The first two picture is one question and the third picture is a separate question so its a total of two questions.

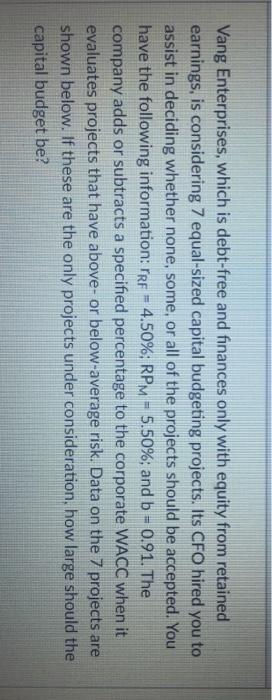

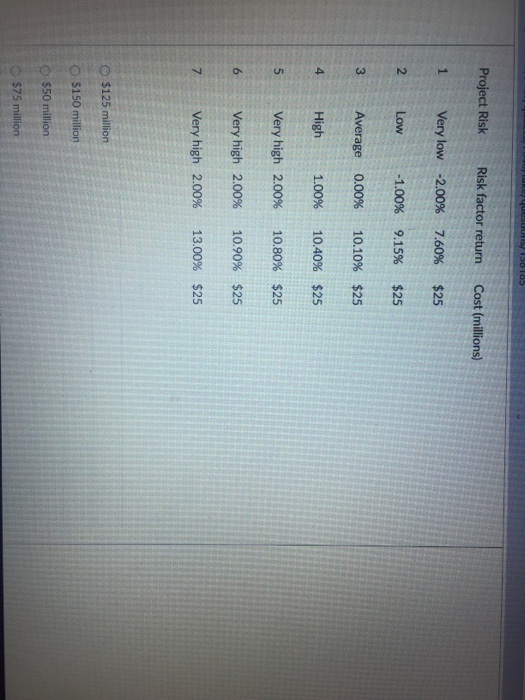

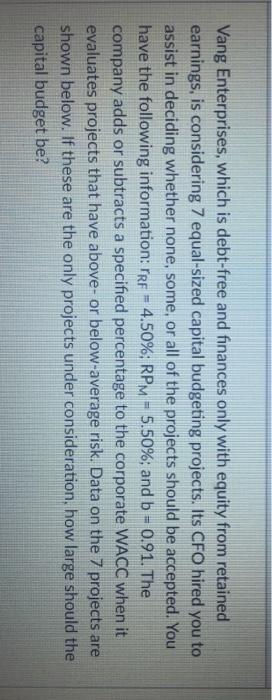

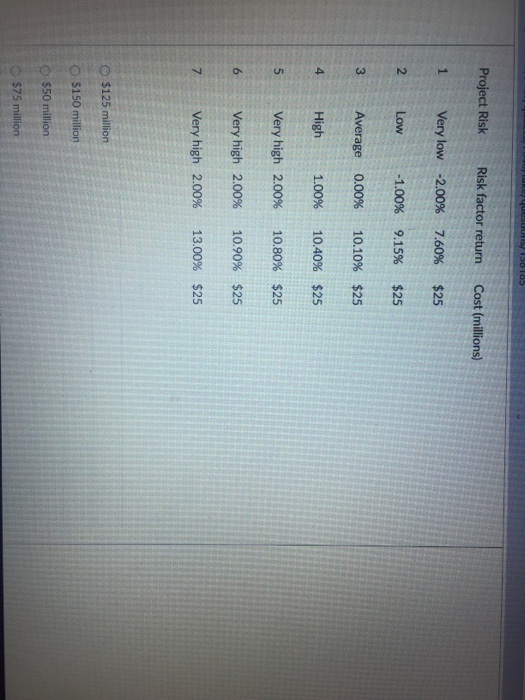

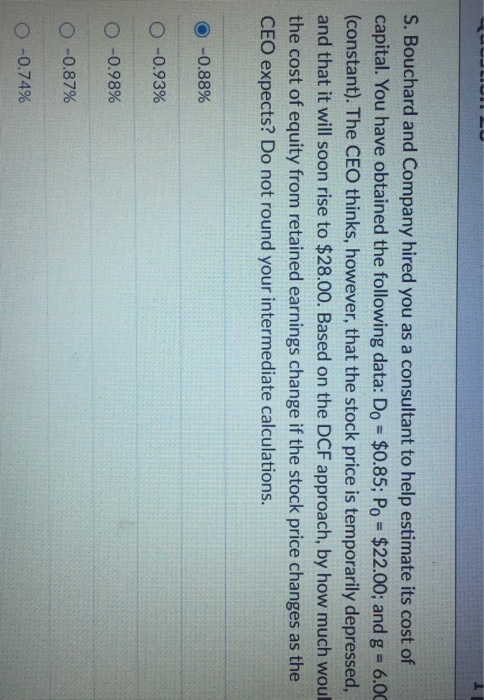

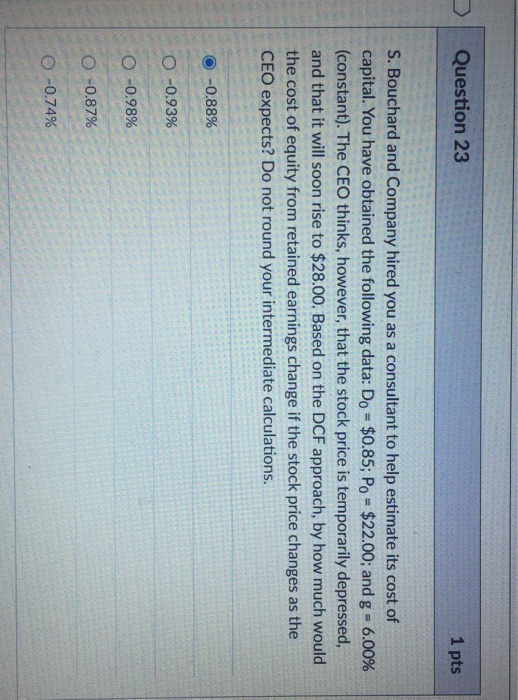

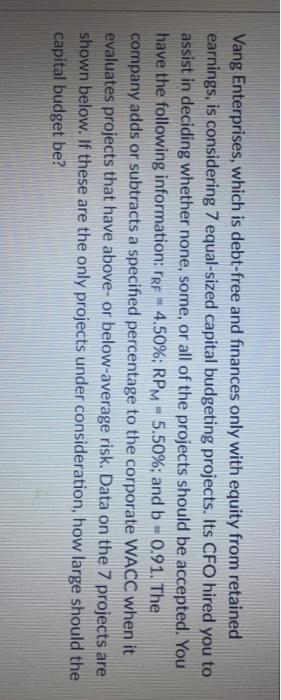

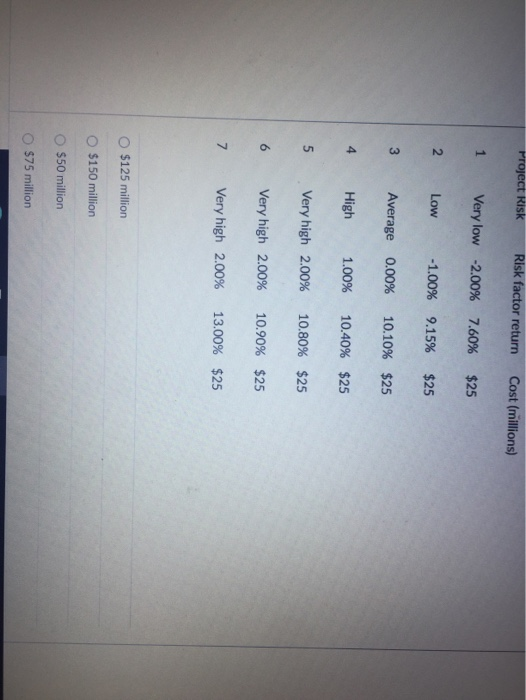

Vang Enterprises, which is debt-free and finances only with equity from retained earnings, is considering 7 equal-sized capital budgeting projects. Its CFO hired you to assist in deciding whether none, some, or all of the projects should be accepted. You have the following information: Tre - 4.50%; RPM = 5.50%; and b = 0.91. The company adds or subtracts a specified percentage to the corporate WACC when it evaluates projects that have above- or below-average risk. Data on the 7 projects are shown below. If these are the only projects under consideration, how large should the capital budget be? queSUTIS IDO105 Project Risk Risk factor return Cost (millions) 1 Very low -2.00% 7.60% $25 2 Low -1.00% 9.15% $25 3 Average 0.00% 10.10% $25 4 High 1.00% 10.40% $25 5 Very high 2.00% 10.80% $25 6 Very high 2.00% 10.90% $25 7 Very high 2.00% 13.00% $25 O $125 million $150 million $50 million $75 million S. Bouchard and Company hired you as a consultant to help estimate its cost of capital. You have obtained the following data: Do = $0.85; Po = $22.00; and g = 6.00 (constant). The CEO thinks, however, that the stock price is temporarily depressed, and that it will soon rise to $28.00. Based on the DCF approach, by how much woul the cost of equity from retained earnings change if the stock price changes as the CEO expects? Do not round your intermediate calculations. -0.88% 0 -0.93% 0 -0.98% 0 -0.87% 0 -0.74% Question 23 1 pts S. Bouchard and Company hired you as a consultant to help estimate its cost of capital. You have obtained the following data: Do = $0.85; Po - $22.00; and g = 6.00% (constant). The CEO thinks, however, that the stock price is temporarily depressed, and that it will soon rise to $28.00. Based on the DCF approach, by how much would the cost of equity from retained earnings change if the stock price changes as the CEO expects? Do not round your intermediate calculations. -0.88% 0 -0.93% 0 -0.98% 0 -0.87% 0 -0.74% Vang Enterprises, which is debt-free and finances only with equity from retained earnings, is considering 7 equal-sized capital budgeting projects. Its CFO hired you to assist in deciding whether none, some, or all of the projects should be accepted. You have the following information: Tre - 4.50%; RPM - 5.50%; and b=0.91. The company adds or subtracts a specified percentage to the corporate WACC when it evaluates projects that have above- or below-average risk. Data on the 7 projects are shown below. If these are the only projects under consideration, how large should the capital budget be? Project Risk Risk factor return Cost (millions) 1 Very low -2.00% 7.60% $25 2 Low -1.00% 9.15% $25 3 Average 0.00% 10.10% $25 4 High 1.00% 10.40% $25 Very high 2.00% 10.80% $25 6 Very high 2.00% 10.90% $25 7 Very high 2.00% 13.00% $25 $125 million $150 million $50 million $75 million