Answered step by step

Verified Expert Solution

Question

1 Approved Answer

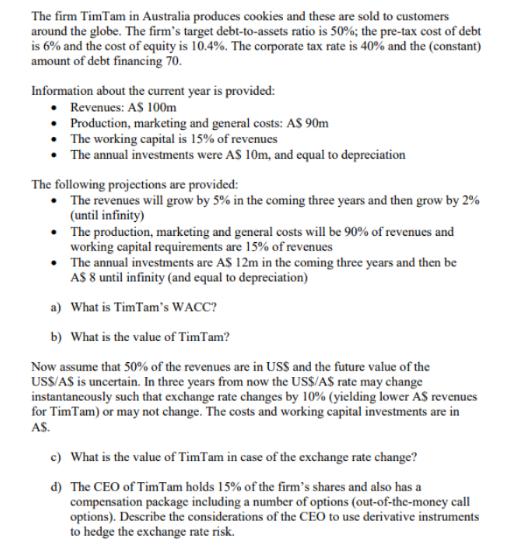

The firm TimTam in Australia produces cookies and these are sold to customers around the globe. The firm's target debt-to-assets ratio is 50%; the

The firm TimTam in Australia produces cookies and these are sold to customers around the globe. The firm's target debt-to-assets ratio is 50%; the pre-tax cost of debt is 6% and the cost of equity is 10.4%. The corporate tax rate is 40% and the (constant) amount of debt financing 70. Information about the current year is provided: Revenues: AS 100m Production, marketing and general costs: AS 90m The working capital is 15% of revenues The annual investments were AS 10m, and equal to depreciation The following projections are provided: The revenues will grow by 5% in the coming three years and then grow by 2% (until infinity) The production, marketing and general costs will be 90% of revenues and working capital requirements are 15% of revenues The annual investments are AS 12m in the coming three years and then be AS 8 until infinity (and equal to depreciation) a) What is TimTam's WACC? b) What is the value of TimTam? Now assume that 50% of the revenues are in USS and the future value of the USS/AS is uncertain. In three years from now the US$/AS rate may change instantaneously such that exchange rate changes by 10% (yielding lower AS revenues for TimTam) or may not change. The costs and working capital investments are in AS. c) What is the value of TimTam in case of the exchange rate change? d) The CEO of TimTam holds 15% of the firm's shares and also has a compensation package including a number of options (out-of-the-money call options). Describe the considerations of the CEO to use derivative instruments to hedge the exchange rate risk. The firm TimTam in Australia produces cookies and these are sold to customers around the globe. The firm's target debt-to-assets ratio is 50%; the pre-tax cost of debt is 6% and the cost of equity is 10.4%. The corporate tax rate is 40% and the (constant) amount of debt financing 70. Information about the current year is provided: Revenues: AS 100m Production, marketing and general costs: AS 90m The working capital is 15% of revenues The annual investments were AS 10m, and equal to depreciation The following projections are provided: The revenues will grow by 5% in the coming three years and then grow by 2% (until infinity) The production, marketing and general costs will be 90% of revenues and working capital requirements are 15% of revenues The annual investments are AS 12m in the coming three years and then be AS 8 until infinity (and equal to depreciation) a) What is TimTam's WACC? b) What is the value of TimTam? Now assume that 50% of the revenues are in USS and the future value of the USS/AS is uncertain. In three years from now the US$/AS rate may change instantaneously such that exchange rate changes by 10% (yielding lower AS revenues for TimTam) or may not change. The costs and working capital investments are in AS. c) What is the value of TimTam in case of the exchange rate change? d) The CEO of TimTam holds 15% of the firm's shares and also has a compensation package including a number of options (out-of-the-money call options). Describe the considerations of the CEO to use derivative instruments to hedge the exchange rate risk.

Step by Step Solution

★★★★★

3.46 Rating (175 Votes )

There are 3 Steps involved in it

Step: 1

a To calculate TimTams Weighted Average Cost of Capital WACC we need to calculate the cost of equity and the cost of debt Cost of Equity Ke The cost of equity is given as 104 This represents the retur...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started