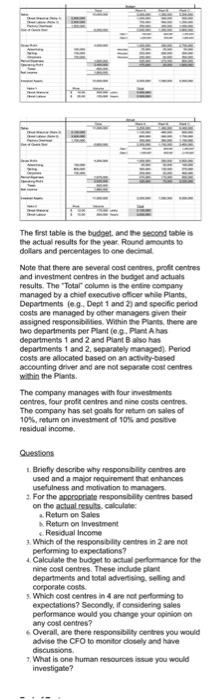

The first table is the budget and the second table is the actual results for the year. Round amounts to dollars and percentages to one decimal Note that there are several cost centres, profit centres and investment centres in the budget and actuals results. The "Total column is the entire company managed by a chief executive officer while Plants Departments (eg, Dept 1 and 2) and specific period costs are managed by other managers given their assigned responsibilities. Within the plants, there are two departments per Plant (eg. Plant Ahas departments 1 and 2 and Piant B also has departments 1 and 2. separately managed). Period costs are allocated based on an activity-based accounting driver and are not separate cost centres within the Parts The company manages with four investments contres, four profit centres and nine concentres The company has set goals for return on sales of 10%, return on investment of 10% and positive residual income Questions 1. Briefly describe why responsibility centres are used and a major requirement that enhances usefulness and motivation to managers. 2. For the appropriate responsibility centres based on the actual resus. calculate . Return on Sales Return on investment Residual income Which of the responsibility centres in 2 are not performing to expectations? Calculate the budget to actual performance for the nine cost centres. These include plant departments and total advertising Selling and corporate costs Which cost centres in 4 are not performing to expectations? Secondly, if considering sales performance would you change your opinion on anycost centres? Overall, are there responsibility centres you would advise the CFO to monitor doty and have discussions What is one human resources issue you would investigate? The first table is the budget and the second table is the actual results for the year. Round amounts to dollars and percentages to one decimal Note that there are several cost centres, profit centres and investment centres in the budget and actuals results. The "Total column is the entire company managed by a chief executive officer while Plants Departments (eg, Dept 1 and 2) and specific period costs are managed by other managers given their assigned responsibilities. Within the plants, there are two departments per Plant (eg. Plant Ahas departments 1 and 2 and Piant B also has departments 1 and 2. separately managed). Period costs are allocated based on an activity-based accounting driver and are not separate cost centres within the Parts The company manages with four investments contres, four profit centres and nine concentres The company has set goals for return on sales of 10%, return on investment of 10% and positive residual income Questions 1. Briefly describe why responsibility centres are used and a major requirement that enhances usefulness and motivation to managers. 2. For the appropriate responsibility centres based on the actual resus. calculate . Return on Sales Return on investment Residual income Which of the responsibility centres in 2 are not performing to expectations? Calculate the budget to actual performance for the nine cost centres. These include plant departments and total advertising Selling and corporate costs Which cost centres in 4 are not performing to expectations? Secondly, if considering sales performance would you change your opinion on anycost centres? Overall, are there responsibility centres you would advise the CFO to monitor doty and have discussions What is one human resources issue you would investigate