Answered step by step

Verified Expert Solution

Question

1 Approved Answer

the first question is (a)what is the second question it corresponds with the first one the second question is based on the first one it

the first question is (a)what is the second question it corresponds with the first one

the second question is based on the first one

it goes with this question and the answer for this is A

thats all the info

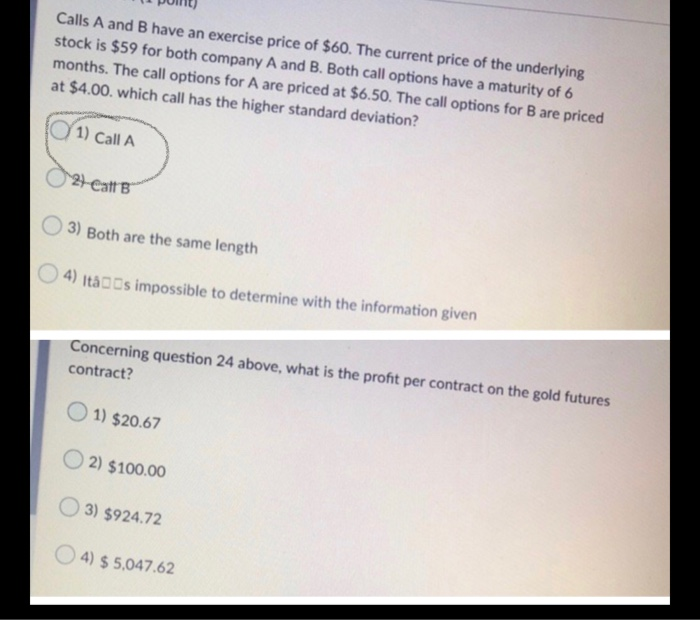

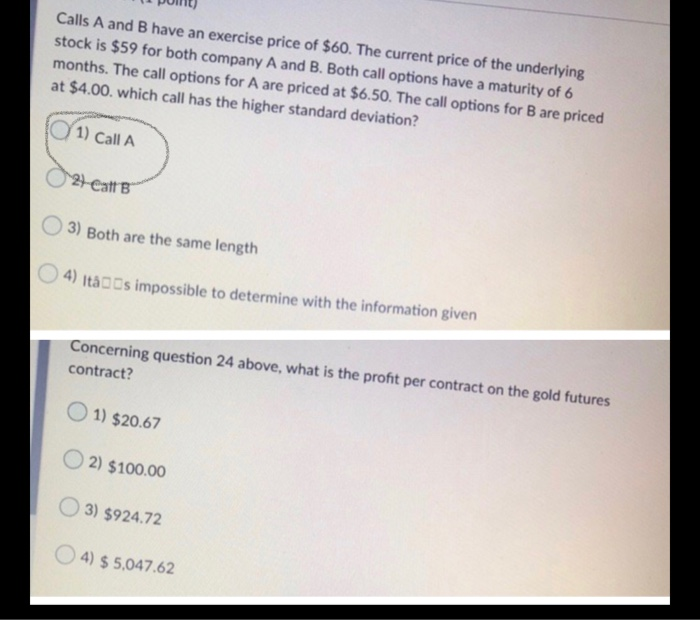

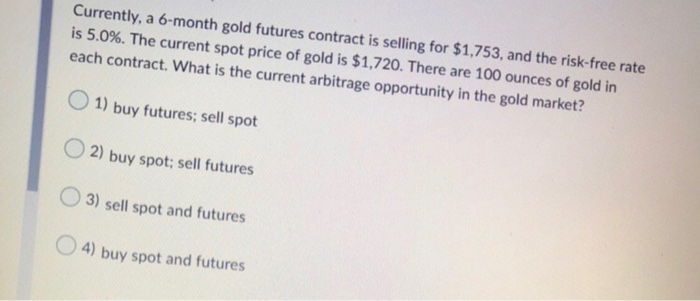

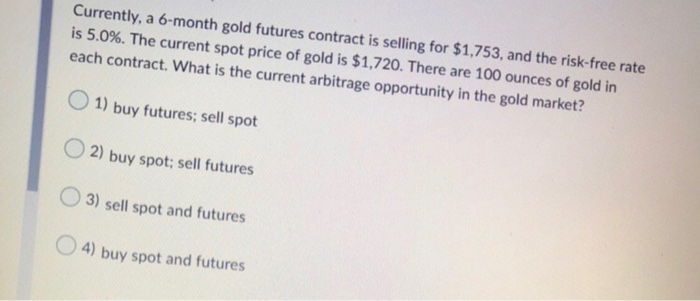

Calls A and B have an exercise price of $60. The current price of the underlying! stock is $59 for both company A and B. Both call options have a maturity of 6 months. The call options for A are priced at $6.50. The call options for B are priced at $4.00. which call has the higher standard deviation? 1) Call A 27- Catt B 3) Both are the same length 4) Ita Os impossible to determine with the information given Concerning question 24 above, what is the profit per contract on the gold futures contract? 1) $20.67 2) $100.00 3) $924.72 4) $5.047.62 Currently, a 6-month gold futures contract is selling for $1.753, and the risk-free rate is 5.0%. The current spot price of gold is $1,720. There are 100 ounces of gold in each contract. What is the current arbitrage opportunity in the gold market? 1) buy futures; sell spot 2) buy spot; sell futures 3) sell spot and futures O4) buy spot and futures Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started