Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Part A The Wholesale Ltd acquired 80 per cent of the shares of House Construction Ltd on 30 June 2020 for a consideration of

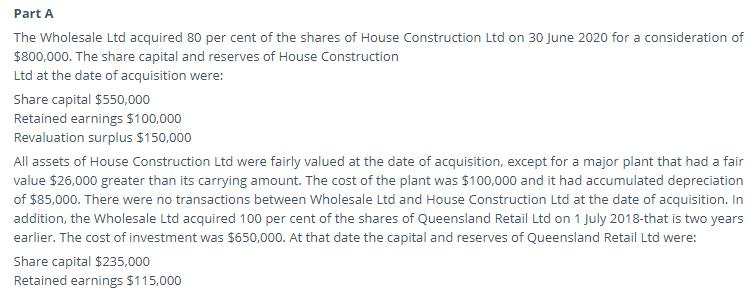

Part A The Wholesale Ltd acquired 80 per cent of the shares of House Construction Ltd on 30 June 2020 for a consideration of $800,000. The share capital and reserves of House Construction Ltd at the date of acquisition were: Share capital $550,000 Retained earnings $100,000 Revaluation surplus $150,000 All assets of House Construction Ltd were fairly valued at the date of acquisition, except for a major plant that had a fair value $26,000 greater than its carrying amount. The cost of the plant was $100,000 and it had accumulated depreciation of $85,000. There were no transactions between Wholesale Ltd and House Construction Ltd at the date of acquisition. In addition, the Wholesale Ltd acquired 100 per cent of the shares of Queensland Retail Ltd on 1 July 2018-that is two years earlier. The cost of investment was $650,000. At that date the capital and reserves of Queensland Retail Ltd were: Share capital $235,000 Retained earnings $115,000 Part B The financial statements for year ending 30 June 2020 for the economic entity have been prepared on the basis of your journals from Part A. These statements have been presented to the Board of Directors. One of the Board members pointed out that the new business acquired by Wholesale Ltd is a construction company. The Board of Directors is concerned about some financial challenges to acquire a business in a different industry. From financial accounting perspective, the Board raised the following question: What are some possible financial challenges to acquire a business in a different industry, any possible plans/solutions to overcome those challenges? (250 words maximum) This Accounting and Finance Assignment has been solved by our Accounting and Finance Experts at TVAssignmentHelp. Our Assignment Writing Experts are efficient to provide a fresh solution to this question. We are serving more than 10000+ Students in Australia, UK & US by helping them to score HD in their academics.Our Experts are well trained to follow all marking rubrics & referencing style. Be it a used or new solution, the quality of the work submitted by our assignment experts remains unhampered. You may continue to expect the same or even better quality with the used and new assignment solution files respectively. There's one thing to be noticed that you could choose one between the two and acquire an HD either way. You could choose a new assignment solution file to get yourself an exclusive, plagiarism (with free Turnitin file), expert quality assignment or order an old solution file that was considered worthy of the highest distinction.

Step by Step Solution

★★★★★

3.44 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Part A To determine the goodwill associated with the acquisition ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started