Question

The firm's comparative income statement and balance sheet for the years 2022 and 2021 follow. THE STAIR COMPANY Comparative Income Statement For Years Ended December

The firm's comparative income statement and balance sheet for the years 2022 and 2021 follow.

| THE STAIR COMPANY Comparative Income Statement For Years Ended December 31, 2022 and 2021 | |||||||

| Amounts | |||||||

| 2022 | 2021 | ||||||

| Revenue | |||||||

| Sales | $ | 1,107,000 | $ | 920,700 | |||

| Less Sales Returns and Allowances | 27,000 | 20,700 | |||||

| Net Sales | $ | 1,080,000 | $ | 900,000 | |||

| Cost of Goods Sold | |||||||

| Merchandise Inventory, January 1 | 115,560 | 108,000 | |||||

| Net Purchases | $ | 374,220 | $ | 314,100 | |||

| Total Merchandise Available for Sale | $ | 489,780 | $ | 422,100 | |||

| Less Merchandise Inventory, December 31 | 118,800 | 115,560 | |||||

| Cost of Goods Sold | $ | 370,980 | $ | 306,540 | |||

| Gross Profit on Sales | $ | 709,020 | $ | 593,460 | |||

| Operating Expenses | |||||||

| Selling Expenses | |||||||

| Sales Salaries Expenses | $ | 110,160 | $ | 101,700 | |||

| Payroll Tax ExpenseSelling | 10,800 | 9,900 | |||||

| Other Selling Expenses | 37,800 | 28,800 | |||||

| Total Selling Expenses | $ | 158,760 | $ | 140,400 | |||

| General and Administrative Expenses | |||||||

| Officers' Salaries Expense | $ | 162,000 | $ | 131,400 | |||

| Payroll Tax ExpenseAdministrative | 16,200 | 10,800 | |||||

| Depreciation Expense | 10,800 | 10,800 | |||||

| Other General and Administrative Expenses | 16,200 | 10,800 | |||||

| Total General and Administrative Expenses | $ | 205,200 | $ | 163,800 | |||

| Total Operating Expenses | $ | 363,960 | $ | 304,200 | |||

| Net Income before Income Taxes | $ | 345,060 | $ | 289,260 | |||

| Income Tax Expense | 103,518 | 86,778 | |||||

| Net Income after Income Taxes | $ | 241,542 | $ | 202,482 | |||

| THE STAIR COMPANY Comparative Balance Sheet December 31, 2022 and 2021 | |||||||

| Amounts | |||||||

| 2022 | 2021 | ||||||

| Assets | |||||||

| Current Assets | |||||||

| Cash | $ | 128,700 | $ | 63,000 | |||

| Accounts Receivable | 114,800 | 105,000 | |||||

| Merchandise Inventory | 118,800 | 115,560 | |||||

| Prepaid Expenses | 11,300 | 6,000 | |||||

| Supplies | 3,500 | 1,640 | |||||

| Total Current Assets | $ | 377,100 | $ | 291,200 | |||

| Property, Plant, and Equipment | |||||||

| Land | $ | 93,000 | $ | 93,000 | |||

| Building and Store Equipment | 98,200 | 98,200 | |||||

| Less Accumulated DepreciationBldg & Store Equipment | (43,200 | ) | (32,400 | ) | |||

| Net Book ValueBuilding and Store Equipment | $ | 55,000 | $ | 65,800 | |||

| Total Property, Plant, and Equipment | $ | 148,000 | $ | 158,800 | |||

| Total Assets | $ | 525,100 | $ | 450,000 | |||

| Liabilities and Stockholders' Equity | |||||||

| Current Liabilities | |||||||

| Accounts Payable | $ | 46,800 | $ | 75,000 | |||

| Sales Tax Payable | 2,800 | 8,000 | |||||

| Payroll Taxes Payable | 2,900 | 2,400 | |||||

| Interest Payable | 2,800 | 8,000 | |||||

| Total Current Liabilities | $ | 55,300 | $ | 93,400 | |||

| Long-Term Liabilities | |||||||

| Mortgage Payable | 58,800 | 63,000 | |||||

| Total Long-Term Liabilities | $ | 58,800 | $ | 63,000 | |||

| Total Liabilities | $ | 114,100 | $ | 156,400 | |||

| Stockholders' Equity | |||||||

| Common Stock ($1 par, 10,000 shares authorized; 10,000 shares issued and outstanding) | $ | 10,000 | $ | 10,000 | |||

| Paid-in CapitalCommon Stock | 10,000 | 10,000 | |||||

| Retained Earnings | 391,000 | 273,600 | |||||

| Total Stockholders' Equity | $ | 411,000 | $ | 293,600 | |||

| Total Liabilities and Stockholders' Equity | $ | 525,100 | $ | 450,000 | |||

Assume all sales are credit sales. Part I

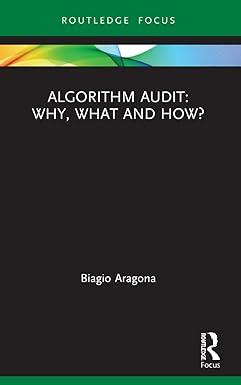

Calculate the current ratio for 2021 and 2022.

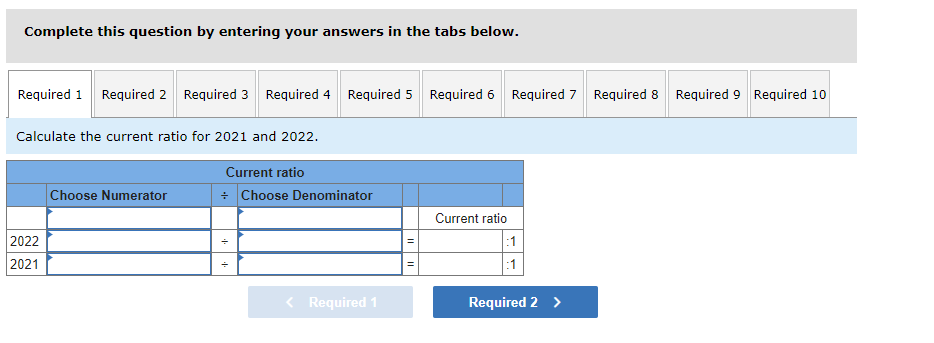

Calculate the acid-test ratio for 2021 and 2022.

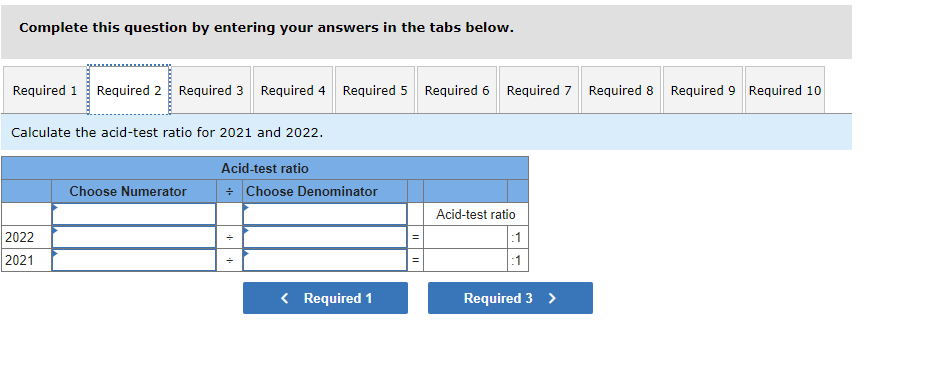

Calculate the inventory turnover for 2021 and 2022.

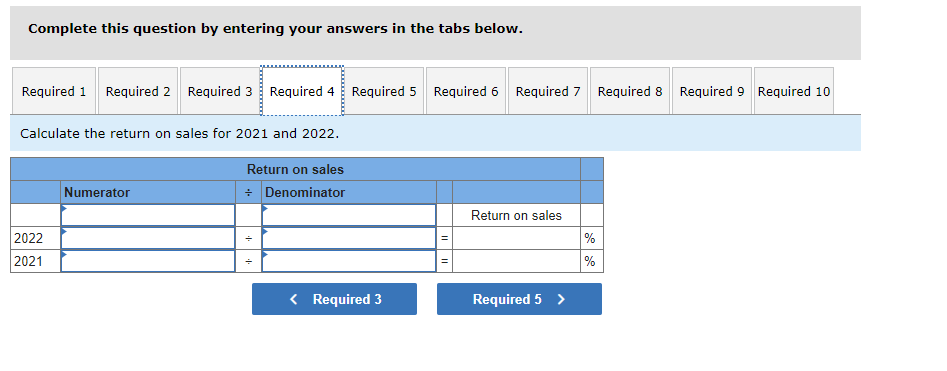

Calculate the return on sales for 2021 and 2022.

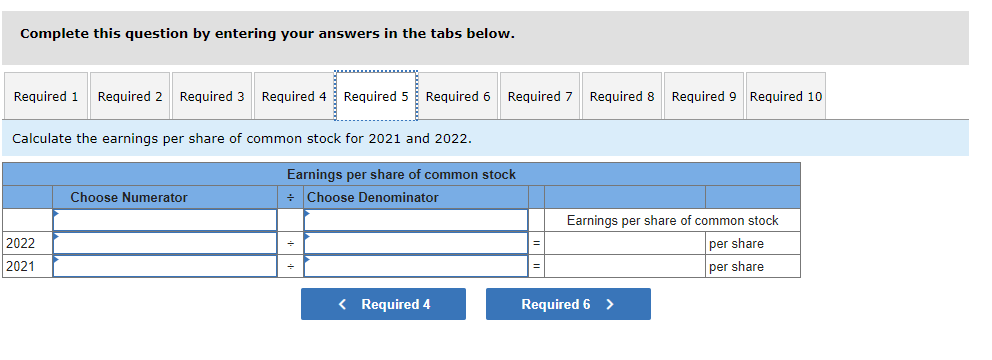

Calculate the earnings per share of common stock for 2021 and 2022.

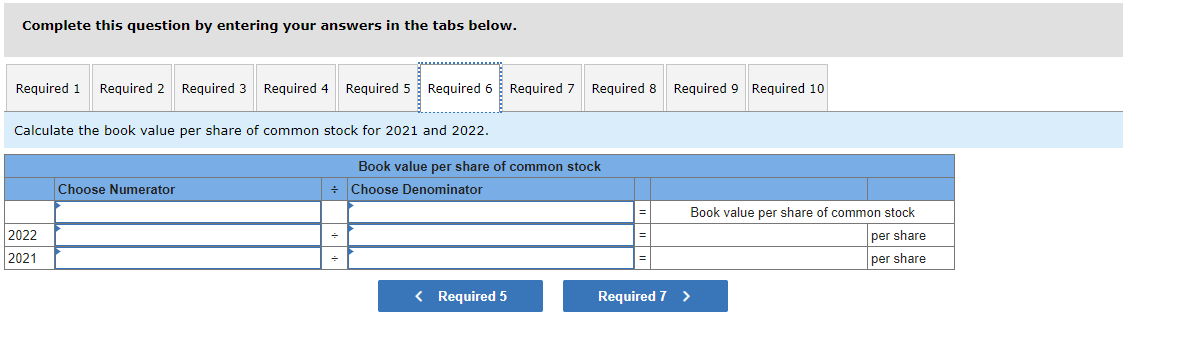

Calculate the book value per share of common stock for 2021 and 2022.

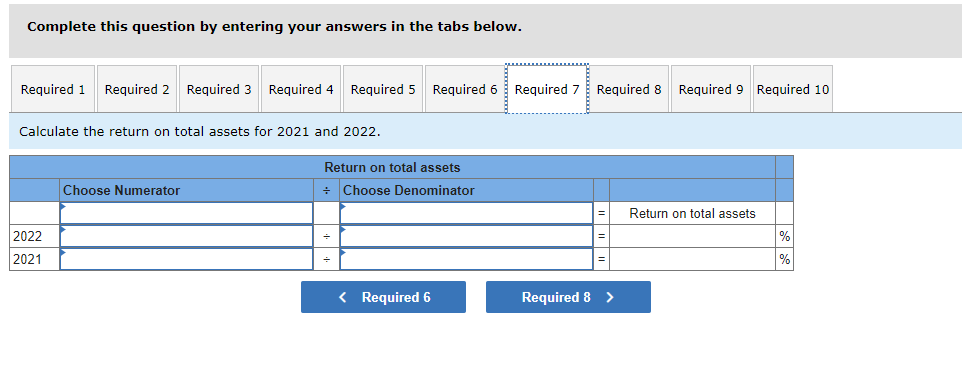

Calculate the return on total assets for 2021 and 2022.

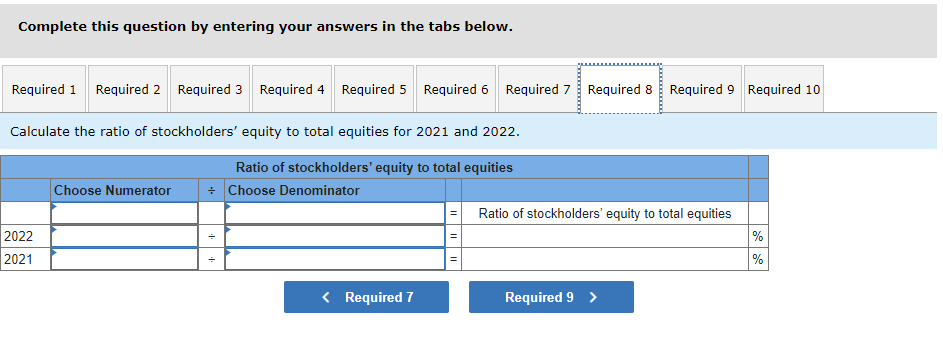

Calculate the ratio of stockholders equity to total equities for 2021 and 2022.

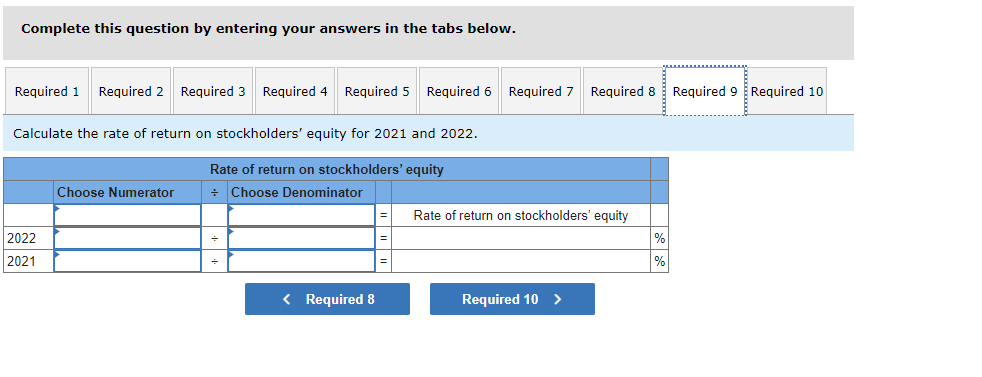

Calculate the rate of return on stockholders equity for 2021 and 2022.

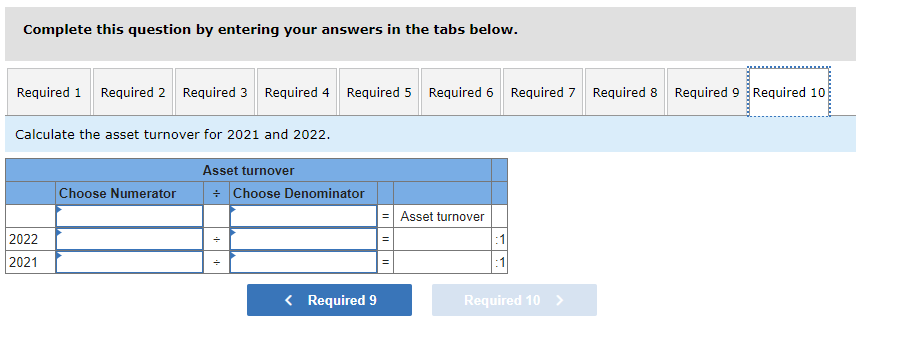

Calculate the asset turnover for 2021 and 2022.

Complete this question by entering your answers in the tabs below. Calculate the current ratio for 2021 and 2022 . Complete this question by entering your answers in the tabs below. Calculate the acid-test ratio for 2021 and 2022 . Complete this question by entering your answers in the tabs below. Calculate the inventory turnover for 2021 and 2022 . Complete this question by entering your answers in the tabs below. Calculate the return on sales for 2021 and 2022 . Complete this question by entering your answers in the tabs below. Calculate the earnings per share of common stock for 2021 and 2022. Complete this question by entering your answers in the tabs below. Calculate the book value per share of common stock for 2021 and 2022 . Complete this question by entering your answers in the tabs below. Calculate the return on total assets for 2021 and 2022 . Complete this question by entering your answers in the tabs below. Calculate the ratio of stockholders' equity to total equities for 2021 and 2022. Complete this question by entering your answers in the tabs below. Calculate the rate of return on stockholders' equity for 2021 and 2022 . Complete this question by entering your answers in the tabs below. Calculate the asset turnover for 2021 and 2022

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started