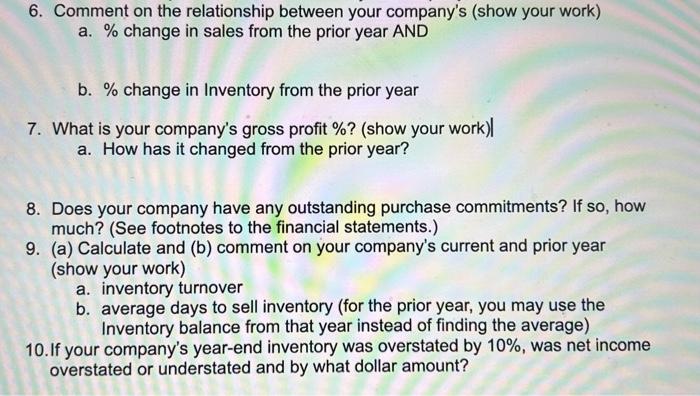

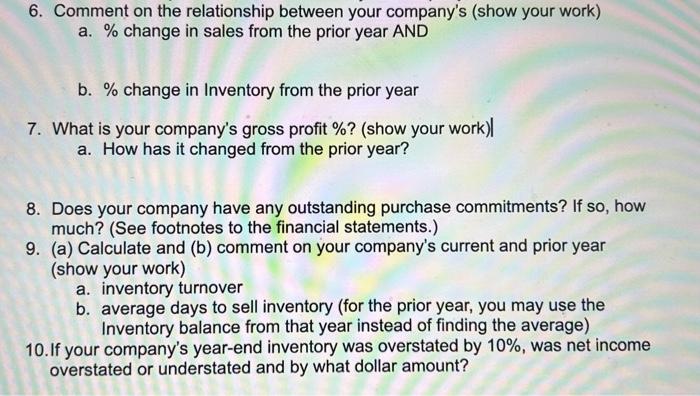

The first attatched photo are the questions. The other photos are what us needed to solve the questions. Thank you and please show work

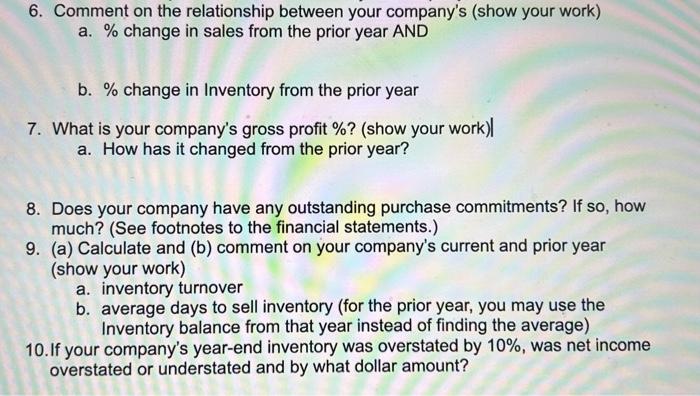

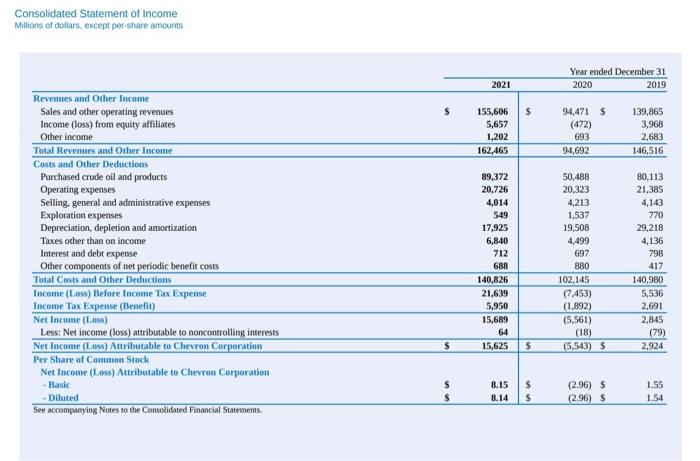

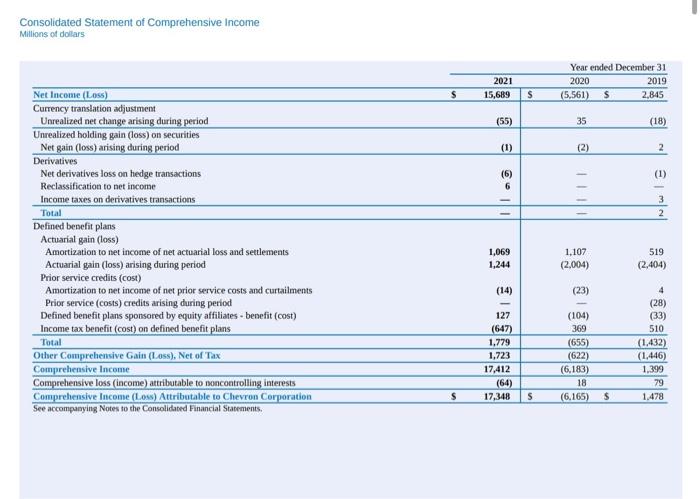

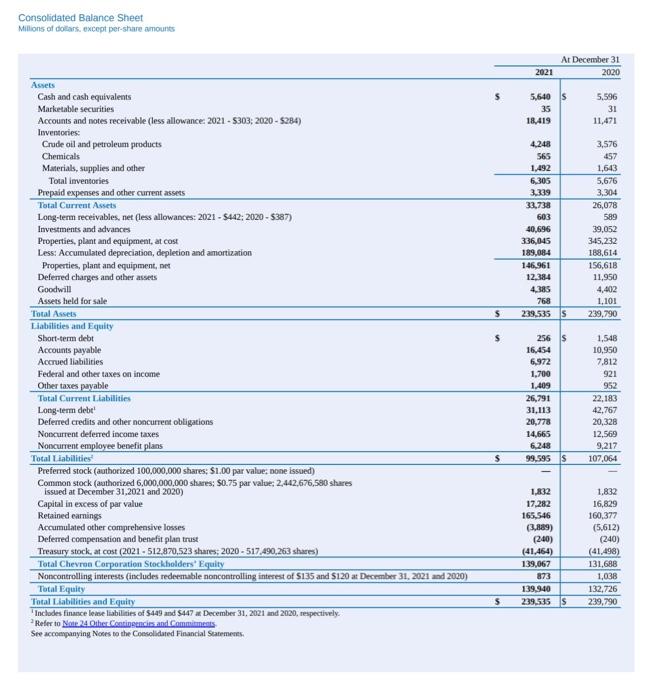

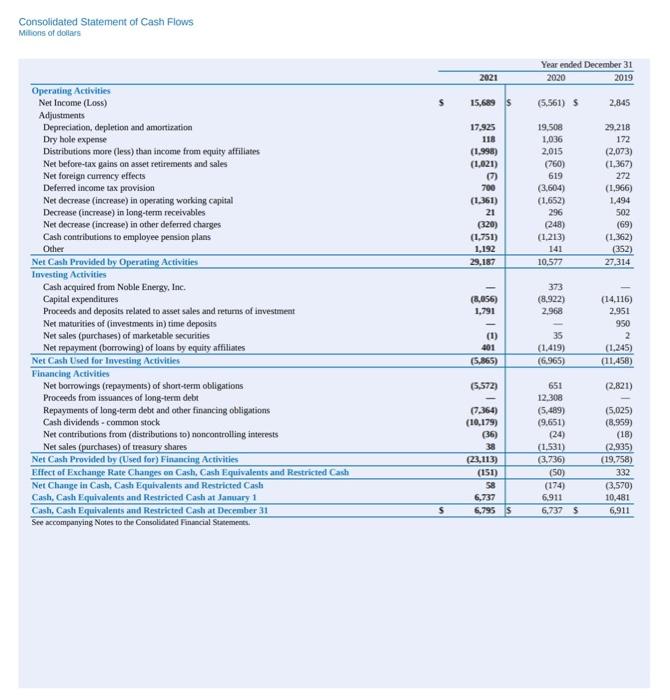

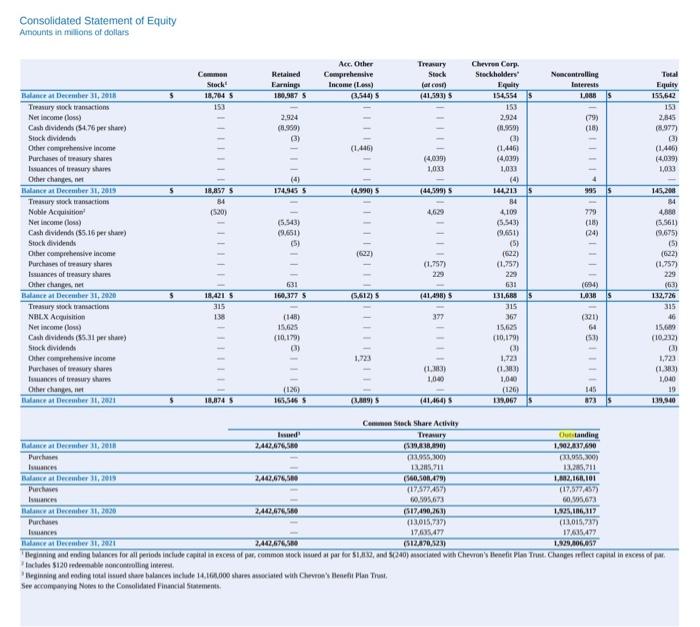

6. Comment on the relationship between your company's (show your work) a. \% change in sales from the prior year AND b. \% change in Inventory from the prior year 7. What is your company's gross profit \%? (show your work) a. How has it changed from the prior year? 8. Does your company have any outstanding purchase commitments? If so, how much? (See footnotes to the financial statements.) 9. (a) Calculate and (b) comment on your company's current and prior year (show your work) a. inventory turnover b. average days to sell inventory (for the prior year, you may use the Inventory balance from that year instead of finding the average) 10. If your company's year-end inventory was overstated by 10%, was net income overstated or understated and by what dollar amount? Consolidated Statement of Income Millions of doilars, except per-share amcunts Consolidated Statement of Comprehensive Income Millions of dollars Consolidated Balance Sheet Milions of dolars. except per-share amounts "Inclodes finarce leise liabilities of $449 and $447 at December 31,2021 and 2020, respectively. 2 Refer to Note 24 Qiher Coatiosencis and Commitnents Sre accompanying Nows bo the Coesolidated Financial Satemenes. Consolidated Statement of Cash Flows Milions of dollas Consolidated Statement of Equity Afnounts in milions of dollars 6. Comment on the relationship between your company's (show your work) a. \% change in sales from the prior year AND b. \% change in Inventory from the prior year 7. What is your company's gross profit \%? (show your work) a. How has it changed from the prior year? 8. Does your company have any outstanding purchase commitments? If so, how much? (See footnotes to the financial statements.) 9. (a) Calculate and (b) comment on your company's current and prior year (show your work) a. inventory turnover b. average days to sell inventory (for the prior year, you may use the Inventory balance from that year instead of finding the average) 10. If your company's year-end inventory was overstated by 10%, was net income overstated or understated and by what dollar amount? Consolidated Statement of Income Millions of doilars, except per-share amcunts Consolidated Statement of Comprehensive Income Millions of dollars Consolidated Balance Sheet Milions of dolars. except per-share amounts "Inclodes finarce leise liabilities of $449 and $447 at December 31,2021 and 2020, respectively. 2 Refer to Note 24 Qiher Coatiosencis and Commitnents Sre accompanying Nows bo the Coesolidated Financial Satemenes. Consolidated Statement of Cash Flows Milions of dollas Consolidated Statement of Equity Afnounts in milions of dollars