Question

The firm expects its sales to increase by 20% in 2022. All the asset and current liabilities vary with sales. The COGS and the operating

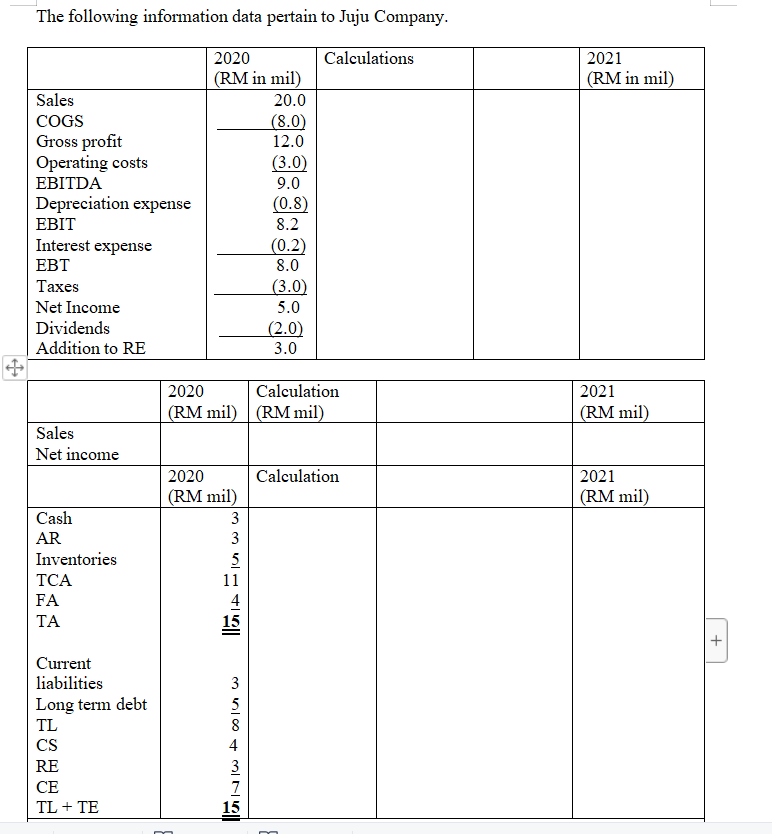

The firm expects its sales to increase by 20% in 2022. All the asset and current liabilities vary with sales. The COGS and the operating cost are by 20% from its sales. The interest expenses are increasing by RM200,000, while depreciation expense will increase by RM200,000 in next year. Tax rate will remain the same. The firm decides to suspend the dividend to its shareholders in the next year. The firm will remain its inventories and fixed assets. The following information data pertain to Juju Company.  Required: a. Construct the proforma for income statement and balance sheet. [You may answer in the provided sheet as above] b. Propose either the firm should borrow from the bank. c. Evaluate either the projected financial statement for 2021 is better plan compared to 2020 in terms of liquidity, profitability and expenses and efficiency of the firm.

Required: a. Construct the proforma for income statement and balance sheet. [You may answer in the provided sheet as above] b. Propose either the firm should borrow from the bank. c. Evaluate either the projected financial statement for 2021 is better plan compared to 2020 in terms of liquidity, profitability and expenses and efficiency of the firm.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started