Answered step by step

Verified Expert Solution

Question

1 Approved Answer

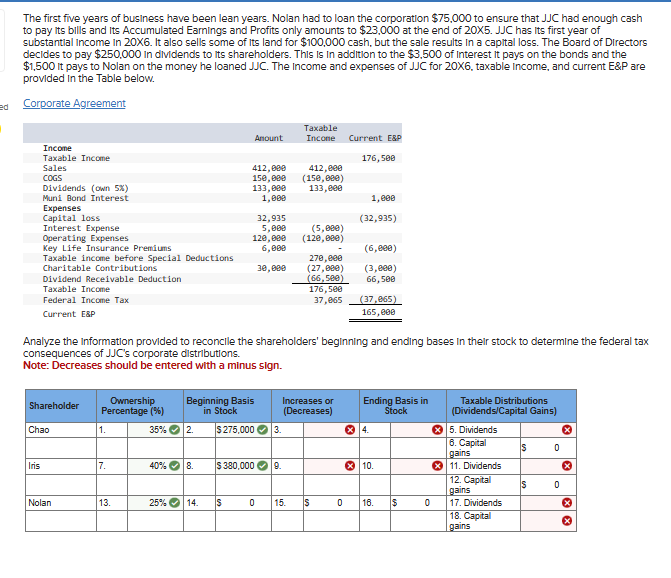

The first five years of business have been lean years. Nolan had to loan the corporation $ 7 5 , 0 0 0 to ensure

The first five years of business have been lean years. Nolan had to loan the corporation $ to ensure that JJC had enough cash

to pay its bills and Its Accumulated Earnings and Profits only amounts to $ at the end of JJC has Its first year of

substantlal Income in It also sells some of Its land for $ cash, but the sale results in a capital loss. The Board of Directors

decides to pay $ in dividends to its shareholders. This Is In addition to the $ of Interest it pays on the bonds and the

$ it pays to Nolan on the money he loaned JJC The Income and expenses of JJC for X taxable Income, and current E&P are

provided In the Table below.

Corporate Agreement

Analyze the information provided to reconclle the shareholders' beginning and ending bases in their stock to determine the federal tax

consequences of JJCs corporate distributions.

Note: Decreases should be entered with a minus sign.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started