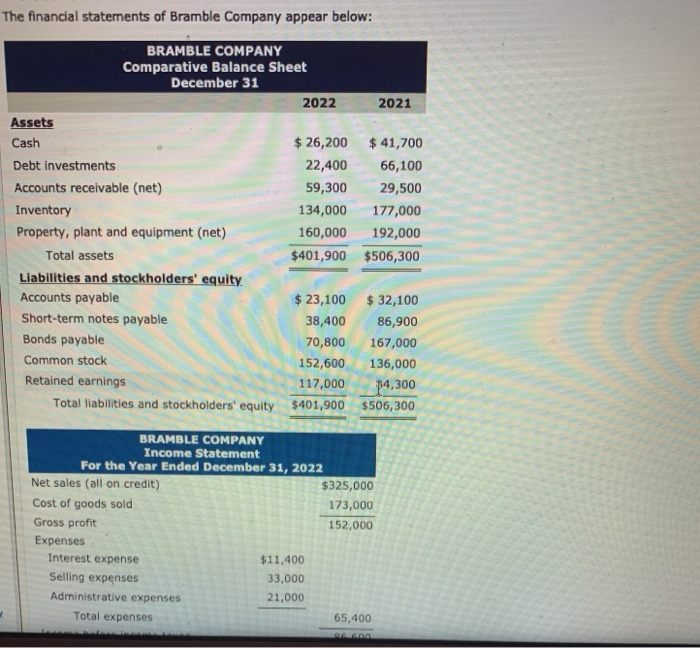

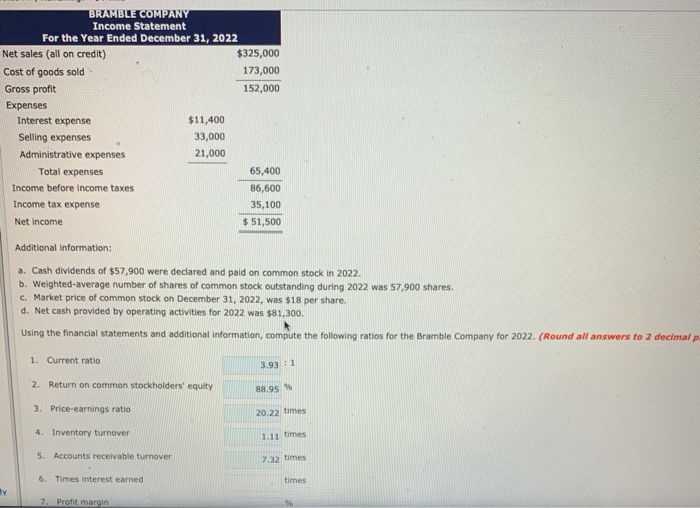

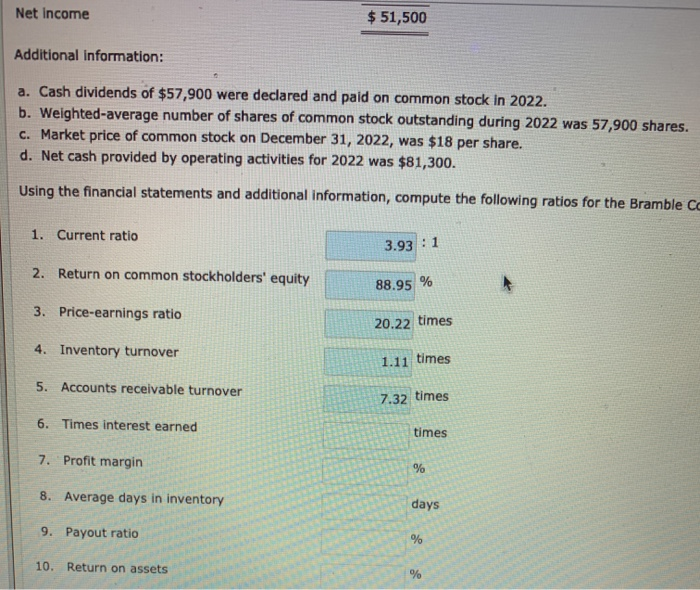

The financial statements of Bramble Company appear below: 2021 BRAMBLE COMPANY Comparative Balance Sheet December 31 2022 Assets Cash $ 26,200 Debt investments 22,400 Accounts receivable (net) 59,300 Inventory 134,000 Property, plant and equipment (net) 160,000 Total assets $401,900 Liabilities and stockholders' equity. Accounts payable $ 23,100 Short-term notes payable 38,400 Bonds payable 70,800 Common stock 152,600 Retained earnings 117,000 Total liabilities and stockholders' equity $401,900 $ 41,700 66,100 29,500 177,000 192,000 $506,300 $ 32,100 86,900 167,000 136,000 34,300 $506,300 BRAMBLE COMPANY Income Statement For the Year Ended December 31, 2022 Net sales (all on credit) $325,000 Cost of goods sold 173,000 Gross profit 152,000 Expenses Interest expense $11,400 Selling expenses 33,000 Administrative expenses 21,000 Total expenses 65,400 BRAMBLE COMPANY Income Statement For the Year Ended December 31, 2022 Net sales (all on credit) $325,000 Cost of goods sold 173,000 Gross profit 152,000 Expenses Interest expense $11,400 Selling expenses 33,000 Administrative expenses 21,000 Total expenses 65,400 Income before income taxes 86,600 Income tax expense 35,100 Net income $ 51,500 Additional Information: a. Cash dividends of $57,900 were declared and paid on common stock in 2022 b. Weighted-average number of shares of common stock outstanding during 2022 was 57,900 shares. c. Market price of common stock on December 31, 2022, was $18 per share. d. Net cash provided by operating activities for 2022 was $81,300. Using the financial statements and additional information, compute the following ratios for the Bramble Company for 2022. (Round all answers to 2 decimal p. 1. Current ratio 3.931 2. Return on common stockholders' equity 88.95 % 3. Price earnings ratio 20.22 times 4. Inventory turnover 1.11 times 5. Accounts receivable turnover 7.32 times 6. Times interest earned times 7. Profit margin Net Income $ 51,500 Additional Information: a. Cash dividends of $57,900 were declared and paid on common stock in 2022. b. Weighted average number of shares of common stock outstanding during 2022 was 57,900 shares. C. Market price of common stock on December 31, 2022, was $18 per share. d. Net cash provided by operating activities for 2022 was $81,300. Using the financial statements and additional information, compute the following ratios for the Bramble Co 1. Current ratio 3.93 : 1 2. Return on common stockholders' equity 88.95 % 3. Price-earnings ratio 20.22 times 4. Inventory turnover 1.11 times 5. Accounts receivable turnover 7.32 times 6. Times interest earned times 7. Profit margin % 8. Average days in inventory days 9. Payout ratio % 10. Return on assets %