Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The firm will become more valuable. The firm could potentially reject projects that provide a higher rate of return than the company requires. The firm's

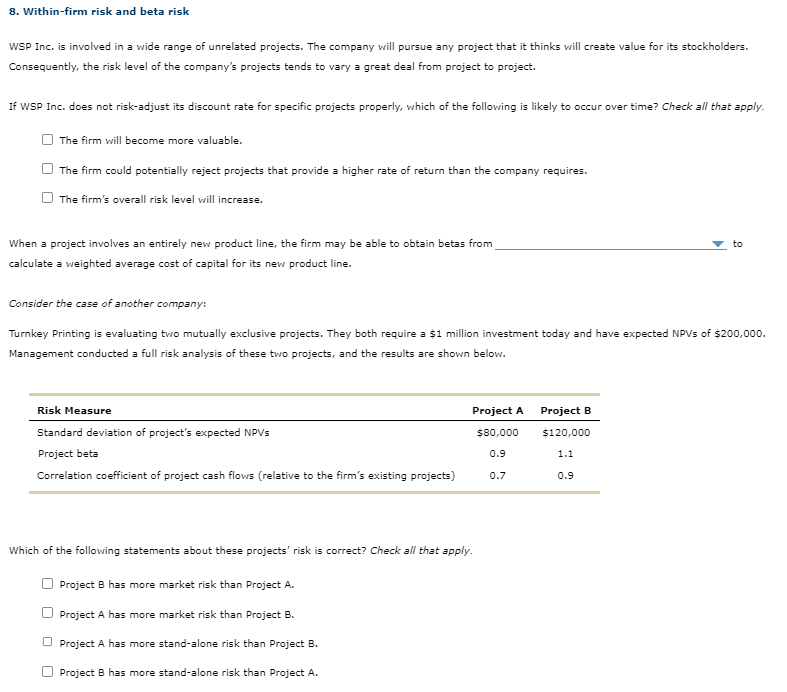

The firm will become more valuable. The firm could potentially reject projects that provide a higher rate of return than the company requires. The firm's overall risk level will increase. When a project involves an entirely new product line, the firm may be able to obtain betas from. to calculate a weighted average cost of capital for its new product line. Consider the case of another company: Turnkey Printing is evaluating two mutually exclusive projects. They both require a $1 million investment today and have expected NPVs of $200,000. Management conducted a full risk analysis of these two projects, and the results are shown below. Which of the following statements about these projects' risk is correct? Check all that apply. Project B has more market risk than Project A. Project A has more market risk than Project B. Project A has more stand-alone risk than Project B. Project B has more stand-alone risk than Project A

The firm will become more valuable. The firm could potentially reject projects that provide a higher rate of return than the company requires. The firm's overall risk level will increase. When a project involves an entirely new product line, the firm may be able to obtain betas from. to calculate a weighted average cost of capital for its new product line. Consider the case of another company: Turnkey Printing is evaluating two mutually exclusive projects. They both require a $1 million investment today and have expected NPVs of $200,000. Management conducted a full risk analysis of these two projects, and the results are shown below. Which of the following statements about these projects' risk is correct? Check all that apply. Project B has more market risk than Project A. Project A has more market risk than Project B. Project A has more stand-alone risk than Project B. Project B has more stand-alone risk than Project A Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started