Question

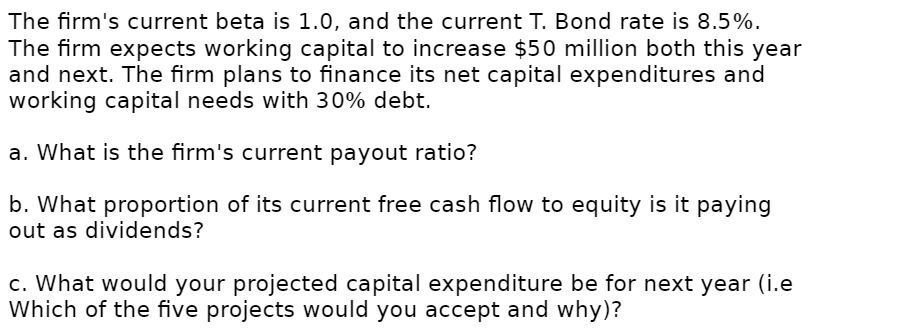

The firm's current beta is 1.0, and the current T. Bond rate is 8.5%. The firm expects working capital to increase $50 million both

The firm's current beta is 1.0, and the current T. Bond rate is 8.5%. The firm expects working capital to increase $50 million both this year and next. The firm plans to finance its net capital expenditures and working capital needs with 30% debt. a. What is the firm's current payout ratio? b. What proportion of its current free cash flow to equity is it paying out as dividends? c. What would your projected capital expenditure be for next year (i.e Which of the five projects would you accept and why)?

Step by Step Solution

3.36 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

a Without any information about the firms earnings dividends or payout policy the...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Applied Corporate Finance

Authors: Aswath Damodaran

4th edition

978-1-118-9185, 9781118918562, 1118808932, 1118918568, 978-1118808931

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App