Question

The firm is looking to expand its operations by 10% of the firm's net property, plant, and equipment. (Calculate this amount by taking 10% of

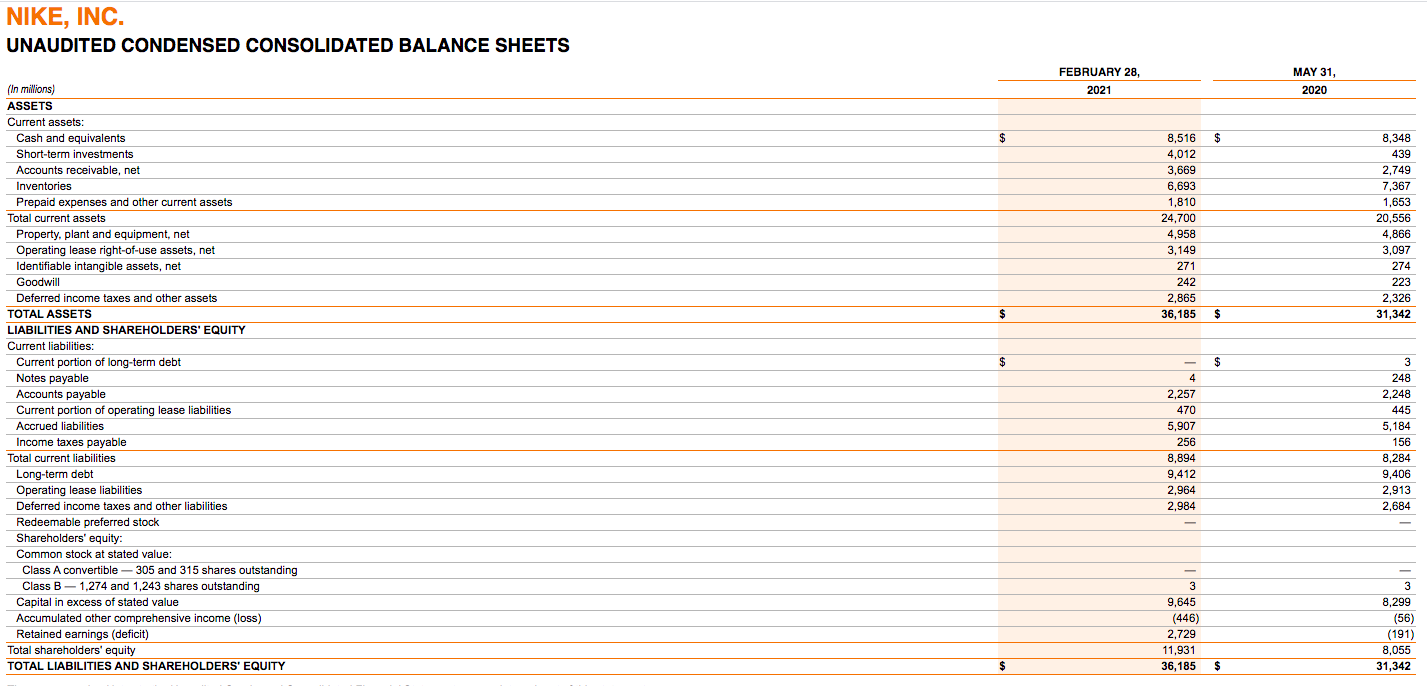

The firm is looking to expand its operations by 10% of the firm's net property, plant, and equipment. (Calculate this amount by taking 10% of the property, plant, and equipment figure that appears on the firm's balance sheet.) The estimated life of this new property, plant, and equipment will be 12 years. The salvage value of the equipment will be 5% of the property, plant and equipment's cost. The annual EBIT for this new project will be 18% of the project's cost. The company will use the straight-line method to depreciate this equipment. Also assume that there will be no increases in net working capital each year. Use 35% as the tax rate in this project. The hurdle rate for this project will be the WACC that you are able to find on a financial website, such as Gurufocus.com. If you are unable to find the WACC for a company, contact your instructor. He or she will assign you a WACC rate.

The firm is looking to expand its operations by 10% of the firm's net property, plant, and equipment. (Calculate this amount by taking 10% of the property, plant, and equipment figure that appears on the firm's balance sheet.) The estimated life of this new property, plant, and equipment will be 12 years. The salvage value of the equipment will be 5% of the property, plant and equipment's cost. The annual EBIT for this new project will be 18% of the project's cost. The company will use the straight-line method to depreciate this equipment. Also assume that there will be no increases in net working capital each year. Use 35% as the tax rate in this project. The hurdle rate for this project will be the WACC that you are able to find on a financial website, such as Gurufocus.com. If you are unable to find the WACC for a company, contact your instructor. He or she will assign you a WACC rate.

- Your calculations for the amount of property, plant, and equipment and the annual depreciation for the project

- Your calculations that convert the project's EBIT to free cash flow for the 12 years of the project.

- The following capital budgeting results for the project

- Net present value

- Internal rate of return

- Discounted payback period.

- Your discussion of the results that you calculated above, including a recommendation for acceptance or rejection of the project

Once again, you may embed your Excel spreadsheets into your document. Be sure to follow APA standards for this project.

NIKE, INC. UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS FEBRUARY 28, MAY 31. 2021 2020 (In millions) ASSETS Current assets: Cash and equivalents $ 8,516 $ 8,348 Short-term investments 439 4,012 3,669 6,693 co 2,749 7,367 Accounts receivable, net Accounts Inut Inventories Prepaid expenses and other current assets cort Total current assets Property, plant and equipment, net Operating lease right-of-use assets, net 1,810 24 200 1,653 20. Ce 20,556 4,866 2007 3,097 4,958 DO 3,149 ee Identifiable intangible assets, net Coodwill 271 274 Goodwill 242 Date 223 2,326 2,865 36,185 $ $ 31,342 $ $ 3 4 248 Deferred income taxes and other assets TOTAL ASSETS LIABILITIES AND SHAREHOLDERS' EQUITY Current liabilities Current portion of long-term debt Mato Notes payable Accounts payable Current portion of operating lease liabilities And list Accrued liabilities Income taxes payable Total current liabilities Long-term debt Operating lease liabilities 2,248 2,257 470 445 5,907 5,184 256 156 8,284 8,894 9,412 9,406 2.913 2,964 2,984 Deferred income taxes and other liabilities 2,684 3 3 Redeemable preferred stock Shareholders' equity: Common stock at stated value: commend Class A convertible - 305 and 315 shares outstanding Class B - 1,274 and 1,243 shares outstanding Capital in excess of stated value manece Accumulated other comprehensive income (loss) Retained earnings (deficit) Total shareholders' equity TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY 9,645 (446) 2,729 11,931 8,299 (56) (191) 8,055 $ 36,185 $ 31,342 NIKE, INC. UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS FEBRUARY 28, MAY 31. 2021 2020 (In millions) ASSETS Current assets: Cash and equivalents $ 8,516 $ 8,348 Short-term investments 439 4,012 3,669 6,693 co 2,749 7,367 Accounts receivable, net Accounts Inut Inventories Prepaid expenses and other current assets cort Total current assets Property, plant and equipment, net Operating lease right-of-use assets, net 1,810 24 200 1,653 20. Ce 20,556 4,866 2007 3,097 4,958 DO 3,149 ee Identifiable intangible assets, net Coodwill 271 274 Goodwill 242 Date 223 2,326 2,865 36,185 $ $ 31,342 $ $ 3 4 248 Deferred income taxes and other assets TOTAL ASSETS LIABILITIES AND SHAREHOLDERS' EQUITY Current liabilities Current portion of long-term debt Mato Notes payable Accounts payable Current portion of operating lease liabilities And list Accrued liabilities Income taxes payable Total current liabilities Long-term debt Operating lease liabilities 2,248 2,257 470 445 5,907 5,184 256 156 8,284 8,894 9,412 9,406 2.913 2,964 2,984 Deferred income taxes and other liabilities 2,684 3 3 Redeemable preferred stock Shareholders' equity: Common stock at stated value: commend Class A convertible - 305 and 315 shares outstanding Class B - 1,274 and 1,243 shares outstanding Capital in excess of stated value manece Accumulated other comprehensive income (loss) Retained earnings (deficit) Total shareholders' equity TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY 9,645 (446) 2,729 11,931 8,299 (56) (191) 8,055 $ 36,185 $ 31,342Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started