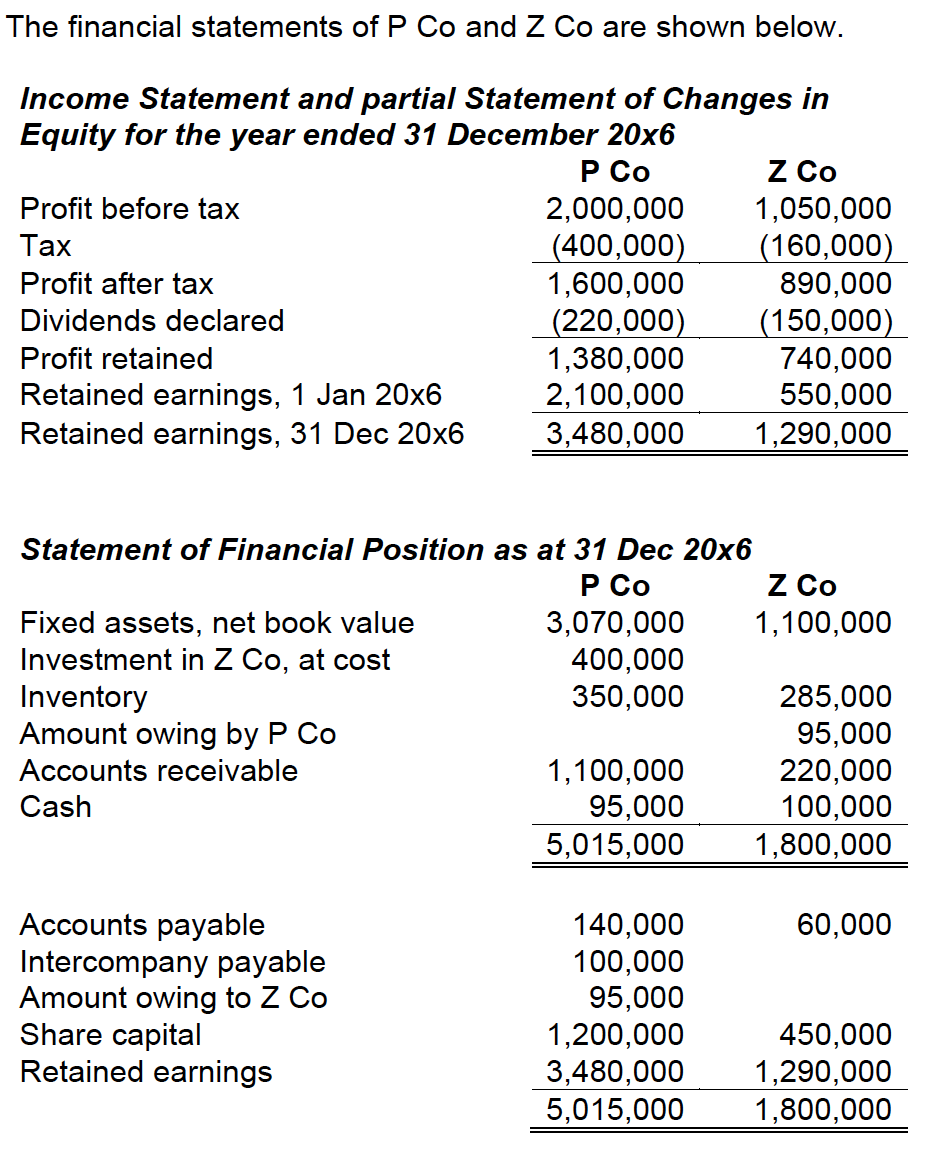

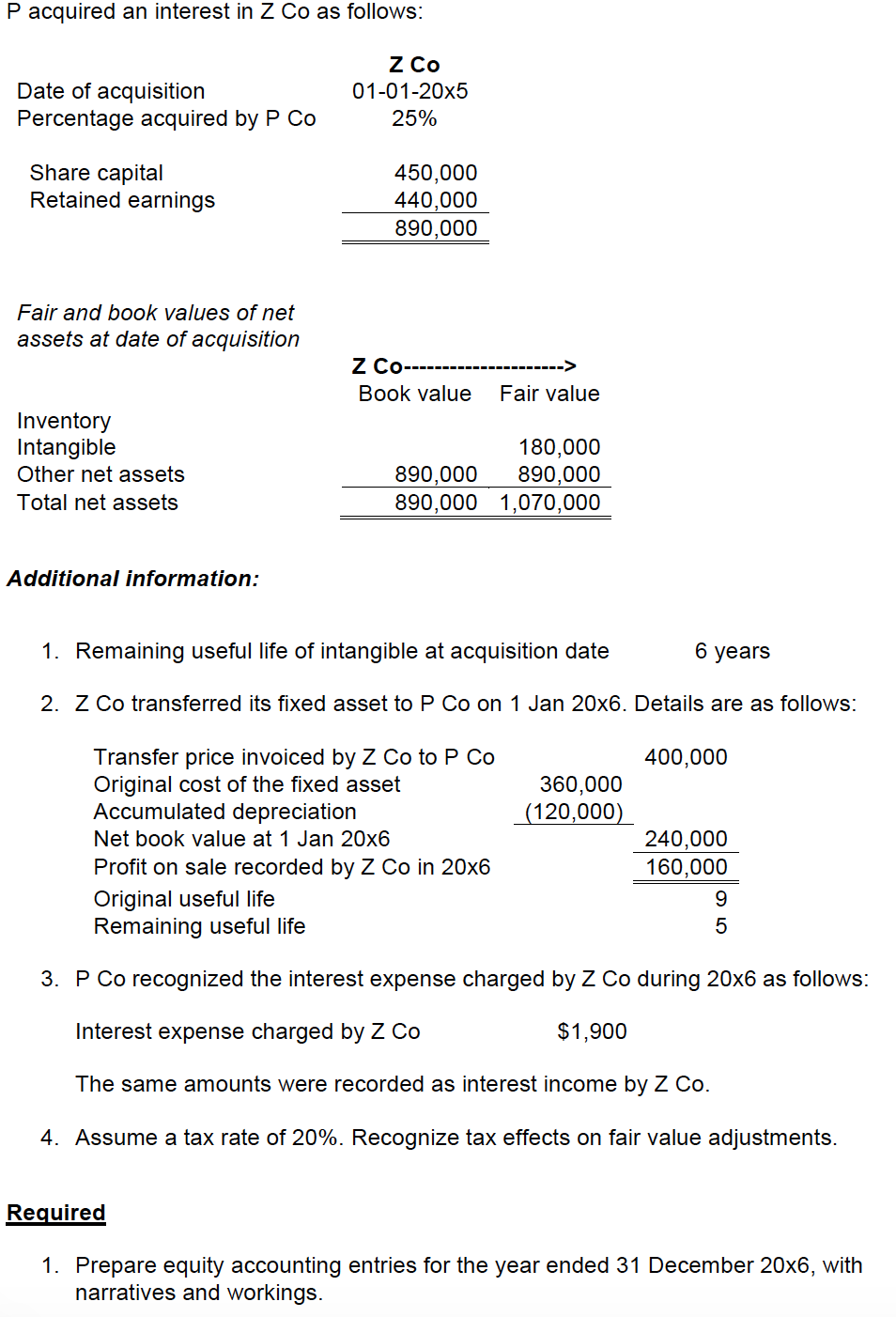

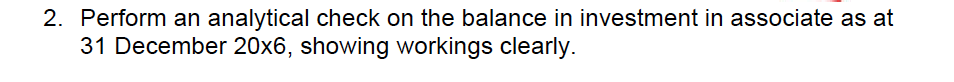

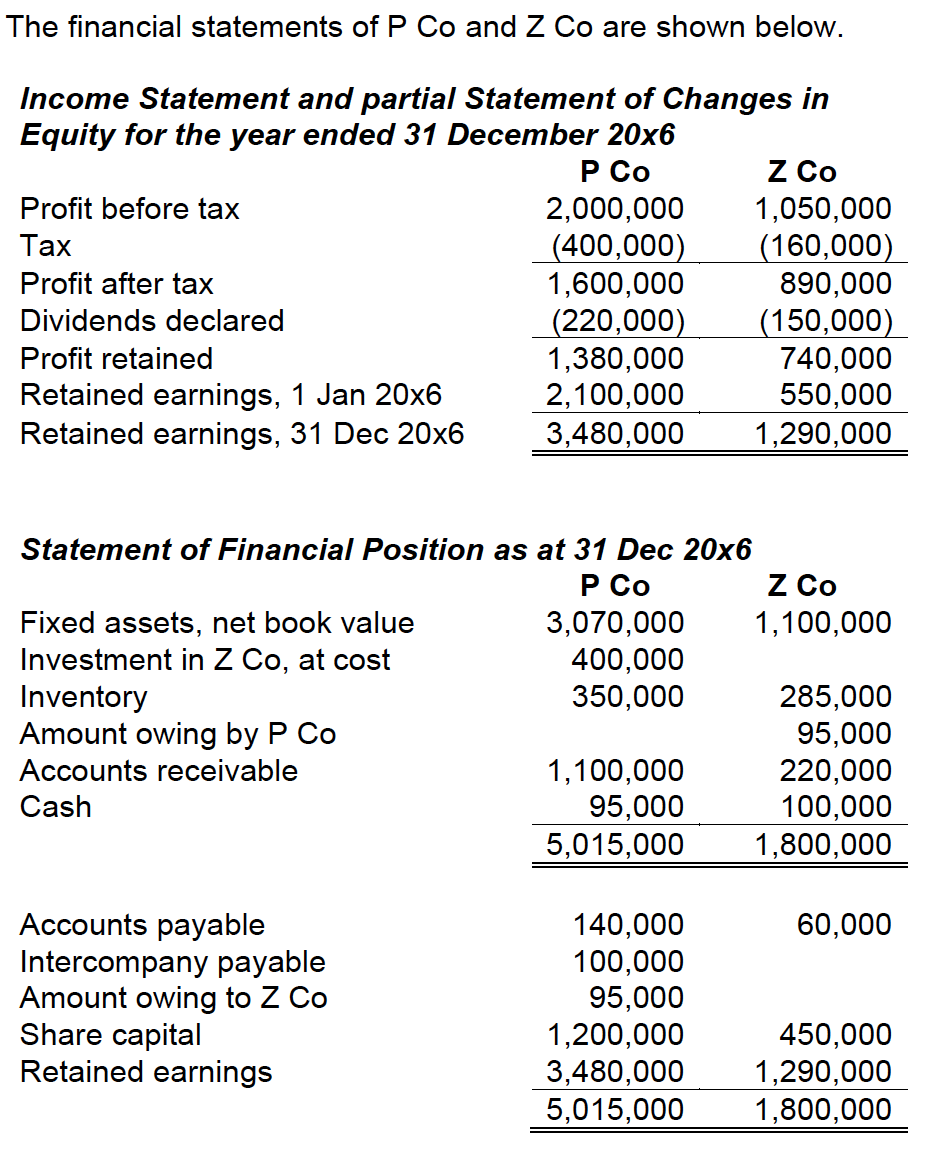

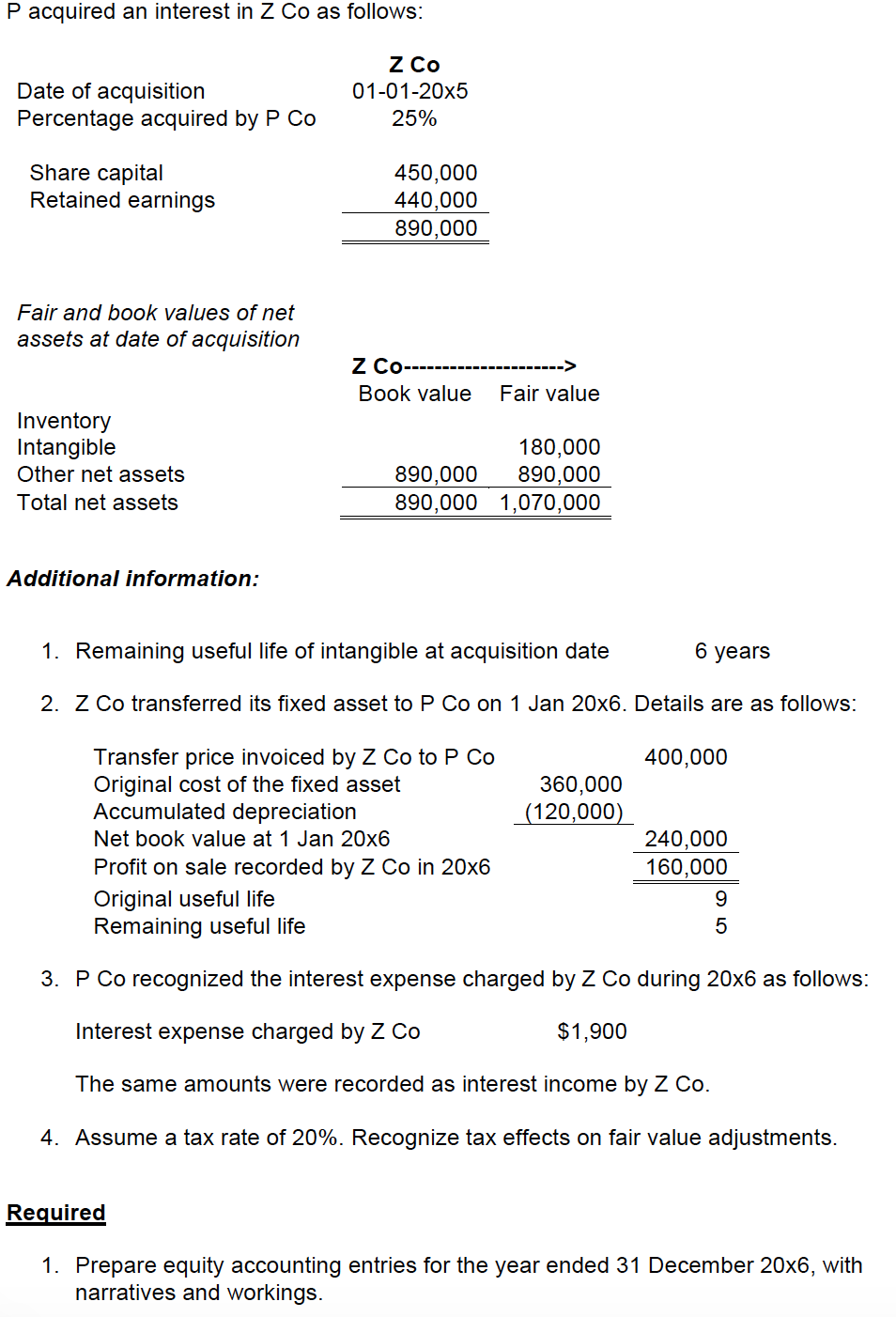

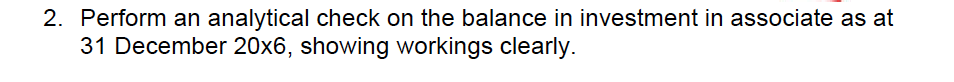

The financial statements of P Co and Z Co are shown below. Income Statement and partial Statement of Changes in Equity for the year ended 31 December 20x6 Z Co Profit before tax 2,000,000 1,050,000 Tax (400,000) (160,000) Profit after tax 1,600,000 890,000 Dividends declared (220,000) (150,000) Profit retained 1,380,000 740,000 Retained earnings, 1 Jan 20x6 2,100,000 550,000 Retained earnings, 31 Dec 20x6 3,480,000 1,290,000 Statement of Financial Position as at 31 Dec 20x6 z Co Fixed assets, net book value 3,070,000 1,100,000 Investment in Z Co, at cost 400,000 Inventory 350,000 285,000 Amount owing by P Co 95,000 Accounts receivable 1,100,000 220,000 Cash 95,000 100,000 5,015,000 1,800,000 60,000 Accounts payable Intercompany payable Amount owing to Z Co Share capital Retained earnings 140,000 100,000 95,000 1,200,000 3,480,000 5,015,000 450,000 1,290,000 1,800,000 P acquired an interest in Z Co as follows: Date of acquisition Percentage acquired by P Co Z Co 01-01-20x5 25% Share capital Retained earnings 450,000 440,000 890,000 Fair and book values of net assets at date of acquisition Z CO---- Book value Fair value Inventory Intangible Other net assets Total net assets 180,000 890,000 890,000 890,000 1,070,000 Additional information: 1. Remaining useful life of intangible at acquisition date 6 years 2. Z Co transferred its fixed asset to P Co on 1 Jan 20x6. Details are as follows: 400,000 360,000 (120,000) Transfer price invoiced by Z Co to P Co Original cost of the fixed asset Accumulated depreciation Net book value at 1 Jan 20x6 Profit on sale recorded by Z Co in 20x6 Original useful life Remaining useful life 240,000 160,000 9 5 3. P Co recognized the interest expense charged by Z Co during 20x6 as follows: Interest expense charged by Z Co $1,900 The same amounts were recorded as interest income by Z Co. 4. Assume a tax rate of 20%. Recognize tax effects on fair value adjustments. Required 1. Prepare equity accounting entries for the year ended 31 December 20x6, with narratives and workings. 2. Perform an analytical check on the balance in investment in associate as at 31 December 20x6, showing workings clearly. The financial statements of P Co and Z Co are shown below. Income Statement and partial Statement of Changes in Equity for the year ended 31 December 20x6 Z Co Profit before tax 2,000,000 1,050,000 Tax (400,000) (160,000) Profit after tax 1,600,000 890,000 Dividends declared (220,000) (150,000) Profit retained 1,380,000 740,000 Retained earnings, 1 Jan 20x6 2,100,000 550,000 Retained earnings, 31 Dec 20x6 3,480,000 1,290,000 Statement of Financial Position as at 31 Dec 20x6 z Co Fixed assets, net book value 3,070,000 1,100,000 Investment in Z Co, at cost 400,000 Inventory 350,000 285,000 Amount owing by P Co 95,000 Accounts receivable 1,100,000 220,000 Cash 95,000 100,000 5,015,000 1,800,000 60,000 Accounts payable Intercompany payable Amount owing to Z Co Share capital Retained earnings 140,000 100,000 95,000 1,200,000 3,480,000 5,015,000 450,000 1,290,000 1,800,000 P acquired an interest in Z Co as follows: Date of acquisition Percentage acquired by P Co Z Co 01-01-20x5 25% Share capital Retained earnings 450,000 440,000 890,000 Fair and book values of net assets at date of acquisition Z CO---- Book value Fair value Inventory Intangible Other net assets Total net assets 180,000 890,000 890,000 890,000 1,070,000 Additional information: 1. Remaining useful life of intangible at acquisition date 6 years 2. Z Co transferred its fixed asset to P Co on 1 Jan 20x6. Details are as follows: 400,000 360,000 (120,000) Transfer price invoiced by Z Co to P Co Original cost of the fixed asset Accumulated depreciation Net book value at 1 Jan 20x6 Profit on sale recorded by Z Co in 20x6 Original useful life Remaining useful life 240,000 160,000 9 5 3. P Co recognized the interest expense charged by Z Co during 20x6 as follows: Interest expense charged by Z Co $1,900 The same amounts were recorded as interest income by Z Co. 4. Assume a tax rate of 20%. Recognize tax effects on fair value adjustments. Required 1. Prepare equity accounting entries for the year ended 31 December 20x6, with narratives and workings. 2. Perform an analytical check on the balance in investment in associate as at 31 December 20x6, showing workings clearly