The first one with the MACRS is the most imporatant one if you can only do one of them. thanks!

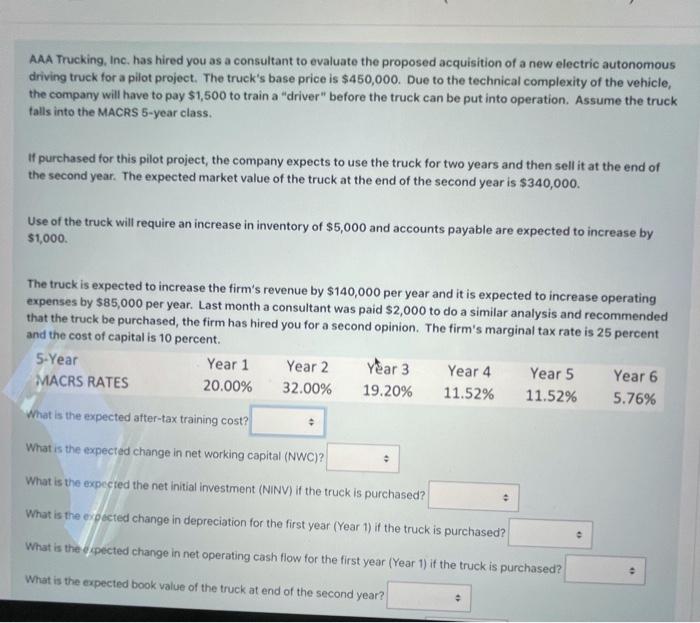

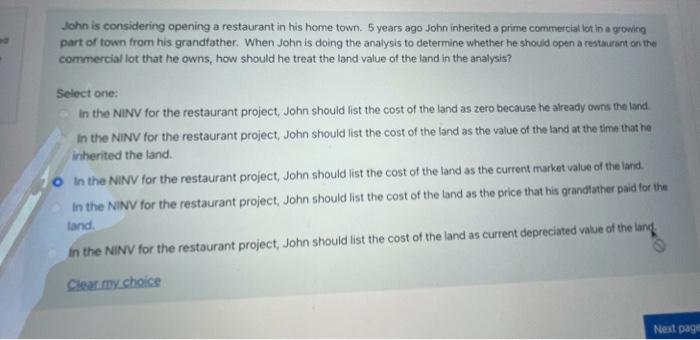

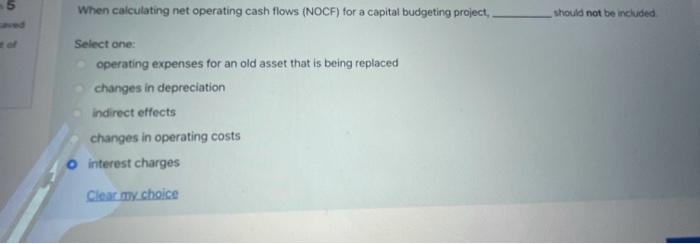

AAA Trucking, Inc. has hired you as a consultant to evaluate the proposed acquisition of a new electric autonomous driving truck for a pilot project. The truck's base price is $450,000. Due to the technical complexity of the vehicle, the company will have to pay $1,500 to train a "driver" before the truck can be put into operation. Assume the truck talls into the MACRS 5-year class. If purchased for this pilot project, the company expects to use the truck for two years and then sell it at the end of the second year. The expected market value of the truck at the end of the second year is $340,000. Use of the truck will require an increase in inventory of $5,000 and accounts payable are expected to increase by $1,000 The truck is expected to increase the firm's revenue by $140,000 per year and it is expected to increase operating expenses by $85,000 per year. Last month a consultant was paid $2,000 to do a similar analysis and recommended that the truck be purchased, the firm has hired you for a second opinion. The firm's marginal tax rate is 25 percent and the cost of capital is 10 percent. 5-Year Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 MACRS RATES 20.00% 32.00% 19.20% 11.52% 11.52% 5.76% What is the expected after-tax training cost? What is the expected change in net working capital (NWC)? What is the expected the net initial investment (NINV) if the truck is purchased? What is the expected change in depreciation for the first year (Year 1) if the truck is purchased? What is the spected change in net operating cash flow for the first year (Year 1) if the truck is purchased? . What is the expected book value of the truck at end of the second year? John is considering opening a restaurant in his home town. 5 years ago John inherited a prime commercial tot in a growing part of town from his grandfather. When John is doing the analysis to determine whether he should open a restaurant on the commercial lot that he owns, how should he treat the land value of the land in the analysis? Select one: In the NINV for the restaurant project, John should list the cost of the land as zero because he already owns the land In the NINV for the restaurant project, John should list the cost of the land as the value of the land at the time that he inherited the land, o in the INV for the restaurant project, John should list the cost of the land as the current market value of the land. In the NINV for the restaurant project, John should list the cost of the land as the price that his grandfather paid for the land. In the NINV for the restaurant project, John should list the cost of the land as current depreciated value of the land Clear my choice Neal page When calculating net operating cash flows (NOCF) for a capital budgeting project, should not be included Select one: operating expenses for an old asset that is being replaced changes in depreciation indirect effects changes in operating costs interest charges Clear my choice When calculating net operating cash flows (NOCF) for a capital budgeting project, should not be included Select one: operating expenses for an old asset that is being replaced changes in depreciation indirect effects changes in operating costs interest charges Clear my choice