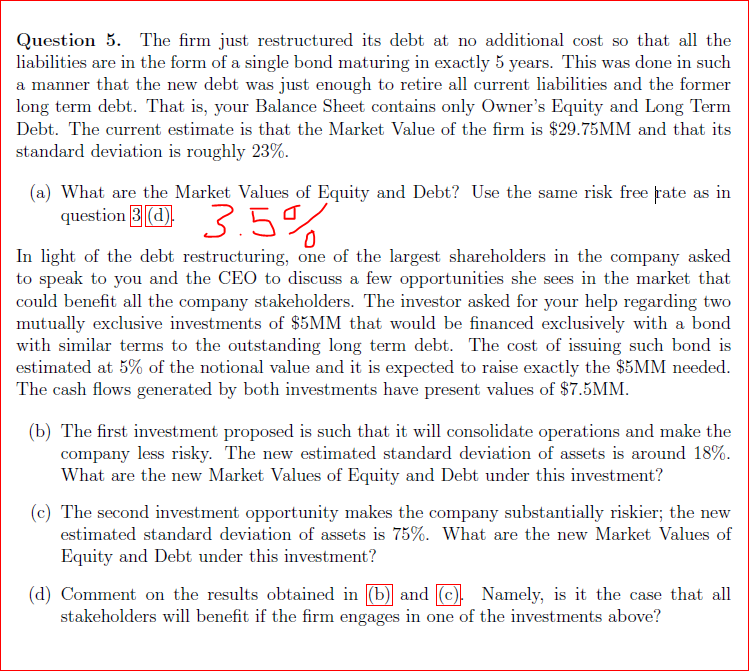

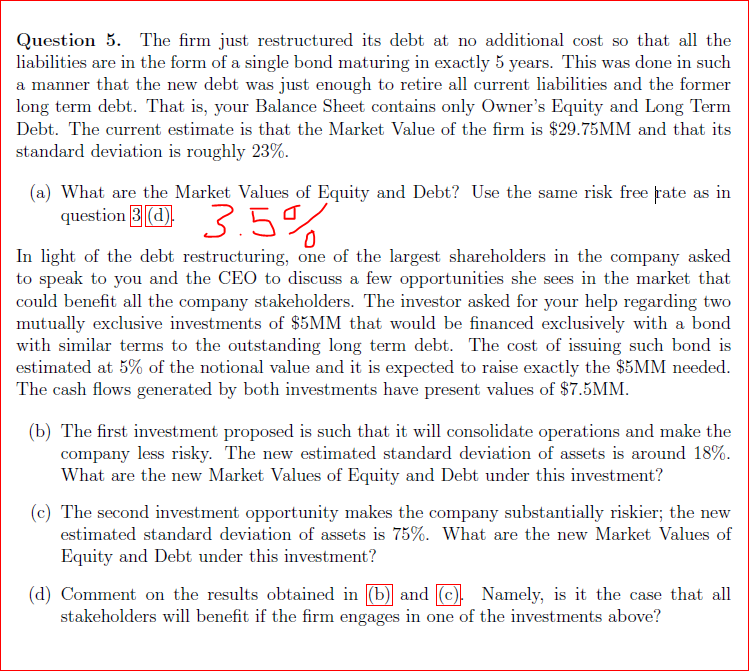

The firm just restructured its debt at no additional cost so that all the liabilities are in the form of a single bond maturing in exactly 5 years. This was done in such a manner that the new debt was just enough to retire all current liabilities and the former long term debt. That is, your Balance Sheet contains only Owner's Equity and Long Term Debt. The current estimate is that the Market Value of the firm is $29.75MM and that its standard deviation is roughly 23%. (a) What are the Market Values of Equity and Debt? Use the same risk free rate as in question 3 (d). In light of the debt restructuring, one of the largest shareholders in the company asked to speak to you and the CEO to discuss a few opportunities she sees in the market that could benefit all the company stakeholders. The investor asked for your help regarding two mutually exclusive investments of $5MM that would be financed exclusively with a bond with similar terms to the outstanding long term debt. The cost of issuing such bond is estimated at 5% of the notional value and it is expected to raise exactly the $5MM needed. The cash flows generated by both investments have present values of $7.5MM. (b) The first investment proposed is such that it will consolidate operations and make the company less risky. The new estimated standard deviation of assets is around 18%. What are the new Market Values of Equity and Debt under this investment? (c) The second investment opportunity makes the company substantially riskier; the new estimated standard deviation of assets is 75%. What are the new Market Values of Equity and Debt under this investment? (d) Comment on the results obtained in (b) and (c). Namely, is it the case that all stakeholders will benefit if the firm engages in one of the investments above? The firm just restructured its debt at no additional cost so that all the liabilities are in the form of a single bond maturing in exactly 5 years. This was done in such a manner that the new debt was just enough to retire all current liabilities and the former long term debt. That is, your Balance Sheet contains only Owner's Equity and Long Term Debt. The current estimate is that the Market Value of the firm is $29.75MM and that its standard deviation is roughly 23%. (a) What are the Market Values of Equity and Debt? Use the same risk free rate as in question 3 (d). In light of the debt restructuring, one of the largest shareholders in the company asked to speak to you and the CEO to discuss a few opportunities she sees in the market that could benefit all the company stakeholders. The investor asked for your help regarding two mutually exclusive investments of $5MM that would be financed exclusively with a bond with similar terms to the outstanding long term debt. The cost of issuing such bond is estimated at 5% of the notional value and it is expected to raise exactly the $5MM needed. The cash flows generated by both investments have present values of $7.5MM. (b) The first investment proposed is such that it will consolidate operations and make the company less risky. The new estimated standard deviation of assets is around 18%. What are the new Market Values of Equity and Debt under this investment? (c) The second investment opportunity makes the company substantially riskier; the new estimated standard deviation of assets is 75%. What are the new Market Values of Equity and Debt under this investment? (d) Comment on the results obtained in (b) and (c). Namely, is it the case that all stakeholders will benefit if the firm engages in one of the investments above