Answered step by step

Verified Expert Solution

Question

1 Approved Answer

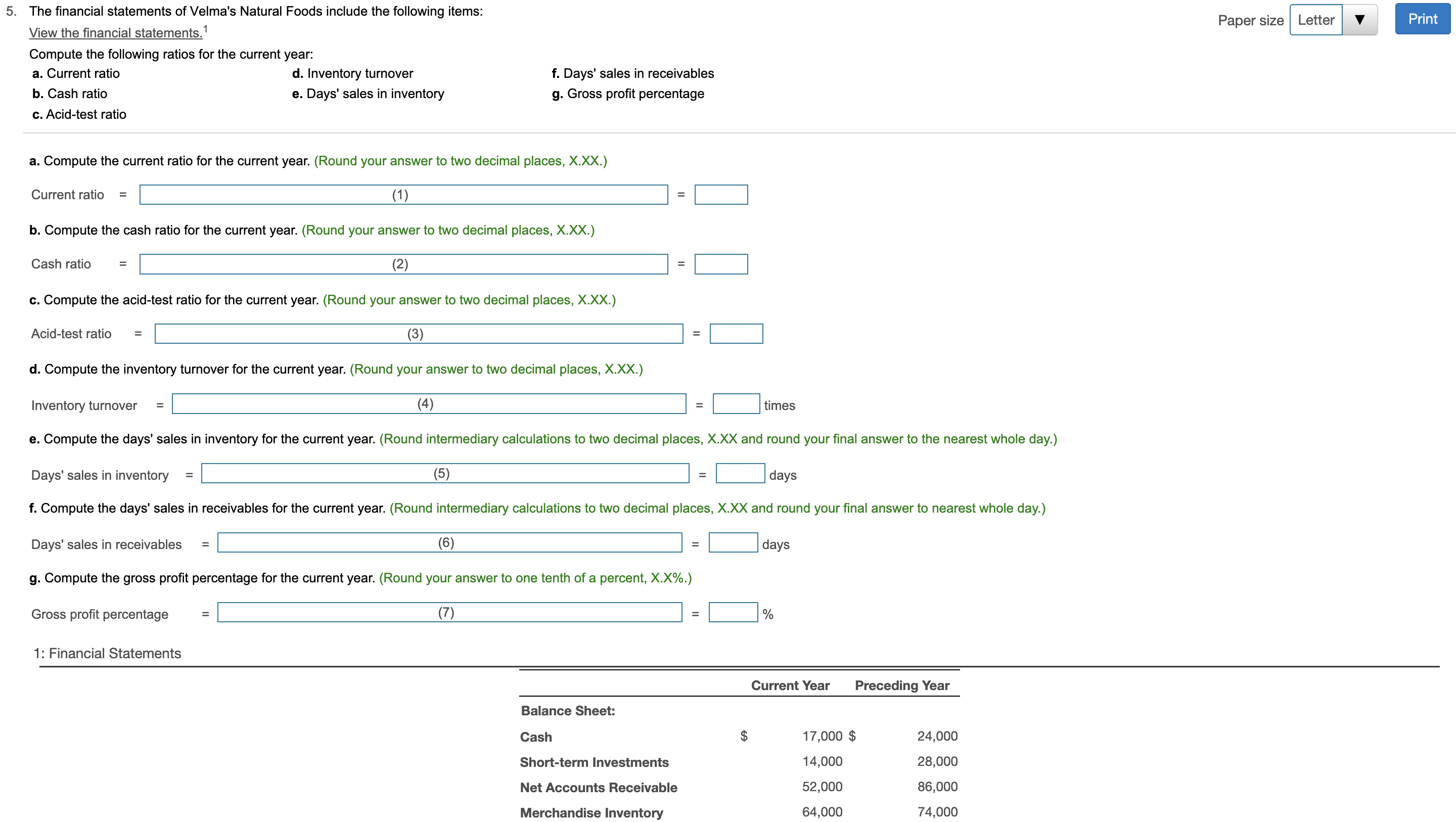

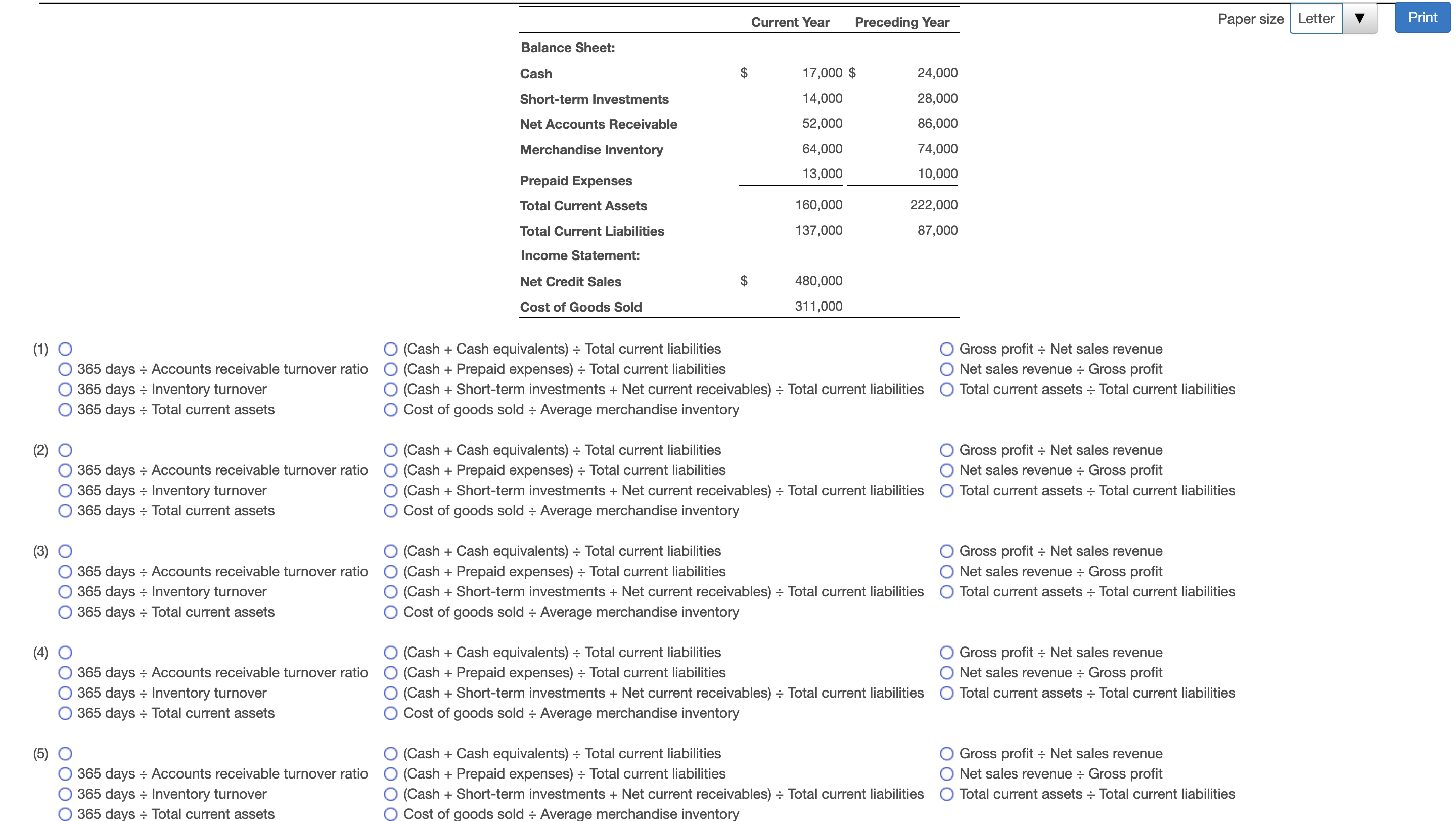

The financial statements of Velma's Natural Foods include the following items: View the financial statements. 1 Compute the following ratios for the current year: a.

The financial statements of Velma's Natural Foods include the following items: View the financial statements. 1 Compute the following ratios for the current year: a. Current ratio d. Inventory turnover f. Days' sales in receivables b. Cash ratio e. Days' sales in inventory g. Gross profit percentage c. Acid-test ratio a. Compute the current ratio for the current year. (Round your answer to two decimal places, X.XX.) Current ratio = b. Compute the cash ratio for the current year. (Round your answer to two decimal places, X.XX.) Cash ratio = c. Compute the acid-test ratio for the current year. (Round your answer to two decimal places, X.XX.) Acid-test ratio = = d. Compute the inventory turnover for the current year. (Round your answer to two decimal places, X.XX.) Inventory turnover =[ e. Compute the days' sales in inventory for the current year. (Round intermediary calculations to two decimal places, X.XX and round your final answer to the nearest whole day.) Days' sales in inventory = i) = days f. Compute the days' sales in receivables for the current year. (Round intermediary calculations to two decimal places, X.XX and round your final answer to nearest whole day.) Days' sales in receivables = ]=days g. Compute the gross profit percentage for the current year. (Round your answer to one tenth of a percent, X.X\%.) Gross profit percentage = (7) ]=% (1) 365 days Accounts receivable turnover ratio 365 days Inventory turnover 365 days Total current assets (2) 365 days Accounts receivable turnover ratio 365 days Inventory turnover 365 days Total current assets 365 days Accounts receivable turnover ratio 365 days Inventory turnover 365 days Total current assets (4) 365 days Accounts receivable turnover ratio 365 days Inventory turnover 365 days Total current assets (5) 365 days Accounts receivable turnover ratio 365 days Inventory turnover 365 days Total current assets (Cash + Cash equivalents ) Total current liabilities (Cash + Prepaid expenses) Total current liabilities ( Cash + Short-term investments + Net current receivables ) Total current liabilities Cost of goods sold Average merchandise inventory (Cash + Cash equivalents) Total current liabilities (Cash + Prepaid expenses) Total current liabilities (Cash + Short-term investments + Net current receivables ) Total current liabilities Cost of goods sold Average merchandise inventory (Cash + Cash equivalents ) Total current liabilities (Cash + Prepaid expenses) Total current liabilities (Cash + Short-term investments + Net current receivables ) Total current liabilities Cost of goods sold Average merchandise inventory (Cash + Cash equivalents ) Total current liabilities (Cash + Prepaid expenses) Total current liabilities (Cash + Short-term investments + Net current receivables ) Total current liabilities Cost of goods sold Average merchandise inventory (Cash + Cash equivalents) Total current liabilities (Cash + Prepaid expenses) Total current liabilities (Cash + Short-term investments + Net current receivables ) Total current liabilities Cost of goods sold Average merchandise inventory Gross profit Net sales revenue Net sales revenue Gross profit Total current assets Total current liabilities Gross profit Net sales revenue Net sales revenue Gross profit Total current assets Total current liabilities Gross profit Net sales revenue Net sales revenue Gross profit Total current assets Total current liabilities Gross profit Net sales revenue Net sales revenue Gross profit Total current assets Total current liabilities Gross profit Net sales revenue Net sales revenue Gross profit Total current assets Total current liabilities The financial statements of Velma's Natural Foods include the following items: View the financial statements. 1 Compute the following ratios for the current year: a. Current ratio d. Inventory turnover f. Days' sales in receivables b. Cash ratio e. Days' sales in inventory g. Gross profit percentage c. Acid-test ratio a. Compute the current ratio for the current year. (Round your answer to two decimal places, X.XX.) Current ratio = b. Compute the cash ratio for the current year. (Round your answer to two decimal places, X.XX.) Cash ratio = c. Compute the acid-test ratio for the current year. (Round your answer to two decimal places, X.XX.) Acid-test ratio = = d. Compute the inventory turnover for the current year. (Round your answer to two decimal places, X.XX.) Inventory turnover =[ e. Compute the days' sales in inventory for the current year. (Round intermediary calculations to two decimal places, X.XX and round your final answer to the nearest whole day.) Days' sales in inventory = i) = days f. Compute the days' sales in receivables for the current year. (Round intermediary calculations to two decimal places, X.XX and round your final answer to nearest whole day.) Days' sales in receivables = ]=days g. Compute the gross profit percentage for the current year. (Round your answer to one tenth of a percent, X.X\%.) Gross profit percentage = (7) ]=% (1) 365 days Accounts receivable turnover ratio 365 days Inventory turnover 365 days Total current assets (2) 365 days Accounts receivable turnover ratio 365 days Inventory turnover 365 days Total current assets 365 days Accounts receivable turnover ratio 365 days Inventory turnover 365 days Total current assets (4) 365 days Accounts receivable turnover ratio 365 days Inventory turnover 365 days Total current assets (5) 365 days Accounts receivable turnover ratio 365 days Inventory turnover 365 days Total current assets (Cash + Cash equivalents ) Total current liabilities (Cash + Prepaid expenses) Total current liabilities ( Cash + Short-term investments + Net current receivables ) Total current liabilities Cost of goods sold Average merchandise inventory (Cash + Cash equivalents) Total current liabilities (Cash + Prepaid expenses) Total current liabilities (Cash + Short-term investments + Net current receivables ) Total current liabilities Cost of goods sold Average merchandise inventory (Cash + Cash equivalents ) Total current liabilities (Cash + Prepaid expenses) Total current liabilities (Cash + Short-term investments + Net current receivables ) Total current liabilities Cost of goods sold Average merchandise inventory (Cash + Cash equivalents ) Total current liabilities (Cash + Prepaid expenses) Total current liabilities (Cash + Short-term investments + Net current receivables ) Total current liabilities Cost of goods sold Average merchandise inventory (Cash + Cash equivalents) Total current liabilities (Cash + Prepaid expenses) Total current liabilities (Cash + Short-term investments + Net current receivables ) Total current liabilities Cost of goods sold Average merchandise inventory Gross profit Net sales revenue Net sales revenue Gross profit Total current assets Total current liabilities Gross profit Net sales revenue Net sales revenue Gross profit Total current assets Total current liabilities Gross profit Net sales revenue Net sales revenue Gross profit Total current assets Total current liabilities Gross profit Net sales revenue Net sales revenue Gross profit Total current assets Total current liabilities Gross profit Net sales revenue Net sales revenue Gross profit Total current assets Total current liabilities

The financial statements of Velma's Natural Foods include the following items: View the financial statements. 1 Compute the following ratios for the current year: a. Current ratio d. Inventory turnover f. Days' sales in receivables b. Cash ratio e. Days' sales in inventory g. Gross profit percentage c. Acid-test ratio a. Compute the current ratio for the current year. (Round your answer to two decimal places, X.XX.) Current ratio = b. Compute the cash ratio for the current year. (Round your answer to two decimal places, X.XX.) Cash ratio = c. Compute the acid-test ratio for the current year. (Round your answer to two decimal places, X.XX.) Acid-test ratio = = d. Compute the inventory turnover for the current year. (Round your answer to two decimal places, X.XX.) Inventory turnover =[ e. Compute the days' sales in inventory for the current year. (Round intermediary calculations to two decimal places, X.XX and round your final answer to the nearest whole day.) Days' sales in inventory = i) = days f. Compute the days' sales in receivables for the current year. (Round intermediary calculations to two decimal places, X.XX and round your final answer to nearest whole day.) Days' sales in receivables = ]=days g. Compute the gross profit percentage for the current year. (Round your answer to one tenth of a percent, X.X\%.) Gross profit percentage = (7) ]=% (1) 365 days Accounts receivable turnover ratio 365 days Inventory turnover 365 days Total current assets (2) 365 days Accounts receivable turnover ratio 365 days Inventory turnover 365 days Total current assets 365 days Accounts receivable turnover ratio 365 days Inventory turnover 365 days Total current assets (4) 365 days Accounts receivable turnover ratio 365 days Inventory turnover 365 days Total current assets (5) 365 days Accounts receivable turnover ratio 365 days Inventory turnover 365 days Total current assets (Cash + Cash equivalents ) Total current liabilities (Cash + Prepaid expenses) Total current liabilities ( Cash + Short-term investments + Net current receivables ) Total current liabilities Cost of goods sold Average merchandise inventory (Cash + Cash equivalents) Total current liabilities (Cash + Prepaid expenses) Total current liabilities (Cash + Short-term investments + Net current receivables ) Total current liabilities Cost of goods sold Average merchandise inventory (Cash + Cash equivalents ) Total current liabilities (Cash + Prepaid expenses) Total current liabilities (Cash + Short-term investments + Net current receivables ) Total current liabilities Cost of goods sold Average merchandise inventory (Cash + Cash equivalents ) Total current liabilities (Cash + Prepaid expenses) Total current liabilities (Cash + Short-term investments + Net current receivables ) Total current liabilities Cost of goods sold Average merchandise inventory (Cash + Cash equivalents) Total current liabilities (Cash + Prepaid expenses) Total current liabilities (Cash + Short-term investments + Net current receivables ) Total current liabilities Cost of goods sold Average merchandise inventory Gross profit Net sales revenue Net sales revenue Gross profit Total current assets Total current liabilities Gross profit Net sales revenue Net sales revenue Gross profit Total current assets Total current liabilities Gross profit Net sales revenue Net sales revenue Gross profit Total current assets Total current liabilities Gross profit Net sales revenue Net sales revenue Gross profit Total current assets Total current liabilities Gross profit Net sales revenue Net sales revenue Gross profit Total current assets Total current liabilities The financial statements of Velma's Natural Foods include the following items: View the financial statements. 1 Compute the following ratios for the current year: a. Current ratio d. Inventory turnover f. Days' sales in receivables b. Cash ratio e. Days' sales in inventory g. Gross profit percentage c. Acid-test ratio a. Compute the current ratio for the current year. (Round your answer to two decimal places, X.XX.) Current ratio = b. Compute the cash ratio for the current year. (Round your answer to two decimal places, X.XX.) Cash ratio = c. Compute the acid-test ratio for the current year. (Round your answer to two decimal places, X.XX.) Acid-test ratio = = d. Compute the inventory turnover for the current year. (Round your answer to two decimal places, X.XX.) Inventory turnover =[ e. Compute the days' sales in inventory for the current year. (Round intermediary calculations to two decimal places, X.XX and round your final answer to the nearest whole day.) Days' sales in inventory = i) = days f. Compute the days' sales in receivables for the current year. (Round intermediary calculations to two decimal places, X.XX and round your final answer to nearest whole day.) Days' sales in receivables = ]=days g. Compute the gross profit percentage for the current year. (Round your answer to one tenth of a percent, X.X\%.) Gross profit percentage = (7) ]=% (1) 365 days Accounts receivable turnover ratio 365 days Inventory turnover 365 days Total current assets (2) 365 days Accounts receivable turnover ratio 365 days Inventory turnover 365 days Total current assets 365 days Accounts receivable turnover ratio 365 days Inventory turnover 365 days Total current assets (4) 365 days Accounts receivable turnover ratio 365 days Inventory turnover 365 days Total current assets (5) 365 days Accounts receivable turnover ratio 365 days Inventory turnover 365 days Total current assets (Cash + Cash equivalents ) Total current liabilities (Cash + Prepaid expenses) Total current liabilities ( Cash + Short-term investments + Net current receivables ) Total current liabilities Cost of goods sold Average merchandise inventory (Cash + Cash equivalents) Total current liabilities (Cash + Prepaid expenses) Total current liabilities (Cash + Short-term investments + Net current receivables ) Total current liabilities Cost of goods sold Average merchandise inventory (Cash + Cash equivalents ) Total current liabilities (Cash + Prepaid expenses) Total current liabilities (Cash + Short-term investments + Net current receivables ) Total current liabilities Cost of goods sold Average merchandise inventory (Cash + Cash equivalents ) Total current liabilities (Cash + Prepaid expenses) Total current liabilities (Cash + Short-term investments + Net current receivables ) Total current liabilities Cost of goods sold Average merchandise inventory (Cash + Cash equivalents) Total current liabilities (Cash + Prepaid expenses) Total current liabilities (Cash + Short-term investments + Net current receivables ) Total current liabilities Cost of goods sold Average merchandise inventory Gross profit Net sales revenue Net sales revenue Gross profit Total current assets Total current liabilities Gross profit Net sales revenue Net sales revenue Gross profit Total current assets Total current liabilities Gross profit Net sales revenue Net sales revenue Gross profit Total current assets Total current liabilities Gross profit Net sales revenue Net sales revenue Gross profit Total current assets Total current liabilities Gross profit Net sales revenue Net sales revenue Gross profit Total current assets Total current liabilities Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started