The first three pictures are the question information and answers to the questions.

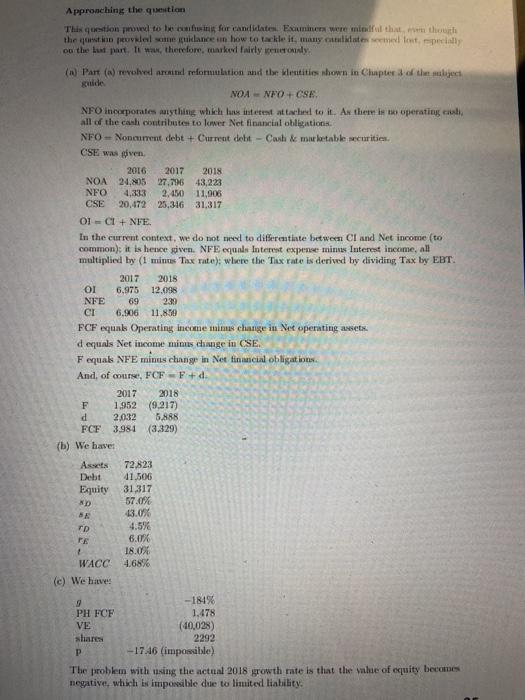

I tried question 6(b), but i do not understand why that WACC formula is correcr and the other is wrong.

*Why do you only multiply (1-t) to debt and not equity?

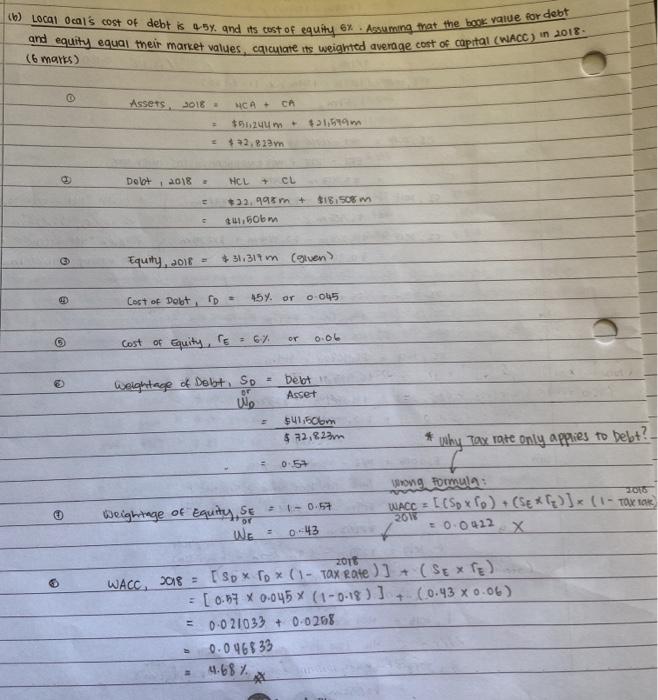

As for question 6(c), answer and working is completely different from the answer sheer provided. Could you explain and show where i gone wrong. And how it should be done? Thanks!

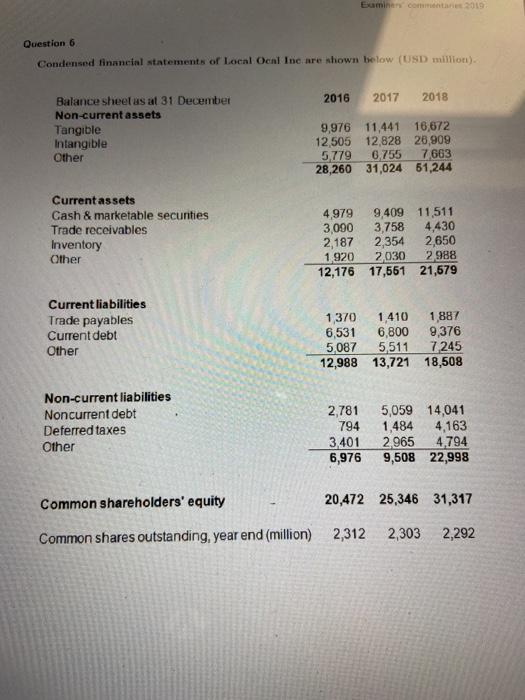

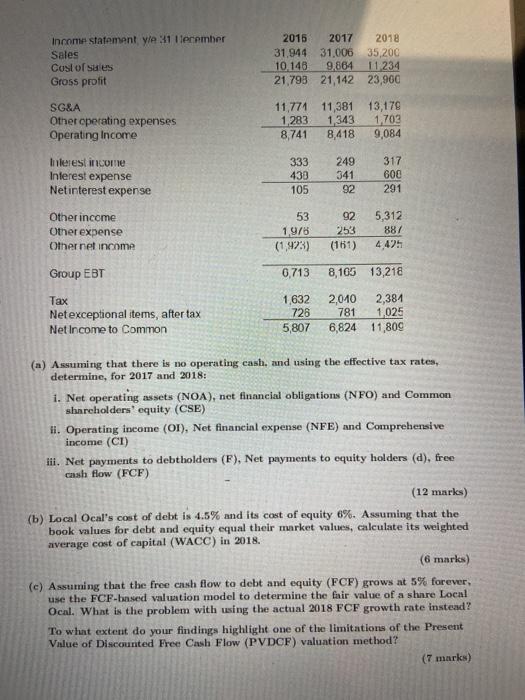

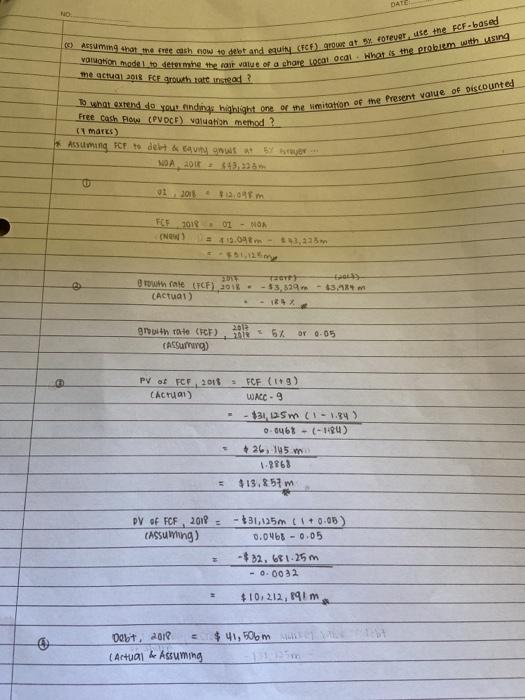

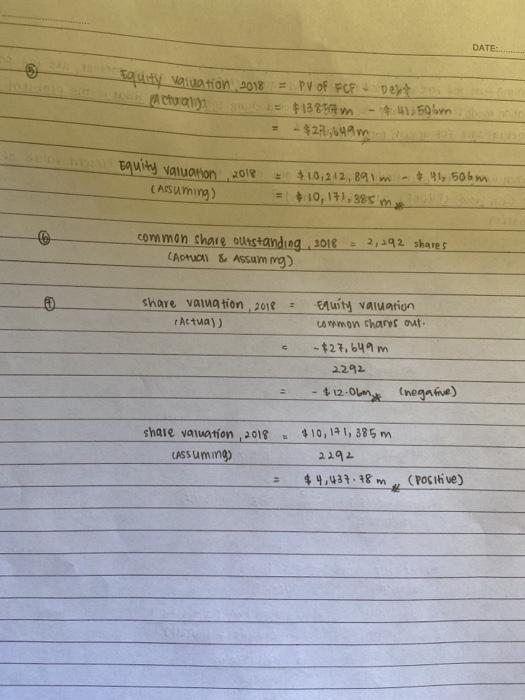

Euminen on 2019 Question 6 Condensed financial statements of Local Ocal Inc are shown below (USD) million). 2016 2017 2018 Balance sheet us at 31 December Non-current assets Tangible Intangible Other 9,976 11,441 16,672 12,505 12,828 26,909 57796755 7663 28,260 31,024 61,244 Current assets Cash & marketable securities Trade receivables Inventory Other 4,979 9,409 11,511 3,090 3,758 4,430 2,187 2,354 2,650 1.920 2030 2988 12,176 17,561 21,679 Current liabilities Trade payables Current debt Other 1370 1.410 1 887 6,531 6,800 9,376 5087 5,511 7245 12,988 13,721 18,508 Non-current liabilities Noncurrent debt Deferred taxes Other 2,781 794 3.401 6,976 5,059 14,041 1,484 4,163 2.965 4,794 9,508 22,998 Common shareholders' equity 20,472 25,346 31,317 Common shares outstanding, year end (million) 2,312 2,303 2,292 Income statement le 31 lerember Sales Cost of sules Gross profit 2015 2017 2018 31,944 31.006 35,200 10146 9.864 11234 21.793 21,142 23,900 SG&A Other operating expenses Operating Income 11,771 11,381 13,179 1,283 1343 1,703 8,741 8,418 9,084 Interest income Interest expense Netinterest expense 333 430 105 249 341 92 317 600 291 Other income Other expense Othernet income 53 1,978 (1,923) 92 253 (161) 5,312 88/ 4 425 6713 8,105 13,218 Group EBT Tax Net exceptional items, after tax Net Income to Common 1632 726 5,807 2,010 2,384 781 1,025 6,824 11,809 (a) Assuming that there is no operating cash, and using the effective tax rates, determine, for 2017 and 2018: 1. Net operating assets (NOA), not financial obligations (NFO) and Common shareholders' equity (CSE) li. Operating income (OI), Net financial expense (NFE) and Comprehensive income (CI) iii. Net payments to debtholders (F), Net payments to equity holders (d), free cash flow (FCF) (12 marks) (b) Local Ocal's cost of debt is 4.5% and its cost of equity 6%. Assuming that the book values for debt and equity equal their market values, calculate its weighted average cost of capital (WACC) in 2018. (6 marks) (c) Assuming that the free cash flow to debt and equity (FCF) grows at 5% forever, use the FCF-based valuation model to determine the fair value of a share Local Ocal. What is the problem with using the actual 2018 FCF growth rate instead? To what extent do your findings highlight one of the limitations of the Present Value of Discounted Free Cash Flow (PVDCF) valuation method? (7 marks) Approaching the question This question prowl to le coming for candidates Escuiners were mindful that thouth the qui peuvelsme cuidance un how to tackleit, many calidate med et specially ou the but part, la, therefore marked fairly enero () Part () merched and formulation and the entities shown in Chapter of the subject guide NOANFO+CSE NFO incorporates mything which have interest attached to it. As there is no operating cash, all of the cash contributes to lower Net financial obligations NFO -Noncurrent debt + Current debt - Cash & marketable securities CSE was given 2016 2017 2018 NOA 24.805 27.76 43,223 NFO 4,333 2,45) 11,906 CSE 20,472 25,316 31,317 OLCI + NFE In the current context, we do not need to differentiate between CI and Net income (to common); it is hence given. NFE equales Interest expense minnes Interest income, all multiplied by (1 mintus Tux rate); where the Tax rate is derived by dividing, Tax by EBT. 2017 2018 OI 6.975 12.098 NFE 69 239 CI 6.906 11,850 FCF equal Operating income is change in Net operating assets. d equals Net income minus change in CSE Fequals NFE mins chung in Net financial obligations And, of course, FCF -F+d 2017 F 1952 (9.217) d 2.032 5.888 FCF 3.981 (3,329) (b) We have Assets 72,823 Debt 41.506 Equity 31317 ND 57.0% 13.0% 4.5% 6.0% 18.0% WACC 4.68% (c) We have: -181% PH FCF 1.478 VE (40,028) shares 2292 -17.46 (impossible) The problem with using the actual 2018 growth rate is that the value of equity becomes negative, which is impossible due to limited liability. 2018 (6) LOCI Ocal's cost of debt is 54. and its cost of equity 6%. Assuming that the book value for debt and equity equal their market values, calculate its weighted average cost of capital (WACC) in 2018 (6 marts) Assets 2018 HCA + $512m - $31,519 m $ 2.81 Dolot 2018 HCL CL $18.906 m 22.995m + 160lm Equity. 2018 - $31.311 m (given Cost of Dobtp = 454. or o 045 or 0.0L cost of Equity, ro 67 Weightage of Debt, so = Delt Asset or $41500m $ 22,823m by Tay rate only applies to bebt? 0.5 016 wong Formula: WACC (Soxfo) (SE*T)] (1-TOX tok = 0.0422 X 2018 Weightage of Equity se WE 043 2016 WACC, 2018 = 180 * 1o * (- tax rate)] + (Se x fp) [ 0.57 0.045 x (1-0-18) ] (0.43 x 0.06) 0.021033 + 0-0 208 0.096833 4.68 . DATE NO CE) Assuming the cash now det andet er at forever use the FCF-based valabon model determine the colt value of a shore Ocai What is the problem with using me actuaj 2018 FCE growth instead? to what extend do you and highlight one of the limitation of the Present value of Discounted Free Cash Flow CPVDC) valuation memod? U marts) Assuming For det dawl NOA 2012 U 2012 m TCE 1018 (NOW 01 - NOR =10m - 2,25 SURF Outrale (CF) 2016 - CActuar) TO) -> - 53,529 - $3,47 2012 growth rate CCF) 5% CASung) or 0.05 PV of FCF 2016 CACTU) FCF (19) WAC -9 - 131 Sm (1 - 1.843 0-046% - (-124) 26,145 1-9862 $13.857 m PV OF FOF 2018 (Assu Wing) $31,125m 1 +0.05) 0.0468 -0.05 - $ 22.681.25 m -0.0032 $10,212,891 m $ 41,50m Debt, 2010 (Artual ke Assuming DATE Tutty Valuation 2018 - PV of FCF Dext Acto 2 F138 m $1.50 Equity valuation 2018 (Arsuming) 10,212, 891 1,505 m common share outstanding 2018 CAH & Assuming) 2,192 shares Share valuation 2018 Actual) Equity valuation Lomon shares out - $27,649 m 2292 - $ 12.06m (negative) share valuation 2018 > LASS Uming) $10,14 1,385 m 2292 $ 4,437.48 m (POC Itive)