Question

The firm is looking to expand its operations by 10% of the firm's net property, plant, and equipment. (Calculate this amount by taking 10% of

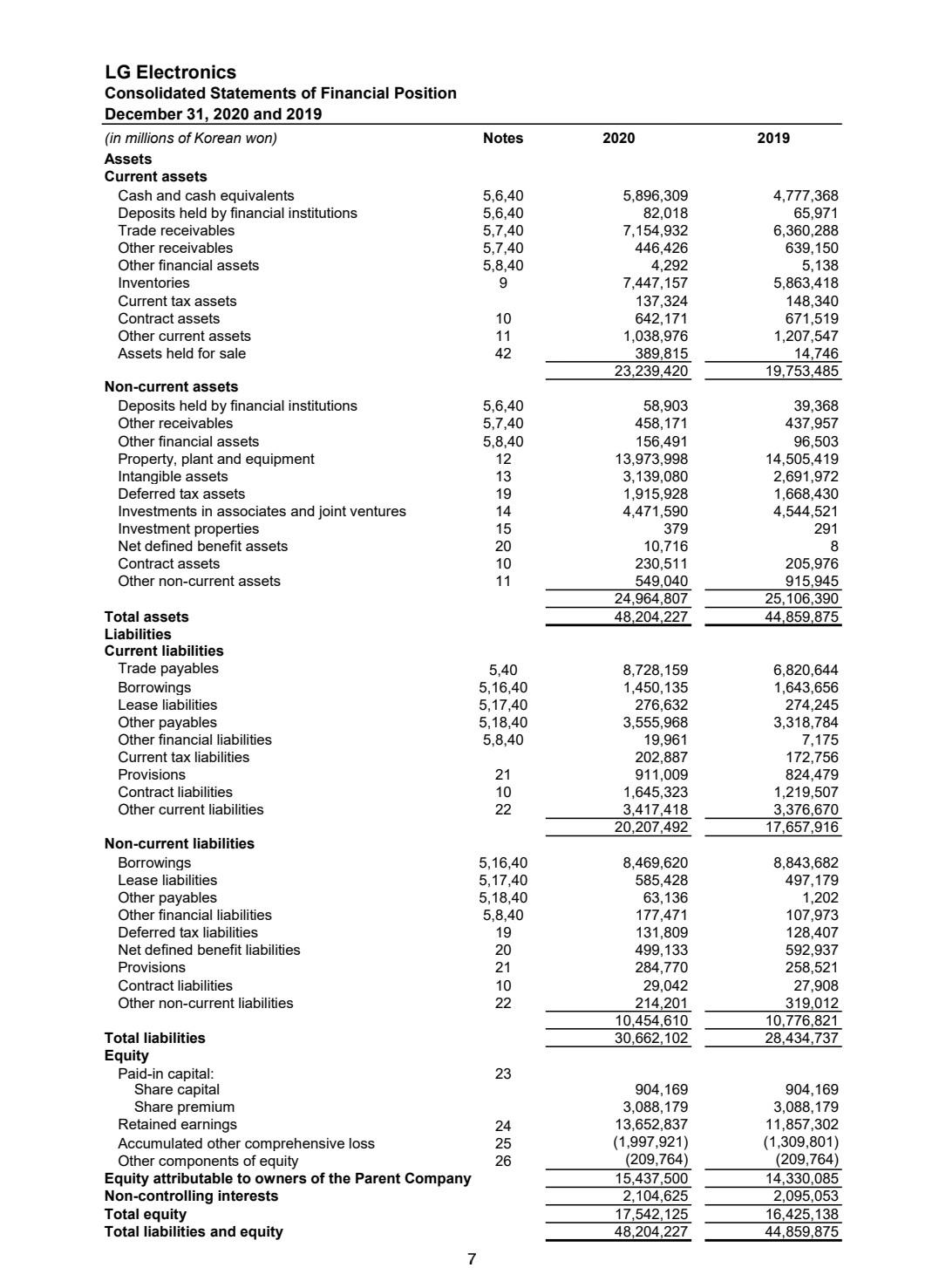

The firm is looking to expand its operations by 10% of the firm's net property, plant, and equipment. (Calculate this amount by taking 10% of the property, plant, and equipment figure that appears on the firm's balance sheet.)

The estimated life of this new property, plant, and equipment will be 12 years. The salvage value of the equipment will be 5% of the property, plant and equipment's cost.

The annual EBIT for this new project will be 18% of the project's cost.

The company will use the straight-line method to depreciate this equipment. Also assume that there will be no increases in net working capital each year. Use 35% as the tax rate in this project.

The hurdle rate for this project will be the 4.9% WACC

Notes 2020 2019 LG Electronics Consolidated Statements of Financial Position December 31, 2020 and 2019 (in millions of Korean won) Assets Current assets Cash and cash equivalents Deposits held by financial institutions Trade receivables Other receivables Other financial assets Inventories Current tax assets Contract assets Other current assets Assets held for sale 5,6,40 5,6,40 5,7,40 5,7,40 5,8,40 9 5,896,309 82,018 7,154,932 446,426 4,292 7,447,157 137,324 642,171 1,038,976 389,815 23,239,420 4,777,368 65,971 6,360,288 639, 150 5,138 5,863,418 148,340 671,519 1,207,547 14,746 19,753,485 10 11 42 5,6,40 5,7,40 Non-current assets Deposits held by financial institutions Other receivables Other financial assets Property, plant and equipment Intangible assets Deferred tax assets Investments in associates and joint ventures Investment properties Net defined benefit assets Contract assets Other non-current assets 5,8,40 12 13 19 14 15 20 10 11 58,903 458,171 156,491 13,973,998 3,139,080 1,915,928 4,471,590 379 10,716 230,511 549,040 24,964,807 48,204,227 39,368 437,957 96,503 14,505,419 2,691,972 1,668,430 4,544,521 291 8 205,976 915,945 25,106,390 44,859,875 Total assets Liabilities Current liabilities Trade payables Borrowings Lease liabilities Other payables Other financial liabilities Current tax liabilities Provisions Contract liabilities Other current liabilities 5,40 5,16,40 5,17,40 5,18,40 5,8,40 8,728,159 1,450,135 276,632 3,555,968 19,961 202,887 911,009 1,645,323 3,417,418 20,207,492 6,820,644 1,643,656 274,245 3,318,784 7,175 172,756 824,479 1,219,507 3,376,670 17,657,916 21 10 22 Non-current liabilities Borrowings Lease liabilities Other payables Other financial liabilities Deferred tax liabilities Net defined benefit liabilities Provisions Contract liabilities Other non-current liabilities 5,16,40 5,17,40 5,18,40 5,8,40 19 20 21 8,469,620 585,428 63,136 177,471 131,809 499,133 284,770 29,042 214,201 10,454,610 30,662,102 8,843,682 497,179 1,202 107,973 128,407 592,937 258,521 27,908 319,012 10,776,821 28,434,737 10 22 23 Total liabilities Equity Paid-in capital: Share capital Share premium Retained earnings Accumulated other comprehensive loss Other components of equity Equity attributable to owners of the Parent Company Non-controlling interests Total equity Total liabilities and equity 24 25 26 904,169 3,088,179 13,652,837 (1,997,921) (209,764) 15,437,500 2,104,625 17,542,125 48,204,227 904,169 3,088,179 11,857,302 (1,309,801) (209,764) 14,330,085 2,095,053 16,425,138 44,859,875 7

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started