Answered step by step

Verified Expert Solution

Question

1 Approved Answer

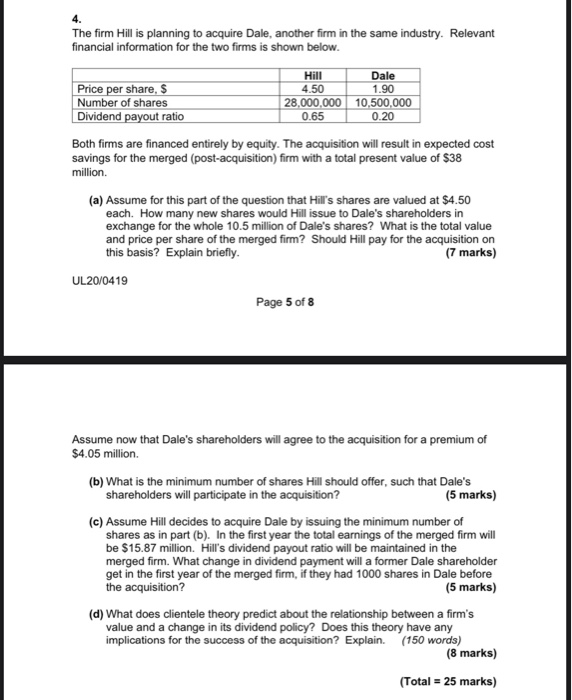

The firm Hill is planning to acquire Dale, another firm in the same industry. Relevant financial information for the two firms is shown below. Price

The firm Hill is planning to acquire Dale, another firm in the same industry. Relevant financial information for the two firms is shown below.

Price per share, $ Number of shares Dividend payout ratio

Hill Dale

4.50 1.90 28,000,000 10,500,000 0.65 0.20

Both firms are financed entirely by equity. The acquisition will result in expected cost savings for the merged (post-acquisition) firm with a total present value of $38 million.

(a) Assume for this part of the question that Hills shares are valued at $4.50 each. How many new shares would Hill issue to Dale's shareholders in exchange for the whole 10.5 million of Dale's shares? What is the total value and price per share of the merged firm? Should Hill pay for the acquisition on

this basis? Explain briefly. UL20/0419

(7 marks)

Page 5 of 8

Assume now that Dale's shareholders will agree to the acquisition for a premium of $4.05 million.

(b) What is the minimum number of shares Hill should offer, such that Dale's shareholders will participate in the acquisition? (5 marks)

(c) Assume Hill decides to acquire Dale by issuing the minimum number of shares as in part (b). In the first year the total earnings of the merged firm will be $15.87 million. Hills dividend payout ratio will be maintained in the merged firm. What change in dividend payment will a former Dale shareholder get in the first year of the merged firm, if they had 1000 shares in Dale before the acquisition? (5 marks)

(d) What does clientele theory predict about the relationship between a firms value and a change in its dividend policy? Does this theory have any implications for the success of the acquisition? Explain. (150 words)

(8 marks) (Total = 25 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started