Question

The first facet of a business that requires definition is the business itself. For the entrepreneur, this should be a straightforward solution to some kind

The first facet of a business that requires definition is the business itself. For the entrepreneur, this should be a straightforward solution to some kind of problem. The solution itself may sometimes entail a degree of complexity, but it should be easy to communicate the solution to others. Define the business broadly enough to be resilient to changes in the industry landscape. Buggy whip manufacturers, as the famous example goes, have all gone out of business, but suppliers of accessories for transportation remain a steady feature of the industrial landscape. Define the business broadly. This will form part of your mission statement. Be ready to define the core product or service more narrowly, as this may have to mutate over time. Your core product or service must appeal to your core market, which you will likewise define narrowly. Thus, a broad business definition and a narrow product or service definition make for a good entrepreneurial idea. Define the core product or service narrowly. This will inform how to define your market. Mission Statement Use your mission statement to achieve focus, while making it clear and actionable to enable partners and employees to support it with their own actions. Write your mission statement as one sentence (in fact, as one sentence fragment, starting with the particle to). Include three parts: 1. What is your product or service? This is the business, not the actual core product or service. To provide, support, supply, make available, offer, equip (reserve generic strategy for #2) 2. For whom will you provide the product or service? What is your customers motivation? [Category:] for professionals, families, young people, workers, busy people, achievers [Motivation:] who need, want, expect, deserve, desire, prefer, require, could benefit from Generic strategies (select focused firm, plus cost leader or differentiatorbut not both): [Focused firm:] friendliness, a personal touch, atmosphere, proximity (use your imagination!) [Cost leader:] value, one-stop shopping, savings, selection, economy, competitive prices [Differentiator:] quality, reliability, durability, best materials, authenticity, refinement 3. How do you provide the product or service? What channels or configuration will you use? by locating near the customer, through third-party vendors, through online sales Strategy Working from the strategy reference in your mission statement, explain why you chose it and how you think it will fit #3. Remember never to mix cost leadership and differentiation elements together. You are a focused firm if you are small, but the choice of the cost leadership or differentiation element is up to you.

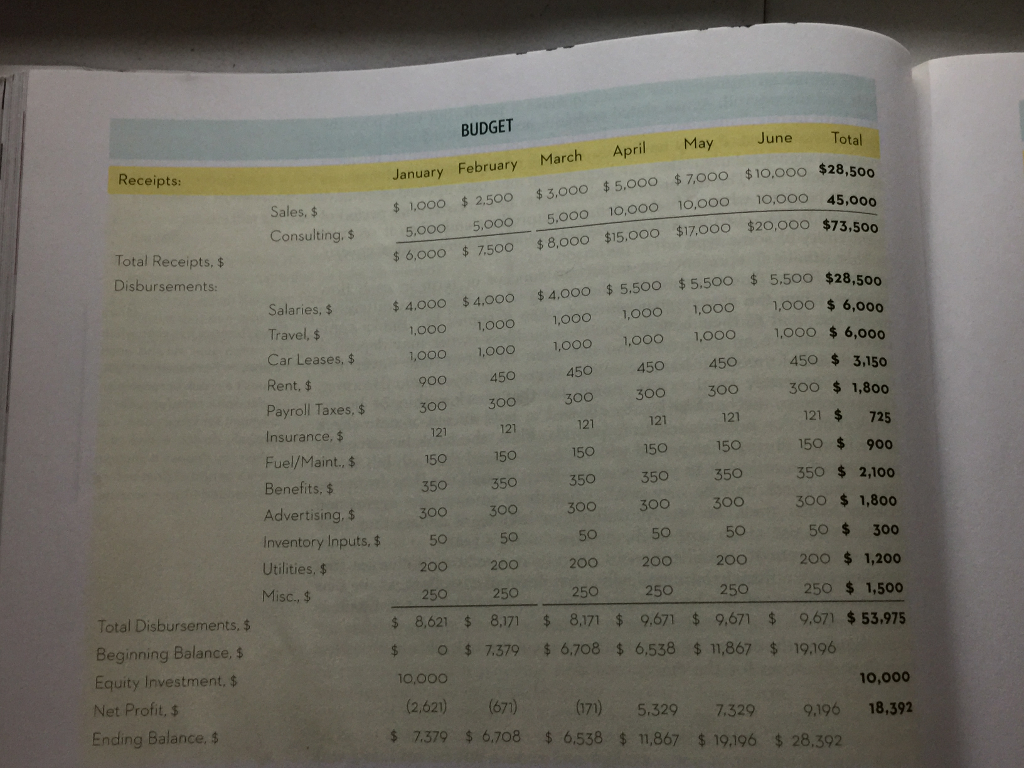

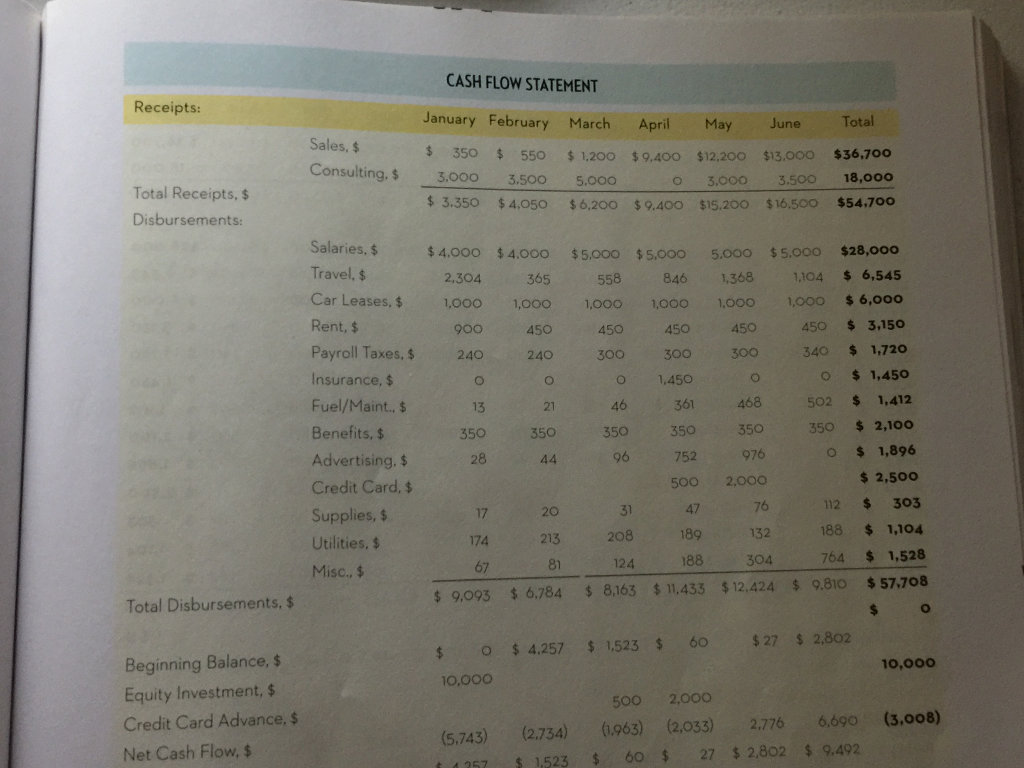

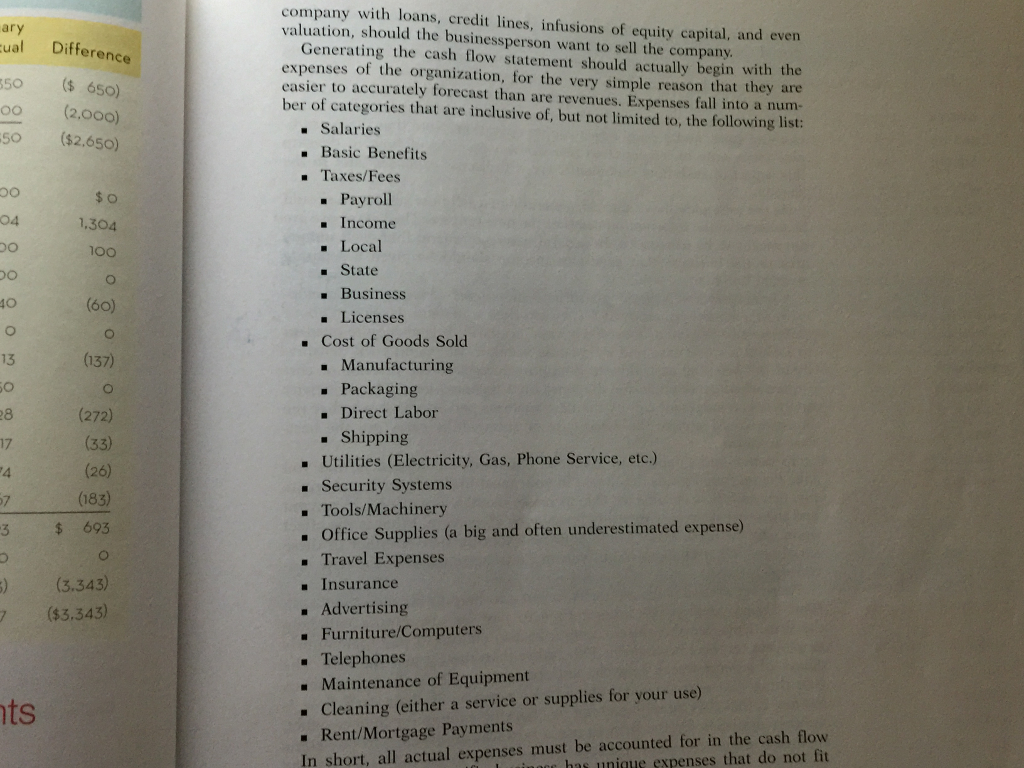

Before starting a business, estimate monthly expenses, prepare a budget, and then estimate cash flow. The Budget Examine the budget model in Bamford and Bruton (2016, p. 102). Estimate expenses (disbursements) first, to know what your revenues have to be. Review the list of possible expenditure categories (p. 107). Note that salary, benefits, and payroll taxes in the example are for the owner, prior to hiring anyone. Estimate backwardsexpenditures first; then you will know what your revenues have to be. Consider contracting with a law firm (~ $100 a month), a CPA firm (~ $100 a month), and a payroll services firm (~ $50 a monthafter you hire someone) for discounted services for a flat monthly fee. How will you operate at first? Home office? Rent a mailbox? Your choices will affect your travel. Complete your estimated budget on a spreadsheet. Format it nicely, and arrange it for later copying as a table to your final business plan. Now, to create your cash flow statement, copy the budget to another spreadsheet. Examine the slight differences (Bamford & Bruton, 2016, p. 103). Adjust accordingly. Negative net profit is finesee below under Recalculate the Budget. The Cash Flow Statement To turn your budget into a cash flow statement, reinterpret your expenditures to conform to their expected timing. Expect a large outflow at first, offset by your equity investment. Expect utilities to be cheapest in the spring and fall. Expect a gradual increase over time for certain items. Some items may remain steady. Ignore the annual totals as you adjust the cash flow. Let them change naturally. Observe these tips: 1

. Personal: Avoid commingling personal and business accounts. Each time you put your own cash into the business, treat it as an equity investment. Put every penny in its proper category.

2. Salaries: For yourself + employeesadd when you plan to hire someone. If you intend to live off other income (e.g., a pension), it is an equity investment. No matter what, you will have a salary.

3. Private automobile or home office: Treat as equity investments from yourself, using IRS figures (57.5 per mile for your carfuel included; $5 per square foot [max. 300], for your home office). Recalculate the Budget Net profit = ending budget balance minus equity. Net cash flow = ending cash flow balance minus equity. Negative net figures are normal, even all year. Just be sure to plan for positive gross figures every month. Remember, your equity is money on hand. As a long-term liability, it is negative value, not negative cash. Upon finalizing your cash flow figures, recalculate your budget by smoothing the numbers (see p. 102) aka budget model

Consult the Business Plan Part II handout before preparing your commentary. You need to try to estimate your expenses (budget and cash flow) first, so you have something to talk about. Once you have completed both your prospective budget and your prospective cash flow statement for the first year, start working on your commentary.

Given the importance of this first step, the handout gives all importance to calculating expenses. Finding financing sources is a separate matter, for the final business plan. In this forum, you will therefore only discuss how you have calculated your expenses. Describe generally how you went about it, especially any surprises or head-scratchers along the way.

Did you benchmark against another company? Did you postpone investing in a storefront? Will you wait to hire people? Did you look up law firms, CPAs, or payroll services? Perhaps you have personal experience with helpful services for small businesses in your area. Is it feasible to start your small business in a business incubator to lower your startup costs? I

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started