The first part is completed, but I am having a hard time calculating out the difference in the new proposal. With the adjusted changes, how would the ending value differ?

COMPLETED

This one is where I need help with the calculation

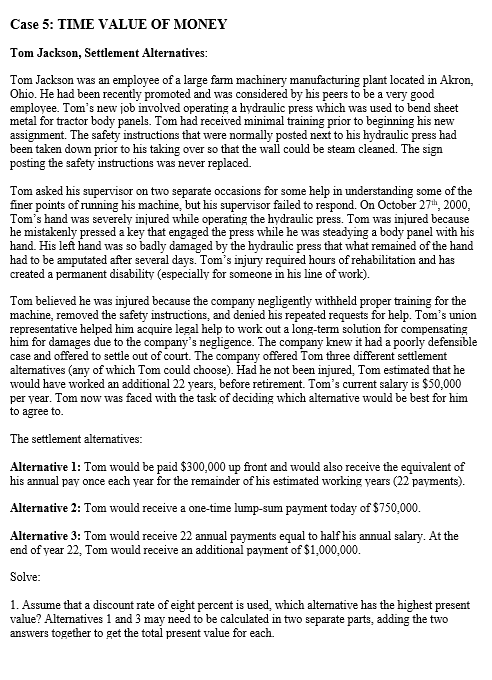

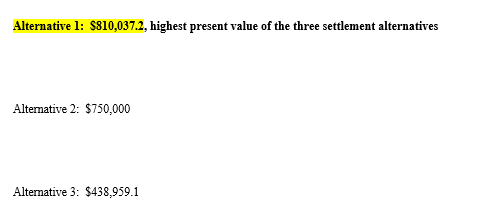

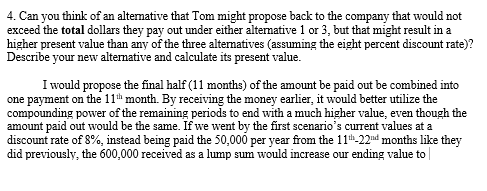

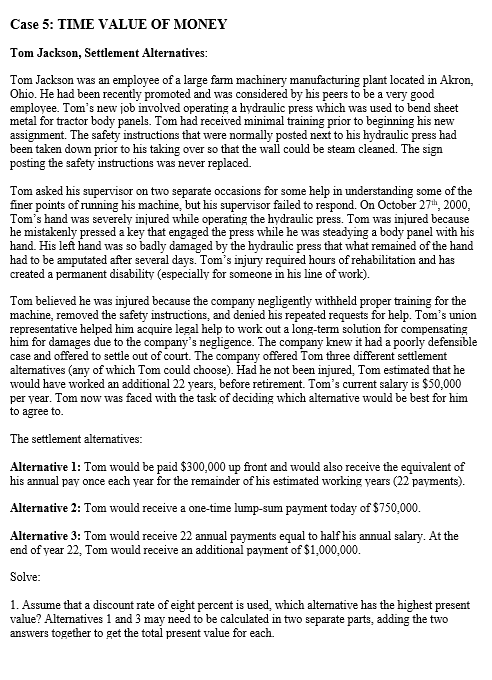

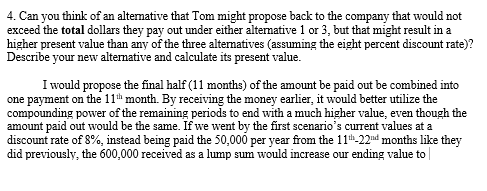

Case 5: TIME VALUE OF MONEY Tom Jackson, Settlement Alternatives: Tom Jackson was an employee of a large farm machinery manufacturing plant located in Akron, Ohio. He had been recently promoted and was considered by his peers to be a very good employee. Tom's new job involved operating a hydraulic press which was used to bend sheet metal for tractor body panels. Tom had received minimal training prior to beginning his new assignment. The safety instructions that were normally posted next to his hydraulic press had been taken down prior to his taking over so that the wall could be steam cleaned. The sign posting the safety instructions was never replaced. Tom asked his supervisor on two separate occasions for some help in understanding some of the Tom's hand was severely injured while operating the hydraulic press. Tom was injured because he mistakenly pressed a key that engaged the press while he was steadying a body panel with his hand. His left hand was so badly damaged by the hydraulic press that what remained of the hand had to be amputated after several days. Tom's injury required hours of rehabilitation and has created a permanent disability (especially for someone in his line of work). Tom believed he was injured because the company negligently withheld proper training for the machine, removed the safety instructions, and denied his repeated requests for help. Tom's union representative helped him acquire legal help to work out a long-term solution for compensating him for damages due to the company's negligence. The company knew it had a poorly defensible case and offered to settle out of court. The company offered Tom three different settlement alternatives (any of which Tom could choose). Had he not been injured, Tom estimated that he would have worked an additional 22 years, before retirement. Tom's current salary is $50,000 per year. Tom now was faced with the task of deciding which alternative would be best for him to agree to. The settlement alternatives: Alternative 1: Tom would be paid $300,000 up front and would also receive the equivalent of his annual pay once each year for the remainder of his estimated working years ( 22 payments). Alternative 2: Tom would receive a one-time lump-sum payment today of $750,000. Alternative 3: Tom would receive 22 annual payments equal to half his annual salary. At the end of year 22 , Tom would receive an additional payment of $1,000,000. Solve: 1. Assume that a discount rate of eight percent is used, which altemative has the highest present value? Alternatives 1 and 3 may need to be calculated in two separate parts, adding the two answers together to get the total present value for each. Alternative 1: $810,037.2, highest present value of the three settlement alternatives Altemative 2: $750,000 Alternative 3: $438,959.1 4. Can you think of an altemative that Tom might propose back to the company that would not exceed the total dollars they pay out under either alternative 1 or 3 , but that might result in a higher present value than any of the three altematives (assuming the eight percent discount rate)? Describe your new alternative and calculate its present value. I would propose the final half (11 months) of the amount be paid out be combined into one payment on the 11th month. By receiving the money earlier, it would better utilize the compounding power of the remaining periods to end with a much higher value, even though the amount paid out would be the same. If we went by the first scenario's current values at a discount rate of 8%, instead being paid the 50,000 per year from the 11th22nd months like they did previously, the 600,000 received as a lump sum would increase our ending value to Case 5: TIME VALUE OF MONEY Tom Jackson, Settlement Alternatives: Tom Jackson was an employee of a large farm machinery manufacturing plant located in Akron, Ohio. He had been recently promoted and was considered by his peers to be a very good employee. Tom's new job involved operating a hydraulic press which was used to bend sheet metal for tractor body panels. Tom had received minimal training prior to beginning his new assignment. The safety instructions that were normally posted next to his hydraulic press had been taken down prior to his taking over so that the wall could be steam cleaned. The sign posting the safety instructions was never replaced. Tom asked his supervisor on two separate occasions for some help in understanding some of the Tom's hand was severely injured while operating the hydraulic press. Tom was injured because he mistakenly pressed a key that engaged the press while he was steadying a body panel with his hand. His left hand was so badly damaged by the hydraulic press that what remained of the hand had to be amputated after several days. Tom's injury required hours of rehabilitation and has created a permanent disability (especially for someone in his line of work). Tom believed he was injured because the company negligently withheld proper training for the machine, removed the safety instructions, and denied his repeated requests for help. Tom's union representative helped him acquire legal help to work out a long-term solution for compensating him for damages due to the company's negligence. The company knew it had a poorly defensible case and offered to settle out of court. The company offered Tom three different settlement alternatives (any of which Tom could choose). Had he not been injured, Tom estimated that he would have worked an additional 22 years, before retirement. Tom's current salary is $50,000 per year. Tom now was faced with the task of deciding which alternative would be best for him to agree to. The settlement alternatives: Alternative 1: Tom would be paid $300,000 up front and would also receive the equivalent of his annual pay once each year for the remainder of his estimated working years ( 22 payments). Alternative 2: Tom would receive a one-time lump-sum payment today of $750,000. Alternative 3: Tom would receive 22 annual payments equal to half his annual salary. At the end of year 22 , Tom would receive an additional payment of $1,000,000. Solve: 1. Assume that a discount rate of eight percent is used, which altemative has the highest present value? Alternatives 1 and 3 may need to be calculated in two separate parts, adding the two answers together to get the total present value for each. Alternative 1: $810,037.2, highest present value of the three settlement alternatives Altemative 2: $750,000 Alternative 3: $438,959.1 4. Can you think of an altemative that Tom might propose back to the company that would not exceed the total dollars they pay out under either alternative 1 or 3 , but that might result in a higher present value than any of the three altematives (assuming the eight percent discount rate)? Describe your new alternative and calculate its present value. I would propose the final half (11 months) of the amount be paid out be combined into one payment on the 11th month. By receiving the money earlier, it would better utilize the compounding power of the remaining periods to end with a much higher value, even though the amount paid out would be the same. If we went by the first scenario's current values at a discount rate of 8%, instead being paid the 50,000 per year from the 11th22nd months like they did previously, the 600,000 received as a lump sum would increase our ending value to