Question

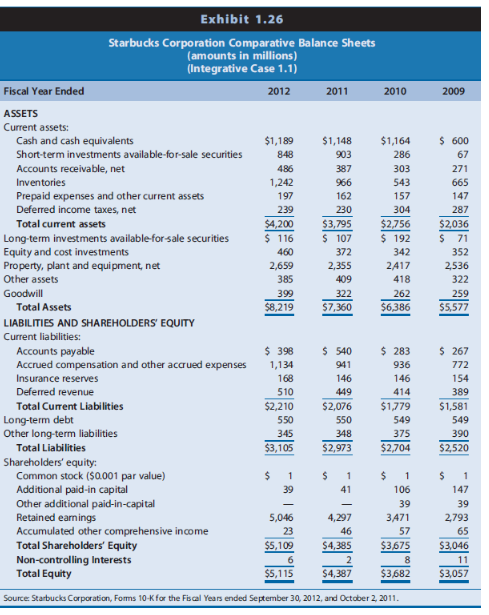

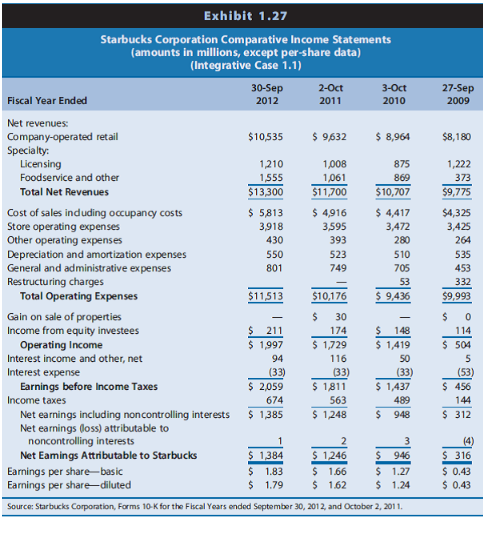

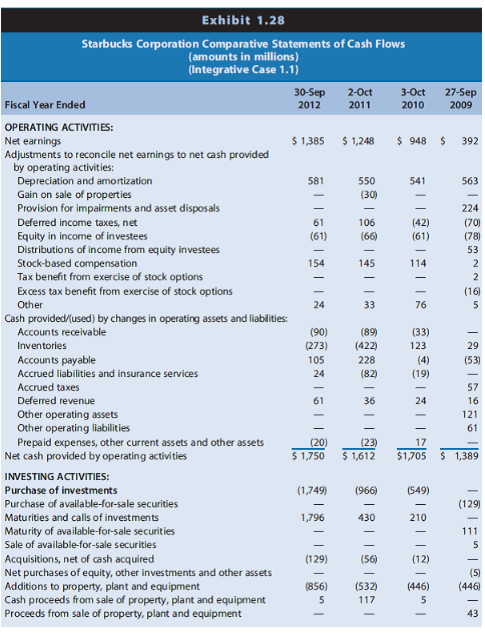

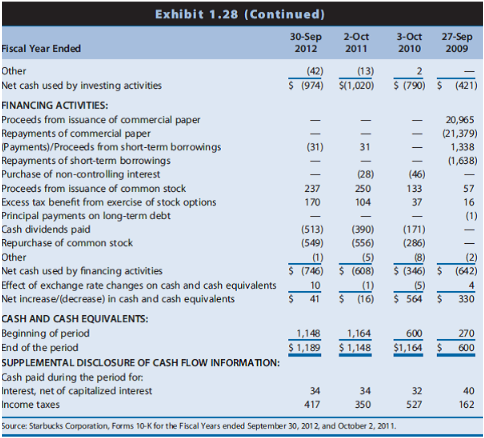

The financial statements of Starbucks Corporation are presented in exhibits 1.26-1.28. The income tax note to those financial statements reveals the information regarding income taxes

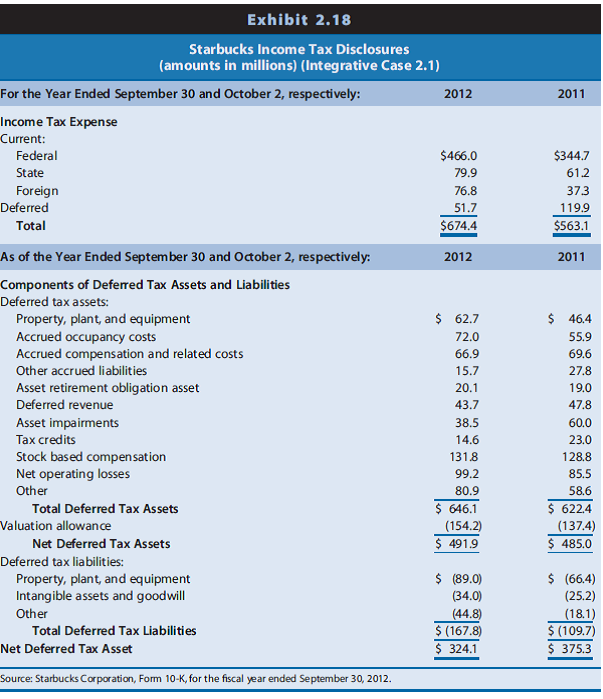

The financial statements of Starbucks Corporation are presented in exhibits 1.26-1.28. The income tax note to those financial statements reveals the information regarding income taxes shown in exhibit 2.18.

E. Starbucks reports deferred revenue for sales of store value cards, such as the starbucks card and gift certificates. These amounts are taxed when collected, but not recognized in financial reporting income until tendered at a store. Why does the tax effect of deferred revenue appear as a deferred tax asset.

F. Starbucks recognizes a valuation allowances on its deferred tax assets to reflect net operating losses of consolidated foreign subsidiaries. Why might the valutation allowance have increased between 2011 and 2012?

G. Starbucks uses the straight-line depreciation method for financial reporting and accelerated depreciation for income tax reporting. Like most firms, the largest deferred tax liability is for property, plant, and equipment (depreciation). Explain how depreciation leads to a deferred tax liability. Suggest possible reasons why the amount of the deferred tax liability related to depreciation increased between 2011 and 2012.

Exhibit 2.18 Starbucks Income Tax Disclosures (amounts in millions) (Integrative Case 2.1) For the Year Ended September 30 and October 2, respectively: 2012 Income Tax Expense Current: Federal $466.0 State 79.9 Foreign 76.8 Deferred 51.7 Total $674.4 As of the Year Ended September 30 and October 2, respectively 2012 Components of Defemed Tax Assets and Liabilities Deferred tax assets: 62.7 Property, plant, and equipment Accrued occupancy costs 72.0 Accrued compensation and related costs 66.9 Other accrued liabilities 15.7 Asset retirement obligation asset 20.1 Deferred revenue 43.7 Asset impairments 38.5 Tax credits 14.6. Stock based compensation 1318 Net operating losses 99.2 Other 80.9 Total Deferred Tax Assets 646.1 Valuation allowance (154.20 Net Deferred Tax Assets 4919 Deferred tax liabilities: Property, plant, and equipment (89.0) Intangible assets and goodwill Other (44.8) Total Deferred Tax Liabilities (167.8) Net Deferred Tax Asset 324.1 Source: Starbucks Corporation, Form 10-K for the fiscal year ended September 30, 2012. 2011 $344.7 61.2 37.3 119.9 $563.1 2011 46.4 55.9 69.6 27.8 19.0 47.8 60.0 23.0 1288 85.5 58.6 622.4 (137.4) 485.0 (66.4) (25.2) 18.1) (109.7) 375.3Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started