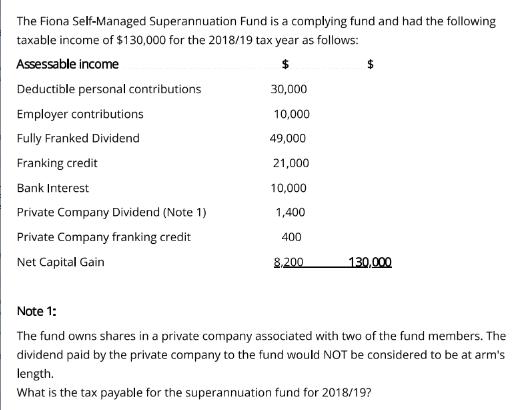

The Fiona Self-Managed Superannuation Fund is a complying fund and had the following taxable income of $130,000 for the 2018/19 tax year as follows:

The Fiona Self-Managed Superannuation Fund is a complying fund and had the following taxable income of $130,000 for the 2018/19 tax year as follows: Assessable income $ Deductible personal contributions 30,000 Employer contributions Fully Franked Dividend Franking credit Bank Interest Private Company Dividend (Note 1) Private Company franking credit Net Capital Gain 10,000 49,000 21,000 10,000 1,400 400 8,200 $ 130,000 Note 1: The fund owns shares in a private company associated with two of the fund members. The dividend paid by the private company to the fund would NOT be considered to be at arm's length. What is the tax payable for the superannuation fund for 2018/19?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Taxable Income30000100004900029000 Tax on Net Capital Gai...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started