Answered step by step

Verified Expert Solution

Question

1 Approved Answer

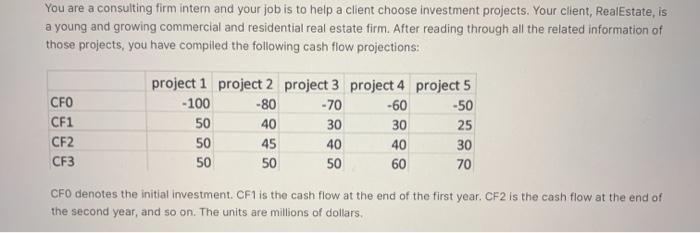

The first picture is by mistake. Just use the schedule (table) to solve the 3 questions in the last picture were they are asking for

The first picture is by mistake. Just use the schedule (table) to solve the 3 questions in the last picture were they are asking for NPV please

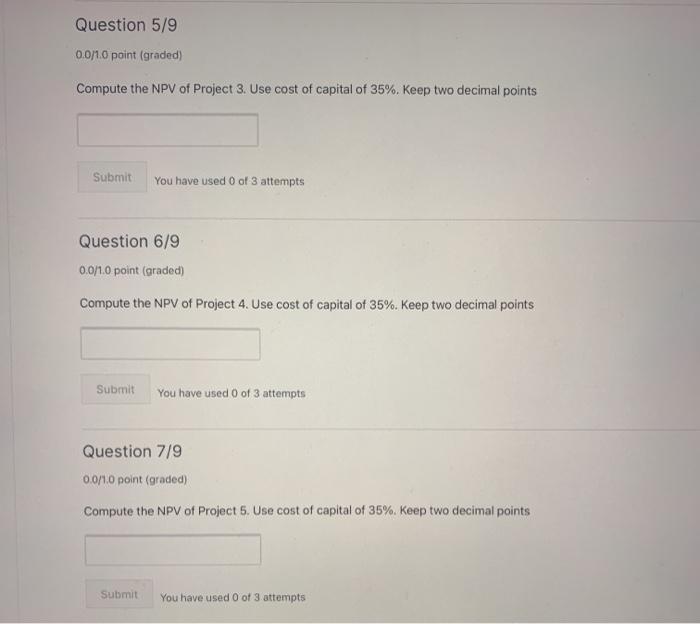

You invested $100 in a project that generates 20% rate of return annually. After two years, you will have $100*(1+20%)^2= $144. How much profit is coming from compounding the gains obtained in the first year? You are a consulting firm intern and your job is to help a client choose investment projects. Your client, RealEstate, is a young and growing commercial and residential real estate firm. After reading through all the related information of those projects, you have compiled the following cash flow projections: -70 CFO CF1 CF2 CF3 project 1 project 2 project 3 project 4 project 5 -100 -80 -60 -50 50 30 30 25 50 45 40 40 30 50 50 50 60 70 40 CEO denotes the initial investment. CF1 is the cash flow at the end of the first year. CF2 is the cash flow at the end of the second year, and so on. The units are millions of dollars. Question 5/9 0.0/1.0 point (graded) Compute the NPV of Project 3. Use cost of capital of 35%. Keep two decimal points Submit You have used 0 of 3 attempts Question 6/9 0.0/1.0 point (graded) Compute the NPV of Project 4. Use cost of capital of 35%. Keep two decimal points Submit You have used 0 of 3 attempts Question 7/9 0.0/1.0 point (graded) Compute the NPV of Project 6. Use cost of capital of 35%. Keep two decimal points Submit You have used 0 of 3 attempts Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started