The first photo is the question I need help with & the other photos are the format I need. Thanks

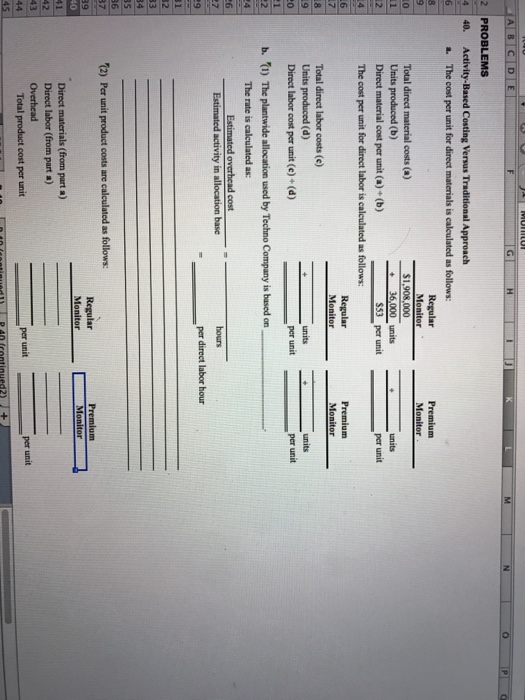

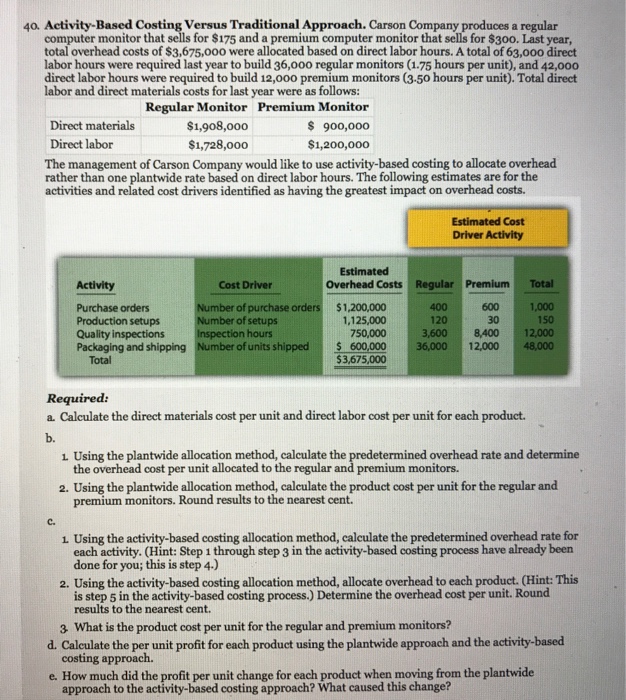

40. Activity-Based Costing Versus Traditional Approach. Carson Company produces a regular computer monitor that sells for $175 and a premium computer monitor that sells for $300. Last year, total overhead costs of $3,675,0oo were allocated based on direct labor hours. A total of 63,000 direct labor hours were required last year to build 36,000 regular monitors (1.75 hours per unit), and 42,00o direct labor hours were required to build 12,000 premium monitors (3-50 hours per unit). Total direct labor and direct materials costs for last year were as follows: Direct materials Direct labor Regular Monitor Premium Monitor s 900,00o $1,200,0o0 $1,908,o0o $1,728,00o The management of Carson Company would like to use activity-based costing to allocate overhead rather than one plantwide rate based on direct labor hours. The following estimates are for the activities and related cost drivers identified as having the greatest impact on overhead costs. Estimated Cost Driver Activity Estimated Activity Cost Driver Overhead Costs Regular Premium Total 1,000 150 Number of purchase orders Number of setups Inspection hours Number of units shipped $1,200,000 1,125,000 750,000 600 400 120 Purchase orders Production setups Quality inspections Packaging and shipping 30 3,6008,40012,000 12,000 600,000 $3,675,000 | 36,000 48,000 Total Required: a. Calculate the direct materials cost per unit and direct labor cost per unit for each product b. 1 Using the plantwide allocation method, calculate the predetermined overhead rate and determine the overhead cost per unit allocated to the regular and premium monitors. 2. Using the plantwide allocation method, calculate the product cost per unit for the regular and premium monitors. Round results to the nearest cent. C. 1 Using the activity-based costing allocation method, calculate the predetermined overhead rate for each activity. (Hint: Step i through step 3 in the activity-based costing process have already been 2. Using the activity-based costing allocation method, allocate overhead to each product. (Hint: This is step 5 in the activity-based costing process.) Determine the overhead cost per unit. Round results to the nearest cent. 3 What is the product cost per unit for the regular and premium monitors? costing approach. approach to the activity-based costing approach? What caused this change? d. Caleulate the per unit profit for each product using the plantwide approach and the activity-based e. How much did the profit per unit change for each product when moving from the plantwide

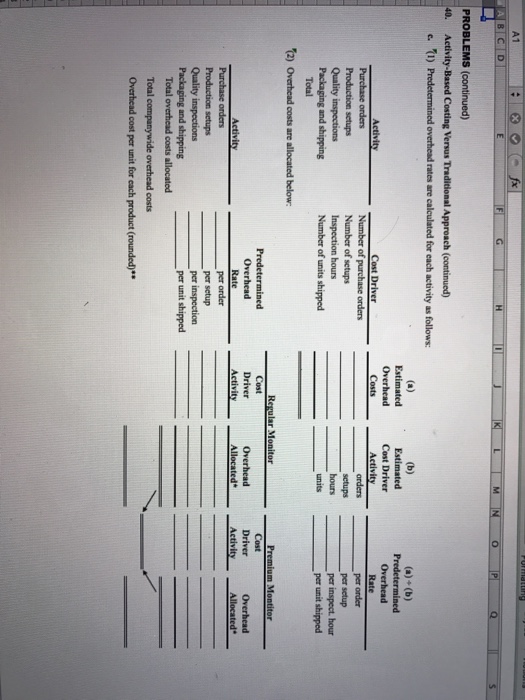

The first photo is the question I need help with & the other photos are the format I need. Thanks

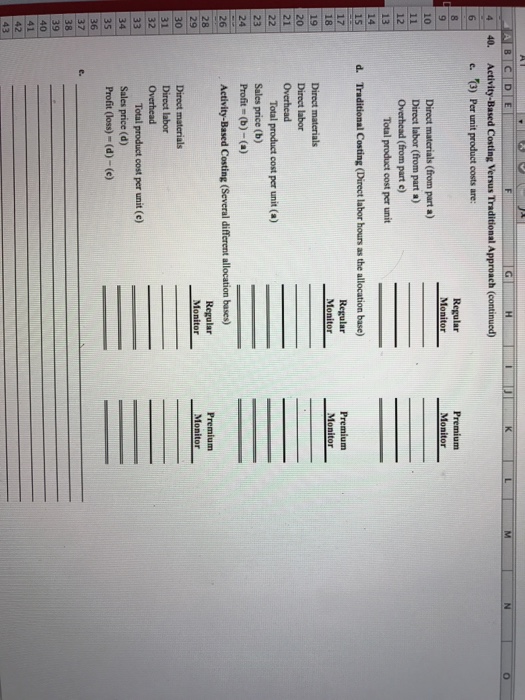

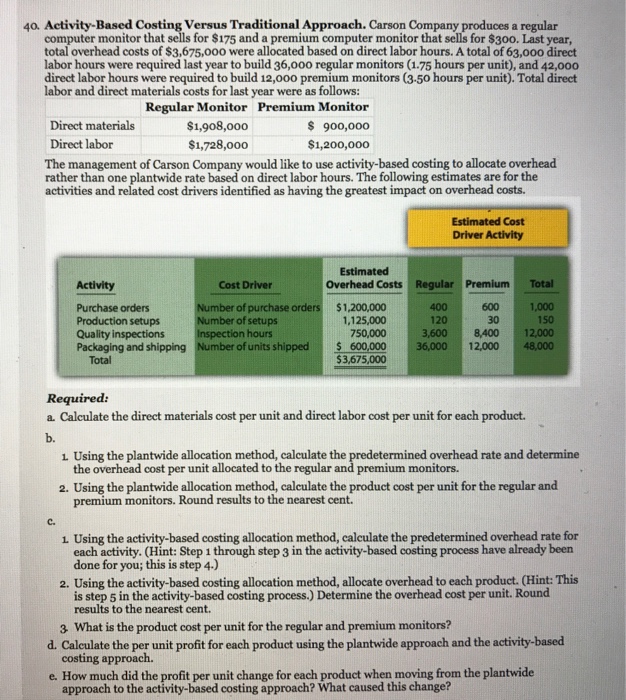

The first photo is the question I need help with & the other photos are the format I need. Thanks