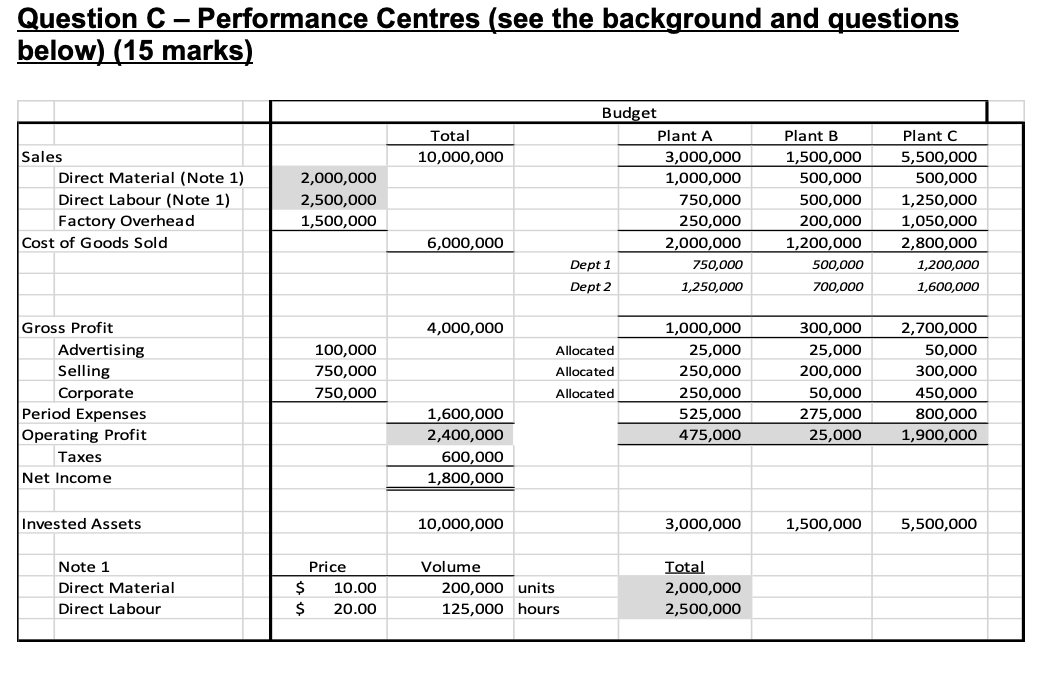

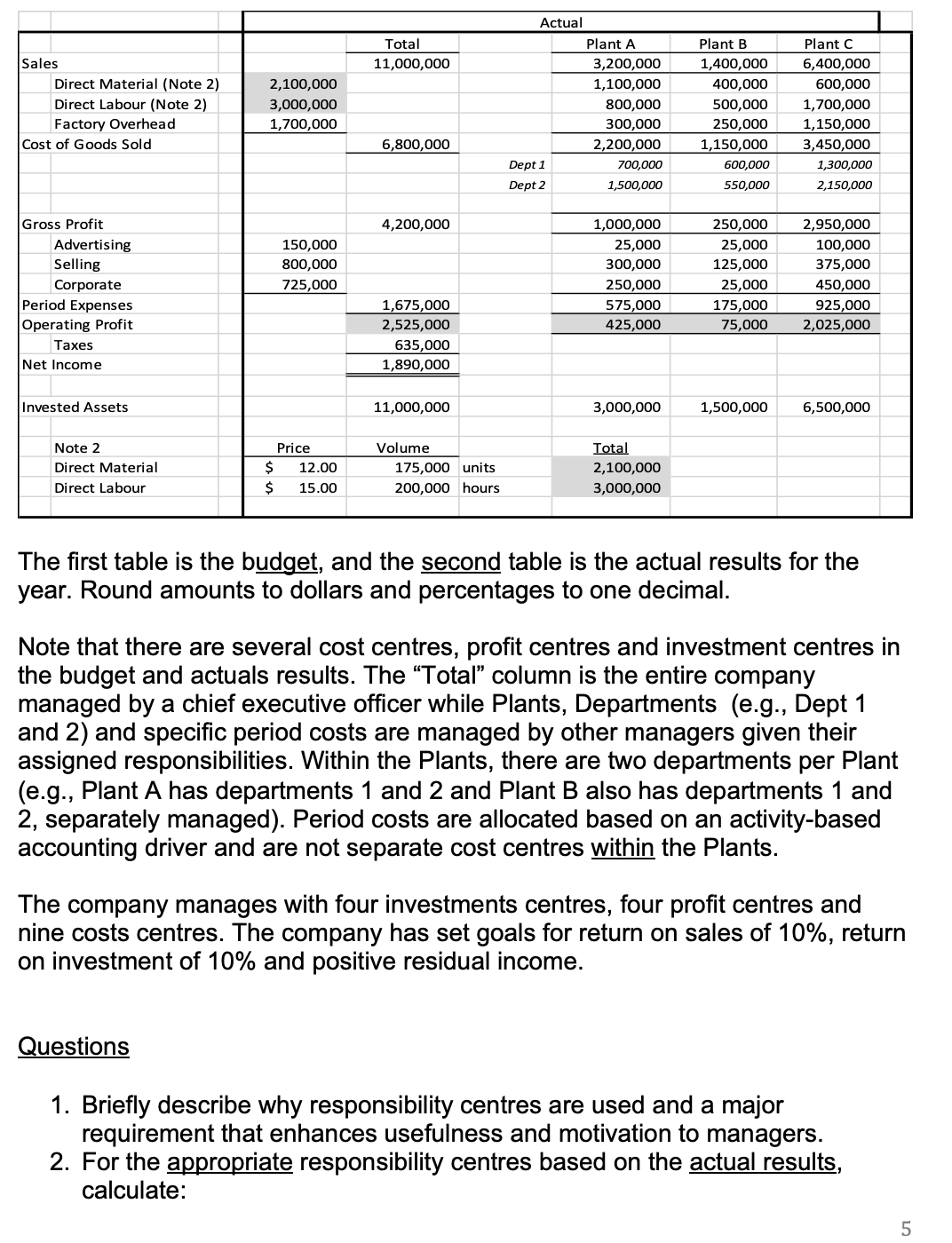

The first table is the budget, and the second table is the actual results for the year. Round amounts to dollars and percentages to one decimal.

Note that there are several cost centres, profit centres and investment centres in the budget and actuals results. The "Total" column is the entire company managed by a chief executive officer while Plants, Departments(e.g., Dept 1 and 2) and specific period costs are managed by other managers given their assigned responsibilities. Within the Plants, there are two departments per Plant (e.g., Plant A has departments 1 and 2 and Plant B also has departments 1 and 2, separately managed). Period costs are allocated based on an activity-based accounting driver and are not separate cost centres within the Plants.

The company manages with four investments centres, four profit centres and nine costs centres. The company has set goals for return on sales of 10%, return on investment of 10% and positive residual income.

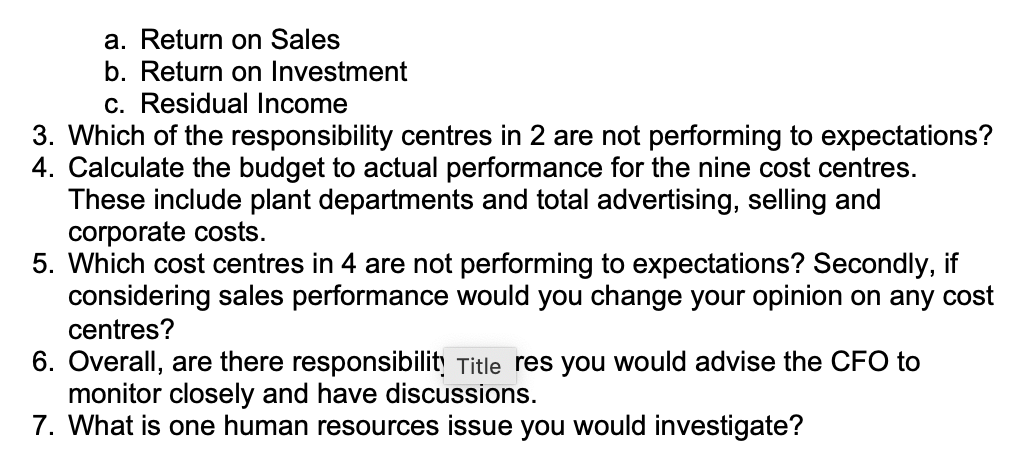

Question C - Performance Centres (see the background and questions below) (15 marks) Budget Total Plant A Plant B Plant C Sales 10,000,000 3,000,000 1,500,000 5,500,000 Direct Material (Note 1) 2,000,000 1,000,000 500,000 500,000 Direct Labour (Note 1) 2,500,000 750,000 500,000 1,250,000 Factory Overhead 1,500,000 250,000 200,000 1,050,000 Cost of Goods Sold 6,000,000 2,000,000 1,200,000 2,800,000 Dept 1 750,000 500,000 1,200,000 Dept 2 1,250,000 700,000 1,600,000 Gross Profit 4,000,000 1,000,000 300,000 2,700,000 Advertising 100,000 Allocated 25,000 25,000 50,000 Selling 750,000 Allocated 250,000 200,000 300,000 Corporate 750,000 Allocated 250,000 50,000 450,000 Period Expenses 1,600,000 525,000 275,000 800,000 Operating Profit 2,400,000 475,000 25,000 1,900,000 Taxes 600,000 Net Income 1,800,000 Invested Assets 10,000,000 3,000,000 1,500,000 5,500,000 Note 1 Price Volume Total Direct Material $ 10.00 200,000 units 2,000,000 Direct Labour 20.00 125,000 hours 2,500,000Total Plant A Plant B Plant C Sales 11,000,000 3,200,000 1,400,000 5,400,000 Direct Material {Note 2) 2,100,000 1,100,000 400,000 500,000 Direct Labour (Note 2) 3,000,000 500,000 500,000 1,700,000 Factory Overhead 1,700,000 300,000 250,000 1,150,000 Cost of Goods Sold 2,200,000 1,150,000 3,450,000 700,000 500,000 1,300,000 1,500,000 550,000 2,150,000 Gross Profit 4,200,000 1,000,000 250,000 2,950,000 Advertising 25,000 25,000 100,000 Selling 300,000 125,000 375,000 Corporate 250,000 25,000 450,000 Period Expenses 1,625,000 525,000 125,000 925,000 Operating Profit 2,525,000 425,000 25,000 2,025,000 Taxes 635 000 f Net Income 1,390,000 Invested Assets 11,000,000 3,000,000 1,500,000 5,500,000 Note 2 Volume 19131 Direct Material 125,000 units 2,100,000 Direct Labour 200,000 hours 3,000,000 The rst table is the budget, and the second table is the actual results for the year. Round amounts to dollars and percentages to one decimal. Note that there are several cost centres, prot centres and investment centres in the budget and actuals results. The \"Total" column is the entire company managed by a chief executive ofcer while Plants, Departments (e.g., Dept 1 and 2) and specic period costs are managed by other managers given their assigned responsibilities. Within the Plants, there are two departments per Plant (e.g., Plant A has departments 1 and 2 and Plant B also has departments 1 and 2, separately managed). Period costs are allocated based on an activity-based accounting driver and are not separate cost centres within the Plants. The company manages with four investments centres, four prot centres and nine costs centres. The company has set goals for return on sales of 10%, return on investment of 10% and positive residual income. Questions 1. Briey describe why responsibility centres are used and a major requirement that enhances usefulness and motivation to managers. 2. For the appropriate responsibility centres based on the actual results, calculate: 45-00 a. Return on Sales b. Return on Investment c. Residual Income . Which of the responsibility centres in 2 are not performing to expectations? . Calculate the budget to actual performance for the nine cost centres. These include plant departments and total advertising, selling and corporate costs. . Which cost centres in 4 are not performing to expectations? Secondly, if considering sales performance would you change your opinion on any cost centres? . Overall, are there responsibility Title res you would advise the CFO to monitor closely and have discussions. . What is one human resources issue you would investigate