Answered step by step

Verified Expert Solution

Question

1 Approved Answer

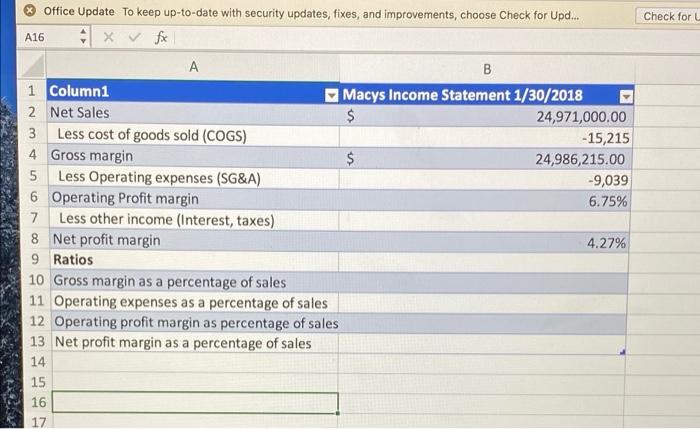

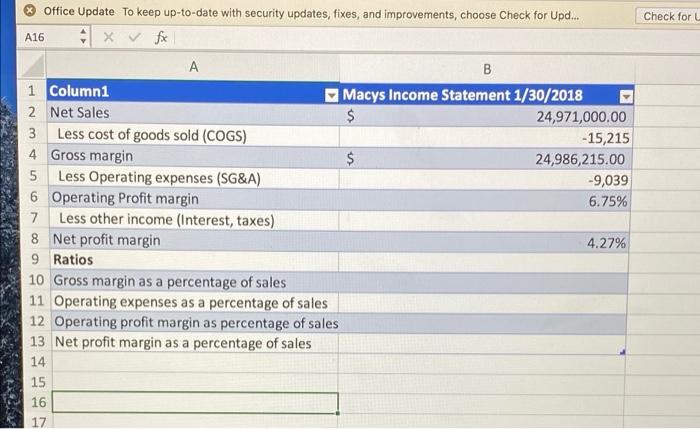

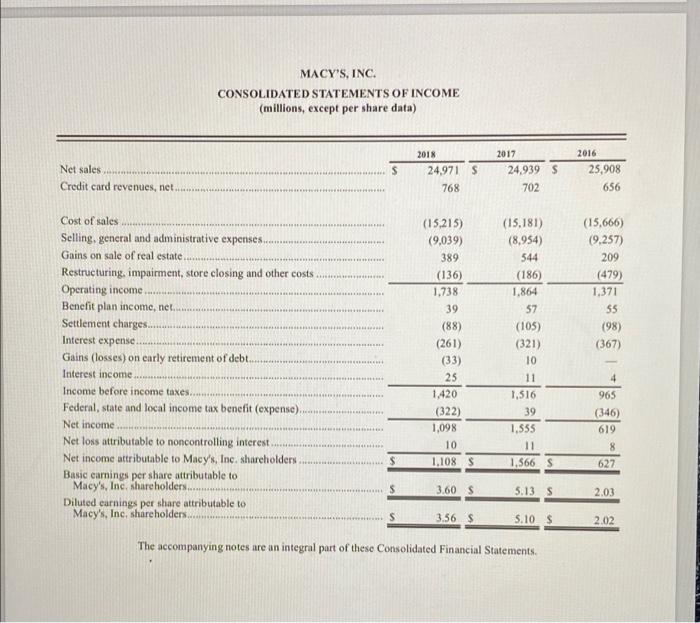

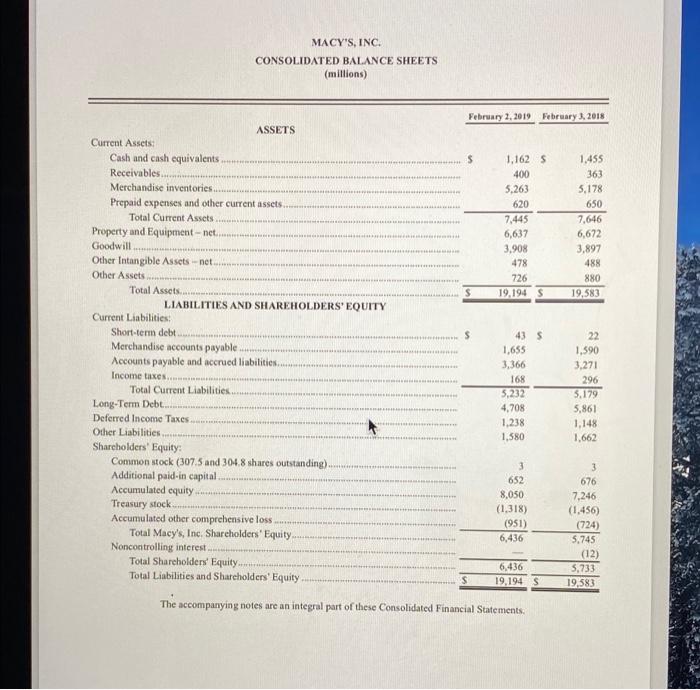

The first photo is what I need the answers to. the 2nd, and 3rd is the income statement and balance sheet. please help me with

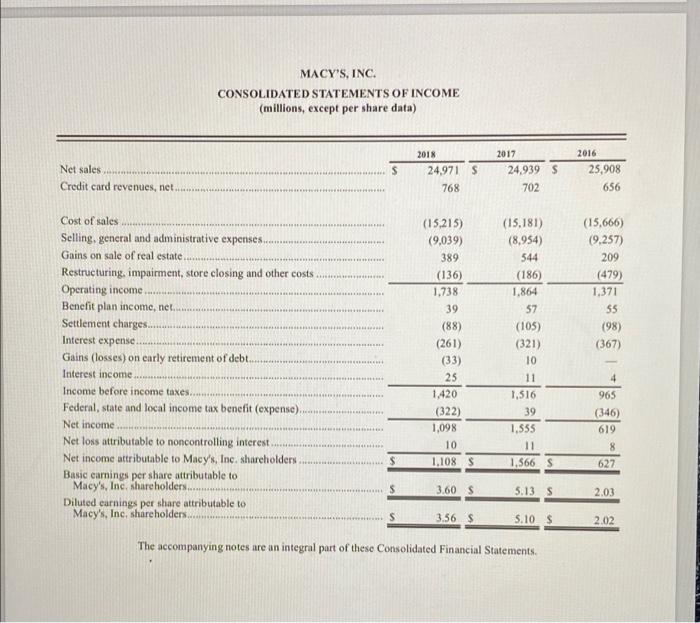

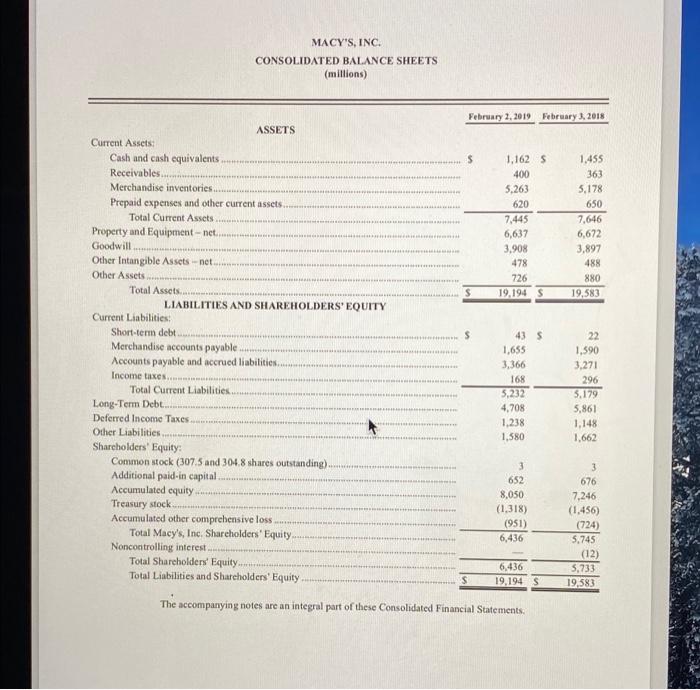

The first photo is what I need the answers to. the 2nd, and 3rd is the income statement and balance sheet. please help me with this. Also show please show your work on how you got the answers, thank you!!

Office Update To keep up-to-date with security updates, fixes, and improvements, choose Check for Upd.... x fx A16 A 1 Column1 2 Net Sales 3 4 Gross margin 5 Less Operating expenses (SG&A) Less cost of goods sold (COGS) 6 Operating Profit margin 7 Less other income (Interest, taxes) 8 Net profit margin 9 Ratios 10 Gross margin as a percentage of sales 11 Operating expenses as a percentage of sales 12 Operating profit margin as percentage of sales 13 Net profit margin as a percentage of sales 14 15 16 17 B Macys Income Statement 1/30/2018 $ $ 24,971,000.00 -15,215 24,986,215.00 -9,039 6.75% 4.27% Check for L Net sales. Credit card revenues, net. MACY'S, INC. CONSOLIDATED STATEMENTS OF INCOME (millions, except per share data) Cost of sales Selling, general and administrative expenses..... Gains on sale of real estate. Restructuring, impairment, store closing and other costs. Operating income. Benefit plan income, net... Settlement charges... Interest expense Gains (losses) on early retirement of debt. Interest income. Income before income taxes... Federal, state and local income tax benefit (expense).. Net income Net loss attributable to noncontrolling interest. Net income attributable to Macy's, Inc. shareholders Basic earnings per share attributable to Macy's, Inc. shareholders... Diluted earnings per share attributable to Macy's, Inc, shareholders.. SHAREABO MOEDE $ $ S 2018 24,971 S 768 (15,215) (9,039) 389 (136) 1,738 39 (88) (261) (33) 25 1,420 (322) 1,098 10 1,108 S 3.60 S 3.56 S 2017 24,939 S 702 (15,181) (8,954) 544 (186) 1,864 57 (105) (321) 10 11 1,516 39 1,555 11 1,566 S 5.13 S 5.10 $ The accompanying notes are an integral part of these Consolidated Financial Statements. 2016 25,908 656 (15,666) (9,257) 209 (479) 1,371 55 (98) (367) 4 965 (346) 619 8 627 2.03 2.02 Current Assets: Cash and cash equivalents Other Intangible Assets-net... Other Assets. Receivables. Merchandise inventories.. Prepaid expenses and other current assets. Total Current Assets Property and Equipment-net.. Goodwill... Total Assets.. Current Liabilities: LIABILITIES AND SHAREHOLDERS' EQUITY MACY'S, INC. CONSOLIDATED BALANCE SHEETS (millions) Total Current Liabilities ASSETS Short-term debt... Merchandise accounts payable. Accounts payable and accrued liabilities. Income taxes... Long-Term Debt..... Deferred Income Taxes. Other Liabilities.... Shareholders' Equity: Common stock (307.5 and 304.8 shares outstanding). Additional paid-in capital. Accumulated equity. Treasury stock.. Accumulated other comprehensive loss. Noncontrolling interest Total Macy's, Inc. Shareholders' Equity. Han HOME COMMEN February 2, 2019 February 3, 2018 $ $ 1,162 S 400 5,263 620 7,445 6,637 3,908 478 726 19,194 S 43 S 1,655 3,366 168 5,232 4,708 1,238. 580 3 652 8,050 (1,318) (951) 6,436 Total Shareholders' Equity. Total Liabilities and Shareholders' Equity The accompanying notes are an integral part of these Consolidated Financial Statements. 6,436 19,194 S 1,455 363 5,178 650 7,646 6,672 3,897 488 880 19,583 22 1,590 3,271 296 5.179 5,861 1,148 1,662 3 676 7,246 (1,456) (724) 5,745 (12) 5,733 19,583

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started