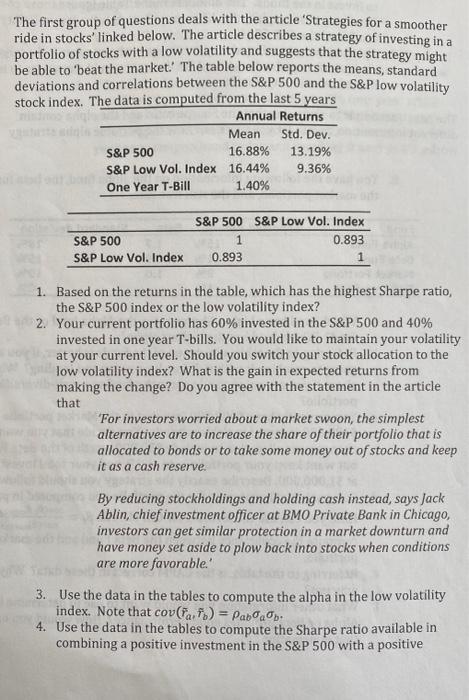

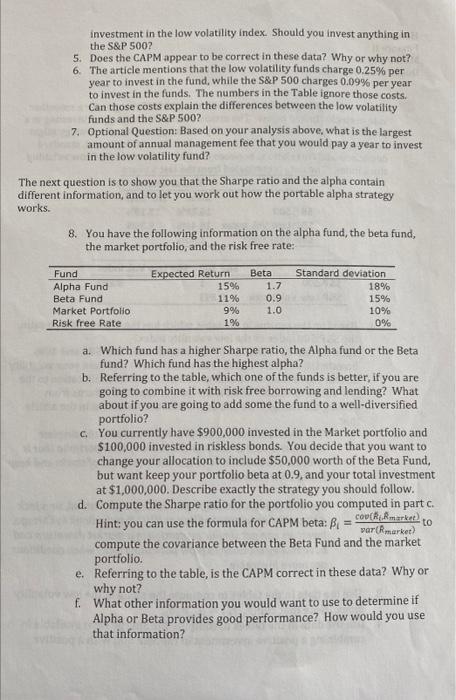

The first group of questions deals with the article 'Strategies for a smoother ride in stocks' linked below. The article describes a strategy of investing in a portfolio of stocks with a low volatility and suggests that the strategy might be able to 'beat the market.' The table below reports the means, standard deviations and correlations between the S\&P 500 and the S\&P low volatility stock index. The data is computed from the last 5 vears 1. Based on the returns in the table, which has the highest Sharpe ratio, the S\&P 500 index or the low volatility index? 2. Your current portfolio has 60% invested in the S\&P 500 and 40% invested in one year T-bills. You would like to maintain your volatility at your current level. Should you switch your stock allocation to the low volatility index? What is the gain in expected returns from making the change? Do you agree with the statement in the article that For investors worried about a market swoon, the simplest alternatives are to increase the share of their portfolio that is allocated to bonds or to take some money out of stocks and keep it as a cash reserve. By reducing stockholdings and holding cash instead, says Jack Ablin, chief investment officer at BMO Private Bank in Chicago, investors can get similar protection in a market downturn and have money set aside to plow back into stocks when conditions are more favorable. 3. Use the data in the tables to compute the alpha in the low volatility index. Note that cov(~a,f~b)=abab. 4. Use the data in the tables to compute the Sharpe ratio available in combining a positive investment in the S\&P 500 with a positive investment in the low volatility index. Should you invest anything in the S\&P 500? 5. Does the CAPM appear to be correct in these data? Why or why not? 6. The article mentions that the low volatility funds charge 0.25% per year to invest in the fund, while the S\&P 500 charges 0.09% per year to invest in the funds. The numbers in the Table ignore those costs. Can those costs explain the differences between the low volatility funds and the S\&P 500 ? 7. Optional Question: Based on your analysis above, what is the largest amount of annual management fee that you would pay a year to invest in the low volatility fund? e next question is to show you that the Sharpe ratio and the alpha contain ferent information, and to let you work out how the portable alpha strategy orks. 8. You have the following information on the alpha fund, the beta fund, the market portfolio, and the risk free rate: a. Which fund has a higher Sharpe ratio, the Alpha fund or the Beta fund? Which fund has the highest alpha? b. Referring to the table, which one of the funds is better, if you are going to combine it with risk free borrowing and lending? What. about if you are going to add some the fund to a well-diversified portfolio? c. You currently have $900,000 invested in the Market portfolio and $100,000 invested in riskless bonds. You decide that you want to change your allocation to include $50,000 worth of the Beta Fund, but want keep your portfolio beta at 0.9 , and your total investment at $1,000,000. Describe exactly the strategy you should follow. d. Compute the Sharpe ratio for the portfolio you computed in part c. Hint: you can use the formula for CAPM beta: i=var(Rmarket)cov(RiRmarkee) to compute the covariance between the Beta Fund and the market portfolio. e. Referring to the table, is the CAPM correct in these data? Why or why not? f. What other information you would want to use to determine if Alpha or Beta provides good performance? How would you use that information? The final question deals with bond pricing, spot rates, forward rates and bond returns 9. Bond pricing. The current one-year spot interest rate is 0.5% and the two-year spot interest rate is 2%. a. What is the price of a one-year zero-coupon bond? b. What is the price of a two-year zero-coupon bond? c. What is the price of a two-year coupon bond with a 2% annual coupon rate? Assume that the coupons are paid once per year. e. You think that interest rates will rise to 2% next year. Which strategy has the highest expected return over the next year: investing in a one year zero-coupon bond or purchasing a two year zero-coupon bond today and reselling it next year? The first group of questions deals with the article 'Strategies for a smoother ride in stocks' linked below. The article describes a strategy of investing in a portfolio of stocks with a low volatility and suggests that the strategy might be able to 'beat the market.' The table below reports the means, standard deviations and correlations between the S\&P 500 and the S\&P low volatility stock index. The data is computed from the last 5 vears 1. Based on the returns in the table, which has the highest Sharpe ratio, the S\&P 500 index or the low volatility index? 2. Your current portfolio has 60% invested in the S\&P 500 and 40% invested in one year T-bills. You would like to maintain your volatility at your current level. Should you switch your stock allocation to the low volatility index? What is the gain in expected returns from making the change? Do you agree with the statement in the article that For investors worried about a market swoon, the simplest alternatives are to increase the share of their portfolio that is allocated to bonds or to take some money out of stocks and keep it as a cash reserve. By reducing stockholdings and holding cash instead, says Jack Ablin, chief investment officer at BMO Private Bank in Chicago, investors can get similar protection in a market downturn and have money set aside to plow back into stocks when conditions are more favorable. 3. Use the data in the tables to compute the alpha in the low volatility index. Note that cov(~a,f~b)=abab. 4. Use the data in the tables to compute the Sharpe ratio available in combining a positive investment in the S\&P 500 with a positive investment in the low volatility index. Should you invest anything in the S\&P 500? 5. Does the CAPM appear to be correct in these data? Why or why not? 6. The article mentions that the low volatility funds charge 0.25% per year to invest in the fund, while the S\&P 500 charges 0.09% per year to invest in the funds. The numbers in the Table ignore those costs. Can those costs explain the differences between the low volatility funds and the S\&P 500 ? 7. Optional Question: Based on your analysis above, what is the largest amount of annual management fee that you would pay a year to invest in the low volatility fund? e next question is to show you that the Sharpe ratio and the alpha contain ferent information, and to let you work out how the portable alpha strategy orks. 8. You have the following information on the alpha fund, the beta fund, the market portfolio, and the risk free rate: a. Which fund has a higher Sharpe ratio, the Alpha fund or the Beta fund? Which fund has the highest alpha? b. Referring to the table, which one of the funds is better, if you are going to combine it with risk free borrowing and lending? What. about if you are going to add some the fund to a well-diversified portfolio? c. You currently have $900,000 invested in the Market portfolio and $100,000 invested in riskless bonds. You decide that you want to change your allocation to include $50,000 worth of the Beta Fund, but want keep your portfolio beta at 0.9 , and your total investment at $1,000,000. Describe exactly the strategy you should follow. d. Compute the Sharpe ratio for the portfolio you computed in part c. Hint: you can use the formula for CAPM beta: i=var(Rmarket)cov(RiRmarkee) to compute the covariance between the Beta Fund and the market portfolio. e. Referring to the table, is the CAPM correct in these data? Why or why not? f. What other information you would want to use to determine if Alpha or Beta provides good performance? How would you use that information? The final question deals with bond pricing, spot rates, forward rates and bond returns 9. Bond pricing. The current one-year spot interest rate is 0.5% and the two-year spot interest rate is 2%. a. What is the price of a one-year zero-coupon bond? b. What is the price of a two-year zero-coupon bond? c. What is the price of a two-year coupon bond with a 2% annual coupon rate? Assume that the coupons are paid once per year. e. You think that interest rates will rise to 2% next year. Which strategy has the highest expected return over the next year: investing in a one year zero-coupon bond or purchasing a two year zero-coupon bond today and reselling it next year