Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The first student to answer this question correctly is: Tiah Oon Hou Total number of students who have answered this question correctly: 85 AllHome Bhd.

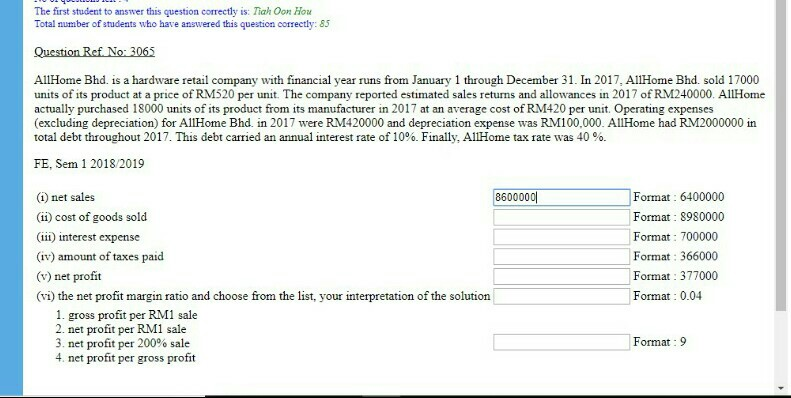

The first student to answer this question correctly is: Tiah Oon Hou Total number of students who have answered this question correctly: 85 AllHome Bhd. is a hardware retail company with financial year runs from January 1 through December 31. In 2017, AllHome Bhd. sold 17000 units of its product at a price of RM520 per unit. The company reported estimated sales returns and allowances in 2017 of RM240000. AllHome actually purchased 18000 units of its product from its manufacturer in 2017 at an average cost of RM420 per unit. Operating expenses (excluding depreciation) for AllHome Bhd. in 2017 were RM420000 and depreciation expense was RM100,000. AllHome had RM2000000 in total debt throughout 2017This debt carried an annual interest rate of 10%. Finally, AllHome tax rate was 40 %. FE, Sem 12018/2019 (1) net sales (ii) cost of goods sold (iii) interest expense 8600000 Format: 6400000 Format 8980000 Format: 700000 Format: 366000 Format: 377000 Format: 0.04 (iv) amount of taxes paid (v) net profit (vi) the net profit margin ratio and choose from the list, your interpretation of the solution 1. gross profit per RMI sale 2. net profit per RM1 sale 3, net profit per 200% sale 4 net profit per gross profit Format : 9

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started