Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The first question provides the data for the last 2 questions. You have the following information on the return to three stocks over the past

The first question provides the data for the last 2 questions.

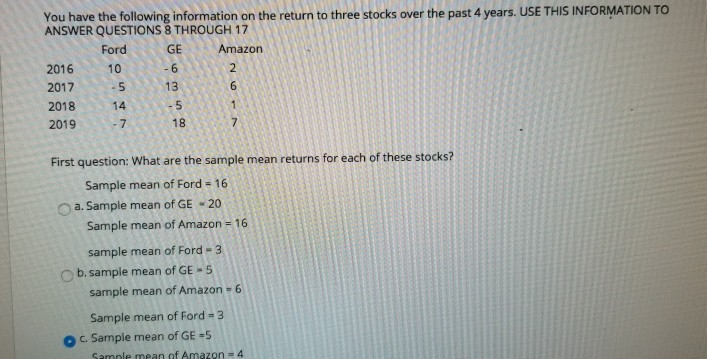

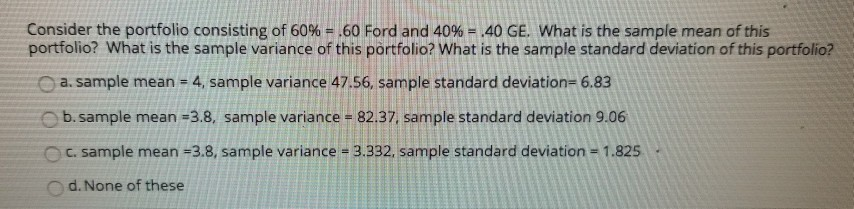

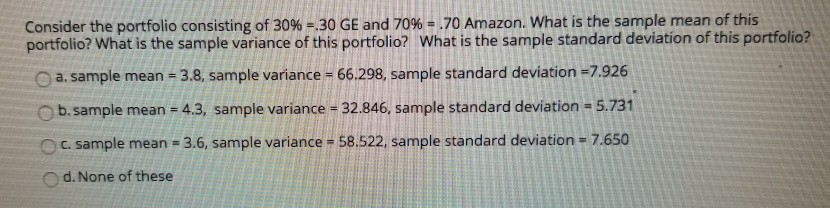

You have the following information on the return to three stocks over the past 4 years. USE THIS INFORMATION TO ANSWER QUESTIONS 8 THROUGH 17 Ford GE Amazon 2016 10 -6 2017 -5 13 2018 14 -5 2019 -7 First question: What are the sample mean returns for each of these stocks? Sample mean of Ford - 16 a. Sample mean of GE - 20 Sample mean of Amazon = 16 sample mean of Ford - 3 b. sample mean of GE - 5 sample mean of Amazon - 6 Sample mean of Ford = 3 c. Sample mean of GE =5 Sample mean of Amazon = 4 Consider the portfolio consisting of 60% = .60 Ford and 40% = 40 GE. What is the sample mean of this portfolio? What is the sample variance of this portfolio? What is the sample standard deviation of this portfolio? a. sample mean = 4, sample variance 47.56, sample standard deviation=6.83 b. sample mean -3.8, sample variance = 82.37. sample standard deviation 9.06 c. sample mean =3.8, sample variance = 3.332, sample standard deviation = 1.825 d. None of these Consider the portfolio consisting of 30% = 30 GE and 70% = .70 Amazon. What is the sample mean of this portfolio? What is the sample variance of this portfolio? What is the sample standard deviation of this portfolio? a. sample mean = 3.8, sample variance = 66.298, sample standard deviation =7.926 b. sample mean = 4.3, sample variance = 32.846, sample standard deviation = 5.731 c. sample mean = 3.6, sample variance - 58.522, sample standard deviation = 7.650 d. None of theseStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started