Question

The firm is planning an expansion project. So a new facility must be established. Cash flows for this project are presented below: Investment outlays: Project

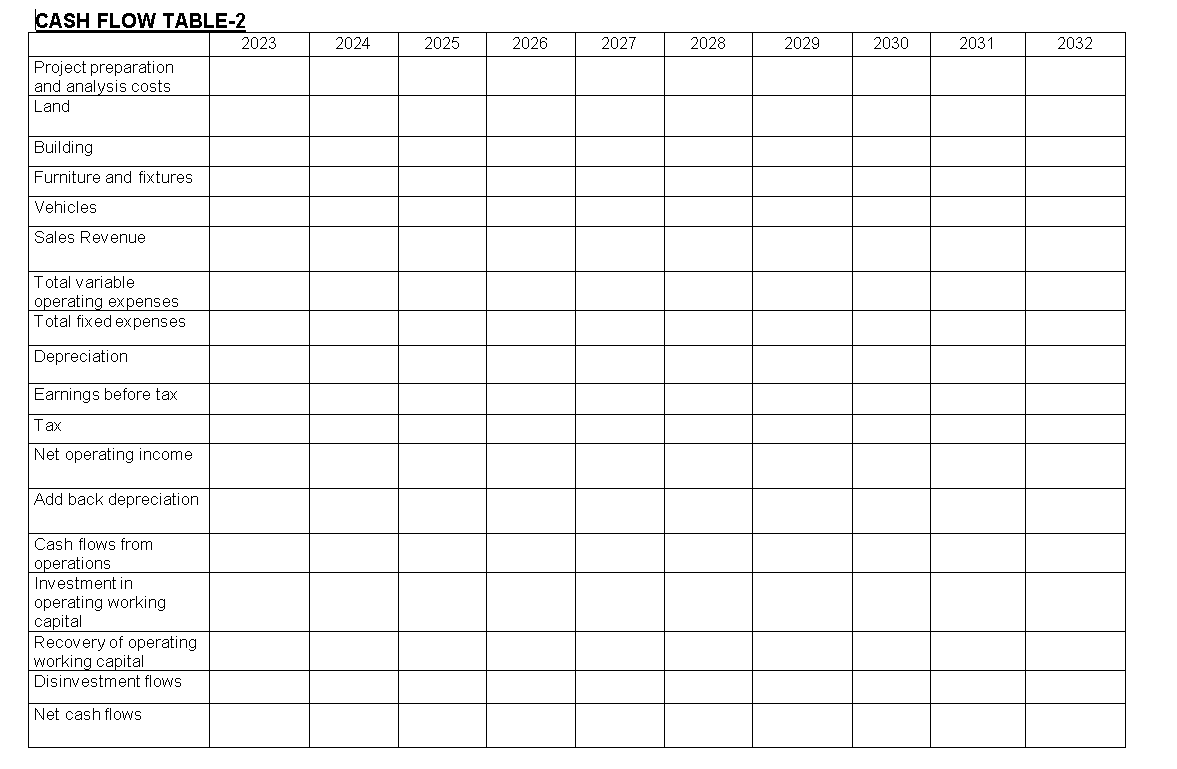

The firm is planning an expansion project. So a new facility must be established. Cash flows for this project are presented below: Investment outlays: Project preparation and analysis costs: 80,000 TL in 2023 Land: 2,500,000 TL in 2023 Building: 2,000,000 TL in 2023, 2,700,000 TL in 2024 Furniture and fixtures: 400,000 TL in 2024 Software: 700,000 TL in 2024 Vehicles: 850,000 TL in 2024 Initial investment in operating working capital: 350,000 TL in 2024 Operating cash flows: Expected sales: 100,000 units in 2025, 120,000 units in 2026, 160,000 units in 2027

Selling price is 110 TL per unit.

Variable manufacturing costs: Direct material 25 TL per unit, direct labor 18 TL per unit, variable manufacturing overhead 20 TL per unit.

Variable marketing, selling, and delivery expenses (mainly transportation): 6 TL per unit

Other fixed costs and expenses (excluding depreciation) are 150,000 TL in each operating year (2025, 2026, 2027, and so on).

Depreciation is 377,500 TL in each operating year (2025, 2026, 2027, and so on)

Investment in operating working capital is 23 % of the sales revenue (2025, 2026, 2027,)

Tax rate is 20 %

Prepare a cash flow table for this project covering 2023, 2024, 2025, 2026, and 2027

The table will be filled according to this information

added a cash flow table in question

CASH FLOW TABLEStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started