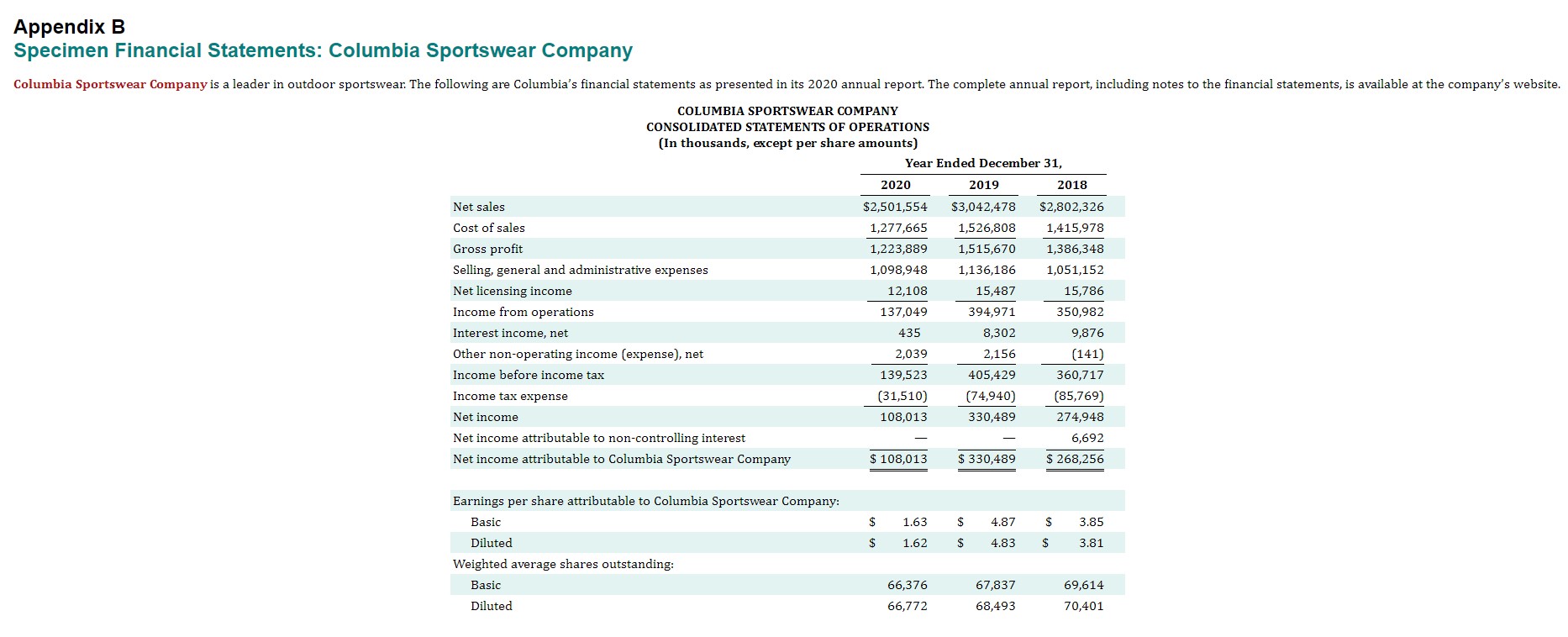

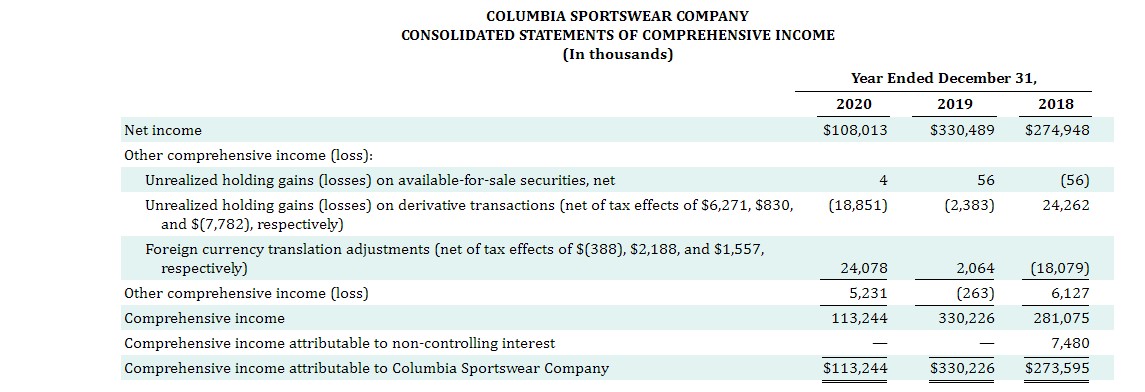

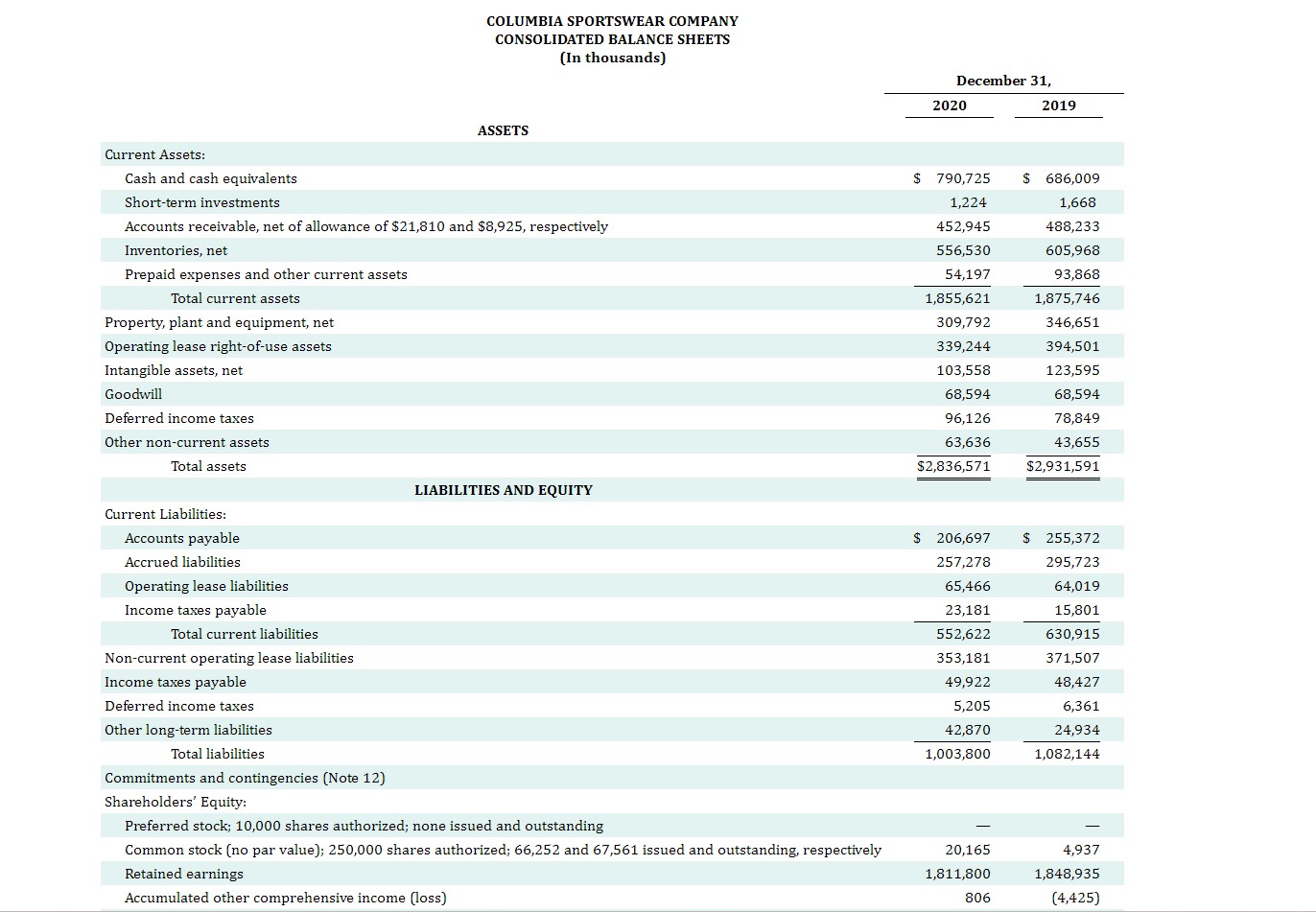

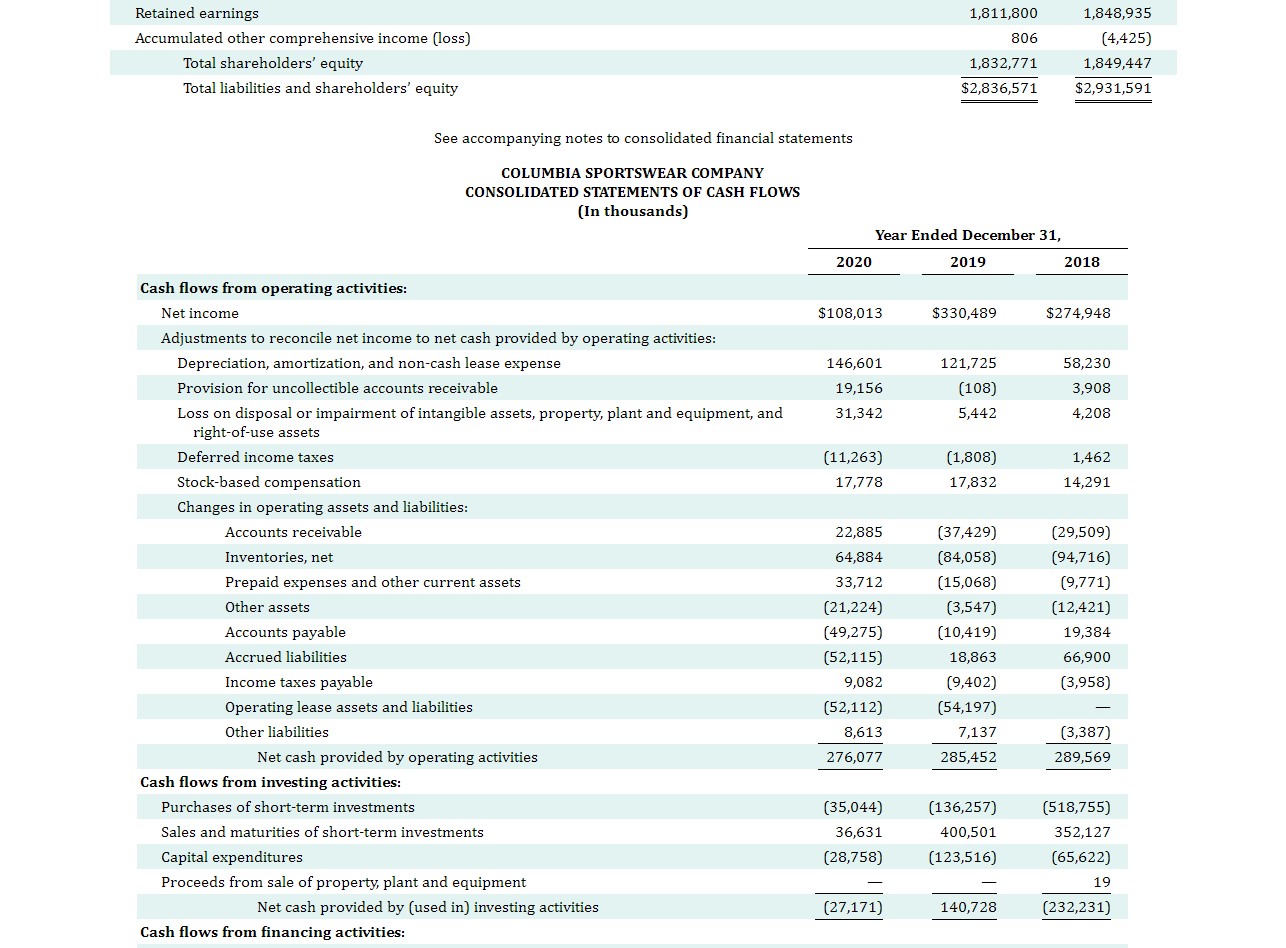

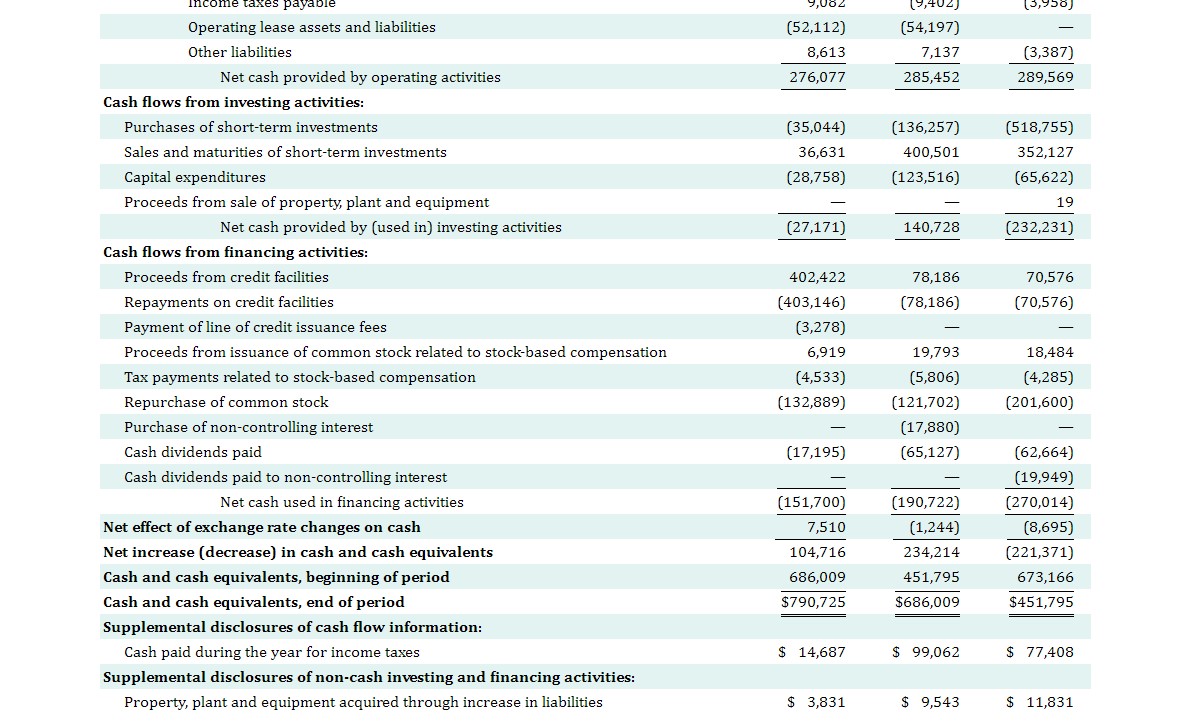

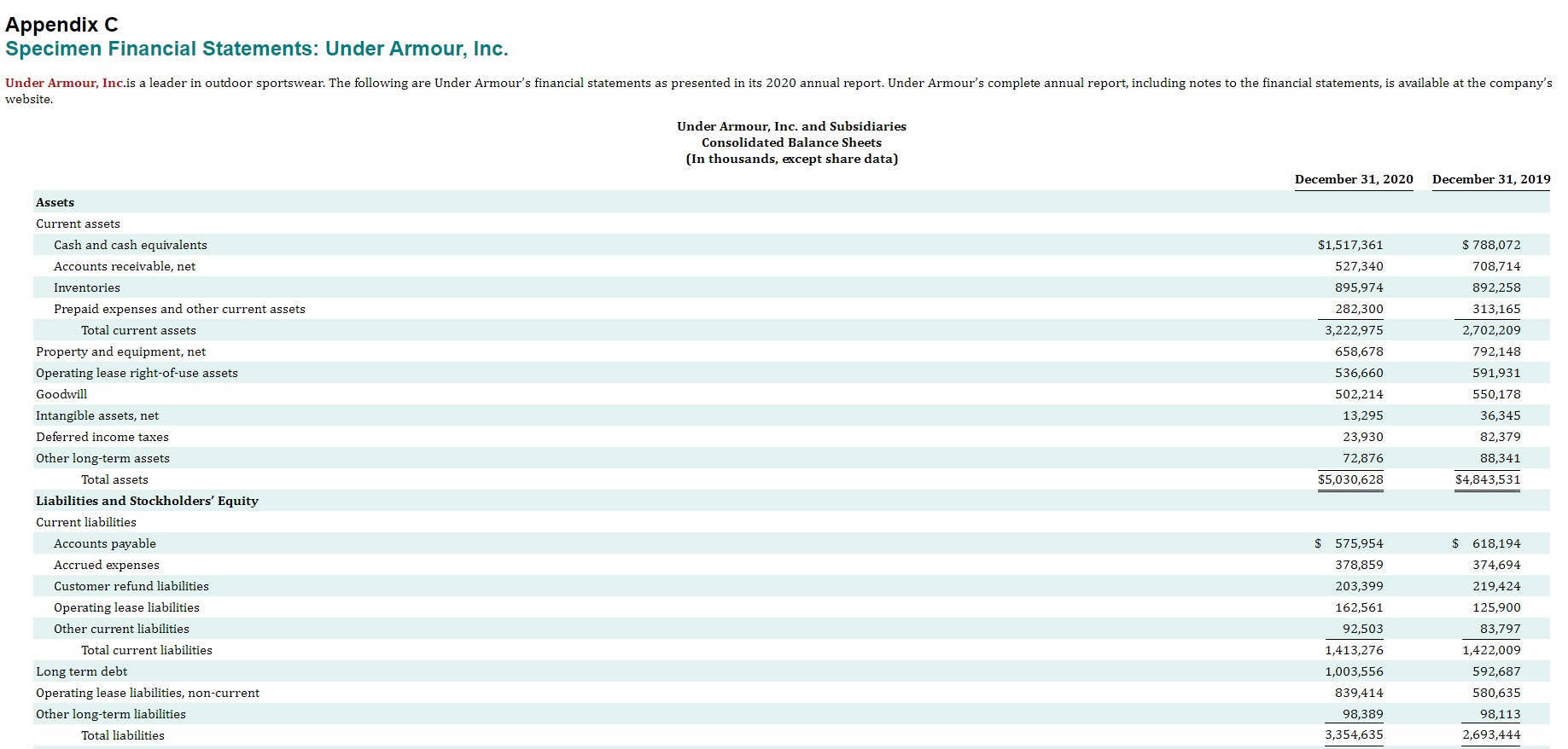

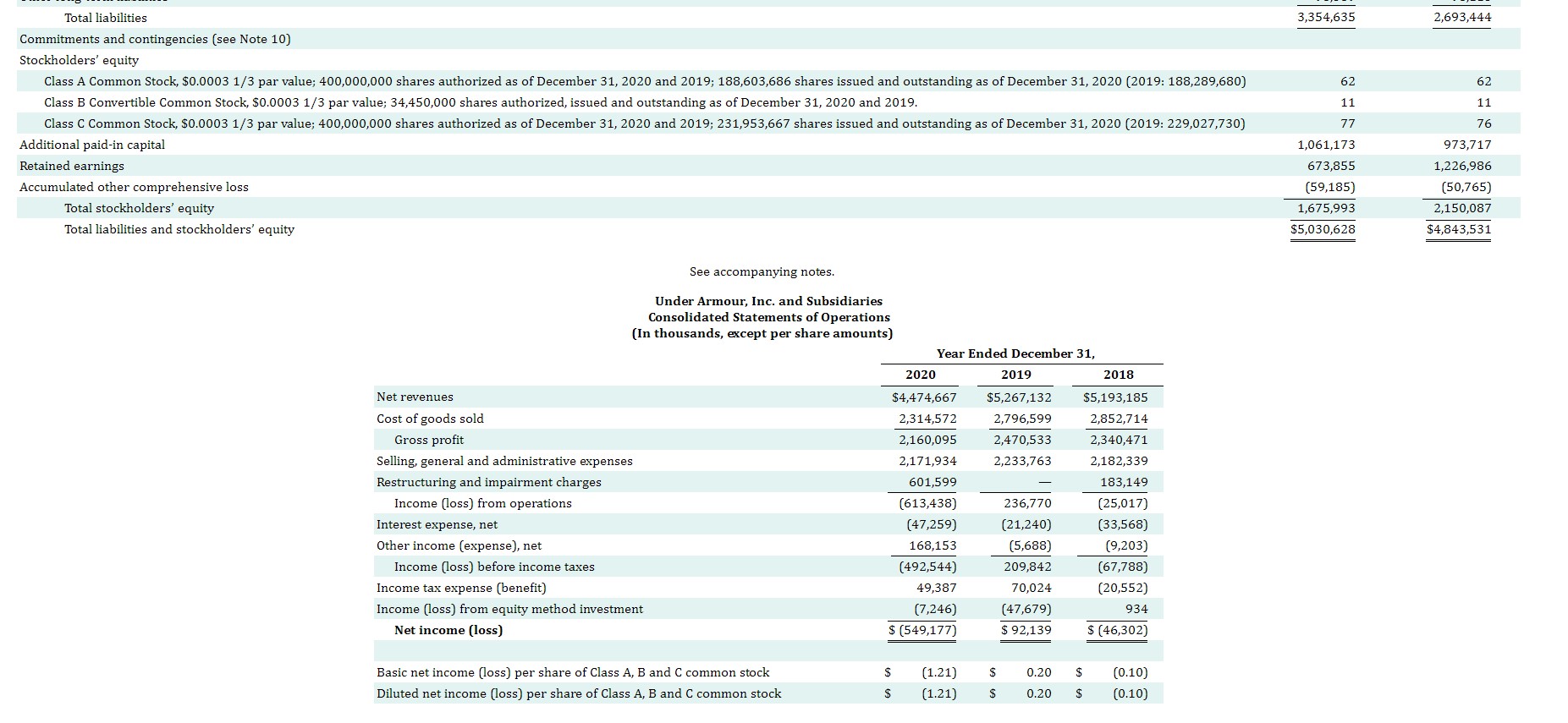

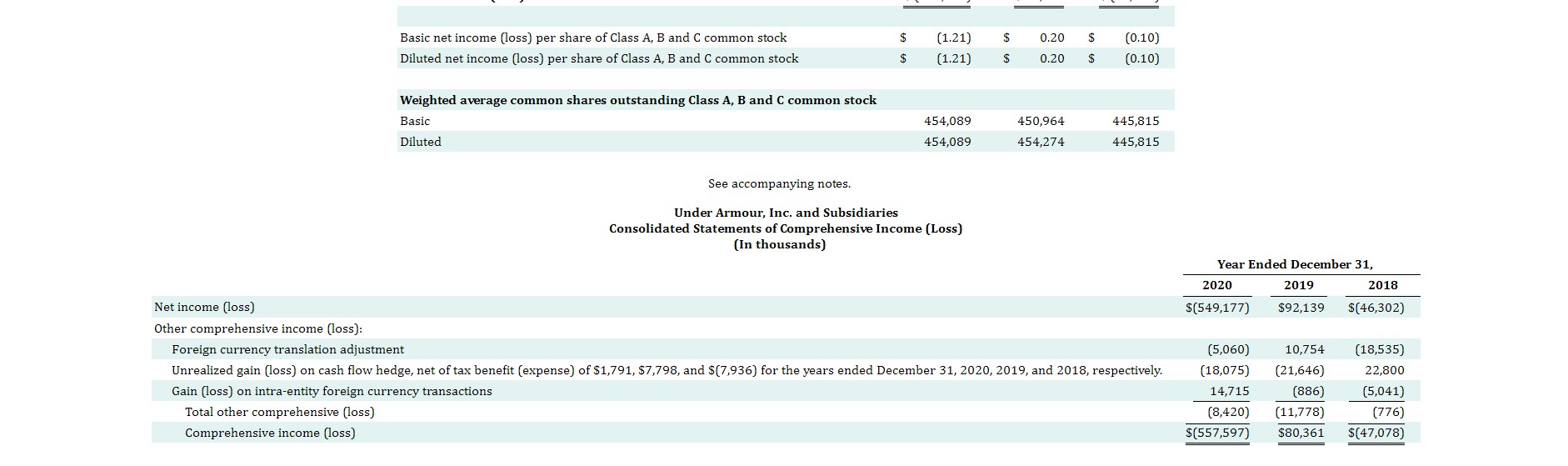

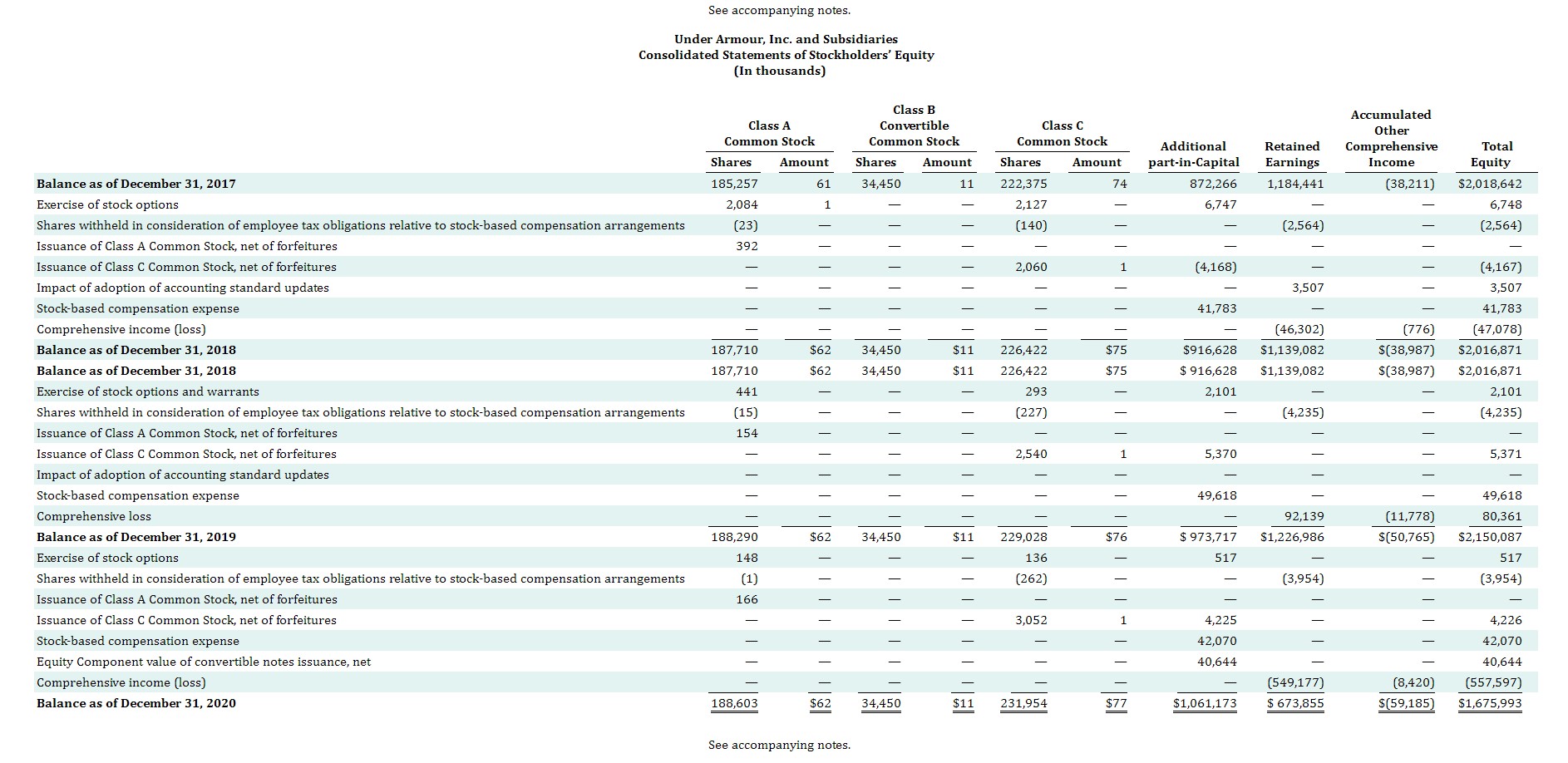

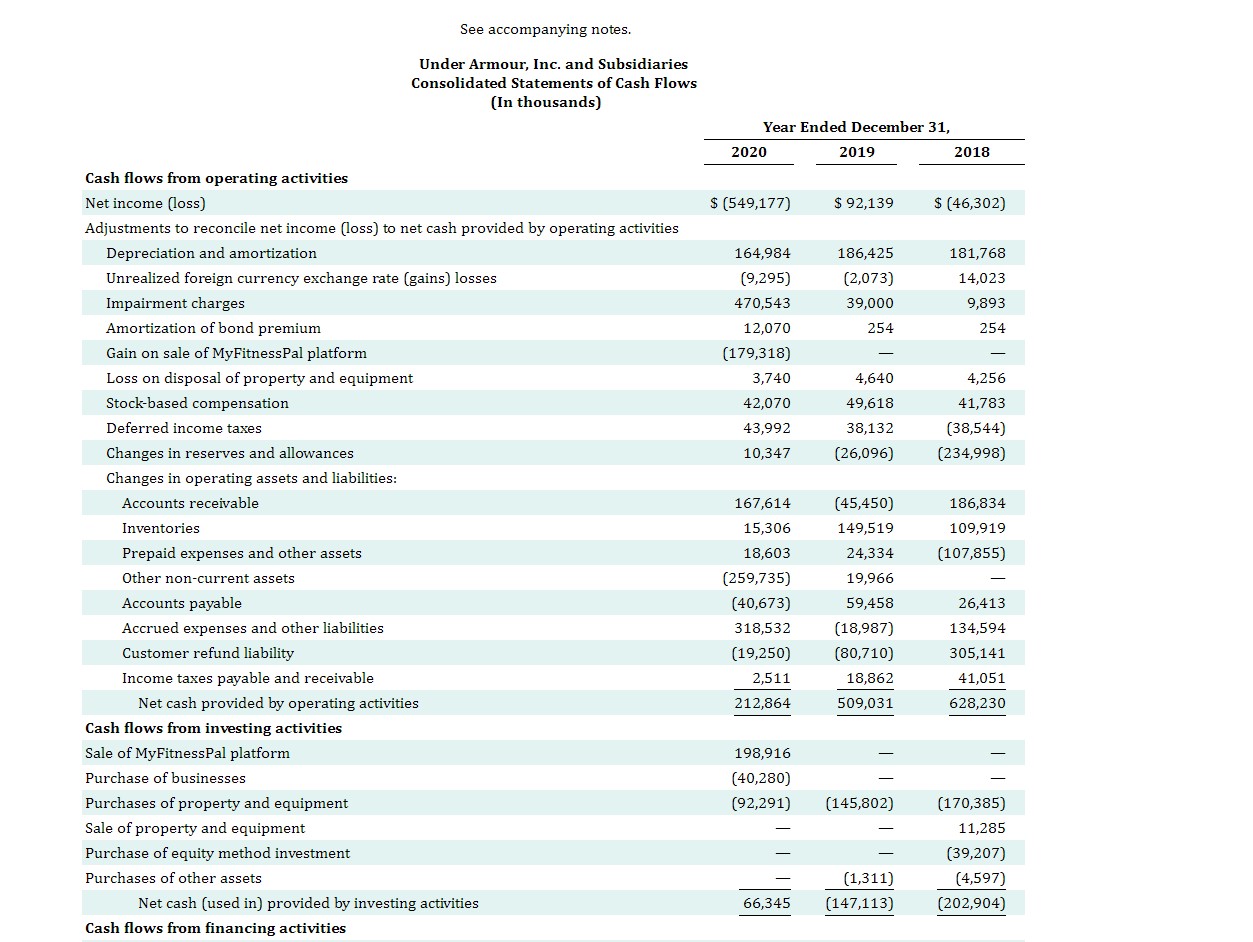

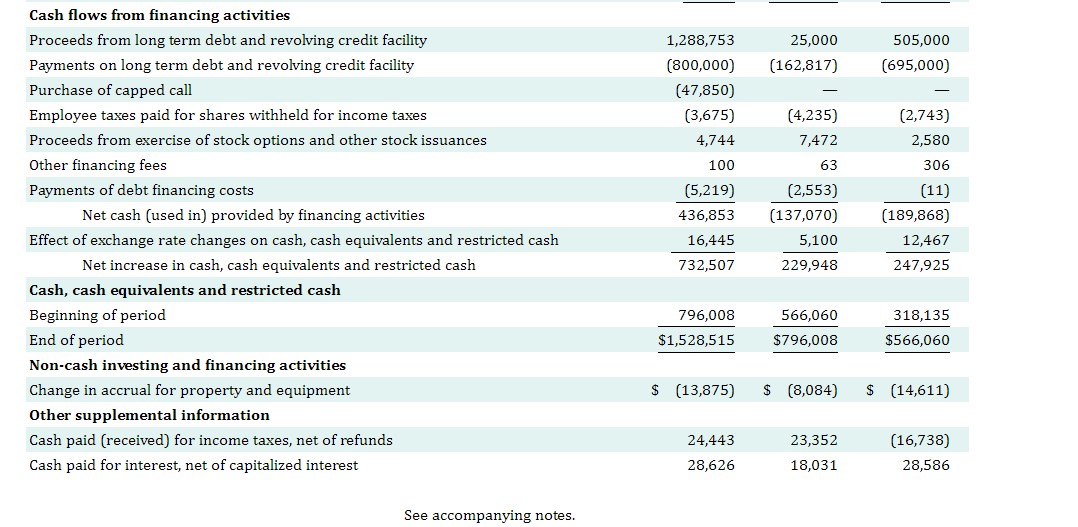

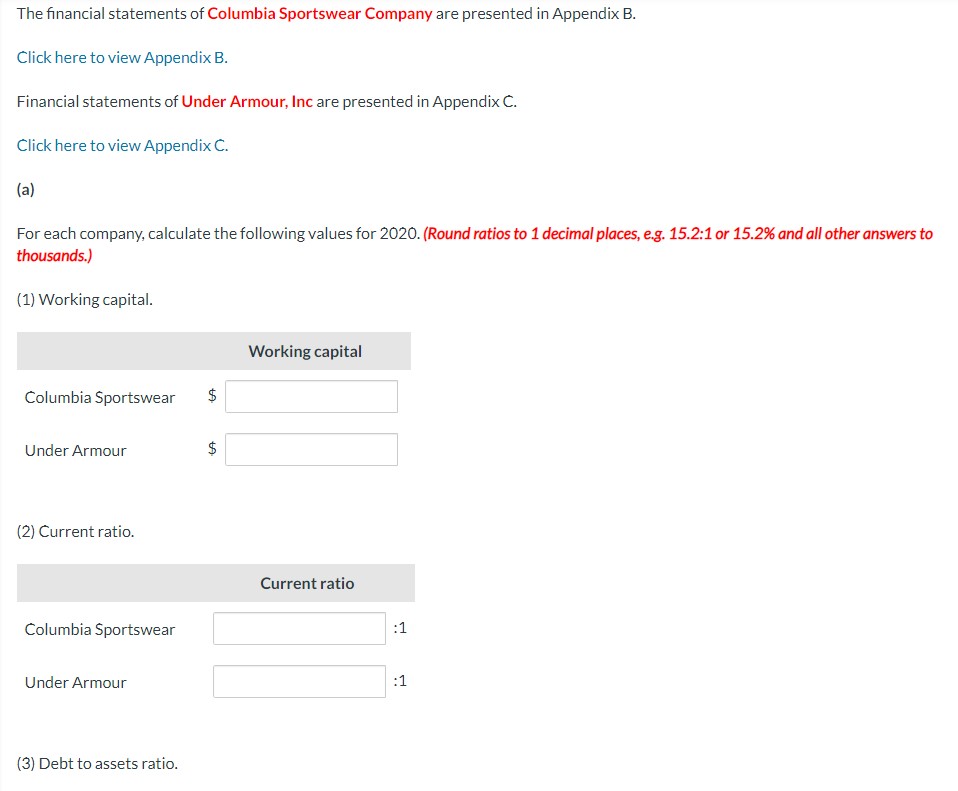

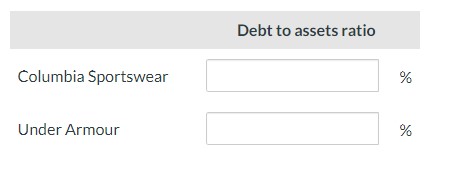

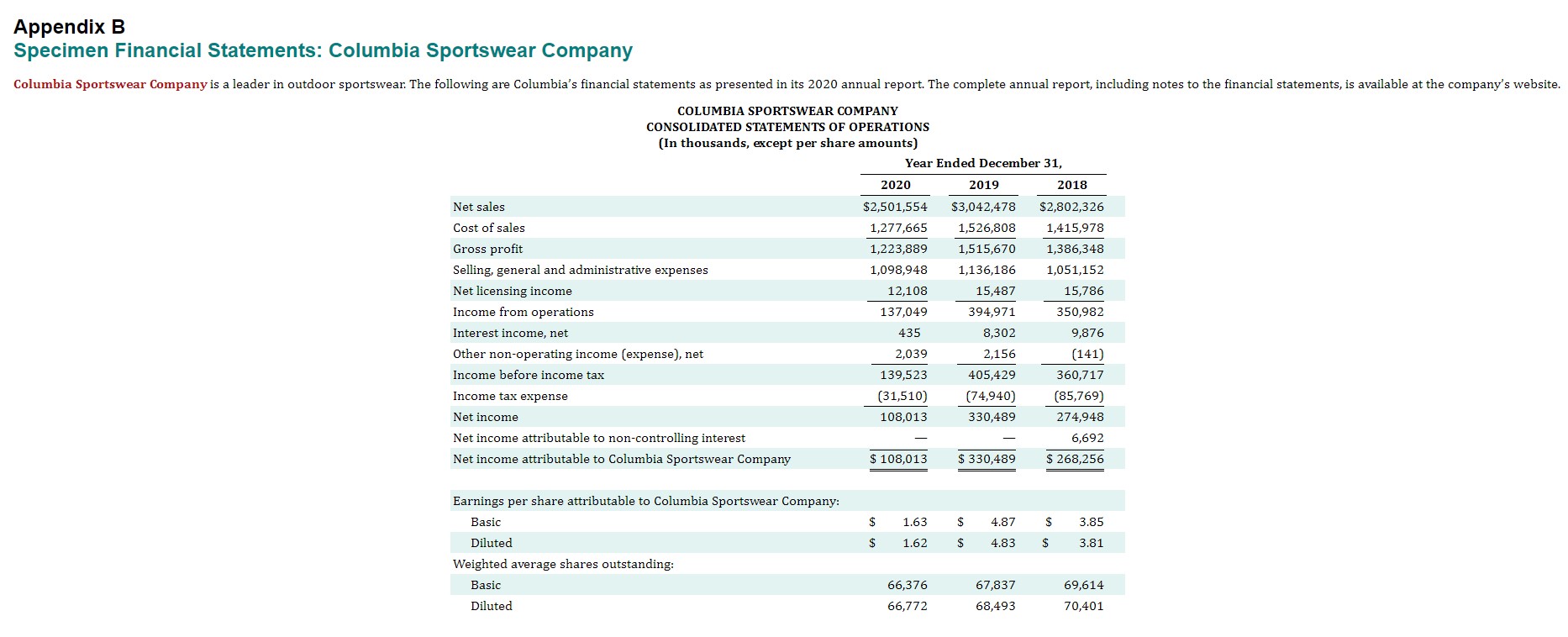

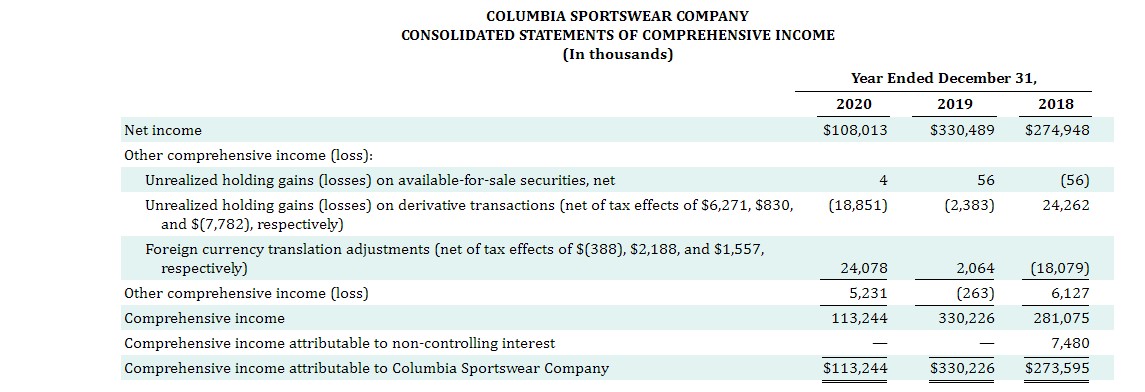

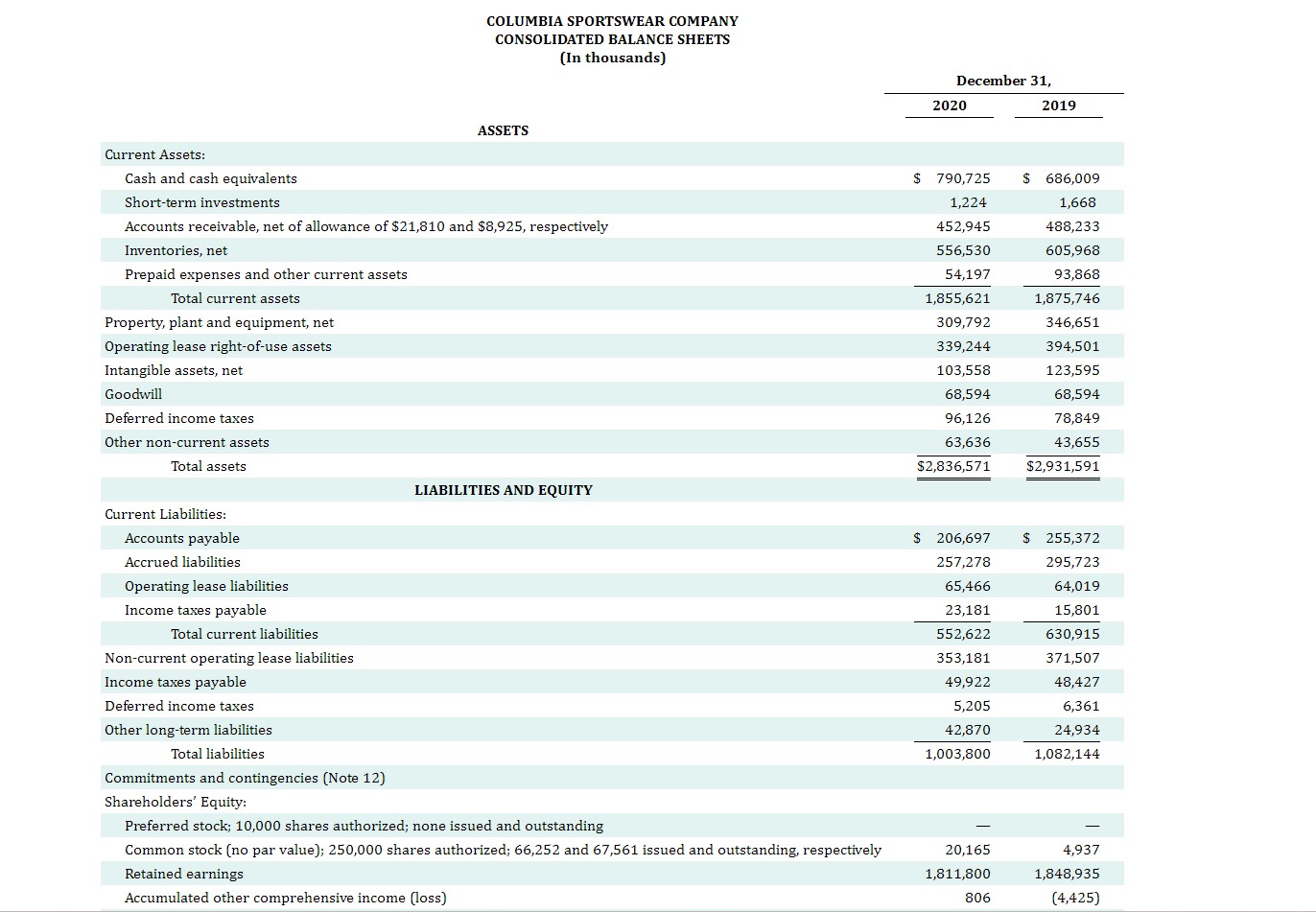

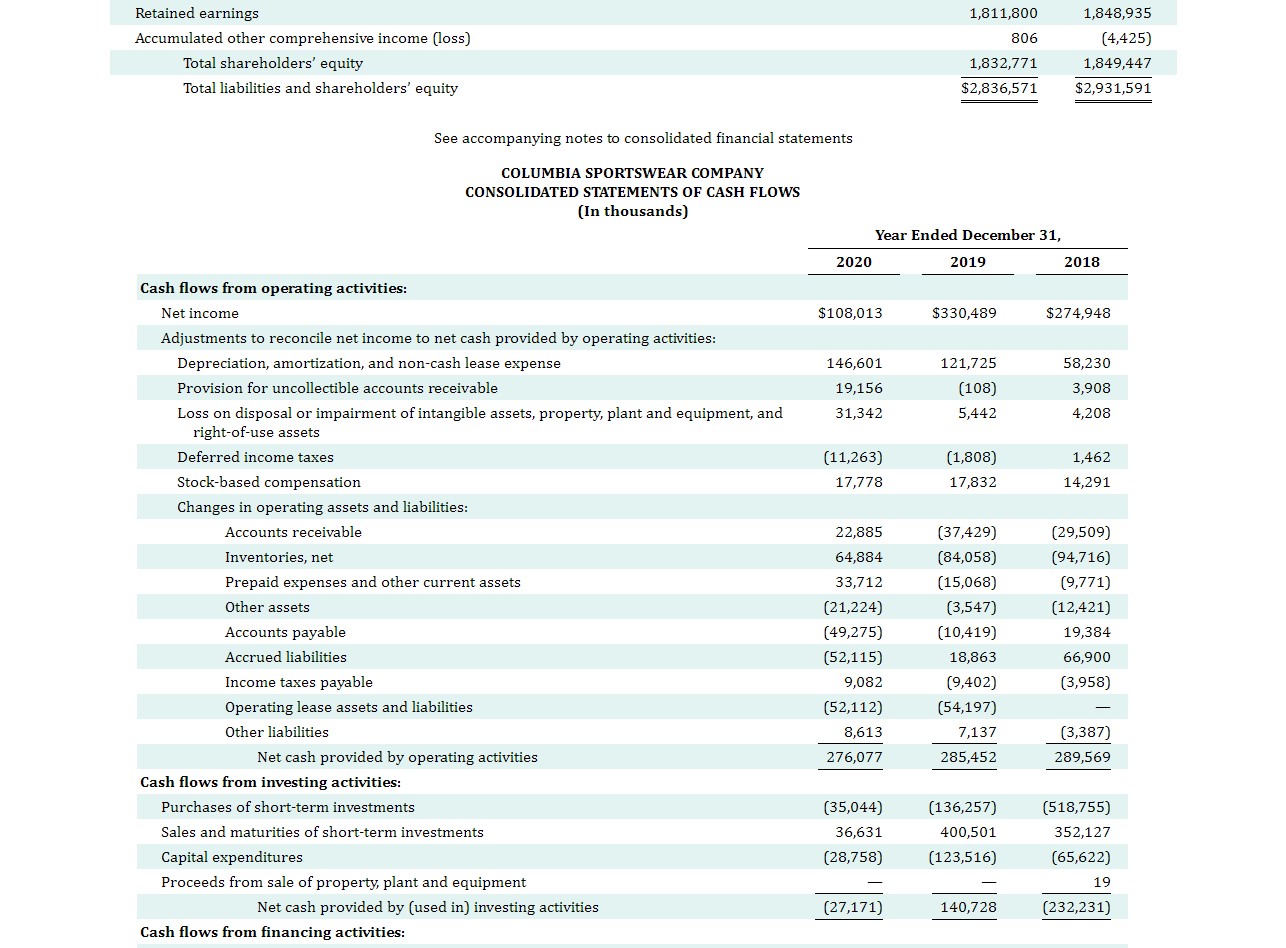

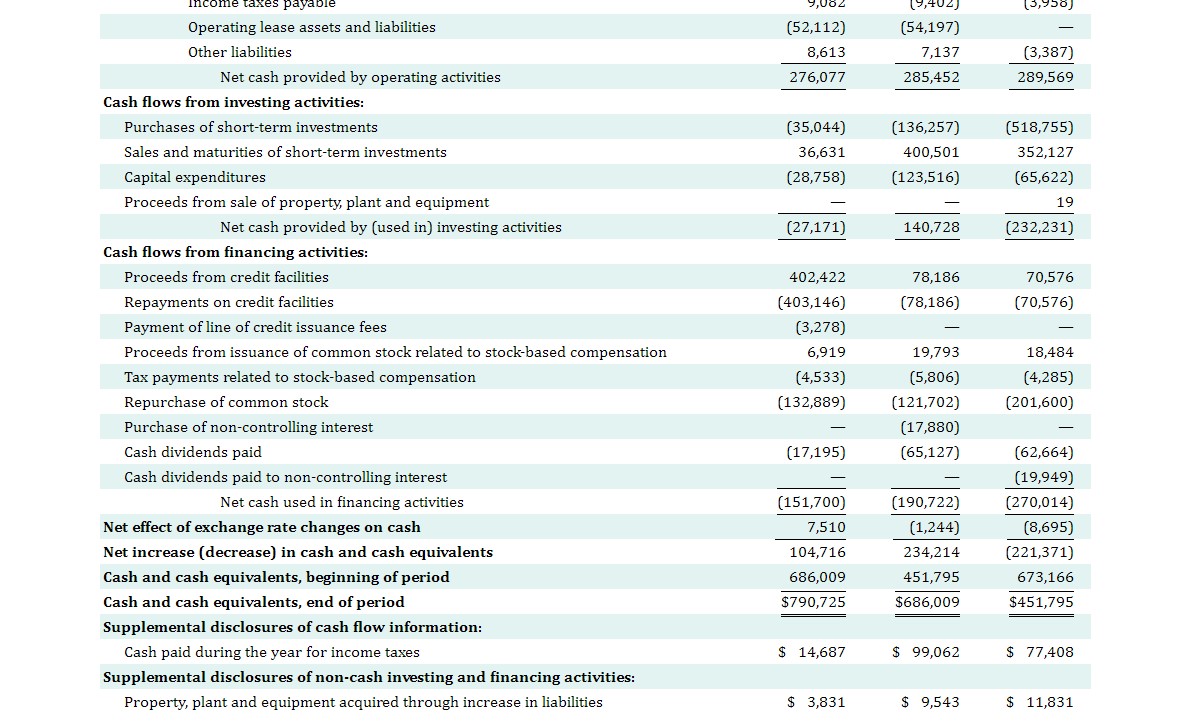

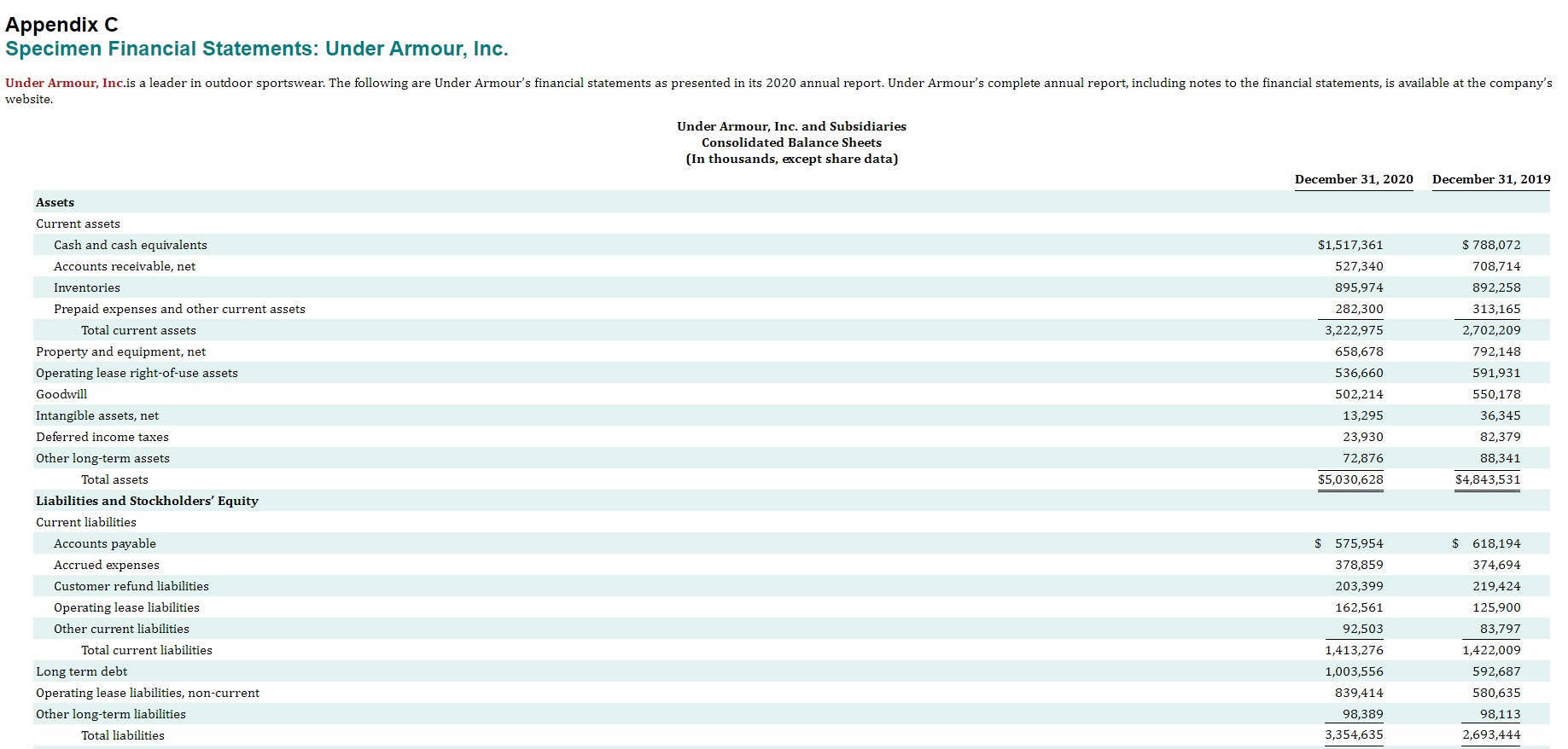

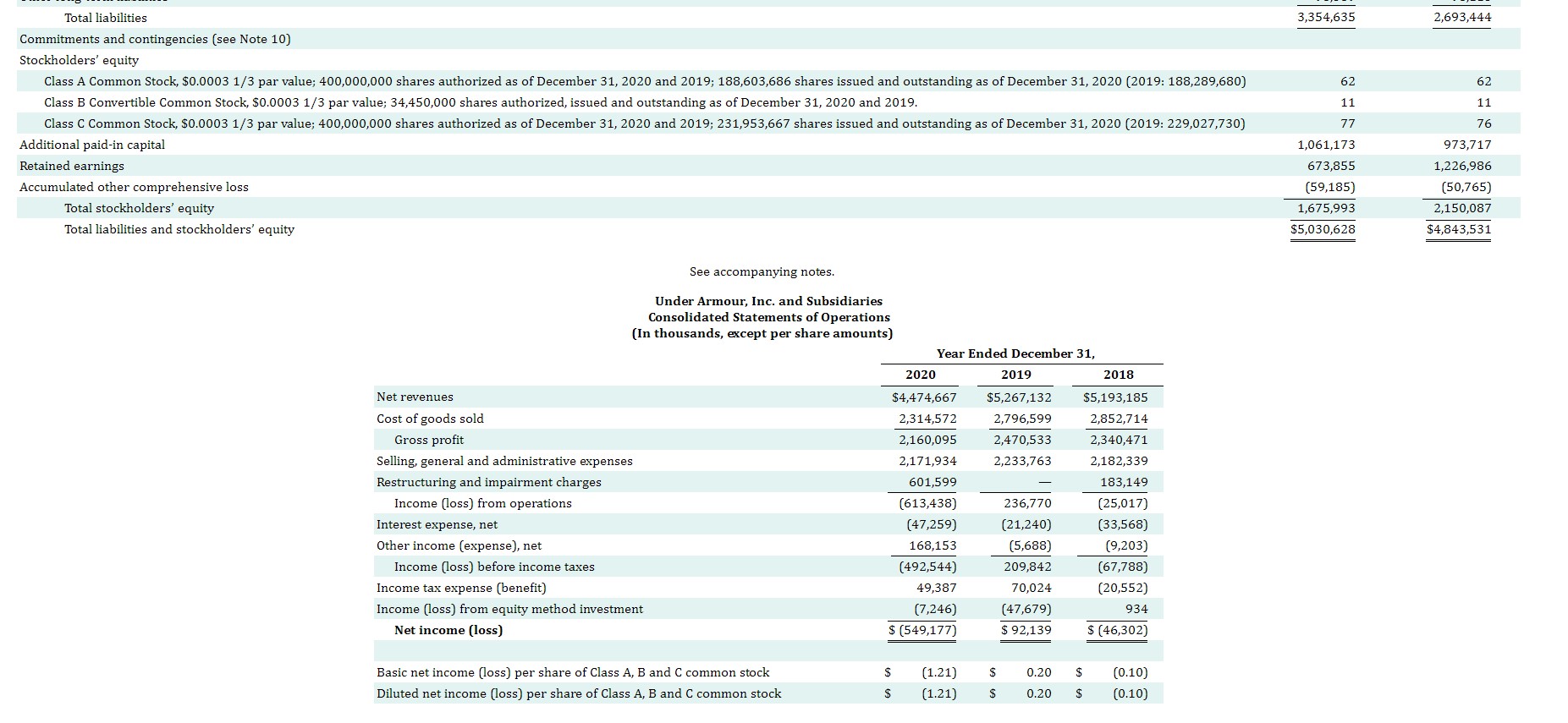

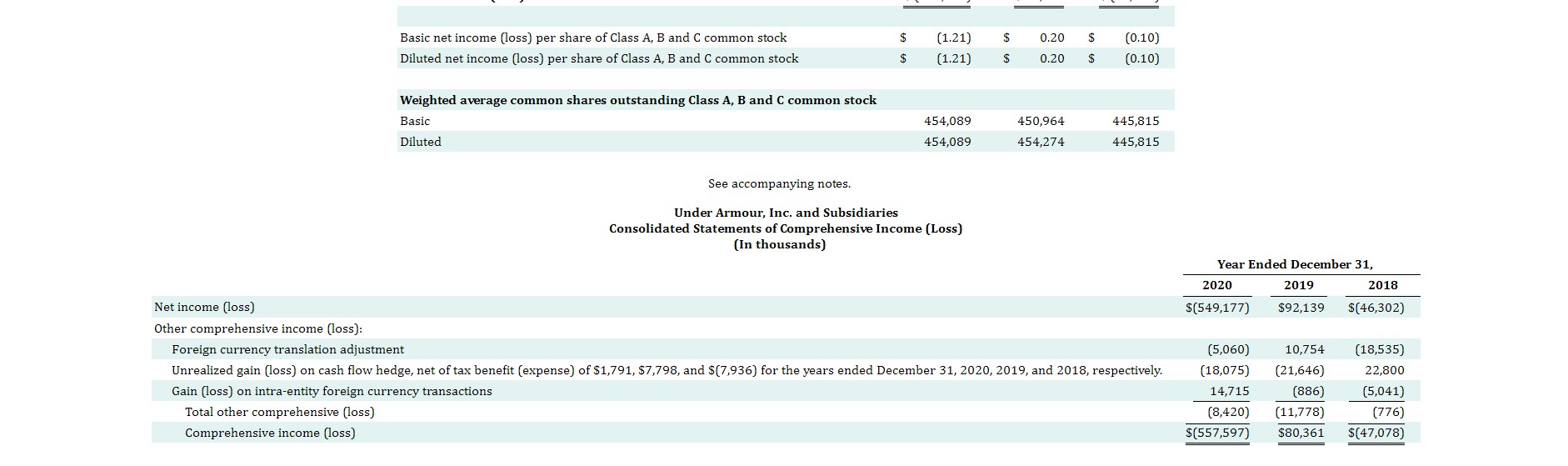

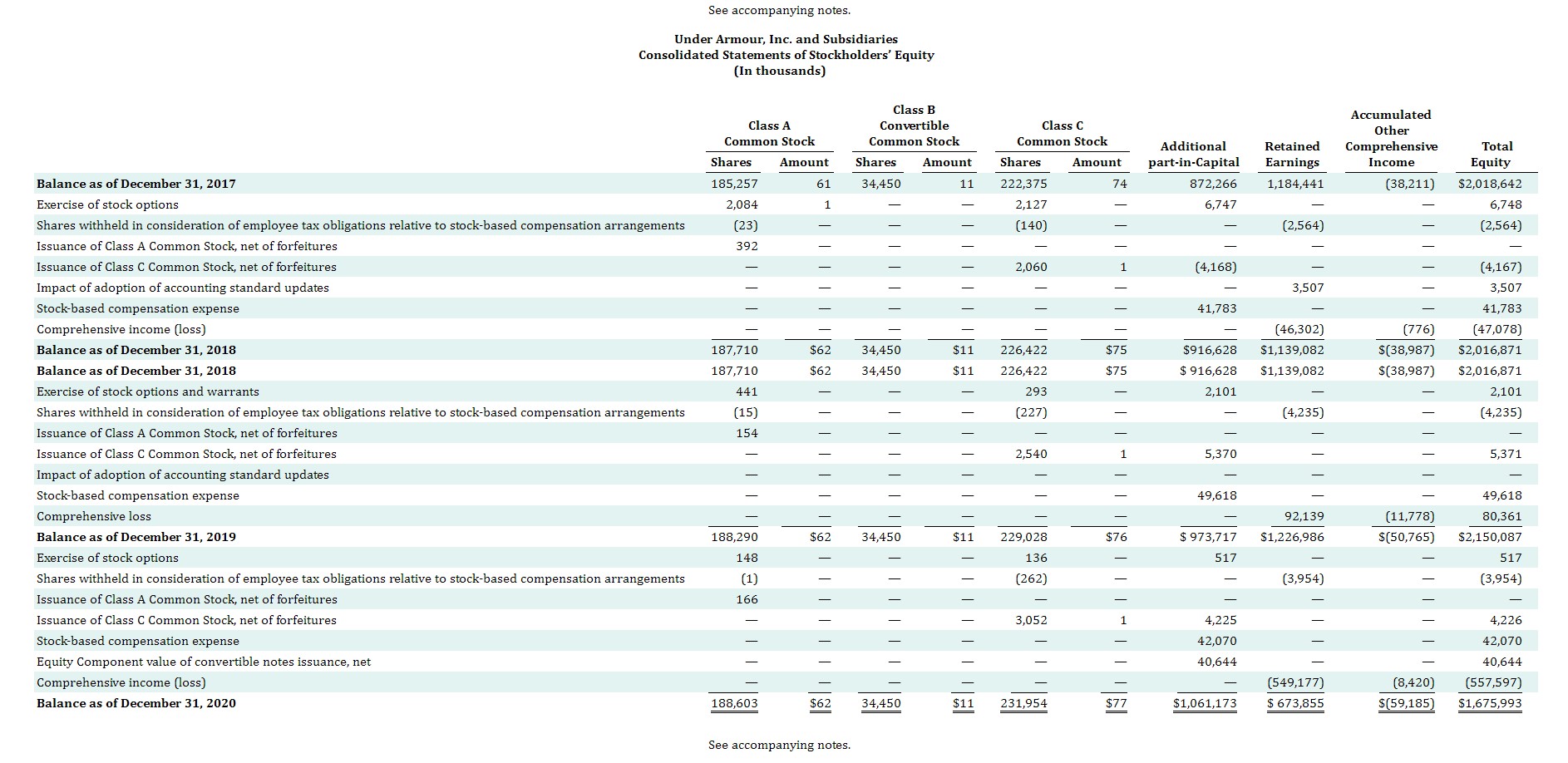

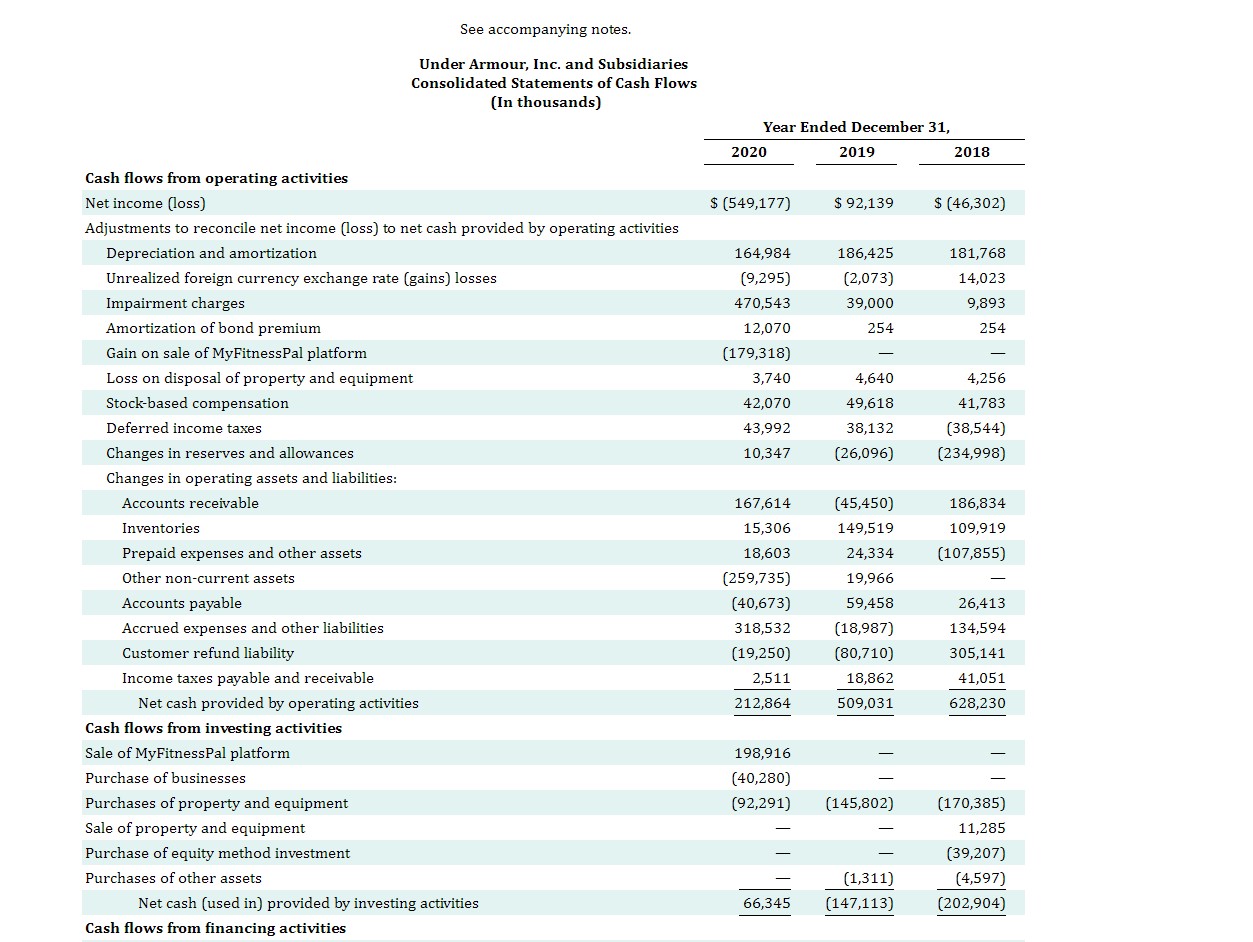

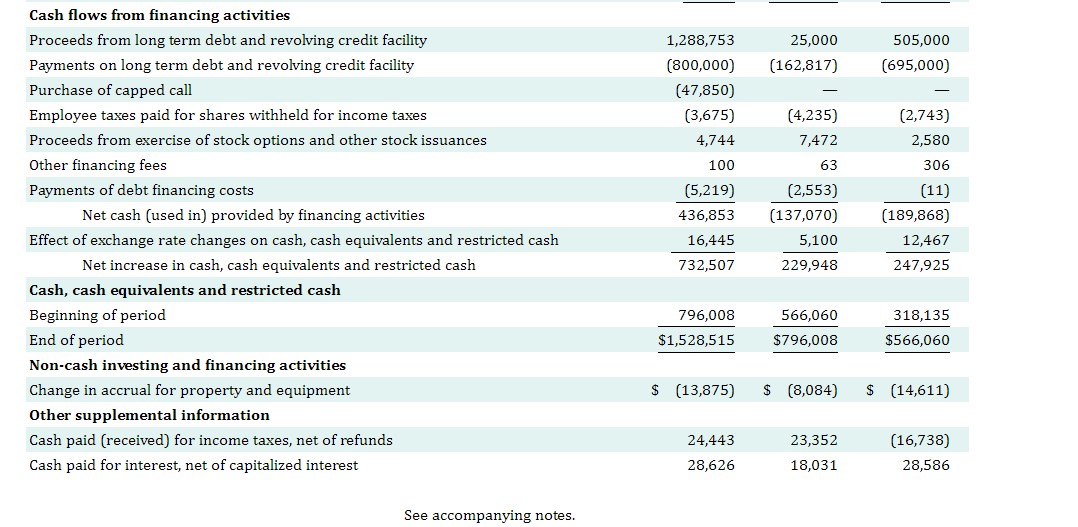

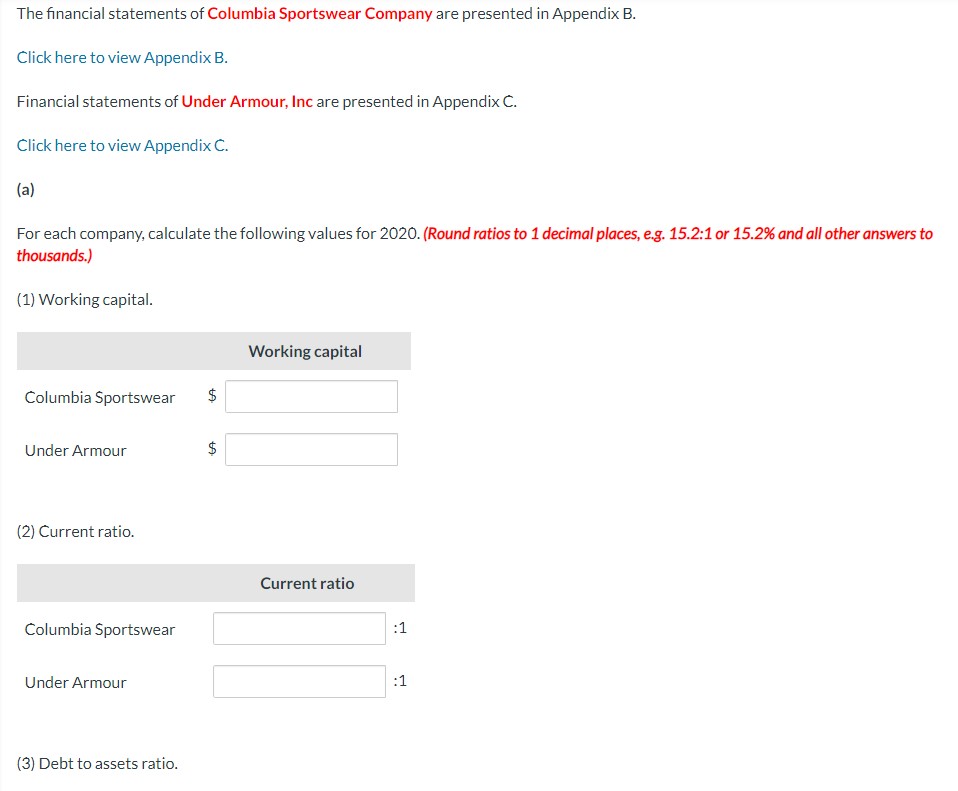

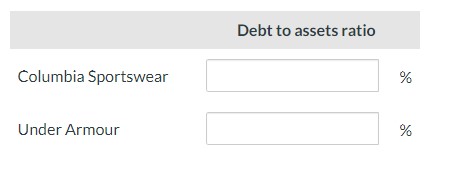

The financial statements of Columbia Sportswear Company are presented in Appendix B. Click here to view Appendix B. Financial statements of Under Armour, Inc are presented in Appendix C. Click here to view Appendix C. (a) For each company, calculate the following values for 2020 . (Round ratios to 1 decimal places, e.g. 15.2:1 or 15.2% and all other answers to thousands.) (1) Working capital. (2) Current ratio. (3) Debt to assets ratio. See accompanying notes. Under Armour, Inc. and Subsidiaries Consolidated Statements of Operations (In thousands, except per share amounts) Appendix C Specimen Financial Statements: Under Armour, Inc. website. Under Armour, Inc. and Subsidiaries Consolidated Balance Sheets (In thousands, except share data) Assets Current assets Cash and cash equivalents Accounts receivable, net Inventories Prepaid expenses and other current assets Total current assets Property and equipment, net Operating lease right-of-use assets Goodwill Intangible assets, net Deferred income taxes Other long-term assets Total assets Liabilities and Stockholders' Equity Current liabilities Accounts payable Accrued expenses Customer refund liabilities Operating lease liabilities Other current liabilities Total current liabilities Long term debt Operating lease liabilities, non-current Other long-term liabilities Total liabilities COLUMBIA SPORTSWEAR COMPANY CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (In thousands) See accompanying notes. Under Armour, Inc. and Subsidiaries Consolidated Statements of Comprehensive Income (Loss) (In thousands) COLUMBIA SPORTSWEAR COMPANY CONSOLIDATED BALANCE SHEETS (In thousands) ee accompanying notes to consolidated financial statement COLUMBIA SPORTSWEAR COMPANY CONSOLIDATED STATEMENTS OF CASH FLOWS (In thousands) Cash flows from financing activities See accompanying notes. \begin{tabular}{l|l} \hline & \multicolumn{2}{c}{ Debt to assets ratio } \\ \hline Columbia Sportswear & \\ \hline Under Armour & % \end{tabular} See accompanying notes. Under Armour, Inc. and Subsidiaries Consolidated Statements of Stockholders' Equity (In thousands) Appendix B Specimen Financial Statements: Columbia Sportswear Company COLUMBIA SPORTSWEAR COMPANY CONSOLIDATED STATEMENTS OF OPERATIONS (In thousands, except per share amounts) See accompanying notes. Under Armour, Inc. and Subsidiaries Consolidated Statements of Cash Flows (In thousands)