The first pictures answers have to be put on the answer sheet pictures.

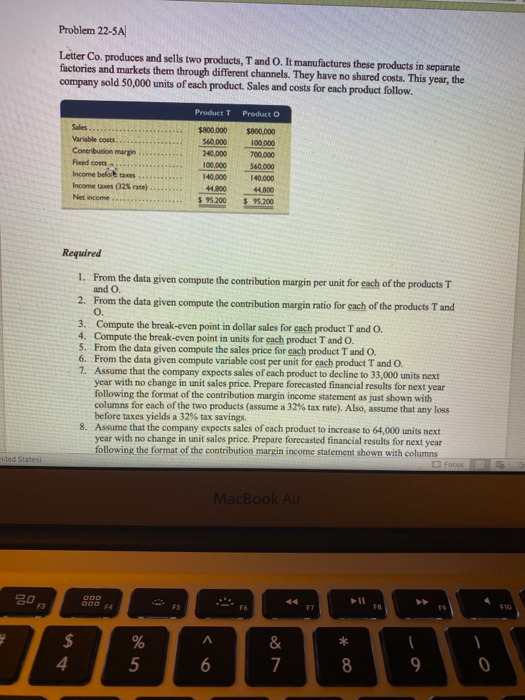

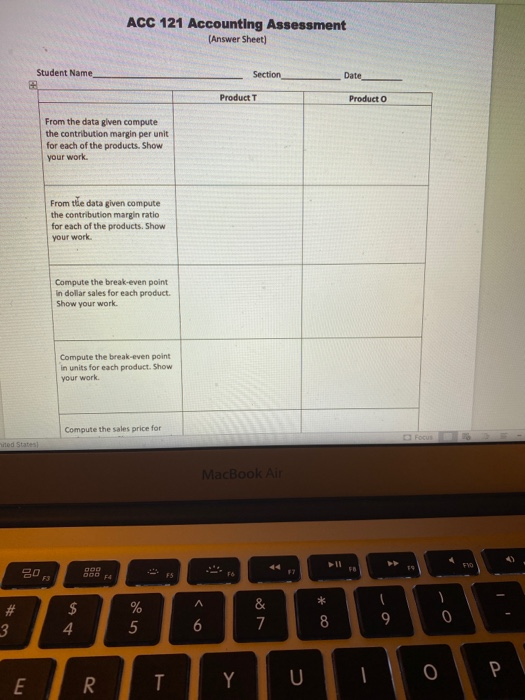

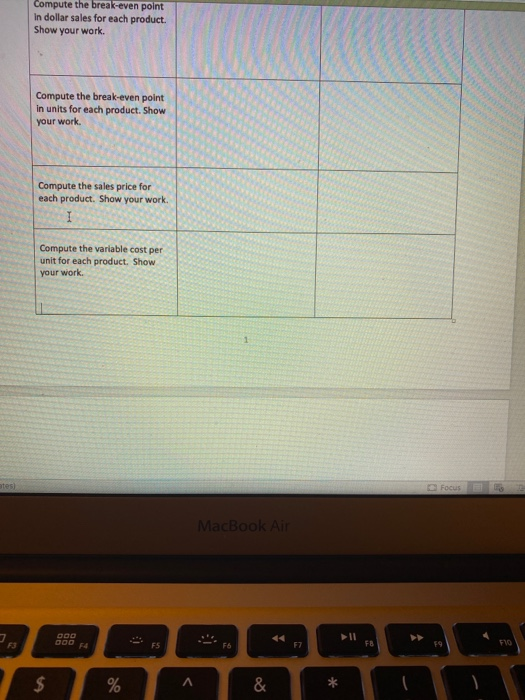

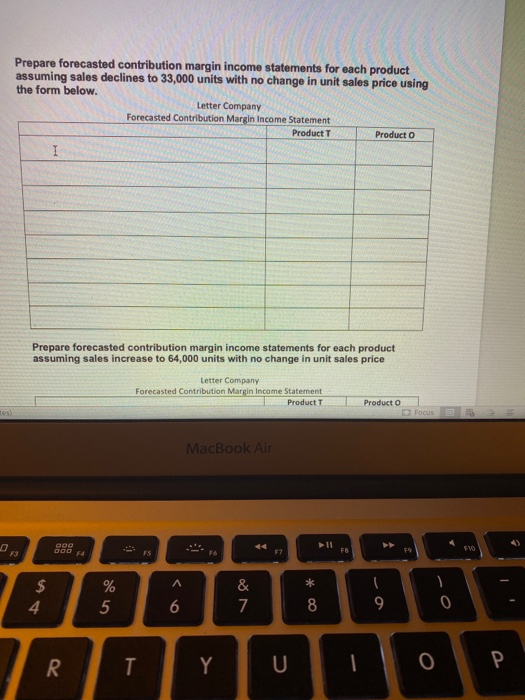

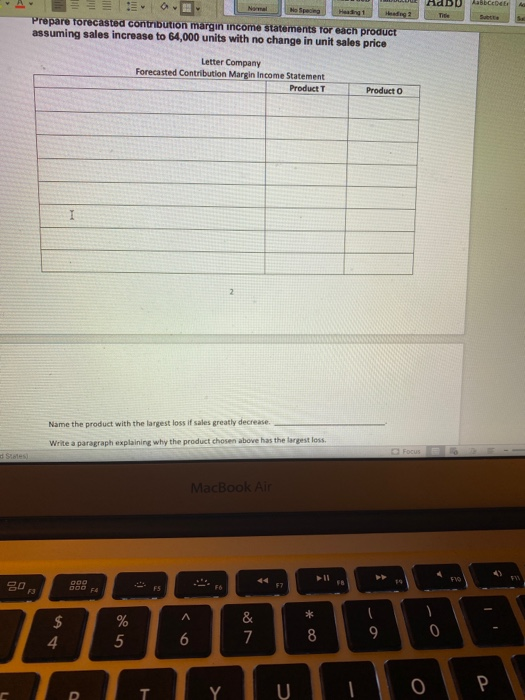

Problem 22-5A Letter Co. produces and sells two products, T and O. It manufactures these products in separate factories and markets them through different channels. They have no shared costs. This year, the company sold 50,000 units of each product. Sales and costs for each product follow Product T Producto Sales Variable costs Contribution marge Puedos Income before Income taxes (12 race) Net income $800.000 560,000 240,000 100,000 140.000 41.800 95.200 $800,000 100 000 700.000 560.000 140.000 44.000 $ 95,200 Required 1. From the data given compute the contribution margin per unit for each of the products T and O. 2. From the data given compute the contribution margin ratio for each of the products T and 0. 3. Compute the break-even point in dollar sales for each product T and O. 4. Compute the break-even point in units for each product T and O. 5. From the data given compute the sales price for each product T and O. 6. From the data given compute variable cost per unit for each product T and O. 7. Assume that the company expects sales of each product to decline to 33,000 units next year with no change in unit sales price. Prepare forecasted financial results for next year following the format of the contribution margin income statement as just shown with columns for each of the two products (assume a 32% tax rate). Also, assume that any loss before taxes yields a 32% tax savings. 8. Assume that the company expects sales of each product to increase to 64,000 units next year with no change in unit sales price. Prepare forecasted financial results for next year following the format of the contribution margin income statement shown with columns Focus ited States MacBook Air DOO FR FVO A & $ 4 % 5 6 7 8 9 0 ACC 121 Accounting Assessment (Answer Sheet) Student Name Section Date Product T Producto From the data given compute the contribution margin per unit for each of the products. Show your work From the data given compute the contribution margin ratio for each of the products. Show your work Compute the break-even point in dollar sales for each product. Show your work. Compute the break-even point in units for each product Show your work Compute the sales price for ited States MacBook Air FYO OOO 20 F3 FS F8 * # 3 $ 4 % 5 & 7 8 9 0 0 E R. T Y Compute the break-even point in dollar sales for each product. Show your work. Compute the break-even point in units for each product. Show your work. Compute the sales price for each product. Show your work. I Compute the variable cost per unit for each product. Show your work 1 tes) Focus MacBook Air DOO DOO F5 F6 FB FO $ % A & Prepare forecasted contribution margin income statements for each product assuming sales declines to 33,000 units with no change in unit sales price using the form below. Letter Company Forecasted Contribution Margin Income Statement Product T Producto I Prepare forecasted contribution margin income statements for each product assuming sales increase to 64,000 units with no change in unit sales price Letter Company Forecasted Contribution Margin Income Statement Product T Producto Focus MacBook Air FB FVO F4 F5 A $ 4 % 5 & 7 * o 6 8 9 0 R T Y U 0 P AaBbce Tie Prepare forecasted contribution margin income statements for each product assuming sales increase to 64,000 units with no change in unit sales price Letter Company Forecasted Contribution Margin Income Statement Product Producto I 2 Name the product with the largest loss if sales greatly decrease. Write a paragraph explaining why the product chosen above has the largest loss. Focus States MacBook Air DOO 80 F3 VO *** A s $ 4 % 5 & 7 8 9 ON ON 0 e 0 D Y