The first ss is the requirement and data table for the second ss. The third one is a different question. Please help me understand these two questions.

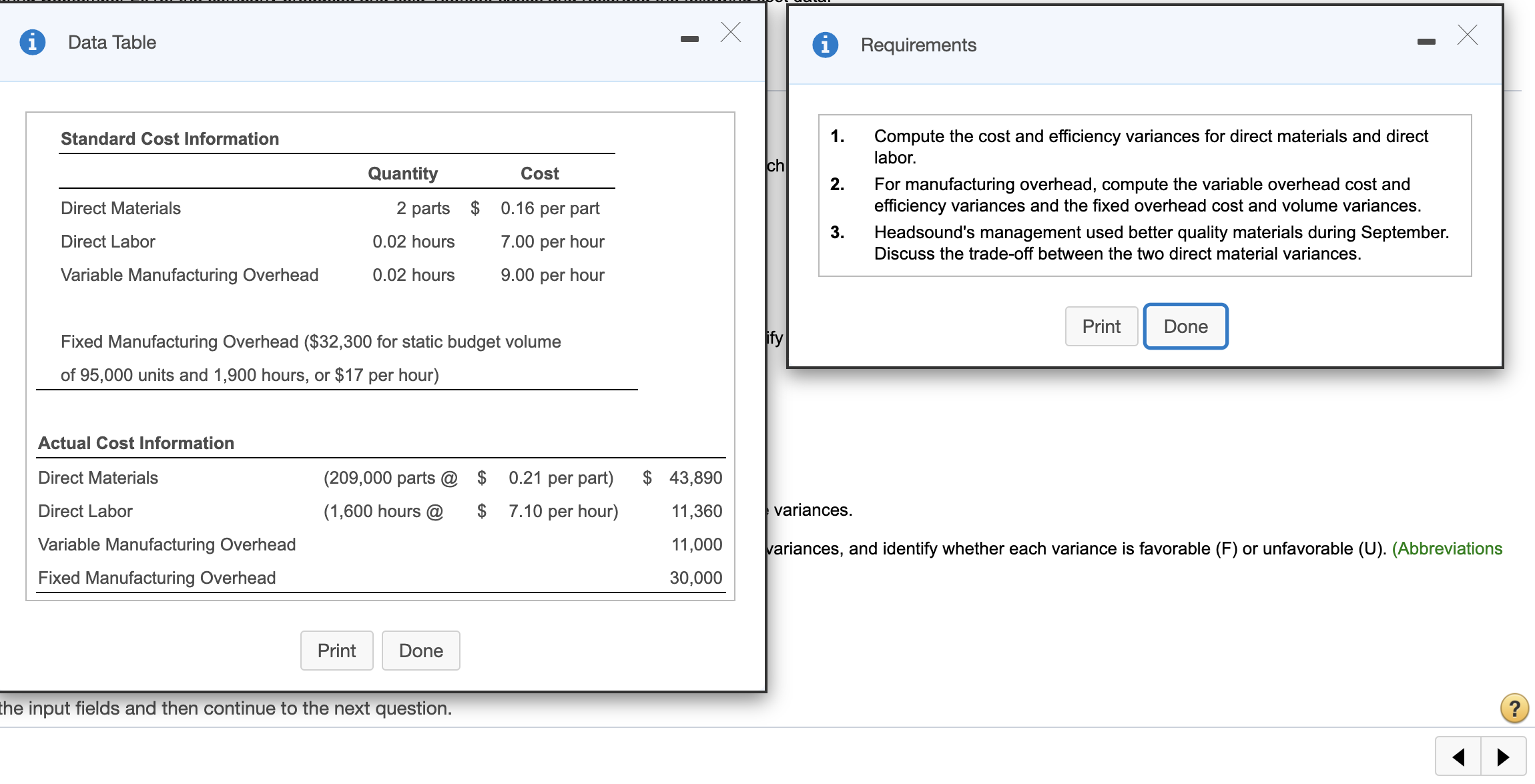

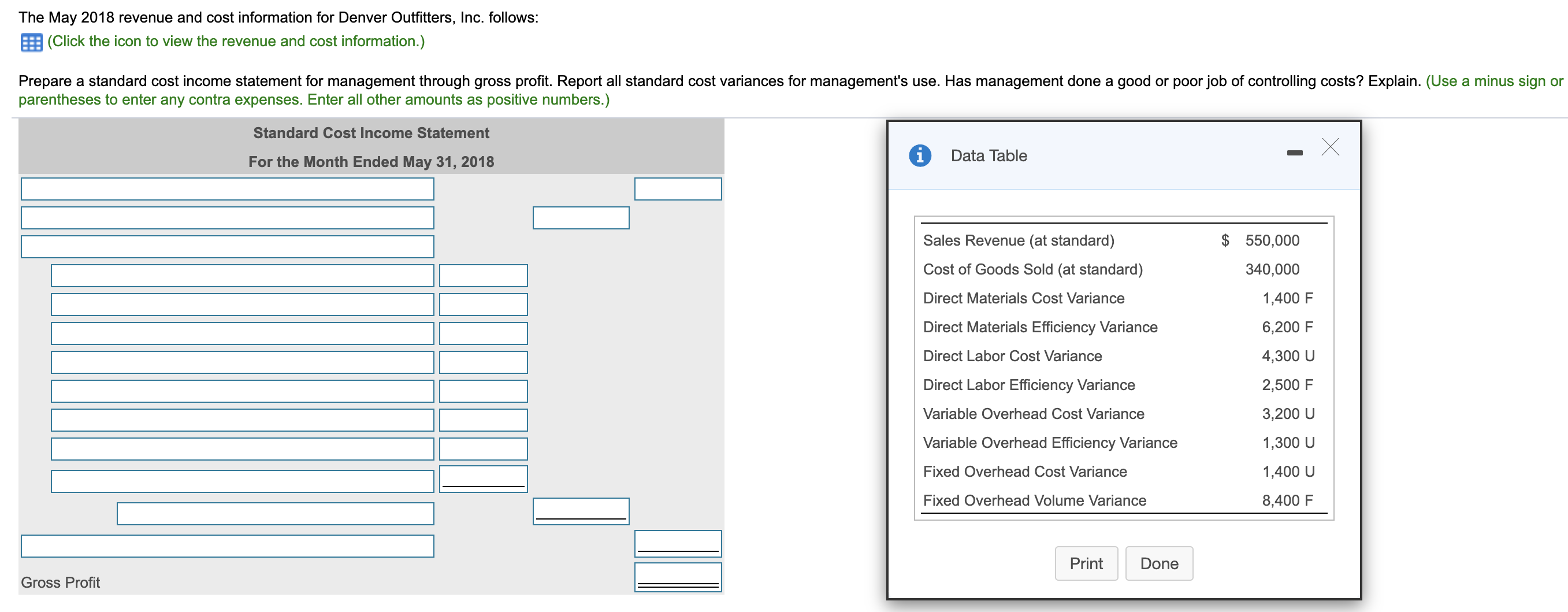

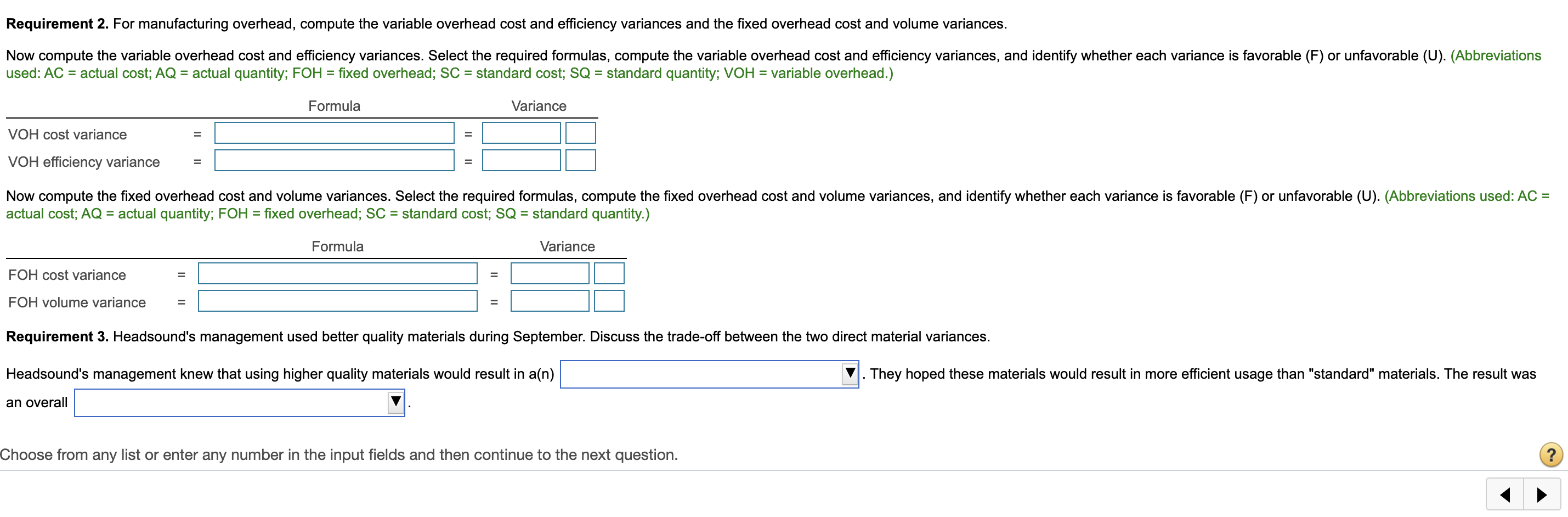

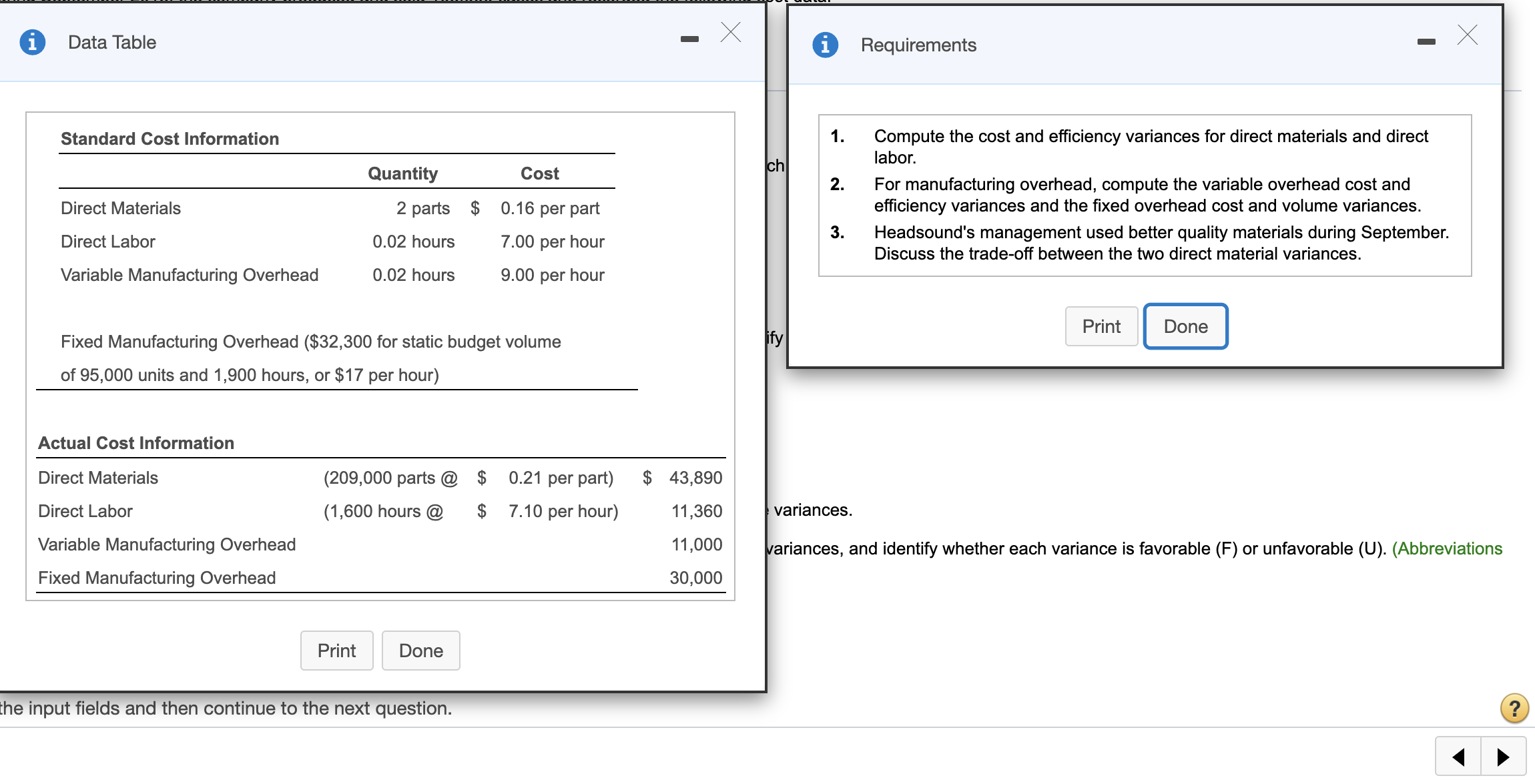

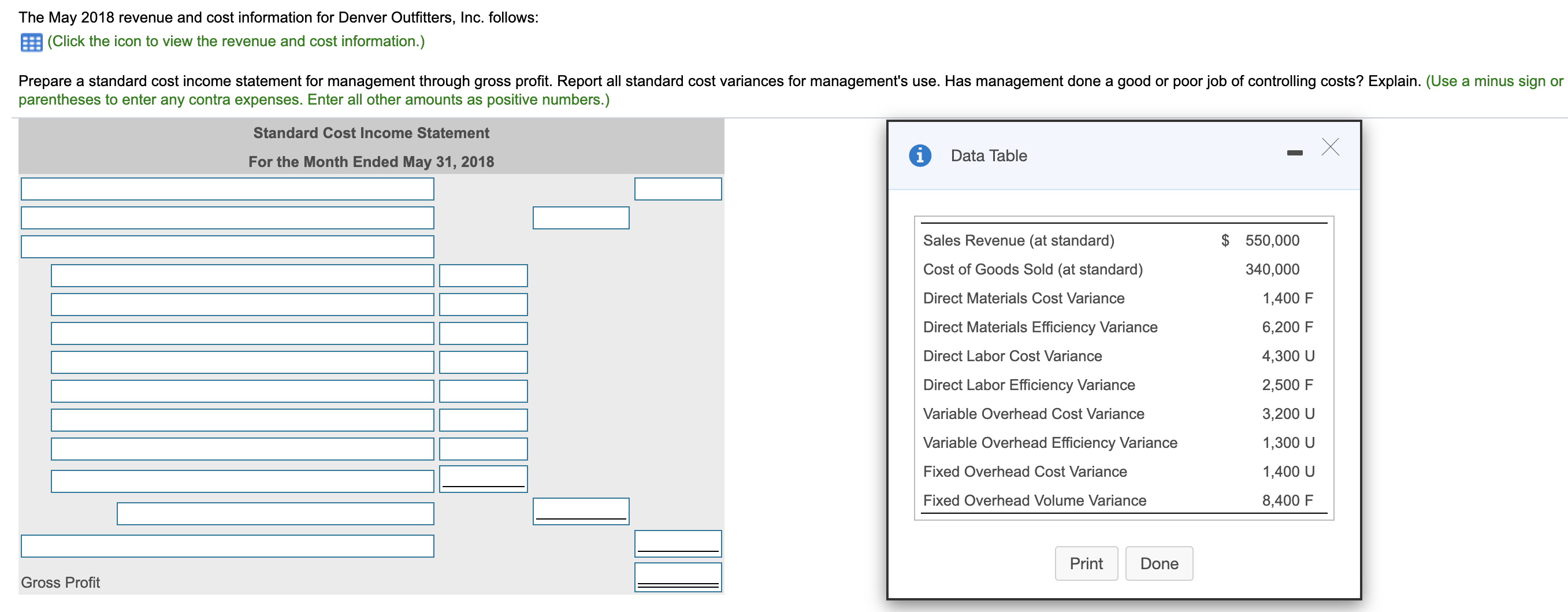

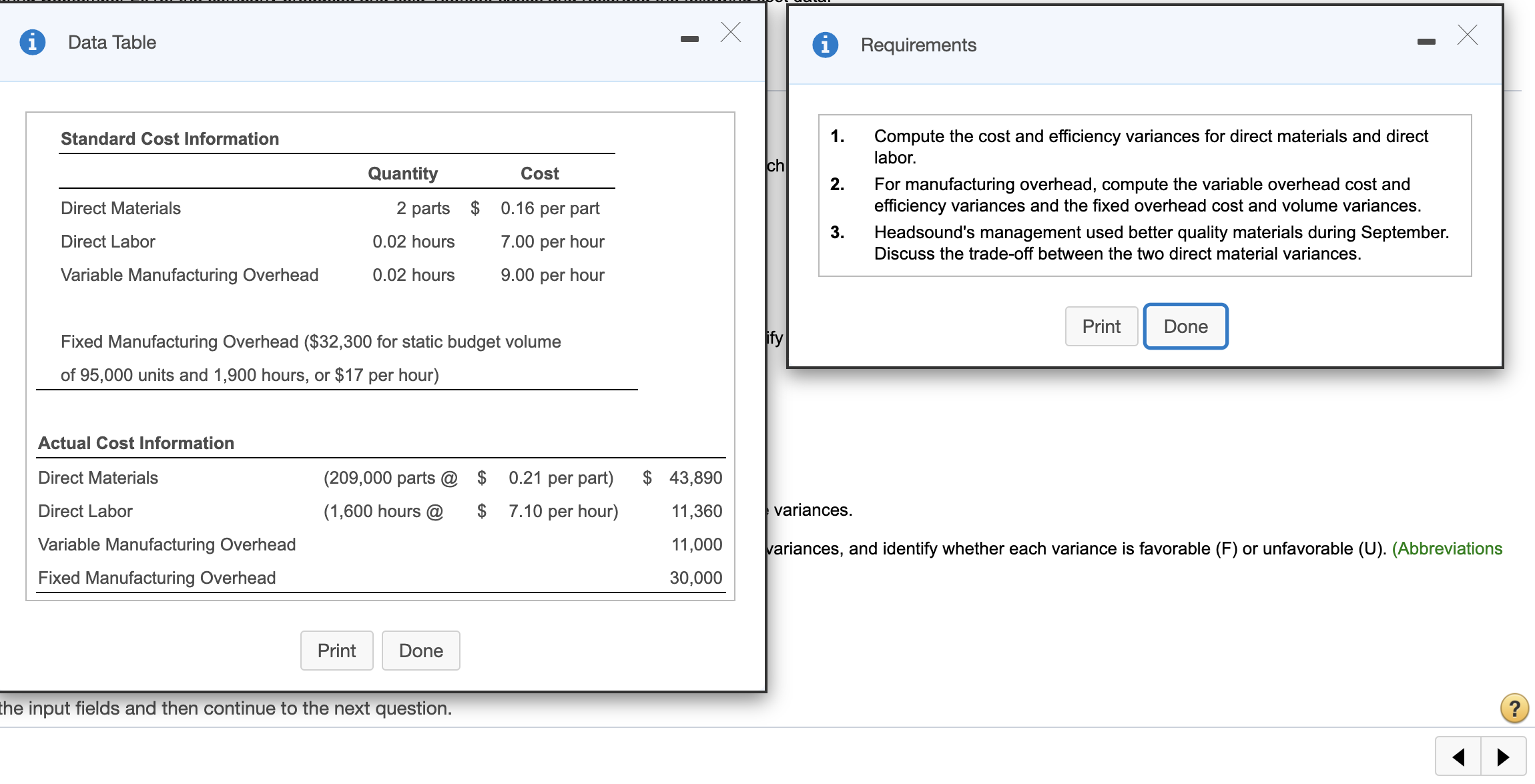

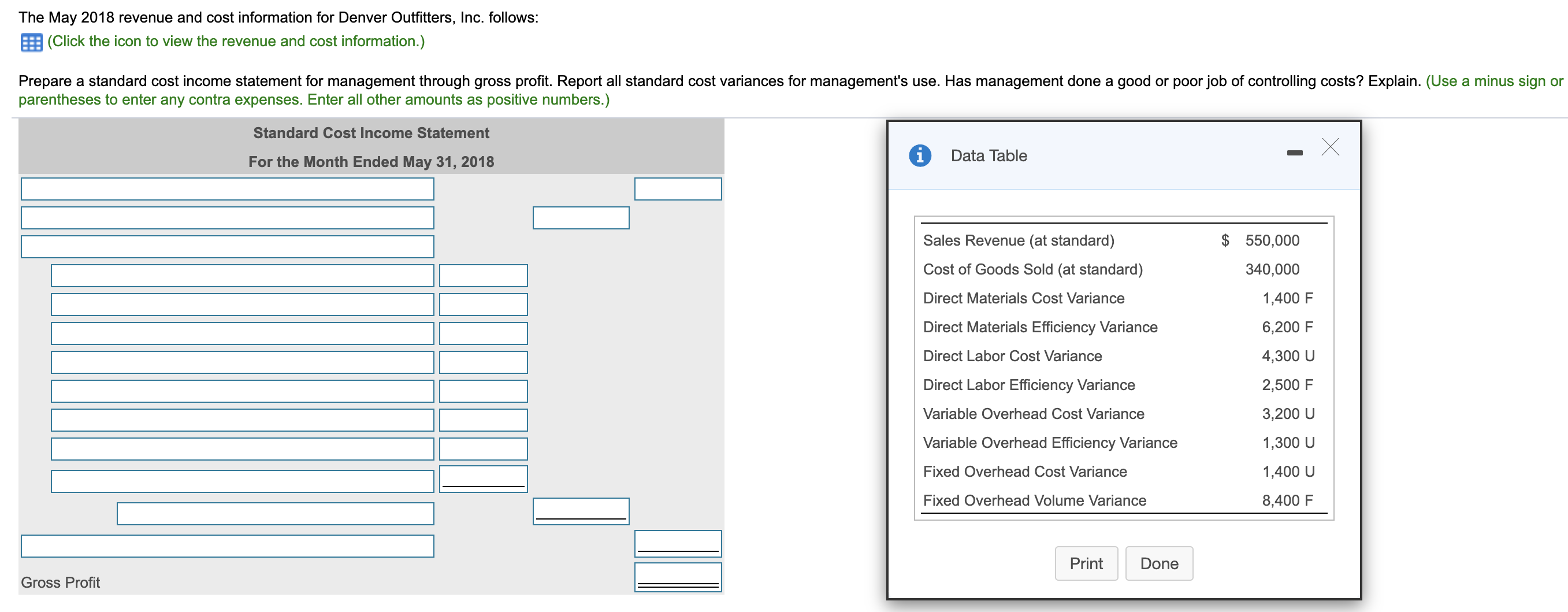

Requirement 2. For manufacturing overhead, compute the variable overhead cost and efficiency variances and the fixed overhead cost and volume variances. Now compute the variable overhead cost and efficiency variances. Select the required formulas, compute the variable overhead cost and efficiency variances, and identify whether each variance is favorable (F) or unfavorable (U). (Abbreviations used: AC = actual cost; AQ = actual quantity; FOH = fixed overhead; SC = standard cost; SQ = standard quantity; VOH = variable overhead.) Formula Variance VOH cost variance VOH efficiency variance Now compute the fixed overhead cost and volume variances. Select the required formulas, compute the fixed overhead cost and volume variances, and identify whether each variance is favorable (F) or unfavorable (U). (Abbreviations used: AC = actual cost; AQ = actual quantity; FOH = fixed overhead; SC = standard cost; SQ = standard quantity.) Formula Variance FOH cost variance FOH volume variance Requirement 3. Headsound's management used better quality materials during September. Discuss the trade-off between the two direct material variances. Headsound's management knew that using higher quality materials would result in a(n) . They hoped these materials would result in more efficient usage than "standard" materials. The result was an overall Choose from any list or enter any number in the input fields and then continue to the next question. ?i Data Table X i Requirements X Standard Cost Information 1. Compute the cost and efficiency variances for direct materials and direct Quantity ch labor. Cost 2. For manufacturing overhead, compute the variable overhead cost and Direct Materials 2 parts $ 0.16 per part efficiency variances and the fixed overhead cost and volume variances. Direct Labor 0.02 hours 7.00 per hour 3. Headsound's management used better quality materials during September. Discuss the trade-off between the two direct material variances. Variable Manufacturing Overhead 0.02 hours 9.00 per hour Fixed Manufacturing Overhead ($32,300 for static budget volume ify Print Done of 95,000 units and 1,900 hours, or $17 per hour) Actual Cost Information Direct Materials (209,000 parts @ $ 0.21 per part) $ 43,890 Direct Labor (1,600 hours @ $ 7.10 per hour) 11,360 variances. Variable Manufacturing Overhead 11,000 variances, and identify whether each variance is favorable (F) or unfavorable (U). (Abbreviations Fixed Manufacturing Overhead 30,000 Print Done he input fields and then continue to the next question. ?The May 2018 revenue and cost information for Denver Outfitters, Inc. follows: (Click the icon to view the revenue and cost information.) Prepare a standard cost income statement for management through gross profit. Report all standard cost variances for management's use. Has management done a good or poor job of controlling costs? Explain. (Use a minus sign or parentheses to enter any contra expenses. Enter all other amounts as positive numbers.) Standard Cost Income Statement For the Month Ended May 31, 2018 i Data Table X Sales Revenue (at standard) $ 550,000 Cost of Goods Sold (at standard) 340,000 Direct Materials Cost Variance 1,400 F Direct Materials Efficiency Variance 6,200 F Direct Labor Cost Variance 4,300 U Direct Labor Efficiency Variance 2,500 F Variable Overhead Cost Variance 3,200 U Variable Overhead Efficiency Variance 1,300 U Fixed Overhead Cost Variance 1,400 U Fixed Overhead Volume Variance 8,400 F Print Done Gross Profit