Question

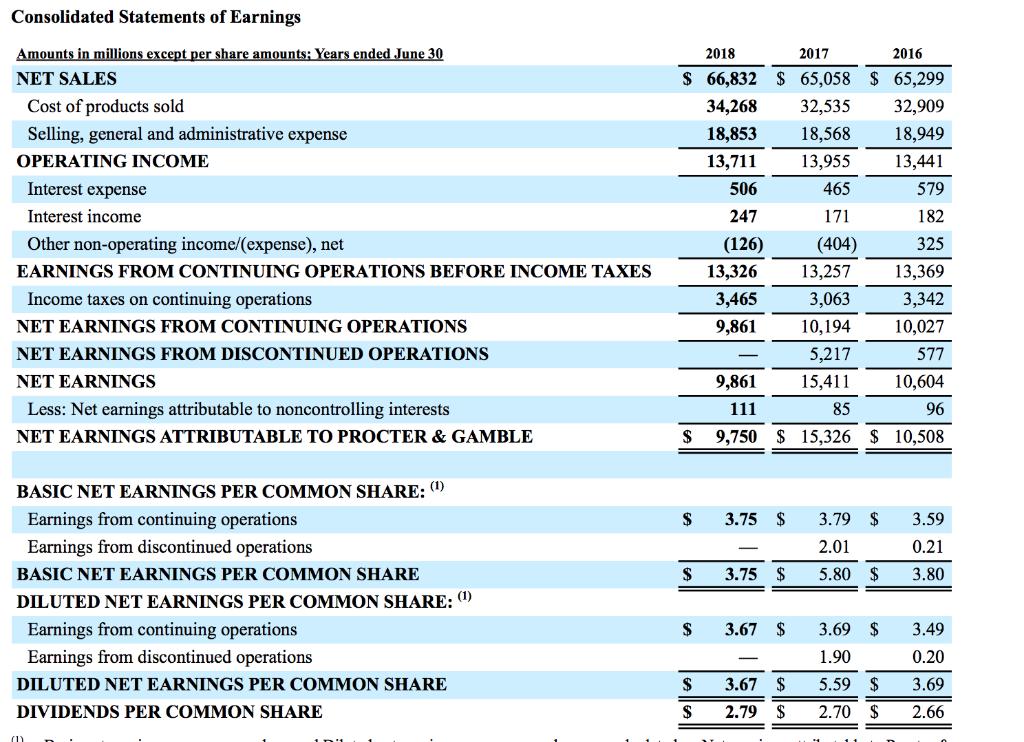

The financial statements of P&G are presented in Appendix B. The company's complete annual report, including the notes to the financial statements, is available online.

The financial statements of P&G are presented in Appendix B. The company's complete annual report, including the notes to the financial statements, is available online. Instructions Refer to P&G's 2018 financial statements and the accompanying notes to answer the following questions.

(a) What cash outflow obligations related to the repayment of long-term debt does P&G have over the next 5 years?

(b) P&G indicates that it believes that it has the ability to meet business requirements in the foreseeable future. Prepare an assessment of its solvency using ratio analysis.

Consolidated Statements of Earnings Amounts in millions except per share amounts; Years ended June 30 2018 2017 2016 NET SALES $ 66,832 $ 65,058 $ 65,299 Cost of products sold 34,268 32,535 32,909 Selling, general and administrative expense 18,853 18,568 18,949 OPERATING INCOME 13,711 13,955 13,441 Interest expense 506 465 579 Interest income 247 171 182 Other non-operating income/(expense), net (126) (404) 325 EARNINGS FROM CONTINUING OPERATIONS BEFORE INCOME TAXES 13,326 13,257 13,369 Income taxes on continuing operations 3,465 3,063 3,342 NET EARNINGS FROM CONTINUING OPERATIONS 9,861 10,194 10,027 NET EARNINGS FROM DISCONTINUED OPERATIONS 5,217 577 NET EARNINGS 9,861 15,411 10,604 Less: Net earnings attributable to noncontrolling interests 111 85 96 NET EARNINGS ATTRIBUTABLE TO PROCTER & GAMBLE 9,750 $ 15,326 $ 10,508 BASIC NET EARNINGS PER COMMON SHARE: " Earnings from continuing operations $ 3.75 $ 3.79 $ 3.59 Earnings from discontinued operations 2.01 0.21 BASIC NET EARNINGS PER COMMON SHARE $ 3.75 $ 5.80 $ 3.80 DILUTED NET EARNINGS PER COMMON SHARE: 0 Earnings from continuing operations 3.67 $ 3.69 $ 3.49 Earnings from discontinued operations 1.90 0.20 DILUTED NET EARNINGS PER COMMON SHARE $ 3.67 $ 5.59 $ 3.69 DIVIDENDS PER COMMON SHARE $ 2.79 $ 2.70 $ 2.66 (1)

Step by Step Solution

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

a What cash outflow obligations related to the repayment of longterm debt does PG have over the next 5 years According to short term and long term deb...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started