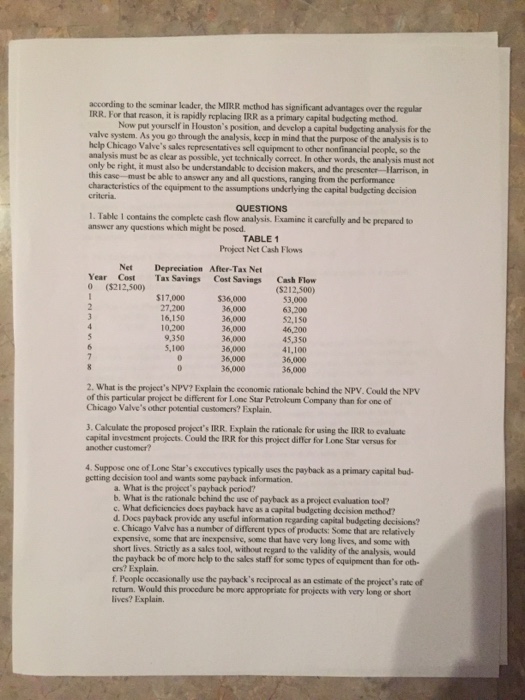

The first page is information I need help with the problems on the second page.

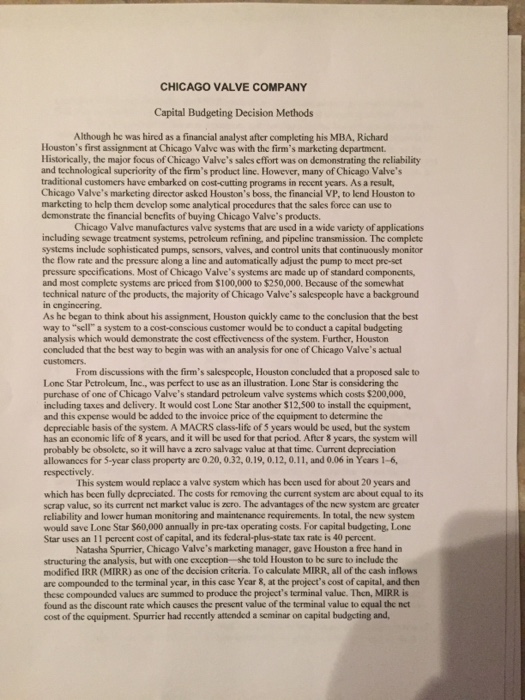

CHICAGO VALVE COMPANY Capital Budgeting Decision Methods Although he was hired as a financial analyst after completing his MBA, Richard Houston's first assignment at Chicago Valve was with the firm's marketing department. Historically, the major focus of Chicago Valve's sales effort was on demonstrating the reliability and technological superiority of the firm's product line. However, many of Chicago Valve's traditional customers have embarked on cost-cutting programs in recent years. As a result, Chicago Valve's marketing director asked Houston's boss, the financial VP, to lend Houston to markcting to help them develop some analytical procedures that the sales force can use to demonstrate the financial bencfits of buying Chicago Valve's products. Chicago Valve manufactures valve systems that are used in a wide varicty of applications including sewage treatment systems, petrolcum refining, and pipeline transmission. The complete systems include sophisticated pumps, sensors, valves, and control units that continuously monitor the flow rate and the pressure along a line and automatically adjust the pump to mect pre-set pressure specifications, Most of Chicago Valve's systems are made up of standard components and most complcte systems are priced from $100,000 to $250,000. Because of the somewhat technical nature of the products, the majority of Chicago Valve's salespeople have a background n cngincering As he began to think about his assignment, Houston quickly came to the conclusion that the best way to "sell" a system to a cost-conscious customer would be to conduct a capital budgcting analysis which would demonstrate the cost effectiveness of the system. Further, Houston concluded that the best way to begin was with an analysis for one of Chicago Valve's actual From discussions with the firm's salespcople, Houston concluded that a proposed sale to Lone Star Pctrolcum, Inc., was perfect to use as an illustration. Lone Star is considering the purchase of one of Chicago Valve's standard petrolcum valve systems which costs $200,000, including taxes and delivery. It would cost Lone Star another $12,500 to install the equipment, and this expense would be added to the invoice price of the equipment to determine the depreciable hasis of the system. A MACRS class-life of 5 years would be used, but the system has an economic lifc of 8 years, and it will be used for that period. After8 ycars, the system will probably be obsolcte, so it will have a zero salvage valuc at that time. Current depreciation allowances for 5-year class property are 0.20, 0.32, 0.19, 0.12, 0.11, and 0.06 in Years 1-6, respectively This system would replace a valve system which has been used for about 20 years and which has been fully depreciated. The costs for removing the current systcm are about equal to its scrap valuc, so its current net markct valuc is zcro. The advantages of the new system are greater reliability and lower human monitoring and maintenance requirements In total, the new system would save Lone Star $60,000 annually in pre-tax operating costs. For capital budgeting, Lonc Star uses an 11 percent cost of capital, and its federal-plus-state tax rate is 40 percent. Natasha Spurrier, Chicago Valve's markcting manager, gave Houston a free hand in structuring the analysis, but with one exception-she told Houston to be sure to include the modified IRR (MIRR) as one of the decision critcria. To calculate MIRR, all of the cash inflows are compounded to the terminal ycar, in this case Year 8, at the projcet's cost of capital, and then these compounded values are summed to produce the project's terminal value. Then, MIRR is found as the discount rate which causes the present value of the terminal value to equal the net cost of the equipment. Spurrier had recently attended a seminar on capital budgcting and