Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The first dropdown answers: Decrease or Increase the second dropdown answers: Decrease or Increase Third dropdown answers: Decrease or Increase Indicate whether each of the

The first dropdown answers: "Decrease" or "Increase"

the second dropdown answers: "Decrease" or "Increase"

Third dropdown answers: "Decrease" or "Increase"

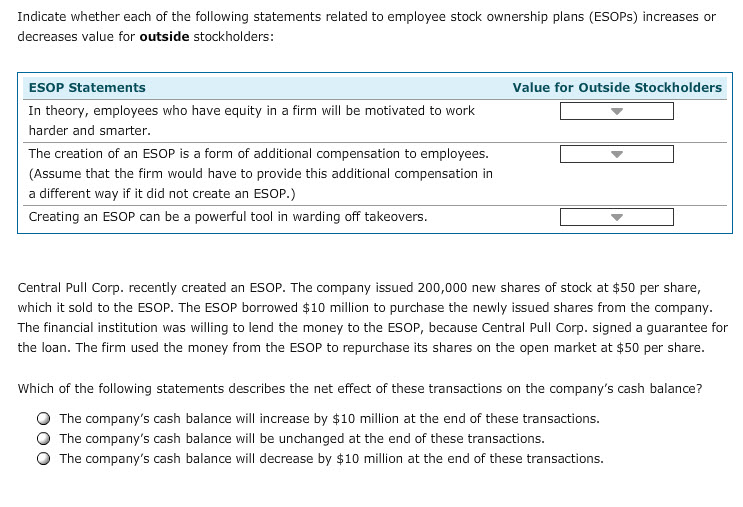

Indicate whether each of the following statements related to employee stock ownership plans (ESOPs) increases or decreases value for outside stockholders: ESOP Statements In theory, employees who have equity in a firm will be motivated to work harder and smarter. The creation of an ESOP is a form of additional compensation to employees. (Assume that the firm would have to provide this additional compensation in a different way if it did not create an ESOP.) Creating an ESOP can be a powerful tool in warding off takeovers. Value for Outside Stockholders Central Pull Corp. recently created an ESOP. The company issued 200,000 new shares of stock at $50 per share, which it sold to the ESOP. The ESOP borrowed $10 million to purchase the newly issued shares from the company. The financial institution was willing to lend the money to the ESOP, because Central Pull Corp. signed a guarantee for the loan. The firm used the money from the ESOP to repurchase its shares on the open market at $50 per share. Which of the following statements describes the net effect of these transactions on the company's cash balance? O The company's cash balance will increase by $10 million at the end of these transactions. O The company's cash balance will be unchanged at the end of these transactions. O The company's cash balance will decrease by $10 million at the end of these transactionsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started