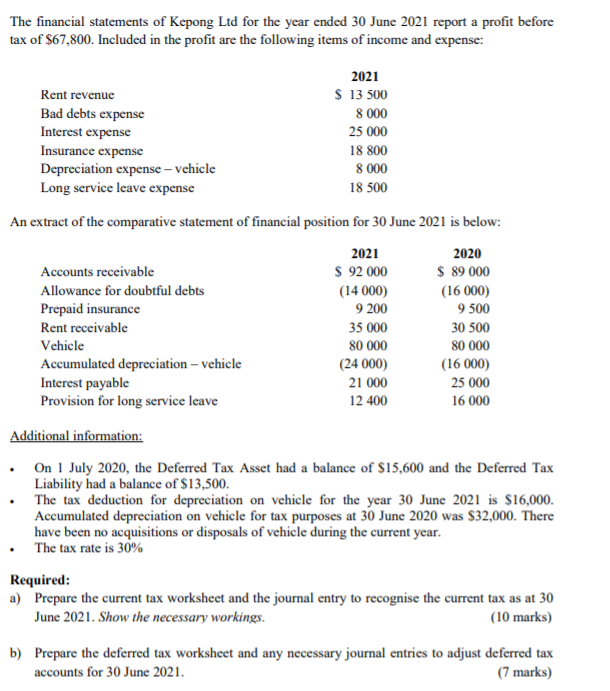

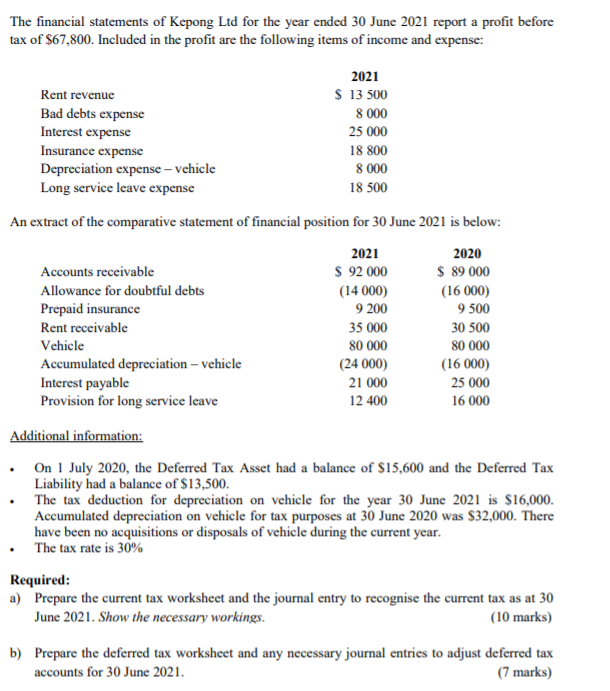

The financial statements of Kepong Ltd for the year ended 30 June 2021 report a profit before tax of $67,800. Included in the profit are the following items of income and expense: 2021 Rent revenue $ 13500 Bad debts expense 8 000 Interest expense 25 000 Insurance expense 18 800 Depreciation expense - vehicle 8 000 Long service leave expense 18 500 An extract of the comparative statement of financial position for 30 June 2021 is below: 2021 2020 Accounts receivable $ 92 000 $ 89 000 Allowance for doubtful debts (14000) (16 000) Prepaid insurance 9 200 9 500 Rent receivable 35 000 30 500 Vehicle 80 000 80 000 Accumulated depreciation - vehicle (24 000) (16 000) Interest payable 21 000 25 000 Provision for long service leave 12 400 16 000 Additional information: On 1 July 2020, the Deferred Tax Asset had a balance of $15,600 and the Deferred Tax Liability had a balance of $13,500. The tax deduction for depreciation on vehicle for the year 30 June 2021 is $16,000. Accumulated depreciation on vehicle for tax purposes at 30 June 2020 was $32,000. There have been no acquisitions or disposals of vehicle during the current year. The tax rate is 30% Required: a) Prepare the current tax worksheet and the journal entry to recognise the current tax as at 30 June 2021. Show the necessary workings. (10 marks) b) Prepare the deferred tax worksheet and any necessary journal entries to adjust deferred tax accounts for 30 June 2021. (7 marks) The financial statements of Kepong Ltd for the year ended 30 June 2021 report a profit before tax of $67,800. Included in the profit are the following items of income and expense: 2021 Rent revenue $ 13500 Bad debts expense 8 000 Interest expense 25 000 Insurance expense 18 800 Depreciation expense - vehicle 8 000 Long service leave expense 18 500 An extract of the comparative statement of financial position for 30 June 2021 is below: 2021 2020 Accounts receivable $ 92 000 $ 89 000 Allowance for doubtful debts (14000) (16 000) Prepaid insurance 9 200 9 500 Rent receivable 35 000 30 500 Vehicle 80 000 80 000 Accumulated depreciation - vehicle (24 000) (16 000) Interest payable 21 000 25 000 Provision for long service leave 12 400 16 000 Additional information: On 1 July 2020, the Deferred Tax Asset had a balance of $15,600 and the Deferred Tax Liability had a balance of $13,500. The tax deduction for depreciation on vehicle for the year 30 June 2021 is $16,000. Accumulated depreciation on vehicle for tax purposes at 30 June 2020 was $32,000. There have been no acquisitions or disposals of vehicle during the current year. The tax rate is 30% Required: a) Prepare the current tax worksheet and the journal entry to recognise the current tax as at 30 June 2021. Show the necessary workings. (10 marks) b) Prepare the deferred tax worksheet and any necessary journal entries to adjust deferred tax accounts for 30 June 2021. (7 marks)