Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The financial statements of Inland Engineering are provided below. The firm has 100 million shares outstanding at the end of 2020 and the stock

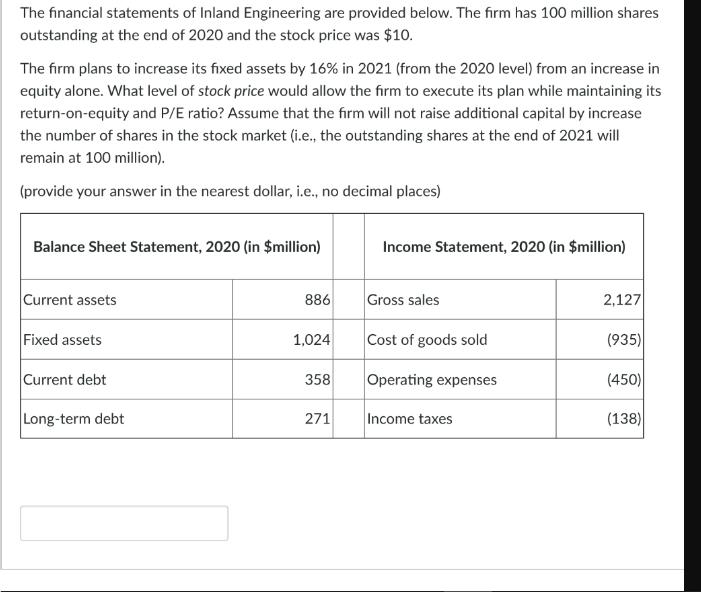

The financial statements of Inland Engineering are provided below. The firm has 100 million shares outstanding at the end of 2020 and the stock price was $10. The firm plans to increase its fixed assets by 16% in 2021 (from the 2020 level) from an increase in equity alone. What level of stock price would allow the firm to execute its plan while maintaining its return-on-equity and P/E ratio? Assume that the firm will not raise additional capital by increase the number of shares in the stock market (i.e., the outstanding shares at the end of 2021 will remain at 100 million). (provide your answer in the nearest dollar, i.e., no decimal places) Balance Sheet Statement, 2020 (in $million) Income Statement, 2020 (in $million) Current assets 886 Gross sales 2,127 Fixed assets 1,024 Cost of goods sold (935) Current debt 358 Operating expenses (450) Long-term debt 271 Income taxes (138)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer To determine the required stock price for Inland Engineering to increase its fixed assets by ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663e9a7db06ad_954107.pdf

180 KBs PDF File

663e9a7db06ad_954107.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started