Answered step by step

Verified Expert Solution

Question

1 Approved Answer

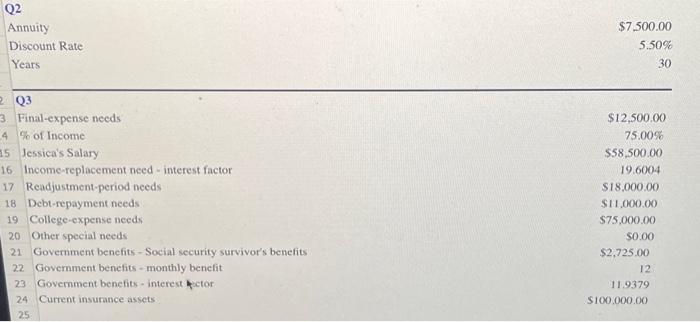

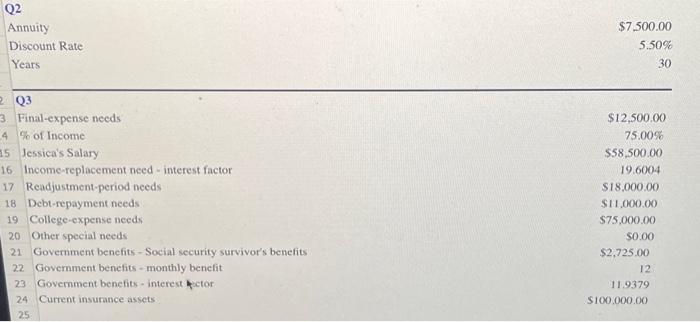

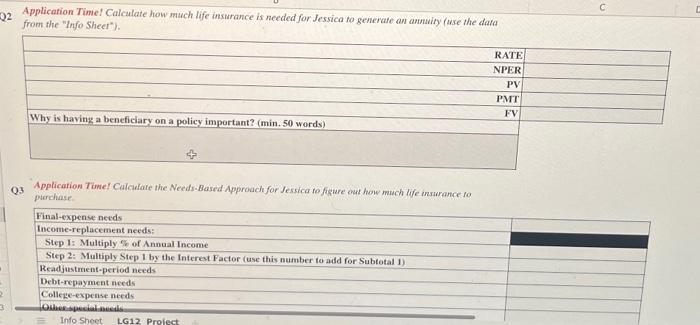

The first picture is the info sheet. Q2 Annuitty Discount Rate Years $7.500.005.50%30 Q3 3. Final-expense needs 4% of Income $12,500.00 75.00% Jessica's Salary $58.500.00

The first picture is the info sheet.

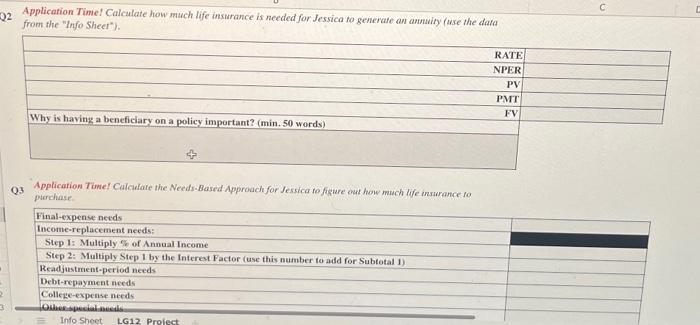

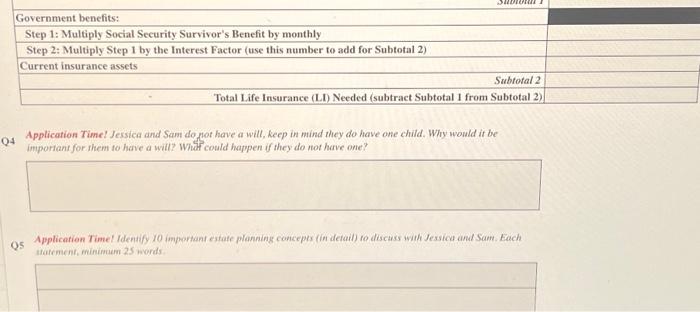

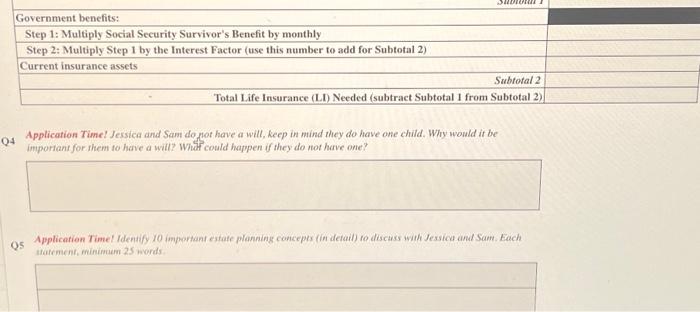

Q2 Annuitty Discount Rate Years $7.500.005.50%30 Q3 3. Final-expense needs 4% of Income $12,500.00 75.00% Jessica's Salary $58.500.00 Income-replacement need - interest factor 19.6004 Readjustment-period needs $18,000.00 18 Debt-repayment needs 19 College-expense needs 20 Other special needs 21 Government benefits - Social security survivor's benefits 22 Government benefits - monthly benefit 23 Governiment benefits - interest p ptor 24 Current insurance assets 25 Application Timel Calculate how mach life insurance is needed for Jessica to generate an annuity (use the data from the "Info Sheet"). Q3. Application Timef Calculate the Needf-Based Approdch for Jessica to fietre out how much life insurance fo purchase Application Time! Jessica and Sam do fot have a will, keep in mind they do have one child. Why would it be important for them to have a will? What could happen if they do not have one? Application Timel Identify 10 important estate planning concepes (in detail) to discass with Jessica and Sam. Each watement, minumaem 25 words

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started