Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The first pic is was i have to do and i dont quite understand. The others are information. Southern New Hampshire University ACC 307 Milestone

The first pic is was i have to do and i dont quite understand. The others are information.

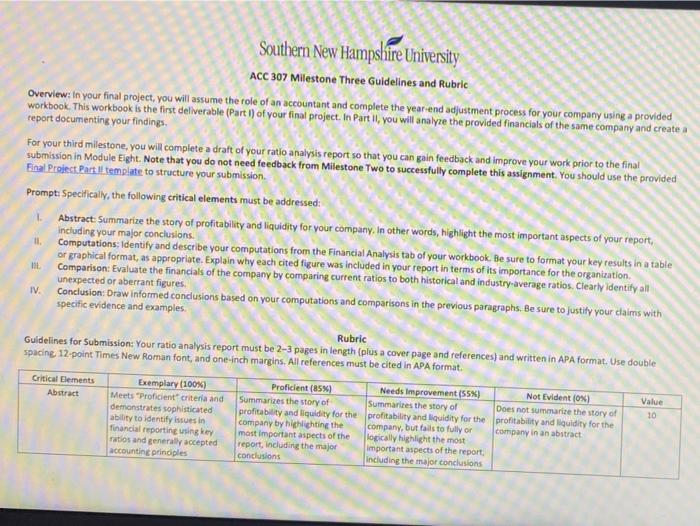

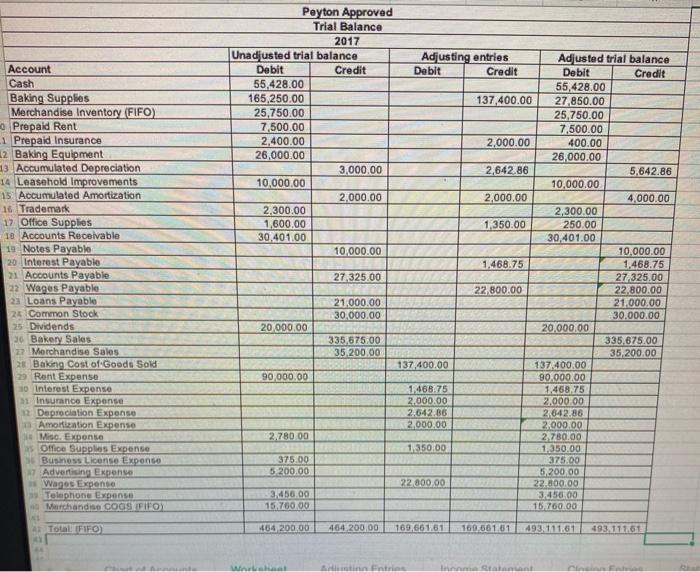

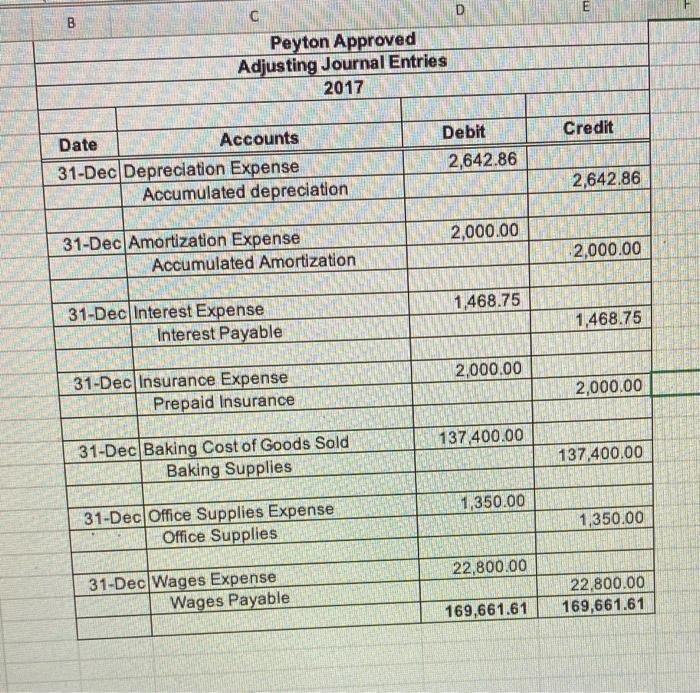

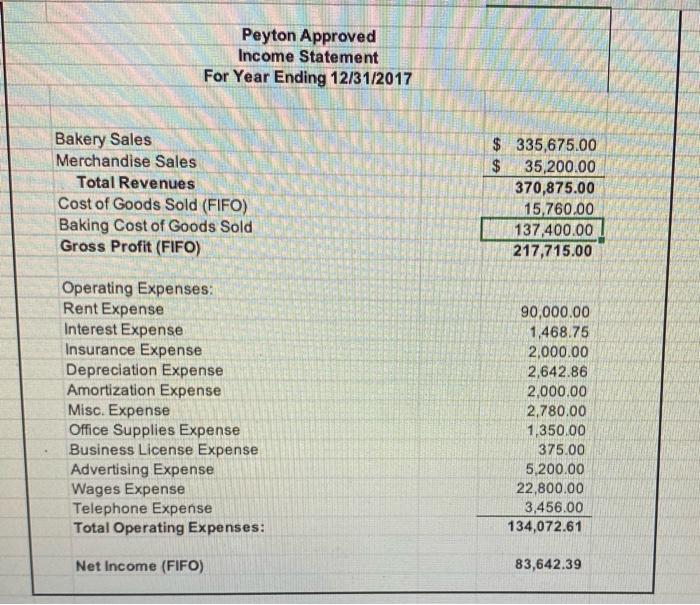

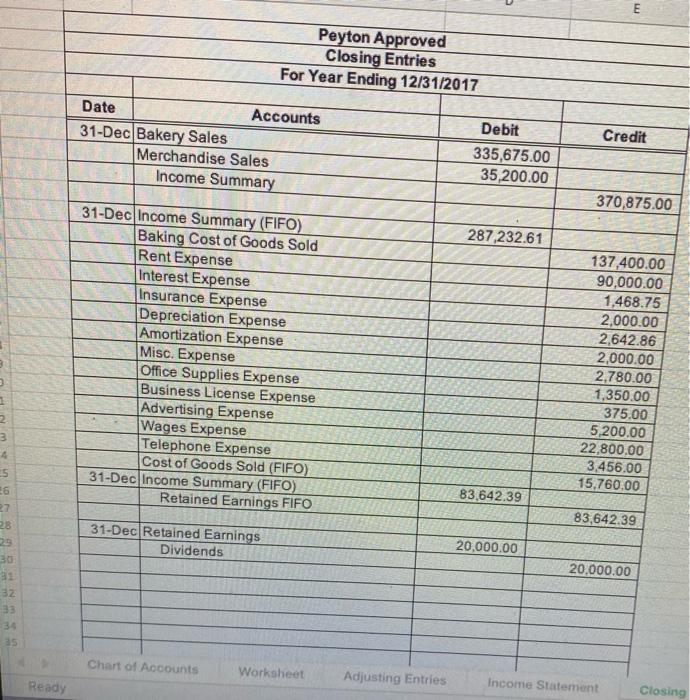

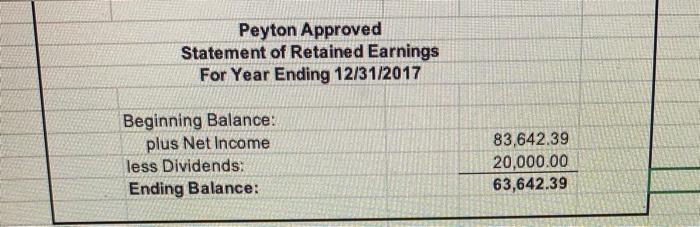

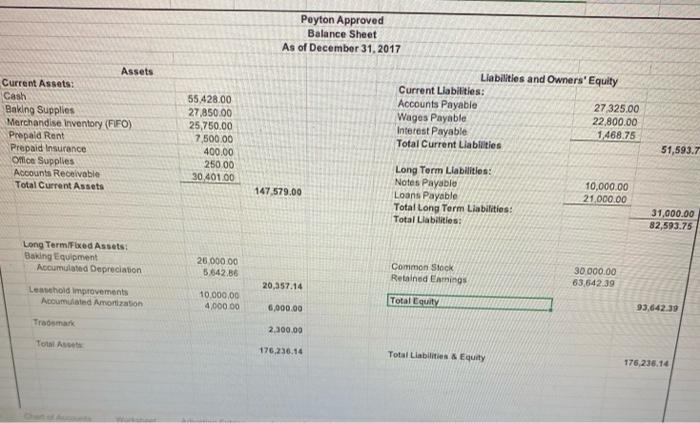

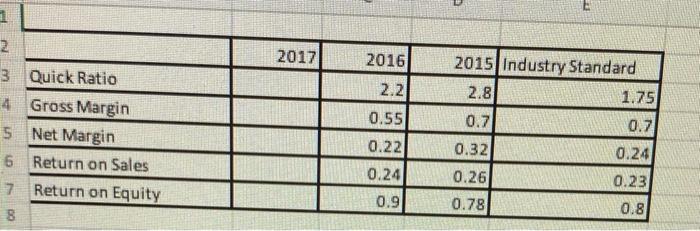

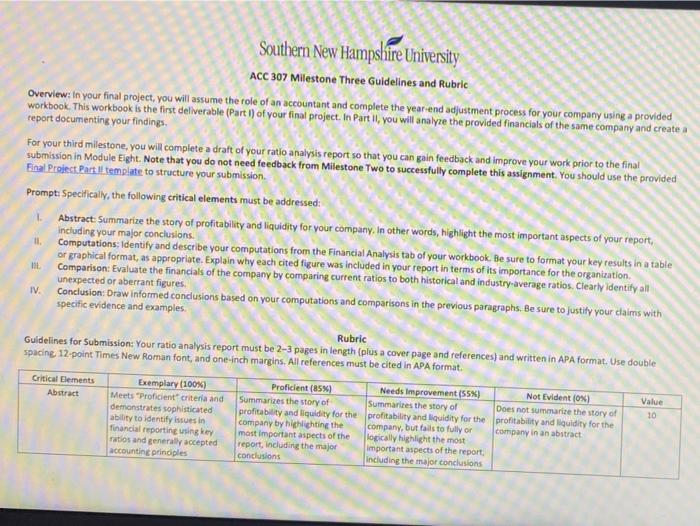

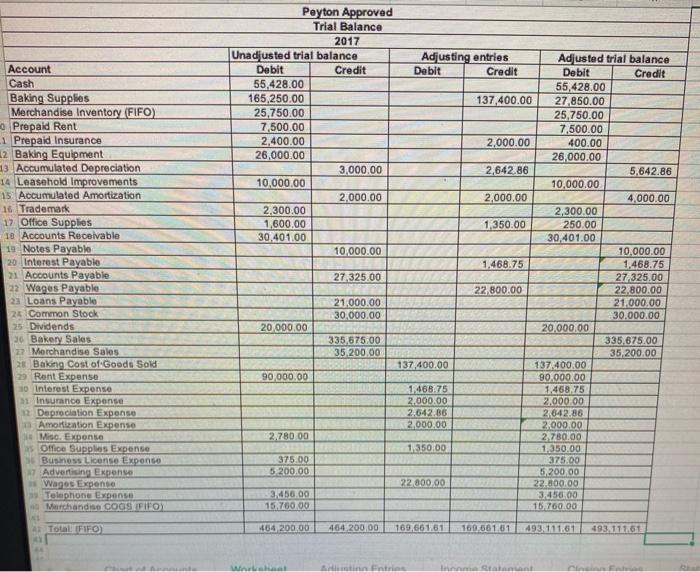

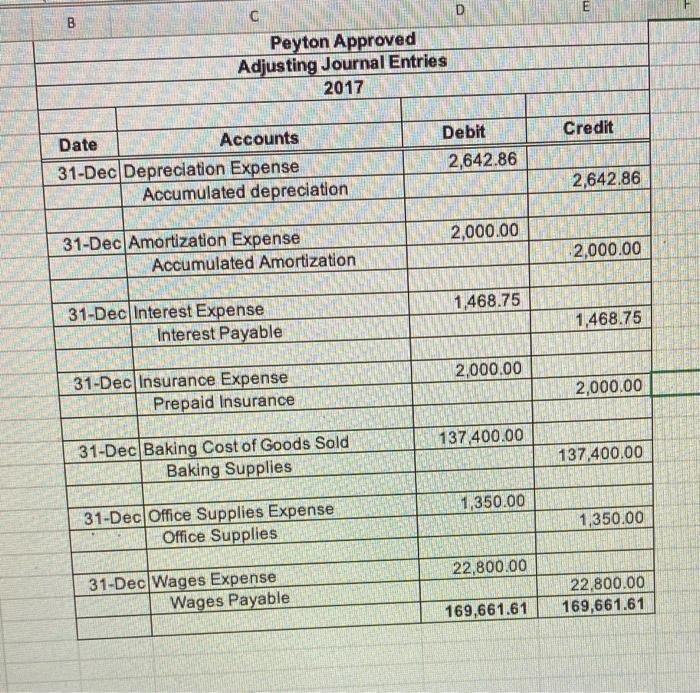

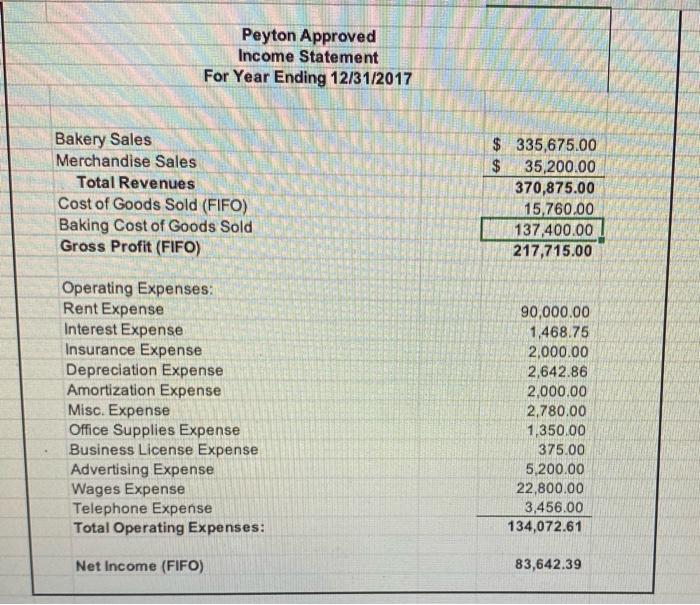

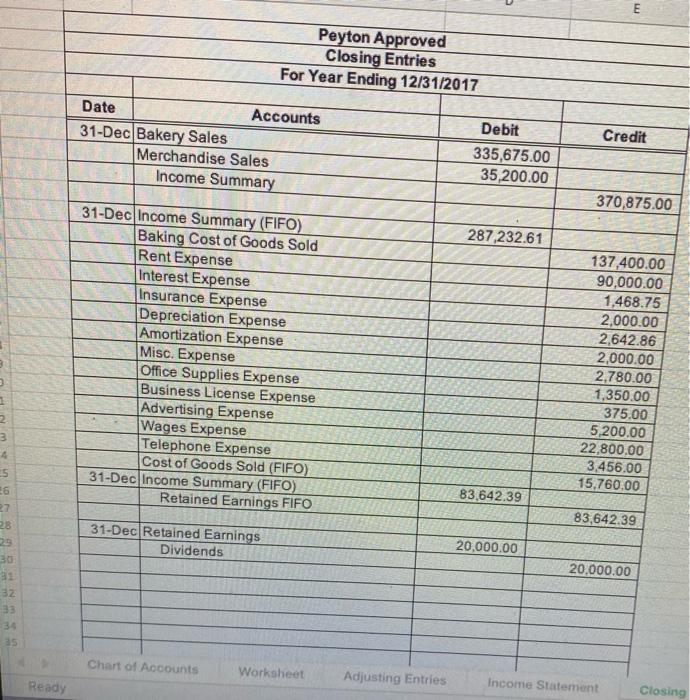

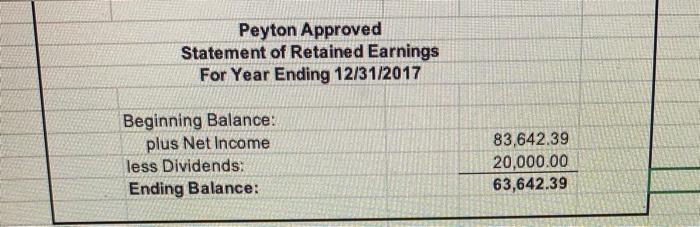

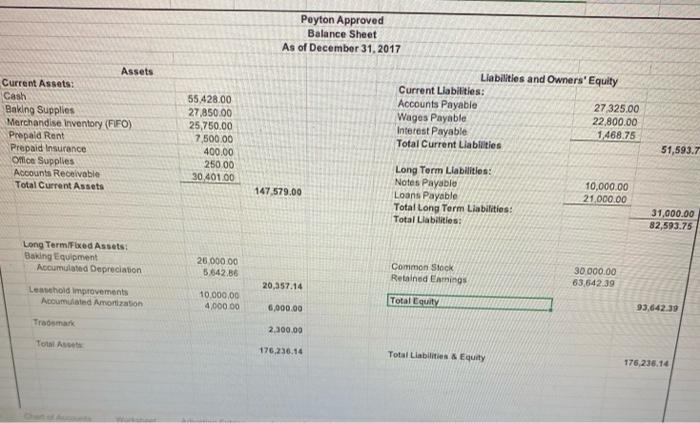

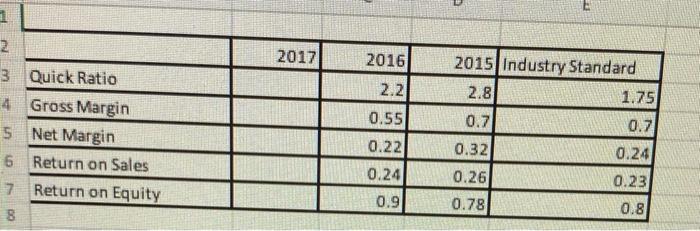

Southern New Hampshire University ACC 307 Milestone Three Guidelines and Rubric Overview: in your final project, you will assume the role of an accountant and complete the year-end adjustment process for your company using a provided workbook. This workbook is the first deliverable (Part 1) of your final project. In Part II, you will analyze the provided financials of the same company and create a report documenting your findings For your third Milestone, you will complete a draft of your ratio analysis report so that you can gain feedback and improve your work prior to the final submission in Module Eight. Note that you do not need feedback from Milestone Two to successfully complete this assignment. You should use the provided Final Project Partit template to structure your submission, Prompt: Specifically, the following critical elements must be addressed: Abstract Summarize the story of profitability and liquidity for your company. In other words, highlight the most important aspects of your report including your major conclusions. Computations, identify and describe your computations from the Financial Analysis tab of your workbook. Be sure to format your key results in a table or graphical format, as appropriate. Explain why each cited figure was included in your report in terms of its importance for the organization. Comparison: Evaluate the financials of the company by comparing current ratios to both historical and industry-average ratios. Clearly identify all unexpected or aberrant figures IV. Conclusion: Draw informed condusions based on your computations and comparisons in the previous paragraphs. Be sure to justify your claims with specific evidence and examples. Rubric Guidelines for Submission: Your ratio analysis report must be 2-3 pages in length (plus a cover page and references and written in APA format. Use double spacing 12-point Times New Roman font, and one-inch margins. All references must be cited in APA format. II. IN Critical Elements Abstract Exemplary (100%) Meets "Proficient criteria and demonstrates sophisticated ability to identify issues in financial reporting using key ratios and generally accepted accounting prindples Value 10 Proficient (85%) Needs Improvement (55%) Not Evident (ON) Summarizes the story of Summarizes the story of Does not summarize the story of profitability and liquidity for the profitability and liquidity for the profitability and liquidity for the company by highlighting the company, but fails to fully or company in an abstract most important aspects of the logically highlight the most report, including the major important aspects of the report, conclusions including the major conclusions Account Cash Baking Supplies Merchandise Inventory (FIFO) Prepaid Rent 1 Prepaid Insurance 12 Baking Equipment 13 Accumulated Depreciation 14 Leasehold Improvements 15 Accumulated Amortization 16 Trademark 17 Office Supplies 18 Accounts Receivable 19 Notes Payable 20 Interest Payable 21 Accounts Payable 22 Wages Payable 23 Loans Payable 2 Common Stock 25 Dividends 36 Bakery Sales 22 Merchandise Sales 20 Baking Cost of Goods Sold 29 Rent Expense 10 Interest Expense 1 Insurance Expense 12 Depreciation Expense Amortization Expenso Mio. EX Office Supplies Expense So Business License Exponse 17 Advertising Expense Wagos Expense Telephone Expanse Merchandise COGS FIFOY Peyton Approved Trial Balance 2017 Unadjusted trial balance Adjusting entries Adjusted trial balance Debit Credit Debit Credit Debit Credit 55,428.00 55,428.00 165,250.00 137,400.00 27,850.00 25,750.00 25,750.00 7,500.00 7,500.00 2,400.00 2,000.00 400.00 26,000.00 26,000.00 3,000.00 2,642.86 5,642.86 10,000.00 10.000.00 2,000.00 2,000.00 4,000.00 2.300.00 2,300.00 1,600.00 1,350.00 250.00 30.401.00 30,401.00 10,000.00 10,000.00 1.468.75 1,468.75 27,325.00 27 325.00 22,800.00 22,800.00 21,000.00 21,000.00 30,000.00 30,000.00 20.000.00 20.000,00 335,675.00 335,675.00 35,200.00 35,200.00 137,400.00 137,400.00 90,000.00 90,000.00 1,468.75 1.468,75 2.000.00 2,000.00 2.542.56 2,642.86 2,000.00 2.000.00 2.780.00 2.780,00 1.350.00 1.350.00 375.00 375.00 5 200.00 5,200.00 22.800.00 22,800.00 3,450,00 3.450.00 15,700.00 15.700.00 Total FIFO) 464 200,00 464,200.00 169.661.01 169.561.61 493, 111.61 493.111.01 Entries E B Peyton Approved Adjusting Journal Entries 2017 Credit Date Accounts 31-Dec Depreciation Expense Accumulated depreciation Debit 2,642.86 2,642.86 2,000.00 31-Dec Amortization Expense Accumulated Amortization 2,000.00 1,468.75 31-Dec Interest Expense Interest Payable 1,468.75 2,000.00 31-Dec Insurance Expense Prepaid Insurance 2,000.00 137,400.00 31-Dec Baking Cost of Goods Sold Baking Supplies 137,400.00 1,350.00 31-Dec Office Supplies Expense Office Supplies 1,350.00 22,800.00 31-Dec Wages Expense Wages Payable 22,800.00 169,661.61 169,661.61 Peyton Approved Income Statement For Year Ending 12/31/2017 Bakery Sales Merchandise Sales Total Revenues Cost of Goods Sold (FIFO) Baking Cost of Goods Sold Gross Profit (FIFO) $ 335,675.00 $ 35,200.00 370,875.00 15,760.00 137,400.00 217,715.00 Operating Expenses: Rent Expense Interest Expense Insurance Expense Depreciation Expense Amortization Expense Misc. Expense Office Supplies Expense Business License Expense Advertising Expense Wages Expense Telephone Expense Total Operating Expenses: 90,000.00 1,468.75 2,000.00 2,642.86 2,000.00 2.780.00 1,350.00 375.00 5,200.00 22,800.00 3,456.00 134,072.61 Net Income (FIFO) 83,642.39 E Peyton Approved Closing Entries For Year Ending 12/31/2017 Date Accounts 31-Dec Bakery Sales Merchandise Sales Income Summary Credit Debit 335,675.00 35,200.00 370,875.00 287,232.61 31-Dec Income Summary (FIFO) Baking Cost of Goods Sold Rent Expense Interest Expense Insurance Expense Depreciation Expense Amortization Expense Misc. Expense Office Supplies Expense Business License Expense Advertising Expense Wages Expense Telephone Expense Cost of Goods Sold (FIFO) 31-Dec Income Summary (FIFO) Retained Earnings FIFO 137,400.00 90,000.00 1,468.75 2,000.00 2.642.86 2,000.00 2,780.00 1,350.00 375.00 5,200.00 22,800.00 3,456.00 15,760.00 1 2 3 15 83.642.39 83,642.39 31-Dec Retained Earnings Dividends 20.000.00 27 28 29 30 91 32 33 34 35 20,000.00 Chart of Accounts Worksheet Adjusting Entries Ready Income Statement Closing Peyton Approved Statement of Retained Earnings For Year Ending 12/31/2017 Beginning Balance: plus Net Income less Dividends: Ending Balance: 83,642.39 20,000.00 63,642.39 Poyton Approved Balance Sheet As of December 31, 2017 Assets Current Assets: Cash Baking Supplies Merchandise inventory (FIFO) Prepaid Rent Prepaid Insurance Once Supplies Accounts Receivable Total Current Assets 55.428,00 27,850.00 25,750.00 7,500.00 400.00 250 00 30.401.00 Liabilities and Owners' Equity Current Liabilities: Accounts Payable 27 325.00 Wages Payable 22,800.00 Interest Payable 1,468.75 Total Current Liabilities 51,593.7 147.579.00 Long Term Liabilities: Notes Payable Loans Payable Total Long Term Liabilities: Total Liabilities: 10,000.00 21,000.00 31,000.00 82,593.75 Long Term Fixed Assets: Baking Equipment Accumulated Depreciation 20.000.00 5.642.86 Common Stock Retained Earnings 30 000.00 63,642.39 20,357.14 Leavhold improvements Accumulated Amortization Trademark 10.000.00 400000 Total Louity 6,000.00 93,642.39 2.300.00 Total 176,236.14 Total Liabilities & Equity 176,238.14 2017 2016 2015 Industry Standard 1.75 2.2 2.8 2. 3 Quick Ratio 4. Gross Margin 5 Net Margin 6 Return on Sales 7 Return on Equity 0.7 0.55 0.22 0.7 0.32 0.24 0.24 0.26 0.9 0.23 0.8 0.78 8 Southern New Hampshire University ACC 307 Milestone Three Guidelines and Rubric Overview: in your final project, you will assume the role of an accountant and complete the year-end adjustment process for your company using a provided workbook. This workbook is the first deliverable (Part 1) of your final project. In Part II, you will analyze the provided financials of the same company and create a report documenting your findings For your third Milestone, you will complete a draft of your ratio analysis report so that you can gain feedback and improve your work prior to the final submission in Module Eight. Note that you do not need feedback from Milestone Two to successfully complete this assignment. You should use the provided Final Project Partit template to structure your submission, Prompt: Specifically, the following critical elements must be addressed: Abstract Summarize the story of profitability and liquidity for your company. In other words, highlight the most important aspects of your report including your major conclusions. Computations, identify and describe your computations from the Financial Analysis tab of your workbook. Be sure to format your key results in a table or graphical format, as appropriate. Explain why each cited figure was included in your report in terms of its importance for the organization. Comparison: Evaluate the financials of the company by comparing current ratios to both historical and industry-average ratios. Clearly identify all unexpected or aberrant figures IV. Conclusion: Draw informed condusions based on your computations and comparisons in the previous paragraphs. Be sure to justify your claims with specific evidence and examples. Rubric Guidelines for Submission: Your ratio analysis report must be 2-3 pages in length (plus a cover page and references and written in APA format. Use double spacing 12-point Times New Roman font, and one-inch margins. All references must be cited in APA format. II. IN Critical Elements Abstract Exemplary (100%) Meets "Proficient criteria and demonstrates sophisticated ability to identify issues in financial reporting using key ratios and generally accepted accounting prindples Value 10 Proficient (85%) Needs Improvement (55%) Not Evident (ON) Summarizes the story of Summarizes the story of Does not summarize the story of profitability and liquidity for the profitability and liquidity for the profitability and liquidity for the company by highlighting the company, but fails to fully or company in an abstract most important aspects of the logically highlight the most report, including the major important aspects of the report, conclusions including the major conclusions Account Cash Baking Supplies Merchandise Inventory (FIFO) Prepaid Rent 1 Prepaid Insurance 12 Baking Equipment 13 Accumulated Depreciation 14 Leasehold Improvements 15 Accumulated Amortization 16 Trademark 17 Office Supplies 18 Accounts Receivable 19 Notes Payable 20 Interest Payable 21 Accounts Payable 22 Wages Payable 23 Loans Payable 2 Common Stock 25 Dividends 36 Bakery Sales 22 Merchandise Sales 20 Baking Cost of Goods Sold 29 Rent Expense 10 Interest Expense 1 Insurance Expense 12 Depreciation Expense Amortization Expenso Mio. EX Office Supplies Expense So Business License Exponse 17 Advertising Expense Wagos Expense Telephone Expanse Merchandise COGS FIFOY Peyton Approved Trial Balance 2017 Unadjusted trial balance Adjusting entries Adjusted trial balance Debit Credit Debit Credit Debit Credit 55,428.00 55,428.00 165,250.00 137,400.00 27,850.00 25,750.00 25,750.00 7,500.00 7,500.00 2,400.00 2,000.00 400.00 26,000.00 26,000.00 3,000.00 2,642.86 5,642.86 10,000.00 10.000.00 2,000.00 2,000.00 4,000.00 2.300.00 2,300.00 1,600.00 1,350.00 250.00 30.401.00 30,401.00 10,000.00 10,000.00 1.468.75 1,468.75 27,325.00 27 325.00 22,800.00 22,800.00 21,000.00 21,000.00 30,000.00 30,000.00 20.000.00 20.000,00 335,675.00 335,675.00 35,200.00 35,200.00 137,400.00 137,400.00 90,000.00 90,000.00 1,468.75 1.468,75 2.000.00 2,000.00 2.542.56 2,642.86 2,000.00 2.000.00 2.780.00 2.780,00 1.350.00 1.350.00 375.00 375.00 5 200.00 5,200.00 22.800.00 22,800.00 3,450,00 3.450.00 15,700.00 15.700.00 Total FIFO) 464 200,00 464,200.00 169.661.01 169.561.61 493, 111.61 493.111.01 Entries E B Peyton Approved Adjusting Journal Entries 2017 Credit Date Accounts 31-Dec Depreciation Expense Accumulated depreciation Debit 2,642.86 2,642.86 2,000.00 31-Dec Amortization Expense Accumulated Amortization 2,000.00 1,468.75 31-Dec Interest Expense Interest Payable 1,468.75 2,000.00 31-Dec Insurance Expense Prepaid Insurance 2,000.00 137,400.00 31-Dec Baking Cost of Goods Sold Baking Supplies 137,400.00 1,350.00 31-Dec Office Supplies Expense Office Supplies 1,350.00 22,800.00 31-Dec Wages Expense Wages Payable 22,800.00 169,661.61 169,661.61 Peyton Approved Income Statement For Year Ending 12/31/2017 Bakery Sales Merchandise Sales Total Revenues Cost of Goods Sold (FIFO) Baking Cost of Goods Sold Gross Profit (FIFO) $ 335,675.00 $ 35,200.00 370,875.00 15,760.00 137,400.00 217,715.00 Operating Expenses: Rent Expense Interest Expense Insurance Expense Depreciation Expense Amortization Expense Misc. Expense Office Supplies Expense Business License Expense Advertising Expense Wages Expense Telephone Expense Total Operating Expenses: 90,000.00 1,468.75 2,000.00 2,642.86 2,000.00 2.780.00 1,350.00 375.00 5,200.00 22,800.00 3,456.00 134,072.61 Net Income (FIFO) 83,642.39 E Peyton Approved Closing Entries For Year Ending 12/31/2017 Date Accounts 31-Dec Bakery Sales Merchandise Sales Income Summary Credit Debit 335,675.00 35,200.00 370,875.00 287,232.61 31-Dec Income Summary (FIFO) Baking Cost of Goods Sold Rent Expense Interest Expense Insurance Expense Depreciation Expense Amortization Expense Misc. Expense Office Supplies Expense Business License Expense Advertising Expense Wages Expense Telephone Expense Cost of Goods Sold (FIFO) 31-Dec Income Summary (FIFO) Retained Earnings FIFO 137,400.00 90,000.00 1,468.75 2,000.00 2.642.86 2,000.00 2,780.00 1,350.00 375.00 5,200.00 22,800.00 3,456.00 15,760.00 1 2 3 15 83.642.39 83,642.39 31-Dec Retained Earnings Dividends 20.000.00 27 28 29 30 91 32 33 34 35 20,000.00 Chart of Accounts Worksheet Adjusting Entries Ready Income Statement Closing Peyton Approved Statement of Retained Earnings For Year Ending 12/31/2017 Beginning Balance: plus Net Income less Dividends: Ending Balance: 83,642.39 20,000.00 63,642.39 Poyton Approved Balance Sheet As of December 31, 2017 Assets Current Assets: Cash Baking Supplies Merchandise inventory (FIFO) Prepaid Rent Prepaid Insurance Once Supplies Accounts Receivable Total Current Assets 55.428,00 27,850.00 25,750.00 7,500.00 400.00 250 00 30.401.00 Liabilities and Owners' Equity Current Liabilities: Accounts Payable 27 325.00 Wages Payable 22,800.00 Interest Payable 1,468.75 Total Current Liabilities 51,593.7 147.579.00 Long Term Liabilities: Notes Payable Loans Payable Total Long Term Liabilities: Total Liabilities: 10,000.00 21,000.00 31,000.00 82,593.75 Long Term Fixed Assets: Baking Equipment Accumulated Depreciation 20.000.00 5.642.86 Common Stock Retained Earnings 30 000.00 63,642.39 20,357.14 Leavhold improvements Accumulated Amortization Trademark 10.000.00 400000 Total Louity 6,000.00 93,642.39 2.300.00 Total 176,236.14 Total Liabilities & Equity 176,238.14 2017 2016 2015 Industry Standard 1.75 2.2 2.8 2. 3 Quick Ratio 4. Gross Margin 5 Net Margin 6 Return on Sales 7 Return on Equity 0.7 0.55 0.22 0.7 0.32 0.24 0.24 0.26 0.9 0.23 0.8 0.78 8

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started