Answered step by step

Verified Expert Solution

Question

1 Approved Answer

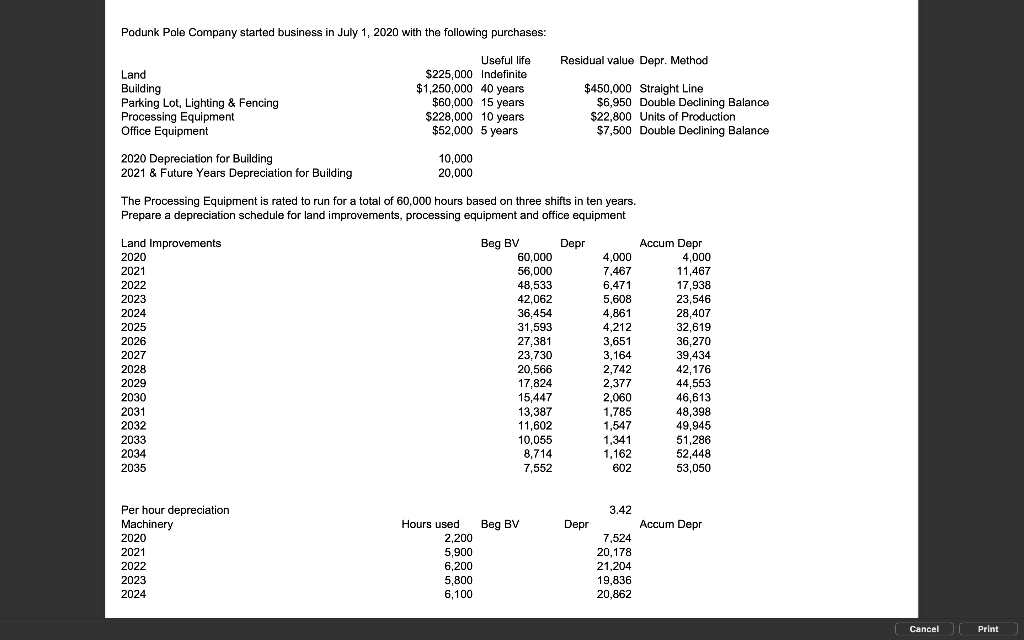

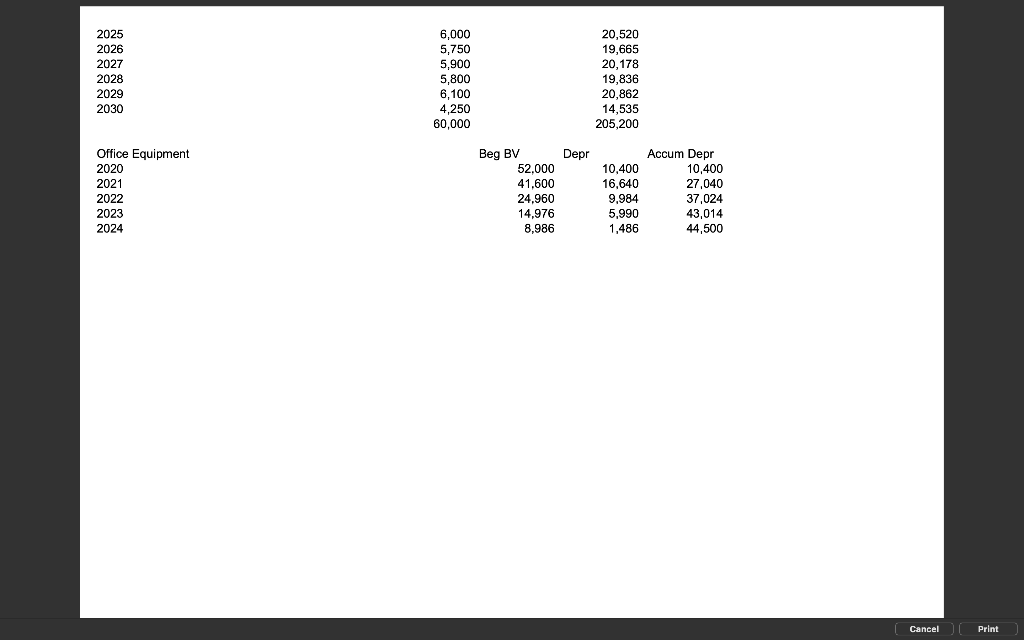

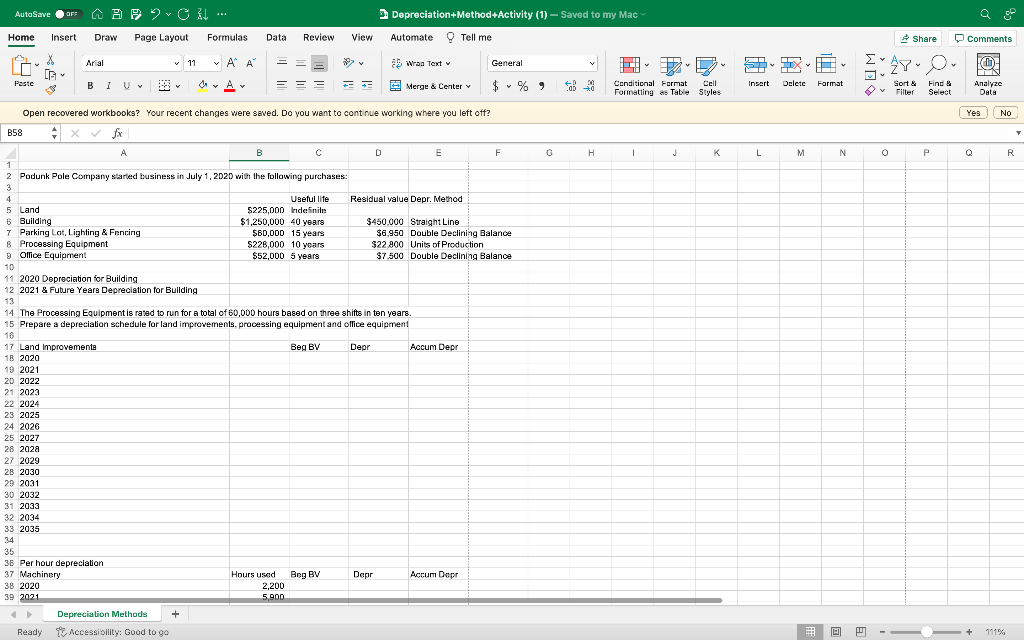

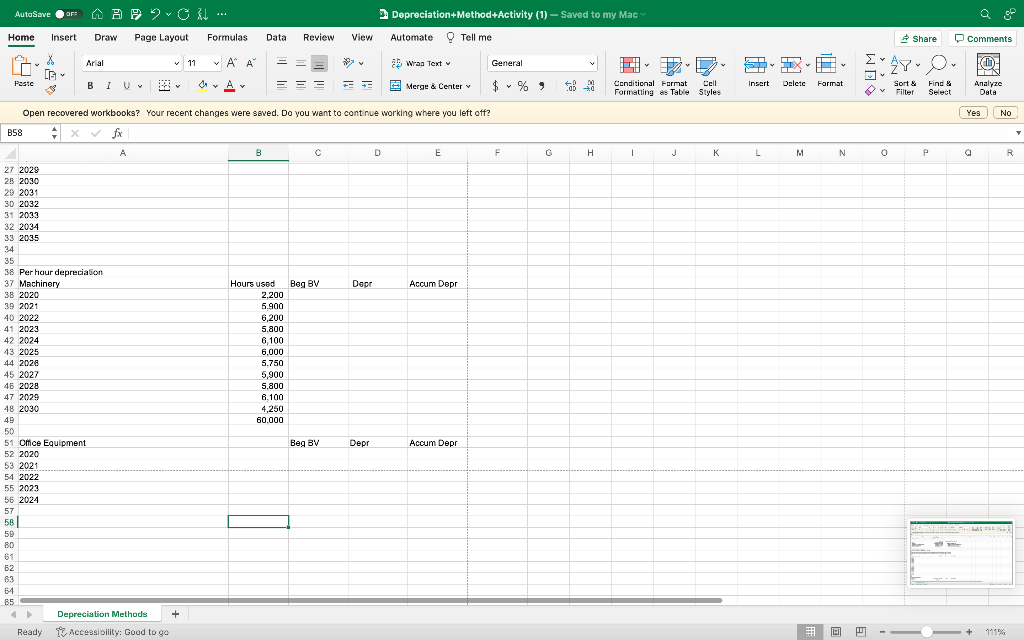

The first two pictures are from the answer key and show correct answers. The pictures of the Excel workbook is what I have been given.

The first two pictures are from the answer key and show correct answers. The pictures of the Excel workbook is what I have been given. Can you please explain how to get the numbers that are in the answer key? Please include the formulas and explanations on how to solve this.

Podunk Pole Company started business in July 1, 2020 with the following purchases: The Processing Equipment is rated to run for a total of 60,000 hours based on three shifts in ten years. Prepare a depreciation schedule for land improvements, processing equipment and office equipment 2025202620272028202920306,0005,7505,9005,8006,1004,25060,00020,52019,66520,17819,83620,86214,535205,200 \begin{tabular}{lrrr} Office Equipment & Beg BV & Depr & \multicolumn{2}{c}{ Accum Depr } \\ 2020 & 52,000 & 10,400 & 10,400 \\ 2021 & 41,600 & 16,640 & 27,040 \\ 2022 & 24,960 & 9,984 & 37,024 \\ 2023 & 14,976 & 5,990 & 43,014 \\ 2024 & 8,986 & 1,486 & 44,500 \end{tabular} 3. Depreciation+Method+Activity (1) Saved to my Mac Home Insert Draw Page Layout Formulas Data Review View Automate Q Tell me Open recovered workbooks? Your recent changes were seved. Do you want to cont nue working where you left off? B58 fx 112020 Depreciation for Building 122021& Fubure Years Depreciation for Building 14 The Processing Equipment is rated to run for a total of 60,000 hours based on three shifts in ten years. 15 Prepare a depreciation schedule for land improvements, processing equipment and ollice equipment 16 Podunk Pole Company started business in July 1, 2020 with the following purchases: The Processing Equipment is rated to run for a total of 60,000 hours based on three shifts in ten years. Prepare a depreciation schedule for land improvements, processing equipment and office equipment 2025202620272028202920306,0005,7505,9005,8006,1004,25060,00020,52019,66520,17819,83620,86214,535205,200 \begin{tabular}{lrrr} Office Equipment & Beg BV & Depr & \multicolumn{2}{c}{ Accum Depr } \\ 2020 & 52,000 & 10,400 & 10,400 \\ 2021 & 41,600 & 16,640 & 27,040 \\ 2022 & 24,960 & 9,984 & 37,024 \\ 2023 & 14,976 & 5,990 & 43,014 \\ 2024 & 8,986 & 1,486 & 44,500 \end{tabular} 3. Depreciation+Method+Activity (1) Saved to my Mac Home Insert Draw Page Layout Formulas Data Review View Automate Q Tell me Open recovered workbooks? Your recent changes were seved. Do you want to cont nue working where you left off? B58 fx 112020 Depreciation for Building 122021& Fubure Years Depreciation for Building 14 The Processing Equipment is rated to run for a total of 60,000 hours based on three shifts in ten years. 15 Prepare a depreciation schedule for land improvements, processing equipment and ollice equipment 16Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started