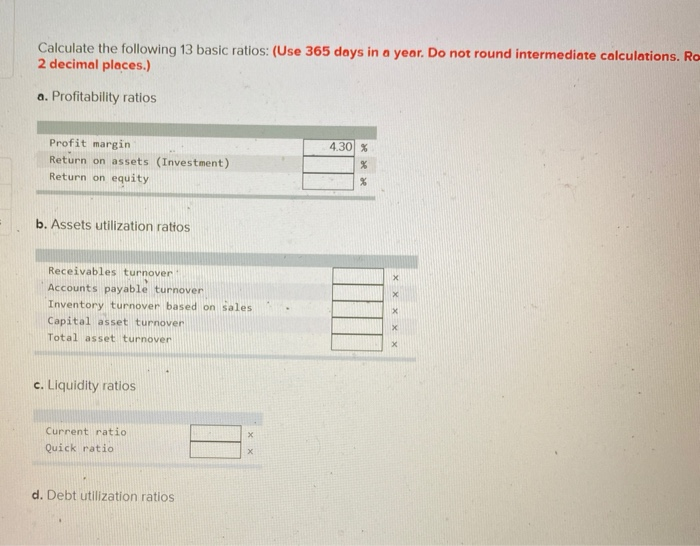

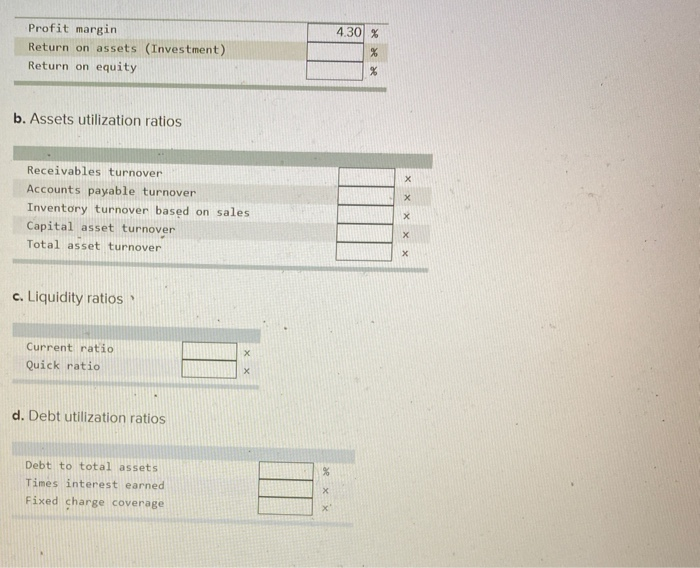

The financial statements for the Snider Corporation is given below. $ 50,000 20,000 160,000 200,000 430,000 6 60,000 600,000 199,000 SNIDER CORPORATION Balance Sheet December 31, 20XX Assets Current assets: Cash Marketable securities Accounts receivable (net) Inventory Total current assets Investments Plant and equipment Accumulated amortization Net plant and equipment Total assets Liabilities and Shareholders' Equity Current liabilities: Accounts payable Notes payable Accrued taxes Total current liabilities Long-term liabilities: Bonds payable Total liabilities Shareholders' equity Preferred stock Common stock Retained earnings Total shareholders' equity Total liabilities and shareholders' equity 410,000 $ 900,000 $ 90,000 70,000 10,000 170,000 150,000 320,000 100,000 270,000 210,000 580,000 $ 900,000 DUEN LUIFUATUN Income Statement Year Ending December 31, 20xx Sales (on credit) Cost of goods sold Gross profit Selling and administrative expenses* Operating profit (EBIT) Interest expense Earnings before taxes (EBT) Taxes Earnings after taxes (EAT) $1,980,000 1,280,000 700,000 475,000 225,000 25,000 200,000 80,000 $ 120,000 *Includes $35,000 in lease payments. Calculate the following 13 basic ratios: (Use 365 days in a year. Do not round intermediate calculation 2 decimal places. a. Profitability ratios 4.30 % Profit margin Return on assets. (Investment) Return on equity % % b. Assets utilization ratios Receivables turnover Accounts payable turnover Inventory turnover based on sales X Calculate the following 13 basic ratios: (Use 365 days in a year. Do not round intermediate calculations. Ro 2 decimal places.) a. Profitability ratios Profit margin Return on assets (Investment) Return on equity 430 % % b. Assets utilization rattos Receivables turnover Accounts payable turnover Inventory turnover based on Sales Capital asset turnover Total asset turnover X X c. Liquidity ratios Current ratio Quick ratio d. Debt utilization ratios 4.30 % Profit margin Return on assets (Investment) Return on equity Rae b. Assets utilization ratios X Receivables turnover Accounts payable turnover Inventory turnover based on sales Capital asset turnover Total asset turnover X X x c. Liquidity ratios X Current ratio Quick ratio X d. Debt utilization ratios % Debt to total assets Times interest earned Fixed charge coverage