Question

The firm expects to struggle to retain its share of the market next year. Relative to sales, the firm will maintain its level of marketing

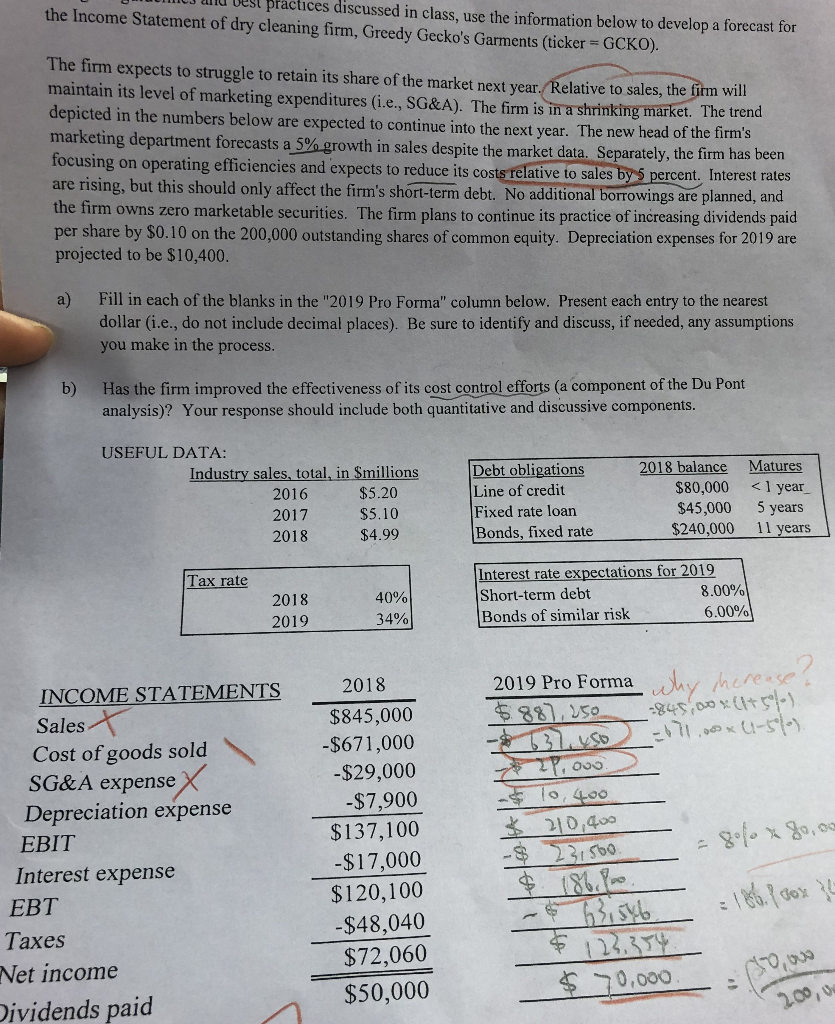

The firm expects to struggle to retain its share of the market next year. Relative to sales, the firm will maintain its level of marketing expenditures (i.e. SG&A). The firm is in a shrinking market. The trend depicted in the numbers below are expected to continue into the next year. The new head of the firms marketing department forecasts a 5% growth in sales despite the market data. Separately, the firm has been focusing on operating efficiencies and expects to reduce its cost relative to sales by 5 percent. Interest rates are rising, but this should only affect the firms short-term debt. No additional borrowing are planned, and the firm owns zero marketable securities. The firm plans to continue is practice of increasing dividends paid per share by $0.10 on the 200000 outstanding shares of common equity. Depreciation expenses for 2019 are projected to be $10400.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started