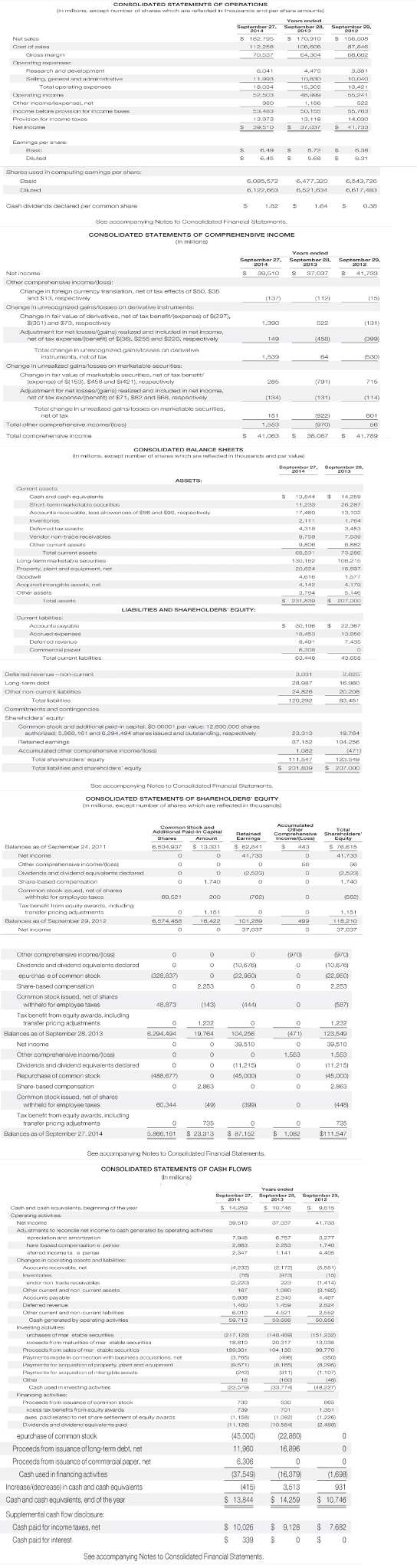

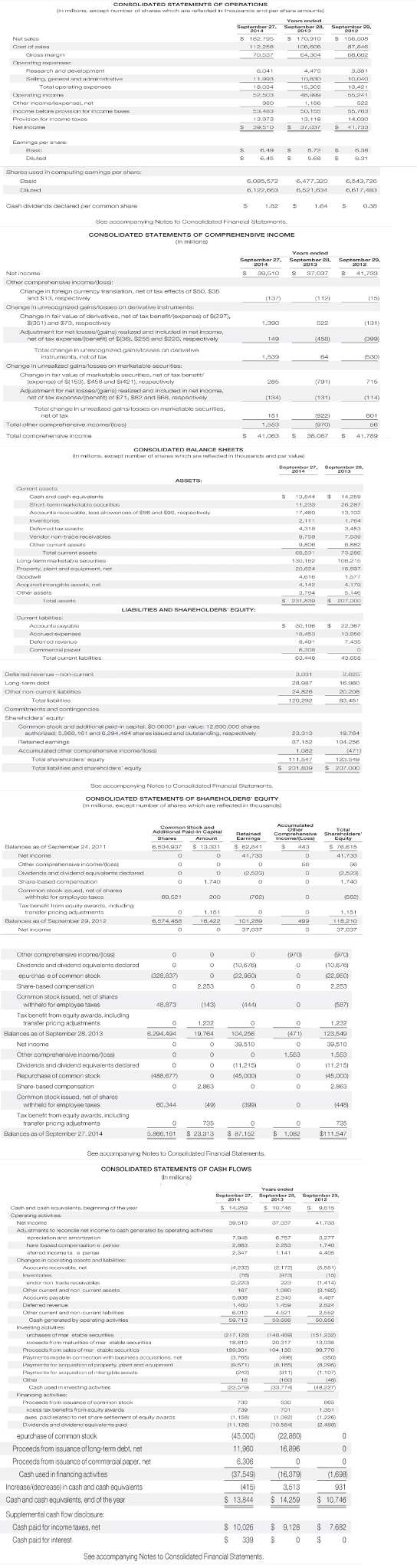

The financial statements of Apple Inc. for 2014 are presented below. Answer the following questions.

(a) What is the par or stated value per share of Apples common stock? (Round answer to 5 decimal places, e.g. 1.25310.)

(b) What percentage of Apples authorized common stock was issued at September 27, 2014? (Round answer to 0 decimal places, e.g. 17%)

(c) How many shares of common stock were outstanding at September 28, 2013, and at September 27, 2014? (Enter the answers in thousands.)

2013

2014

(d) Calculate the following for 2014. (Round earnings per share to 2 decimal places, e.g. 15.12 and all other answers to 1 decimal places, e.g. 12.5%.)

payout ratio

earnings per share

return on common stockholders equity

Total operatingexpenses Sharea used in computing caminga per sharc: 6.477.320 6,521,634 8,122.6e3 6,617.483 Cash dividends daclared per common share 39,510 $ 37,037 41,733 Change in foreign currency translation, net of tex effects of $50. $35 cnr derivative instruments: -in unrecognized g inaioases Change in fair value of darvatives, net of tax benefitoxpensa) of $297 1301) and 373, rospectivaly and Included in rt Incorme, net of tax expenserberert) of $06$255 and $220. respectively inatrumenta, nct of tox Changa in unroalzad gainsosse on markatablo saounitios Change in fair value ot marketable securities, net of tax bernetit expernse of153, $458 and $42 1), respectively Acjustment for net lo8s8sgeins) realzed and incuded in ne1 income Total change in unrealzed gainslosses on markatabke securitics Total other comprehensive income)oss Total comprehenave income s 41,063 $ 38.0e7 41,789 Aesan.rlis reorvatie, ktita altowinstadyB6snd saa, respectively 9.750 ,808 Total current 5sets Total curret babilities Delerred reve-non-crrent Long-term ddebt Common ock nd addition3l peid-in capital, $0.00001 par waiue: 1 2.600.000 8hareg 19,764 authcrized 5.988,161 and 6,204,494 sharea iasued and cutatanding, reapecthay Retaned earnings Toal sharenolder& equity Total labiltiee and thareholders' equity 231.839 207.000 CONSOLIDATED STATEMENTS OF SHAREHOLDERS EQUITY n mlions,exceot number o shares which are reflectecd in thcusanc) Balances a8September 24, 2011 6.504,83713.331 s 82,04 stock.ed, netofghares wthhold for amplayoo taxes Tax bene from equity da, nduding transler pricing ad ustments Belsnoes September 29, 2012 37 037 Cividonds and cividend equiva ents doclared ecucnas e of common stock nare-based compensation Common stock issued, net of shares 0,6761 122.950 2,253 328,837) withhelc for employee tsoes Tax benetn from equity awards, including traneter pricing adjustments Balances as of September 28, 2013 19,764 104,256 Net inooma Cividends and cividend equiva ents declared 11,215) Snare-based oompensation Common stock issued, net of shares 2,563 withhelc for employee 180083 Tax benefrt from equity awards, including transter pricina adjustments 735 735 Balances as of September 27,2014 CONSOLIDATED STATEMENTS OF CASH FLOWS Cash and equivalents, begnnrg of tho year $ 14,25 10.746-9,015 37 037 Ad ustments to reconcie net inoome to oazh ganerated by operating acti itea eferred ircomata Chongeo in operating aacots and oblitioc: 2,220 Other current and non curant ossets 3,162) Cash gonerated by operaing aathtios 59.7133666 03,770 3.75) Cach uced in invosting activiiee benefcs from equity awarda ames paldl relanedi to net share settiemern of equity awards 1.082 avidends and diclend equvalents paid epudhase of common stock Proceeds from ssuance oflong-tem debt, net Proceeds from issuance of commercial paper, net Cash used in fnancing activities Increase/decrease) in cash and cash equivalenms Cashand cash equivalents, end of the year Supplemental cash flow disclosure Cash paid for income taxes, net Cash paid for interest See accompanying Notes to Consoidated Financial Statements