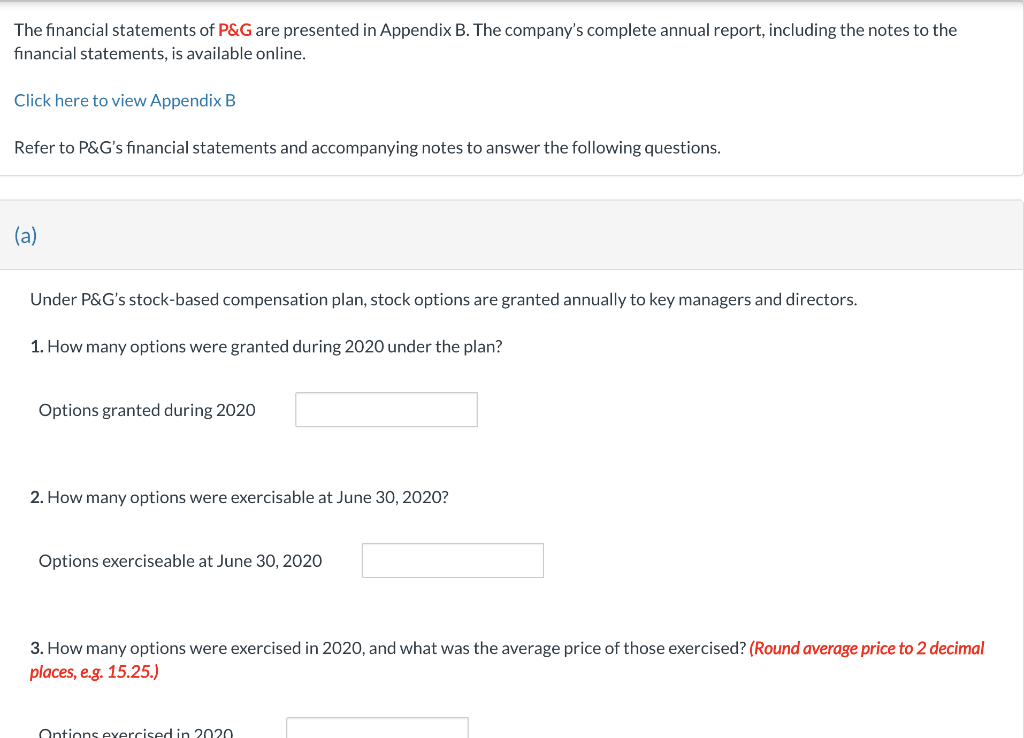

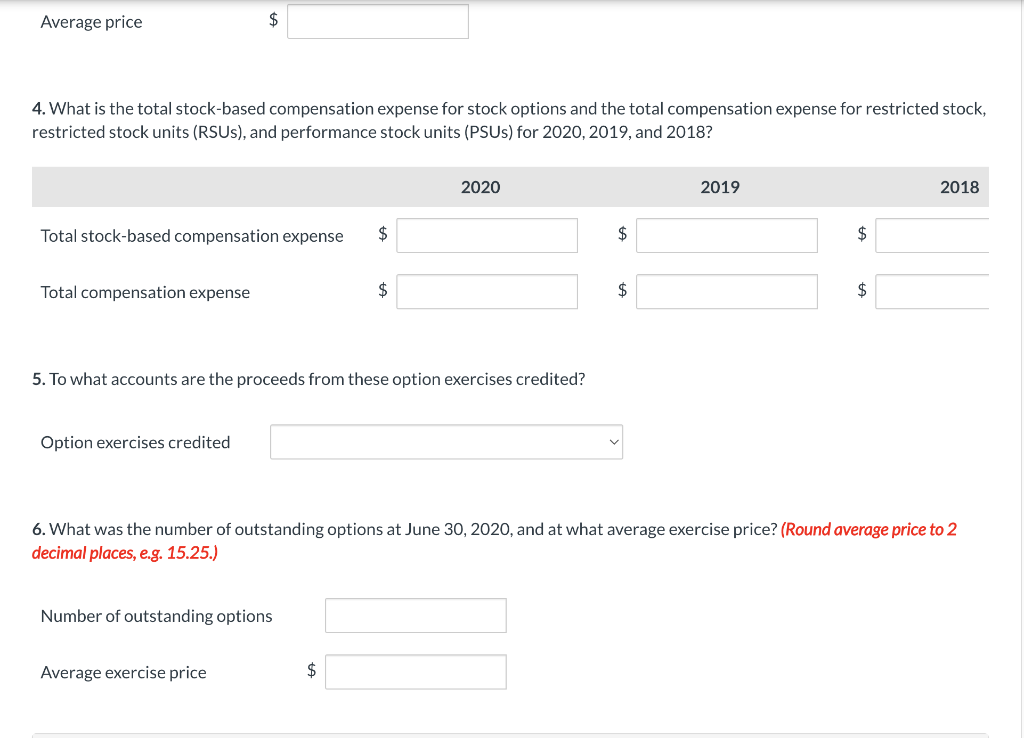

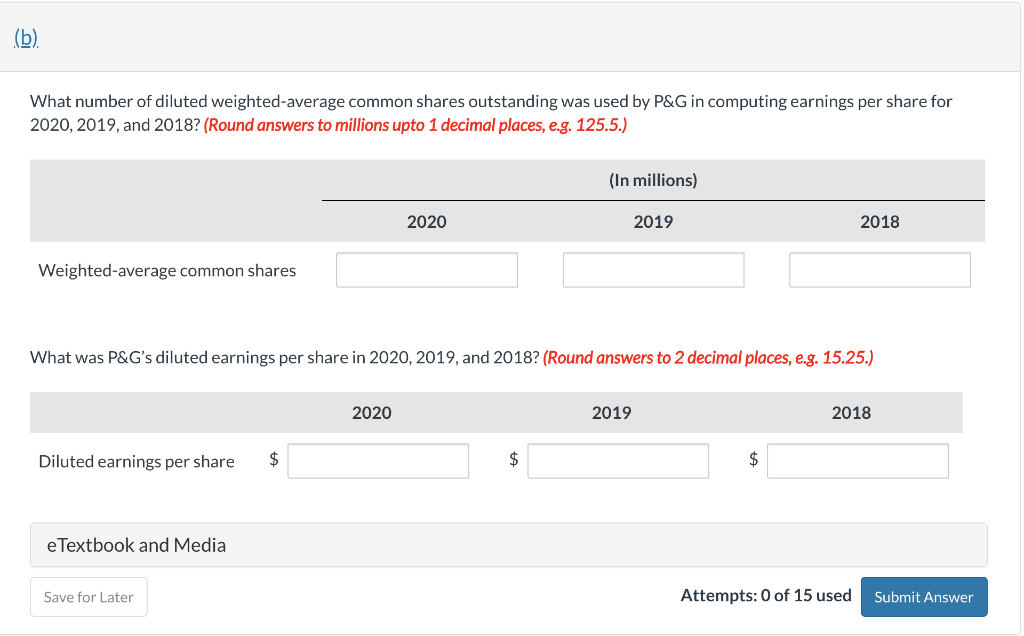

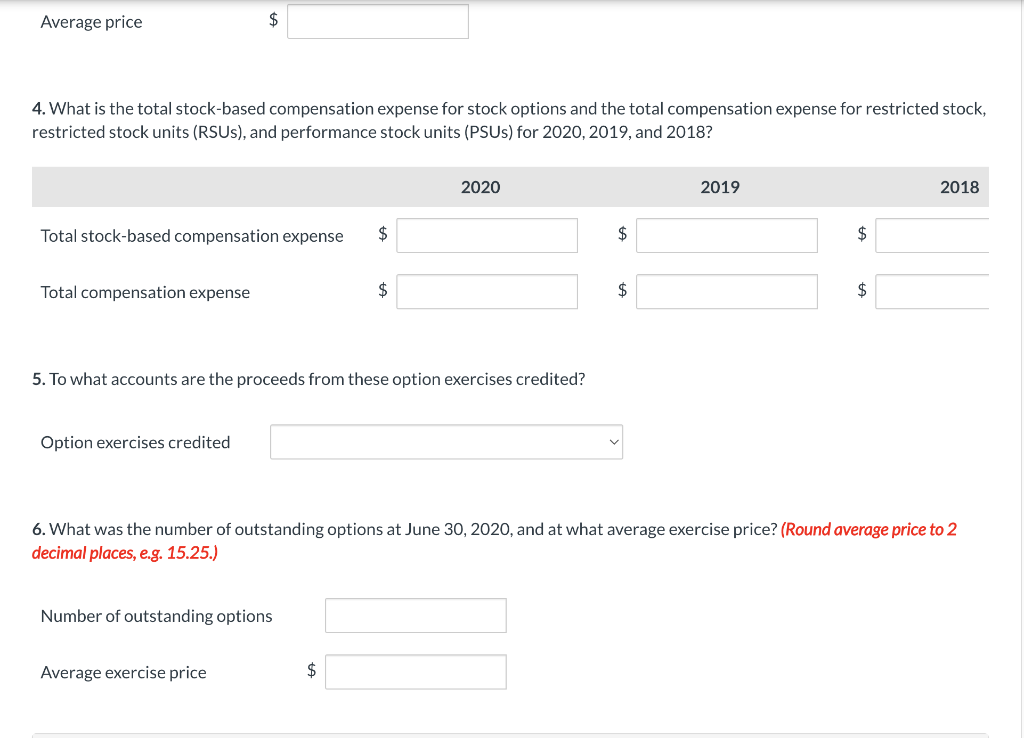

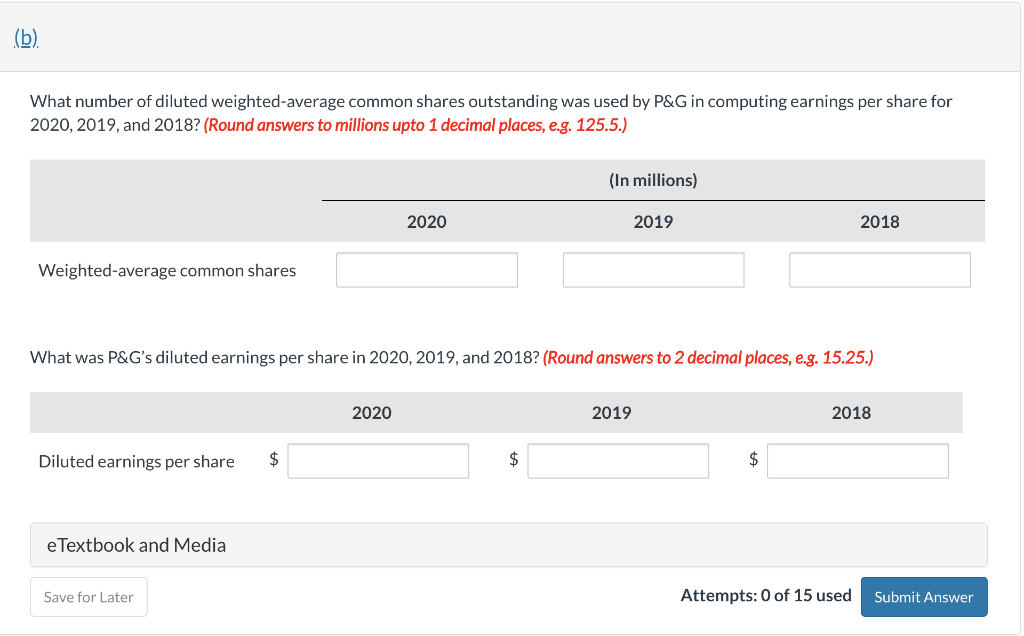

The financial statements of P\&G are presented in Appendix B. The company's complete annual report, including the notes to the financial statements, is available online. Click here to view Appendix B Refer to P&G 's financial statements and accompanying notes to answer the following questions. (a) Under P\&G's stock-based compensation plan, stock options are granted annually to key managers and directors. 1. How many options were granted during 2020 under the plan? Options granted during 2020 2. How many options were exercisable at June 30,2020 ? Options exerciseable at June 30,2020 3. How many options were exercised in 2020 , and what was the average price of those exercised? (Round average price to 2 decimal places, e.g. 15.25.) 4. What is the total stock-based compensation expense for stock options and the total compensation expense for restricted stock, restricted stock units (RSUs), and performance stock units (PSUs) for 2020, 2019, and 2018? 5. To what accounts are the proceeds from these option exercises credited? Option exercises credited 6. What was the number of outstanding options at June 30,2020 , and at what average exercise price? (Round average price to 2 decimal places, e.g. 15.25.) Number of outstanding options Average exercise price $ What number of diluted weighted-average common shares outstanding was used by P\&G in computing earnings per share for 2020, 2019, and 2018? (Round answers to millions upto 1 decimal places, e.g. 125.5.) What was P\&G's diluted earnings per share in 2020, 2019, and 2018? (Round answers to 2 decimal places, e.g. 15.25.) The financial statements of P\&G are presented in Appendix B. The company's complete annual report, including the notes to the financial statements, is available online. Click here to view Appendix B Refer to P&G 's financial statements and accompanying notes to answer the following questions. (a) Under P\&G's stock-based compensation plan, stock options are granted annually to key managers and directors. 1. How many options were granted during 2020 under the plan? Options granted during 2020 2. How many options were exercisable at June 30,2020 ? Options exerciseable at June 30,2020 3. How many options were exercised in 2020 , and what was the average price of those exercised? (Round average price to 2 decimal places, e.g. 15.25.) 4. What is the total stock-based compensation expense for stock options and the total compensation expense for restricted stock, restricted stock units (RSUs), and performance stock units (PSUs) for 2020, 2019, and 2018? 5. To what accounts are the proceeds from these option exercises credited? Option exercises credited 6. What was the number of outstanding options at June 30,2020 , and at what average exercise price? (Round average price to 2 decimal places, e.g. 15.25.) Number of outstanding options Average exercise price $ What number of diluted weighted-average common shares outstanding was used by P\&G in computing earnings per share for 2020, 2019, and 2018? (Round answers to millions upto 1 decimal places, e.g. 125.5.) What was P\&G's diluted earnings per share in 2020, 2019, and 2018? (Round answers to 2 decimal places, e.g. 15.25.)