Answered step by step

Verified Expert Solution

Question

1 Approved Answer

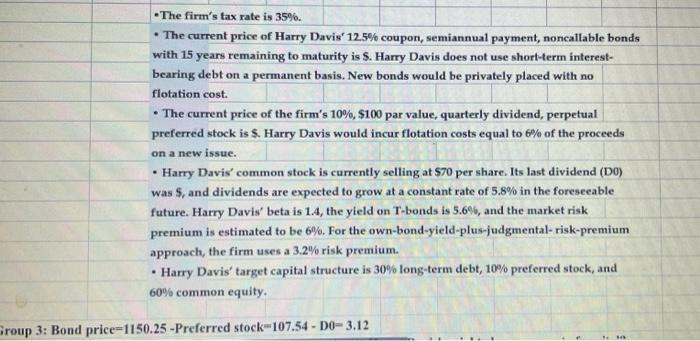

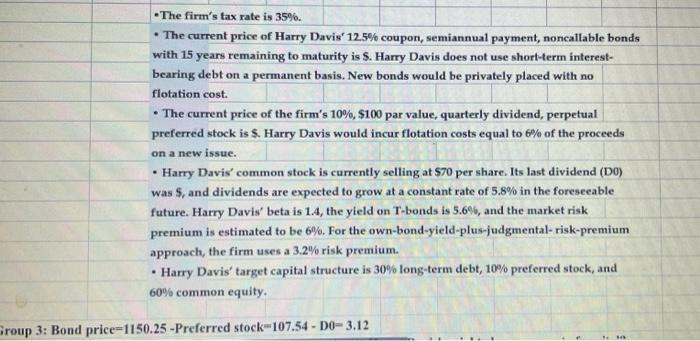

- The firm's tax rate is 35%6. - The current price of Harry Davis'12.5% coupon, semiannual payment, noncallable bonds with 15 years remaining to maturity

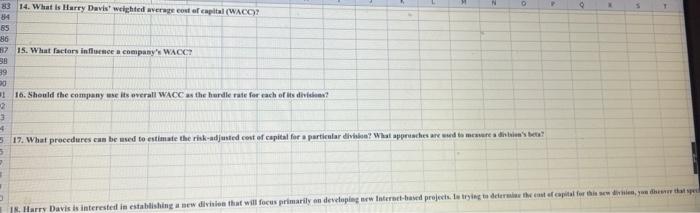

- The firm's tax rate is 35%6. - The current price of Harry Davis'12.5\% coupon, semiannual payment, noncallable bonds with 15 years remaining to maturity is 5 . Harry Davis does not use short-term interestbearing debt on a permanent basis. New bonds would be privately placed with no flotation cost. - The current price of the firm's 10\%, \$100 par value, quarterly dividend, perpetual preferred stock is \$. Harry Davis would incur flotation costs equal to 6% of the proceeds on a new issue. - Harry Davis' common stock is currently selling at $70 per share. Its last dividend (D0) was 5 , and dividends are expected to grow at a constant rate of 5.8% in the foreseeable future. Harry Davis' beta is 1.4, the yield on T-bonds is 5.6%, and the market risk premium is estimated to be 6%. For the own-bond-yield-plus-judgmental-risk-premium approach, the firm uses a 3.2% risk premium. - Harry Davis' target capital structure is 30% long-term debt, 10\% preferred stock, and 60% common equity. Group 3: Bond price=1150.25 -Preferred stock=107.54 - D0= 3.12 14. What is Harry. Davis' weiphted wererage cost of capital (WNACC)? 15. What factars influence a coempany's WACC: 16. Should the compuny ase its averall WACC as the hardle rate for rach of lis divisieas

- The firm's tax rate is 35%6. - The current price of Harry Davis'12.5\% coupon, semiannual payment, noncallable bonds with 15 years remaining to maturity is 5 . Harry Davis does not use short-term interestbearing debt on a permanent basis. New bonds would be privately placed with no flotation cost. - The current price of the firm's 10\%, \$100 par value, quarterly dividend, perpetual preferred stock is \$. Harry Davis would incur flotation costs equal to 6% of the proceeds on a new issue. - Harry Davis' common stock is currently selling at $70 per share. Its last dividend (D0) was 5 , and dividends are expected to grow at a constant rate of 5.8% in the foreseeable future. Harry Davis' beta is 1.4, the yield on T-bonds is 5.6%, and the market risk premium is estimated to be 6%. For the own-bond-yield-plus-judgmental-risk-premium approach, the firm uses a 3.2% risk premium. - Harry Davis' target capital structure is 30% long-term debt, 10\% preferred stock, and 60% common equity. Group 3: Bond price=1150.25 -Preferred stock=107.54 - D0= 3.12 14. What is Harry. Davis' weiphted wererage cost of capital (WNACC)? 15. What factars influence a coempany's WACC: 16. Should the compuny ase its averall WACC as the hardle rate for rach of lis divisieas

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started