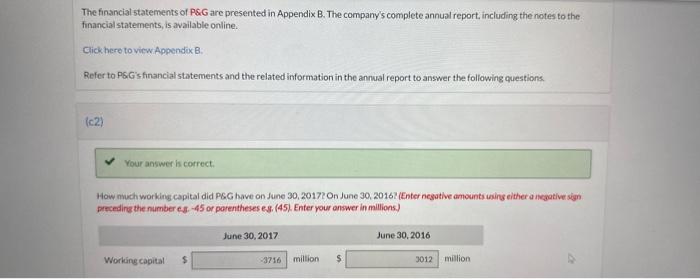

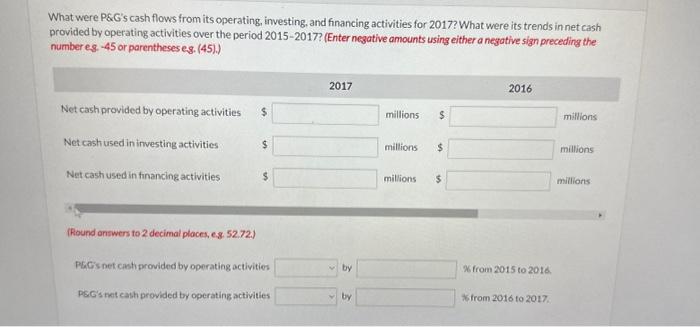

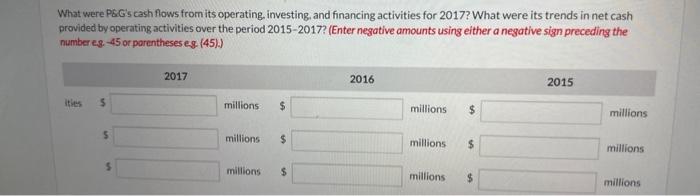

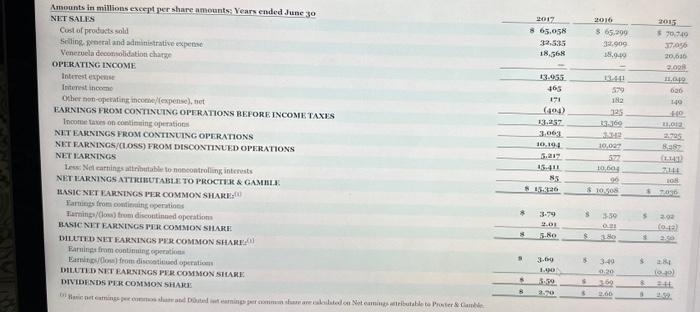

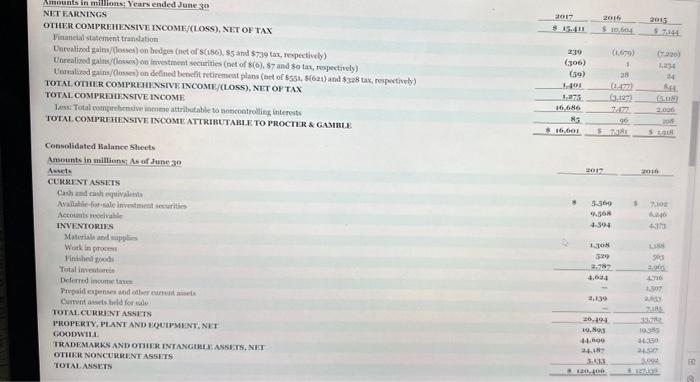

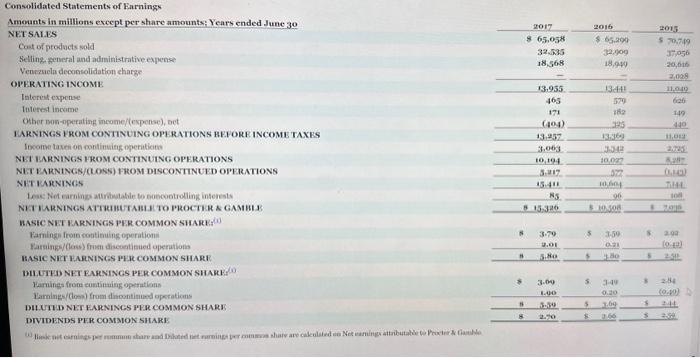

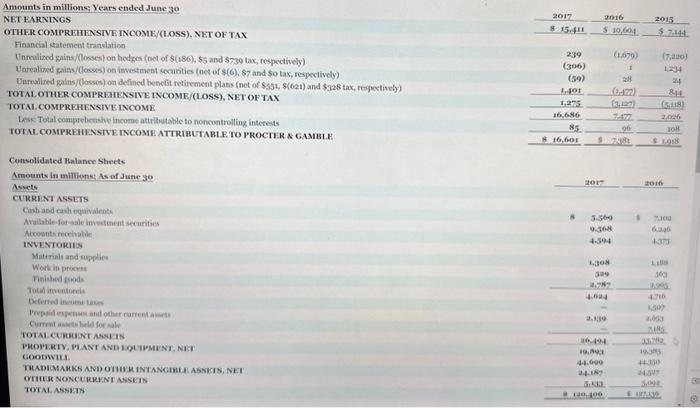

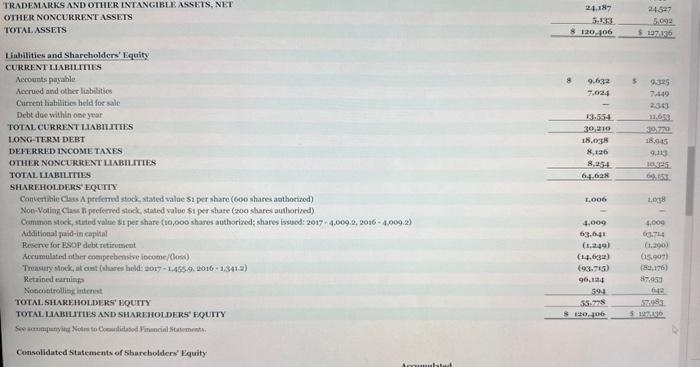

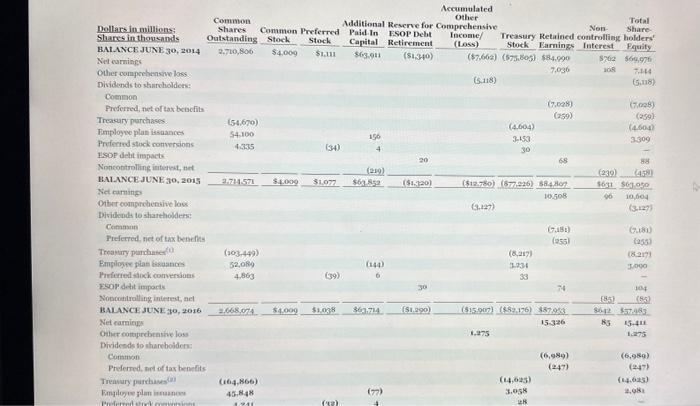

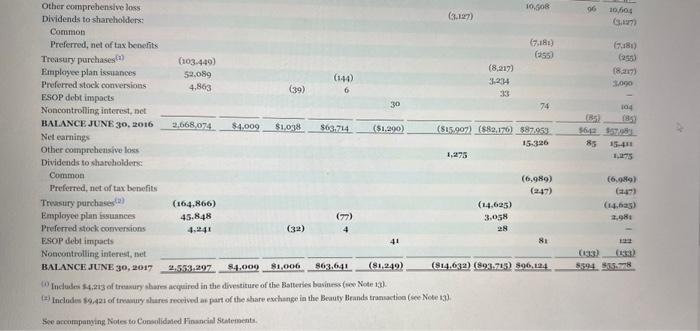

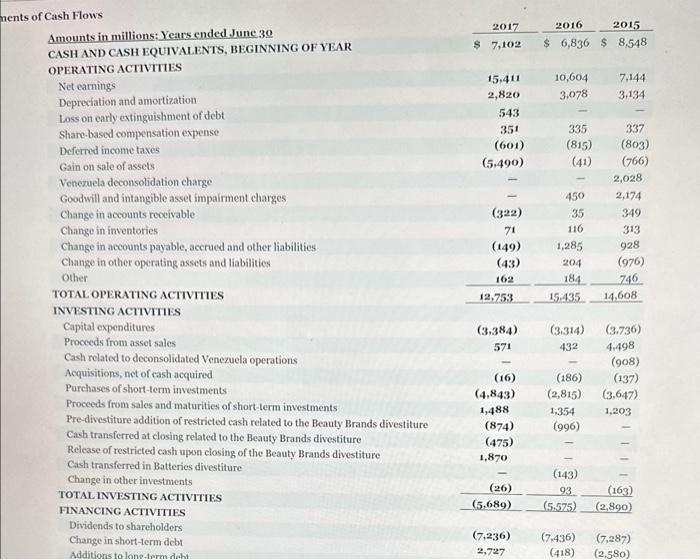

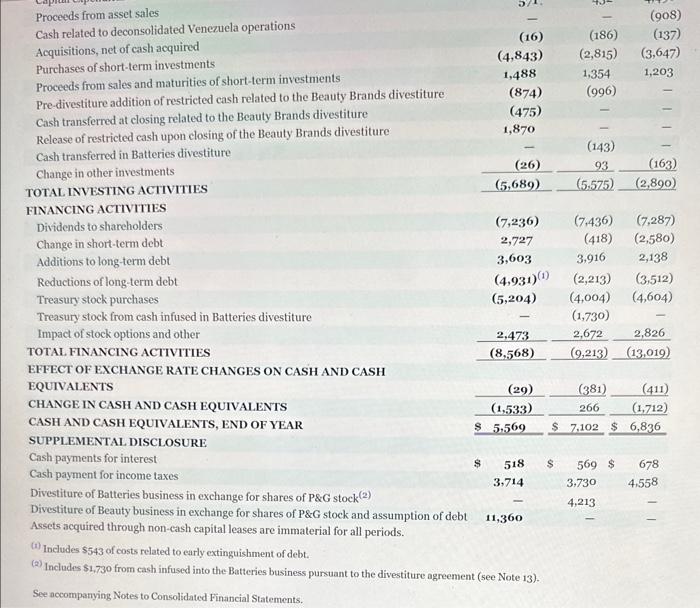

The financial statements of P\$G are presented in Appendix B. The company's complete annual report, including the notes to the financialstatements, is available online. Click here to view.Appendix B. Refer to PSG's financial statements and the related information in the annual report to answer the following questions. (c2) Your answer is correct. How nuch working capital did PSG have on June 30, 20172 On June 30,20162 ' (Enter negative amounts using either a nagative sign . preceding the number es. 45 or porentheses es, (45). Enter your answer in millions.) What were PSG's cash flows from its operating, investing, and financing activities for 2017? What were its trends in net cash provided by operating activities over the period 2015-2017? (Enter negative amounts using cither a negative sign preceding the number e. 45 or parentheses e.g. (45).) (Round answers to 2 decimal places, e.8. 52.72. ) What were PSc's cash flows from its operating, investing, and financing activities for 2017 ? What were its trends in net cash provided by operating activities over the period 2015-2017? (Enter negative amounts using either a negative sign preceding the number eg 45 or parentheses eg (45). Amounts in millions eseept per share amounts Vears ended June 30 NET SALES Cost of provetacts sold Sreling Noeral and admitristrative expense. Venecuela deconsolidation charge OPHRATING INCOME Interestexpouse Interest incomo OCher non-operating inconieg (expense), net FARNINGS FROSI CONTLNUING OFFRATIONS REFORE INCONE TAXUS Thootar taves on contineing operations NIT EAMNINGS FROM CONTINUING OPERATIONS NET EARNINCS/(L OSS) FROM DISCONTINUED OPERATIONS NET IARNINGS Lew Net cartings attribttable to noecontrolling interusts NET UARNINGS ATTHCHOTABUE TO PROCTUS \& GAMMA: HASICNET RARETNGS MER COMMON SHARE Farning from ovidinding operatioss BASIC NIT EARNINGS PIIE COMMON SIMNEE DHUTW NET FARNISGS RYSCOMMON SHAREAU Earmingr from continuing ogrritiots DHUTUD NIT RARNINGS PR COMMON SIUME. DIVIDFNDS TIK CONIMON SHABE NET FARNINCS OIHER COMHREHENSTVE INCOME/(LOSS), NET OE TAX Financial statement trandation Dnrvalinad gaimy/(losses) on bediges (net of 8(180),$5 and 5739 tax, respectively) Unrealised palns.(losess) ob invetineat securities (net of $(6),87 and 30 tax, repectively). Uveralizad gainsy(fosses) on definod benefit retirenseat plans (aCt of $558,5(624) and $328 tax, respectively) TOTAL. OTUER COMPREHENSIVETNCOME/(LOSS), NET OF TAX TOTAL COMPREIENSTVE INCOME: 1ess: Total cotngrehenive income attributable to noscontrolligg interests TOTAL. COMPREHENSTVE TNCOME ATTRIEUTABLE TO PROCTER A GAMBLE Consolidated Balanco Sheets Amounte in millians: As of dune jo Awarty CUnReNT ASsE.TS Caih amd rach nguivalets Avaliable-for-salo investereat sccurition Accoints receivally INVENTORIIS Mtaterish and muppliss Wotk in prosess Fintohel sooti: Total inveatareis Delerred incume taun Fripoid ergenser asd ofler eurwit asels. Cimvit asetsheld fer nale TORA, CURRANT ASSITS MROPERTY, PLANT AND QQUWMEXT, NIT GoOmWII.1. THEDEMARKS AND OTHER INTANGULUS:ASSETS, NET TOTAL. ASETS Consolidated Statements of Earnings Ameants in millions except per share amounts: Years ended June 30 NET SAIES Cost of prodvets sold Selling, foncral and administrative expense Venczucla deconsolidation eharge OHERATING INCOME Interut expenve Isterest incume Other bon-0perating income/(cepense), bet IARNINGS IROMI CONTINUING OPIRATIONS HEEORE INCOME TAXES Ifcolme tasen on pontinuitig operiticter NET HARNINGS FROM CONTINUING OPRRATIONS NIIT IAKNINGS/(LOSS) FROM DISCONTINUED OPERATIONS NITIARNINGS Lese Nor earning atrubuabile to noecootrolling interests NET IARNINGS ATTUIUTTABLITO PROCTH A GAMIH.S UASIC NET IARNINGS PKR COMMON SHARE (6) Farninge froin contimuing ogerationi Farsings/(lew) fron discoatisued operutions IASIC NITT YAGNINGS HUK COMMON SHARE? BHLUTHD NET EARNINGS PER COMMON SHABERT Harmings frome cuntinuing operations larningev(loon) from dinontimued oprrations DH.UTHD NET FARNINGS HER COMMON BHARE DIVIDENDS PER COMMION SHARE Amounts in millions: Years ended June 30 NET RARNINGS OTHER COMPREHENSIVEINCOME/(LOSS), NET OF TAX Financial chatement tranelation Unroulized gains/losses) on hedgos (Det of $(186), $5 asd $739 tax, respectively) Unrealined kaiss/losses) on isvestment secarities (net of $(6),87 and $0 tax, respectively) Unroulised gains ((losses) on defined benefit retirement plans (net of $551,$(621) and $328 tax, reppectively) TOTAL. OTHER COMPRIHENSIVE INCOMEJ(LOSS), NET OFTAX TOTAI. COMPREHENSIVE INCOME Less Total comprehenehe income attrithutable to noncontrolling interests TOTM. COMPREHI.NSIVE INCOME ATTRIBUTABT. TO YROCTER \& GAMBLE Consolidated Halance Sheets Amounts in millions: As of June 30 Assets CURBI NT ASSETS Cash abd earh equivalente Avalbable-fot-sale investenent securities Accoonts ricelialile: INVENTORIIS Matirials and supplien Work in procent Finished zrods Totul ifrumtorela Deteried invouen tanes Trepili wsynses and ofter carrem awests Currmi askevele for Aaly TOIAI CUBUNT Arsitis PHOH:ATV, MANT AND I.QUWMANT, N1:I GOODWII. TUADIMARKS AND OT7UY INTANGIMUI ASSEIS, NET OTIIUS NONCUKREINT ASSETS TOIAL ASSETS TRADEMLARKS AND OTHIER INTANGIBLE ASSETS, NET OTHEIR NONCURRENT ASSETS TOTAL ASSEIS I ialilities and shareholders' Equity CURRENT HABILTTIS Mecounts payahle Acerued and other liabilitios Current liabilities held foc sale Debt doe withln ope year TOTAL CURRENT LABIITIES LONG-TERM DEET DEFZ RRAD WNCOME TAXES OTHER NONCUREFNT HABH .TTES TOTAL.IAEILTIES SHAREHOLDERS' EQLTTY Non-Voling Class fi peeferred stock, stated value $1 per share (2oo shares authorizd) Cummos stack, strind value st per share (10,000 shares autborized; shares issucd: 2017+4.009.2,20164.009.2) Aiditionat paid-in caplhal Presenv for ESOP debt retirement Accumulatid nther eocuprebentwe iosome/(losi) Treaury anok, at ast (ahares hed 20171,455,9.20161,341:2 ) Retained earning Noncemtrollitis internst TOTAL SHAKEHOLDERE' EQUTTY TOTAI. UABILIIE AND SHAREHOLDERS FQUTTY Consolidated Statements of Sharebolders' Equity Accumulated 18) Inclades 19.42t of tracary shares receivev as part of the stare exchange in the Beaufy Brands tranaction (cee Note ig). See accompanying Notes to Conaulidaled Financiel 4 tatements. nents of Cash Flows Proceeds from asset sales Cash related to deconsolidated Venezuela operations Acquisitions, net of cash acquired Purchases of short-term investments Proceeds from sales and maturities of short-term investments Pre-divestiture addition of restricted cash related to the Beauty Brands divestiture Cash transferred at closing related to the Beauty Brands divestiture Release of restricted cash upon closing of the Beauty Brands divestiture Cash transferred in Batteries divestiture Change in other investments TOTAL INVESTING ACTIVITIES FINANCING ACTIVTTIES Dividends to shareholders Change in short-term debt Additions to long-term debt Reductions of long-term debt Treasury stock purchases Treasury stock from cash infused in Batteries divestiture Impact of stock options and other TOTAL. FINANCING ACTIVITIES EFFECT OF EXCHANGE RATE CHANGES ON CASH AND CASH EQUTVALENTS CHANGE IN CASH AND CASH EQUIVALENTS CASH AND CASH EQUIVALENTS, END OF YEAR SUPPLEMENTAL DISCLOSURE Cash payments for interest Cash payment for income taxes Divestiture of Batteries business in exchange for shares of P\&G stock (2) Assets acquired through non-cash capital leases are immaterial for all periods. (1) Includes $543 of costs related to early extinguishment of debt. (2) Includes $1,730 from cash infused into the Batteries business pursuant to the divestiture agreement (see Note 13). See accompanying Notes to Consolidated Financial Statements